設立と位置付け

- 設立: 1975年にHussainNajadiによって設立され、以前はペルシャマレーシア開発銀行でした。

- コアビジネス:リテールバンキング、ホールセールバンキング、イスラム銀行、生命保険、一般保険。

- 市場での地位:AmBank、AmInvestmentBank、Amlamなどのブランドを持つマレーシアの5大銀行グループの1つで、175の支店と766のATMがあります。

株式構造(2014年現在)

- 筆頭株主:オーストラリアANZグループが23.78%を保有。

- キーパーソン:グループ会長のダンスリアズマンハシムが14.01%を保有。

評判事件1 MDBスキャンダル:マレーシア国家投資基金1 MDBマネーロンダリング事件が関係しているため、グループの評判はひどく損なわれ、監督調査と法律訴訟に直面している。

歴史的マイルストーン- 1976年:合弁形式でスタートし、株主にはアラブとマレーシアの資本が含まれている。

- 1980年:マレーシア政府の2億ドルのシンジケートローンの管理を主導し、投資銀行業務の基礎を築いた。

- 1982年:ダンスリアズマンハシムがグループを買収し、私有化変革を始めた。

- 1986年:日本東海銀行の戦略投資(株式保有20%)を導入し、国際ネットワークを拡大した。

- 1991年:持株会社AMMBHoldingsBerhadを設立し、傘下の金融業務を統合した。

- 1994年: SecurityPacificアジア銀行マレーシア業務を買収し、商業銀行分野に進出した。

- 1998年:マレーシア通貨取引所「派生商品店頭取引国家賞」を受賞し、金融市場の地位を強化した。

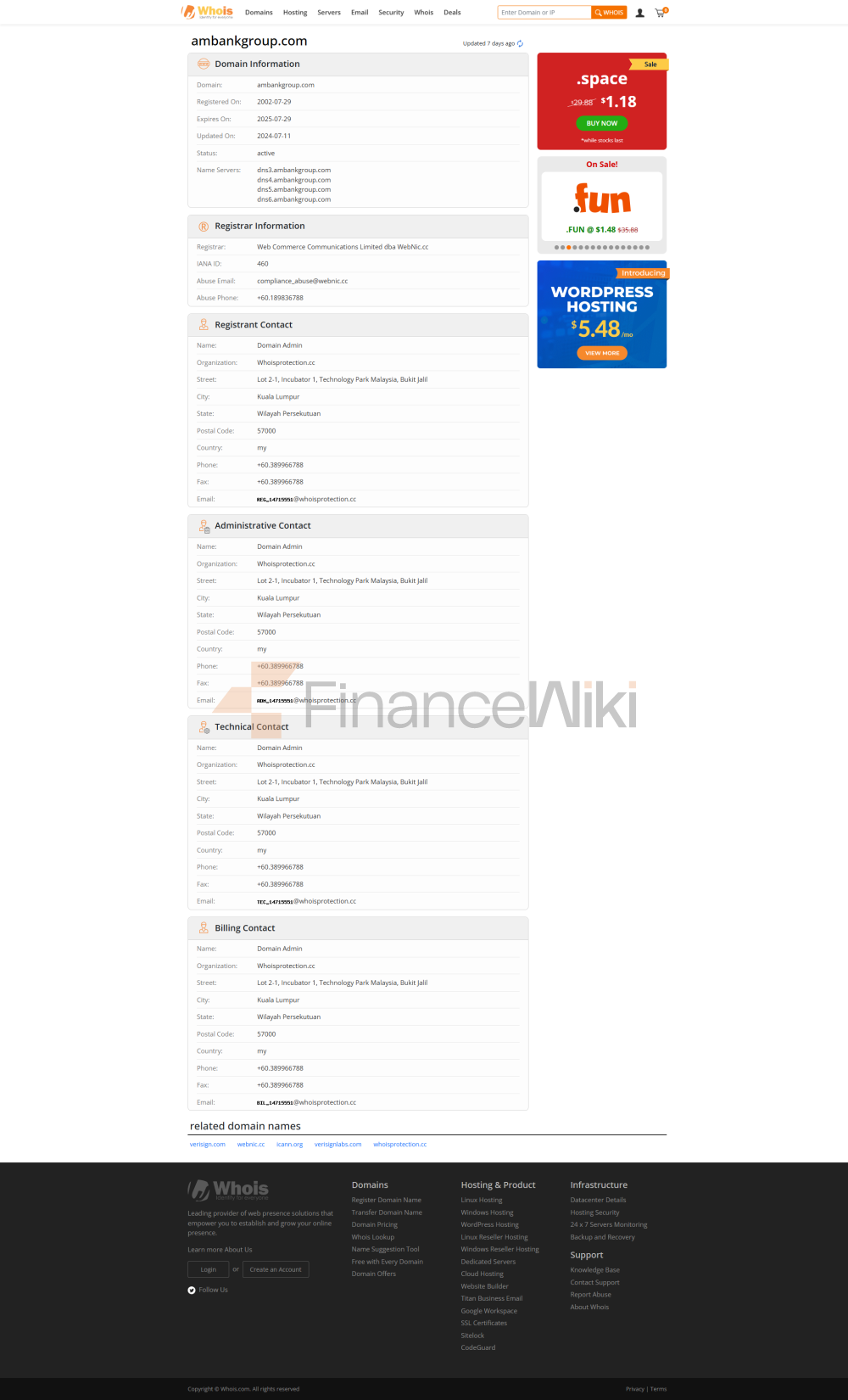

- 2002年:「AmBankGroup」に改名し、赤と黄のブランド色を有効にし、グループイメージを統一する。

- 2005年:投資銀行AmInvestmentGroupの上場を完了し、イスラム銀行業務を分割する。

- 2006年:オーストラリア・ニュージーランド銀行(ANZ)と戦略的協力関係を確立し、技術と管理経験を導入する。

- 2013年:創業者フセイン・ナジャディが撃たれ、世論の注目を集めた。

- 2017年: RHBBankとの合併を試みたが失敗し、内部再編に焦点を当てた。

- 2019年:アズマン・ハシムが会長を退任し、VoonSengChuanが引き継いだ。

- カバレッジエリア:個人貯蓄、ローン、クレジットカード、SMEファイナンス。

- チャネルネットワーク: 175の支店、766のATM、デジタルバンキングサービス。

- サービス範囲:株式引受、債券発行、M&Aコンサルティング、資産管理。

