OFX(フルネームOzForex Limited)は、オーストラリアのシドニーに本社を置くフィンテック企業で、1998年に設立されました。同社は、外国為替サービスと国際決済ソリューションを個人および企業の顧客に提供することに重点を置いており、55以上の通貨と197か国をカバーしています。2023の時点で、OFXは世界中の100万人以上の顧客にサービスを提供しています。同社は、効率的な国境を越えた決済サービスと競争力のある為替レートで知られています。

OFXのコアサービスには、国際送金、外貨両替、企業支払管理、多通貨口座サービスが含まれます。同社は、独自の取引テクノロジープラットフォームを通じて、透明で安全な外国為替取引体験を顧客に提供しています。

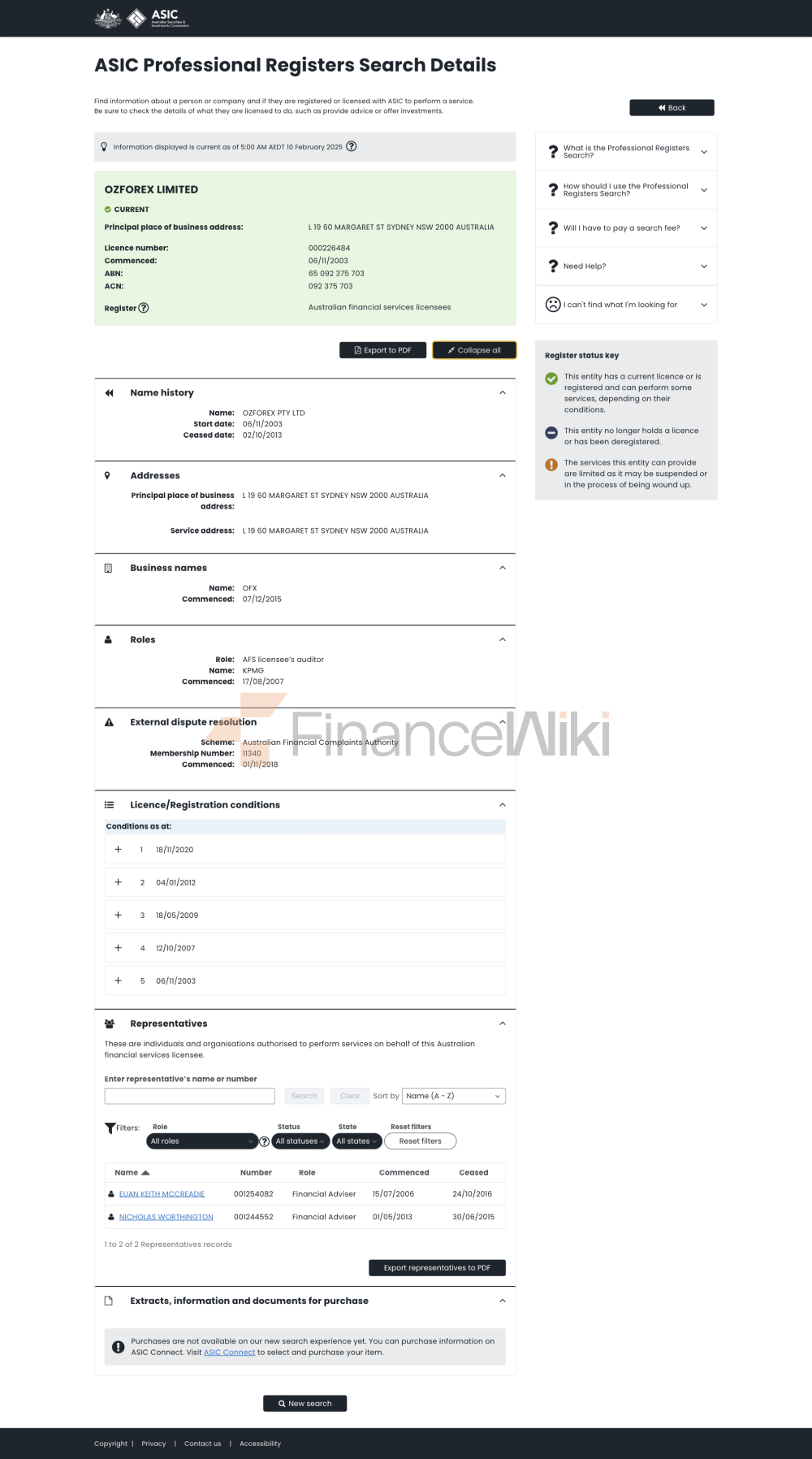

規制情報OFXは、オーストラリア証券投資委員会(ASIC)によって規制されている認可された金融サービスプロバイダーであり、ライセンス番号は437723です。さらに、OFXは、子会社を通じて、アイルランド、ドイツ、スペイン、フランスなどの世界中の複数の管轄区域で登録および運営されており、現地の金融規制要件に厳密に準拠しています。この多地域規制モデルにより、OFXのグローバルな運用の合法性とコンプライアンスが保証されます。

取引商品OFXのコア取引商品には、次のものが含まれます。

外国為替取引所世界の主要通貨と新興市場通貨をカバーする55通貨ペアをサポートし、顧客はいつでもリアルタイムで交換できます。

国際送金は、197の国と地域で送金サービスを提供し、銀行振込や現金受取など、さまざまな受け取り方法をサポートしています。

先渡契約顧客は、為替レートの変動に敏感な長期支払いニーズに適した、先渡契約を通じて将来の取引所為替レートをロックできます。

グローバル通貨口座を使用すると、顧客は複数の通貨を保有および管理できるため、通貨換算コストが削減され、資金管理の効率が向上します。

OFXは、次の取引ツールとプラットフォームを提供します。

