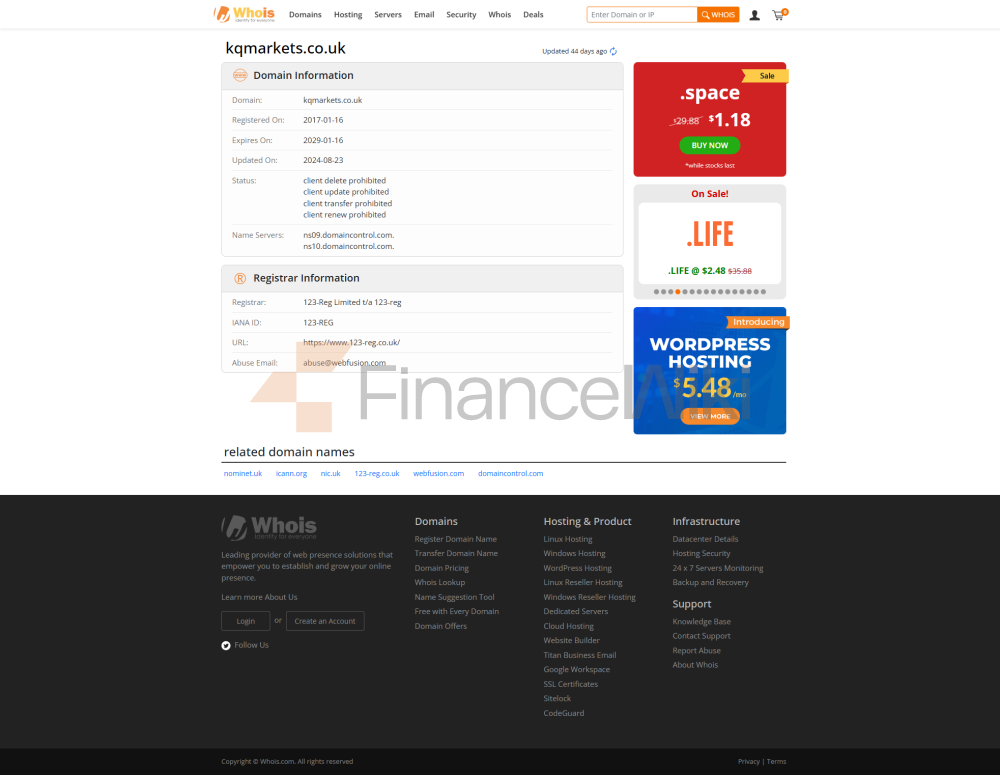

KQ Marketsは、2017年1月16日にに設立された英国に登録された外国為替ブローカーであり、そのフルネームはKQ Markets(UK)Ltdです。この企業は、英国ロンドンに本社を置き、登録住所は1 St. Katharine's Way London E 1 W 1 UN UKであると主張しています。登録資本情報はWebサイトに明示的に開示されていませんが、その事業範囲は、外国為替、コモディティ、ETF、金と銀、インデックス、債券、金利、通貨など、さまざまな金融商品を対象としています。

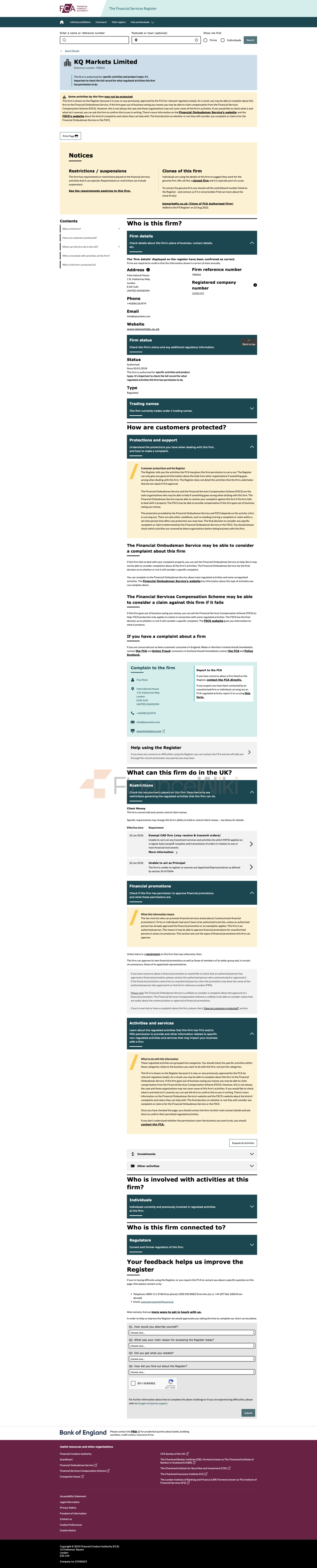

注目すべきは、KQ MarketsのFCA(英国金融行動監督局)ライセンス番号が780026であるが、2023年12月現在、このライセンスの状態は「がを超えている」ということで、FCAの継続的な監督基準を満たしていない可能性があることを意味している。FCAの規定によると、この状況は通常、その企業が監督要件を満たしていないか、経営許可を失った可能性があることを示している。