- 市場での地位:マレーシアを代表する投資銀行の1つであり、RAM債券市場で複数の賞を受賞しています。

- 特徴的な製品:シャリーアに準拠した預金とローン、保険、ファンド。

- 独立して運営:2006年にイスラム金融市場に焦点を当てた完全子会社に分割されました。

- AmGeneralInsurance:自動車保険、財産保険、企業総合保険。

- AmMetLife:生命保険大手MetLifeと合弁し、生命保険と健康保険を提供する。

- 製品ライン:ユニットトラスト、REIT(AmFIRSTREITなど)、プライベートエクイティファンド。

- 国際展開:ブルネイの子会社であるAmCapitalは、オフショア資産管理サービスを提供しています。

- ケースアソシエーション: AM MBは、数億ドルの違法な資金の流れを伴う1 MDB資金移動のアカウントを提供したとして非難されています。

- 結果:法的リスク:マレーシア中央銀行の罰金と国際的な規制調査に直面しています。評判の低下:顧客の信頼が低下し、株価は段階的に急落しました。

- ガバナンスのアップグレード:マネーロンダリング防止のレビューを強化し、独立したコンプライアンスチームを導入します。

- 事業の縮小:非中核資産(先物仲介など)をスピンオフし、地元の小売業とイスラム金融に焦点を当てます。

- ANZグループ:特に決済システムと外国為替の分野で、技術出力と国境を越えたビジネスコラボレーション。

- 国際保険連合:InsuranceAustraliaGroup:株式保有AmGeneralInsurance49%。FriendsProvident: AmLifeInsurance 30%に参加。

- 地域協力:韓国の友利証券と日本の日興証券との投資ファンド。

- オンラインバンキング:アカウント管理、送金、投資をサポートするAmOnlineおよびモバイルアプリを開始します。

- フィンテック協力: Red Hatと協力してITインフラストラクチャを最適化し、取引システムの安定性を向上させます。

- イスラムフィンテック:若い顧客を引き付けるためにSharia-準拠のデジタルウォレットを開発します。

- 包括的金融:「TabungPerumahanEhsan」低所得世帯住宅ローンプログラムを開始します。

- 業界の認知: 6年連続でNACRA「年間最優秀財務報告賞」を受賞した(19911996)。2018年レッドハットフォーラム「革新的ソリューション賞」。

- 市場の課題:1 MDB事件の影響に対処し、監督と顧客の信頼を再構築する。

- 成長方向:イスラム金融:東南アジアと中東市場を拡大する。グリーンファイナンス:ESG債券を発行し、再生可能エネルギープロジェクトを支援する。デジタル変革:AIとビッグデータの投資を増やし、顧客体験を最適化する。