OFX Webプラットフォームシンプルで直感的なWebインターフェイスを介して、顧客はリアルタイムで為替レートを表示し、取引リクエストを送信し、アカウントを管理し、リマインダーを設定できます。

OFX MobileアプリiOSおよびAndroidシステムをサポートするモバイルアプリで、顧客はいつでもどこでも外国為替取引と国際支払いを行うことができます。

APIインターフェイスは、大企業の顧客に自動トランザクションと一括支払い機能を提供し、企業の財務システムへのシームレスな統合を実現します。

OFXは、次の入出金方式をサポートしています。

銀行振込グローバルな銀行ネットワークを介して直接送金または送金することは、OFXの主要な資金処理方法です。

クレジット/デビットカード対象となる個人のお客様の場合、クレジットカードまたはデビットカードでの取引をサポートします。

OFXは、お客様に包括的なカスタマーサポートサービスを提供します。

24時間年中無休のカスタマーサポートライブライブチャット、電話、メールサポートを提供して、お客様の取引とアカウントの問題を解決します。

多言語サービスは、英語、中国語、スペイン語などの複数の言語をサポートし、さまざまな地域の顧客のニーズを満たします。

教育リソースは、基本的な外国為替取引ガイドとFAQを提供し、新規顧客がサービスをすばやく理解できるようにします。

OFXのコアビジネスは、次のセクションに分かれています。

パーソナル外国為替サービスは、個々の顧客に低手数料、高透明性の外国為替および国際送金サービスを提供します。

エンタープライズ決済ソリューションは、中小企業や大規模な多国籍企業向けにカスタマイズされた決済管理、外貨口座、一括決済サービスを提供します。

オンラインセラーサポートは、国境を越えたEコマースに多通貨口座と国際決済サービスを提供し、グローバルな決済プロセスを簡素化します。

OFXの技術インフラストラクチャは、高いセキュリティと高性能を特徴としています。

独自の取引システムOFXは、トランザクションのリアルタイム性と正確性を確保するために、カスタマイズされたトランザクションマッチングおよび清算システムを開発しました。