規制情報KQ MarketsはFCAの規制対象であると主張していますが、そのライセンスステータスは「はを超えています」となっており、規制遵守に重大な疑問があることを示しています。FCAは英国で最も主要な金融規制当局であり、金融サービス会社の運営を監督し、関連する法律および規制を遵守していることを確認しています。ただし、KQ Marketsの規制状況は、金融サービスを運営するための合法的な資格をもはや持っていないことを意味する可能性があります。

取引商品KQ Marketsは、以下のカテゴリをカバーする1300以上の取引可能なツールを提供しています:

- 外国為替:主要通貨ペア(EUR/USD、GBP/USDなど)とマイナー通貨ペアを含みます。

- 商品:原油、金、銀などを含みます。

- ETF:複数のインデックスETF商品を提供します。

- 金と銀:貴金属取引をサポートします。

- 指数:世界の主要な株価指数(S&P 500、ダウジョーンズなど)をカバーしています。

- 債券:債券取引ツールを提供します。

- 金利ツール:短期および長期の金利商品が含まれます。

- 通貨:複数の通貨での直接取引をサポートします。

ただし、KQ Marketsの取引商品では、株式、ミューチュアルファンド、貴金属の取引はサポートされていません。

取引ソフトウェアKQ Marketsは、さまざまなトレーダーのニーズを満たすために、さまざまな取引プラットフォームを提供しています。

- Web Trader: Webを介した取引をサポートし、便利で迅速な取引操作に適しています。

- MT 5:MetaQuotesが提供し、Windows、Mac、iOS、Androidデバイスをサポートし、経験豊富なトレーダーに適しています。

- KQ Markets App:モバイルデバイス向けに設計され、iOSおよびAndroidユーザーをサポートしています。

さらに、KQ Marketsは、顧客が取引スキルを練習するために3か月間有効なデモ口座も提供しています。

入出金方法KQ Marketsは、次のようなさまざまな入出金方法をサポートしています。

- Visa

- Skrill

- ペイパル

- MasterCard

- 銀行振込

ただし、入出金の処理時間と手数料に関する情報は明示的に開示されていません。

カスタマーサポートKQ Marketsは、次のカスタマーサポートチャネルを提供しています。

- 電話サポート:+44(0)208 126 3974

- 電子メールサポート:info@kqmarkets.com

- ソーシャルメディアサポート: Twitter、Face book、LinkedIn、You Tube

ただし、規制状況に疑問があるため、投資家はKQ Marketsを選択する際に注意し、潜在的なリスクによる損失を回避することをお勧めします。

コアビジネスとサービスKQ Marketsのコアビジネスには以下が含まれます:

- 外国為替取引:顧客に複数の外国為替通貨ペアの取引サービスを提供します。

- 商品取引:原油、金、銀などの商品の取引ツールを提供します。

- レバレッジ取引:ウェブサイトではレバレッジについて明示的に言及していませんが、外国為替取引にはレバレッジ操作が含まれることが多く、過度のリスクを回避するために慎重に使用する必要があります。

KQ Marketsは、MT 5やWeb Traderなどの確立されたプラットフォームを使用して、トレーダーに安定した技術サポートを提供しています。ただし、その技術インフラの具体的な詳細(サーバーの場所、遅延時間など)は明示的に開示されていません。

コンプライアンスとリスク管理システムKQ Marketsは、FCAの規制要件に準拠していると主張していますが、ライセンスステータスは「はを超えています」となっており、コンプライアンスに重大な疑問があることを示しています。さらに、リスク管理システムの具体的な内容は明確に開示されておらず、投資家はリスク管理能力を慎重に評価する必要があります。

市場の位置付けと競争上の優位性KQ Marketsは、顧客に多様な金融商品と便利な取引体験を提供することを目的としています。その競争上の優位性には、

- マルチプラットフォームサポート: Web Trader、MT 5、モバイルアプリなど、さまざまな取引プラットフォームを提供します。

- デモ口座:初心者に練習の機会を提供します。

ただし、市場でのポジショニングと競争上の優位性は規制状況によって深刻な影響を受けており、投資家は潜在的なリスクを十分に考慮して選択することをお勧めします。

カスタマーサポートとエンパワーメントKQ Marketsは、電話、電子メール、ソーシャルメディアなど、さまざまなチャネルを通じて顧客をサポートしています。デモアカウントは、初心者にも練習の機会を提供します。ただし、カスタマーサポートの具体的な応答時間とサービス品質は明示的に開示されていません。

社会的責任とESG2023年12月現在、KQ Marketsは社会的責任とESG(環境、社会、企業統治)に関連する活動と政策を明確に開示していない。

戦略協力生態KQ Marketsの戦略協力情報は明確に開示されておらず、投資家は選択時にパートナーと業界の評判に注目することを提案している。

財務健康度KQ Marketsの財務健康度情報は明確に開示されておらず、投資家は選択時に財務報告書や第三者の評価を参考にすることを提案している。

将来のロードマップ2023年12月の時点で、KQ Marketsは将来の開発計画とロードマップを明示的に開示していません。

結論として、KQ Marketsは多様な取引商品と技術サポートを提供していますが、その規制状況とコンプライアンスには大きな疑問があります。投資家はリスクを慎重に評価し、規制コンプライアンスのある金融サービスプロバイダーを優先的に選択する必要があります。