銀行レベルのセキュリティ256ビットSSL暗号化テクノロジーを使用して、顧客データとトランザクションを保護します。

マルチデータセンターサポート世界中の複数のデータセンターに分散し、取引システムの安定性と災害復旧能力を確保します。

OFXは、完全なコンプライアンスとリスク管理フレームワークを確立しました:

マネーロンダリング防止(AML)およびテロ対策資金調達(CTF)OFXは、国際的および地域的なマネーロンダリング防止規制を厳格に遵守し、顧客の身元を厳格に検証および監視します。

リスク管理モデルリアルタイムの監視と予測分析を通じて、取引における潜在的なリスクを特定し、防止します。

カバレッジは、顧客の資金を安全に保護し、極端な状況で顧客の資金が失われないようにします。

業界の地位OFXは、特にアジア太平洋地域とヨーロッパ市場で強い影響力を持つ、世界をリードする外国為替および国際決済サービスプロバイダーの1つです。

ターゲット顧客グループ主なサービス対象には、個人送金者、中小企業、国境を越えたEコマース、多国籍企業が含まれます。

競争力のある為替レートOFXは銀行間市場の為替レートに近い為替レートを提供し、顧客の取引コストを節約します。

グローバルなサービスネットワークは50以上の国と地域に代理銀行とパートナーを設置し、取引の効率性と信頼性を確保している。

多通貨サポートは55以上の通貨をサポートし、お客様の多様なニーズに対応しています。

技術革新継続的な技術研究開発投資を通じて、便利で安全な取引体験を提供します。

OFXは、マルチチャネルのカスタマーサポートサービスを顧客に提供します:

電話サポートグローバルに統一されたカスタマーサービスホットラインを提供し、顧客は+35315825307に電話して相談できます。

電子メールサポート顧客は、customer.service@ofx.comおよびsolutionsemea@ofx.comを介してヘルプを取得できます。

ライブチャット取引プラットフォーム上のカスタマーサービスとリアルタイムで通信し、取引の問題を解決します。

OFXは、次の方法で顧客をエンパワメントします。

教育サポート基本的な外国為替取引ガイドを提供し、顧客が為替レートの変動と取引戦略を理解するのに役立ちます。

アカウント管理ツールは、顧客が取引履歴とアカウント残高をリアルタイムで確認できるオンラインアカウント管理機能を提供します。

OFXは、次の分野に焦点を当て、社会的責任を積極的に果たしています。

環境保護デジタルサービスを通じて紙の取引を減らし、持続可能な開発を支援します。

社会福祉定期的に慈善寄付に参加し、教育や医療などの社会福祉プロジェクトを支援します。

ガバナンスの透明性OFXは、企業の運営の透明性と公平性を確保するために、最高のコーポレートガバナンス基準を順守しています。

OFXは、次のような多くの有名な機関や企業と戦略的パートナーシップを結んでいます。

Travelex複数通貨のトラベラーズチェックと外貨両替サービスを提供するために協力する世界有数の旅行金融会社。

MoneyGramOFXの送金ネットワークを拡大するために協力する国際送金サービスプロバイダー。

Xero中小企業の財務管理システムを最適化するために協力するクラウド会計ソフトウェアプロバイダー。

公開市場に上場している企業として、OFXは財務健全性の面で安定しています。

収益成長近年、同社の営業利益は、主に顧客基盤の拡大と新規事業の拡大により、着実な成長を維持しています。

収益性OFXは、運用コストを抑制し、取引効率を向上させることにより、良好な収益性を維持しています。

自己資本比率同社は、グローバル市場での拡大ニーズをサポートするために十分な資本を持っています。

OFXの将来の開発計画には、次の側面が含まれます。

製品革新多様な金融サービスに対する顧客のニーズを満たすために、新しい金融商品を開発し続けます。

市場拡大新興市場、特に東南アジアとアフリカでの事業展開をさらに拡大します。

技術アップグレードブロックチェーン、AIなどの最先端技術に投資し、取引効率と顧客体験を向上させる。

上記の戦略的レイアウトを通じて、OFXは引き続き世界の外貨両替と国際決済サービス市場でのリーダーシップを強化する。