회사 프로필

설립 시간 및 본부 :

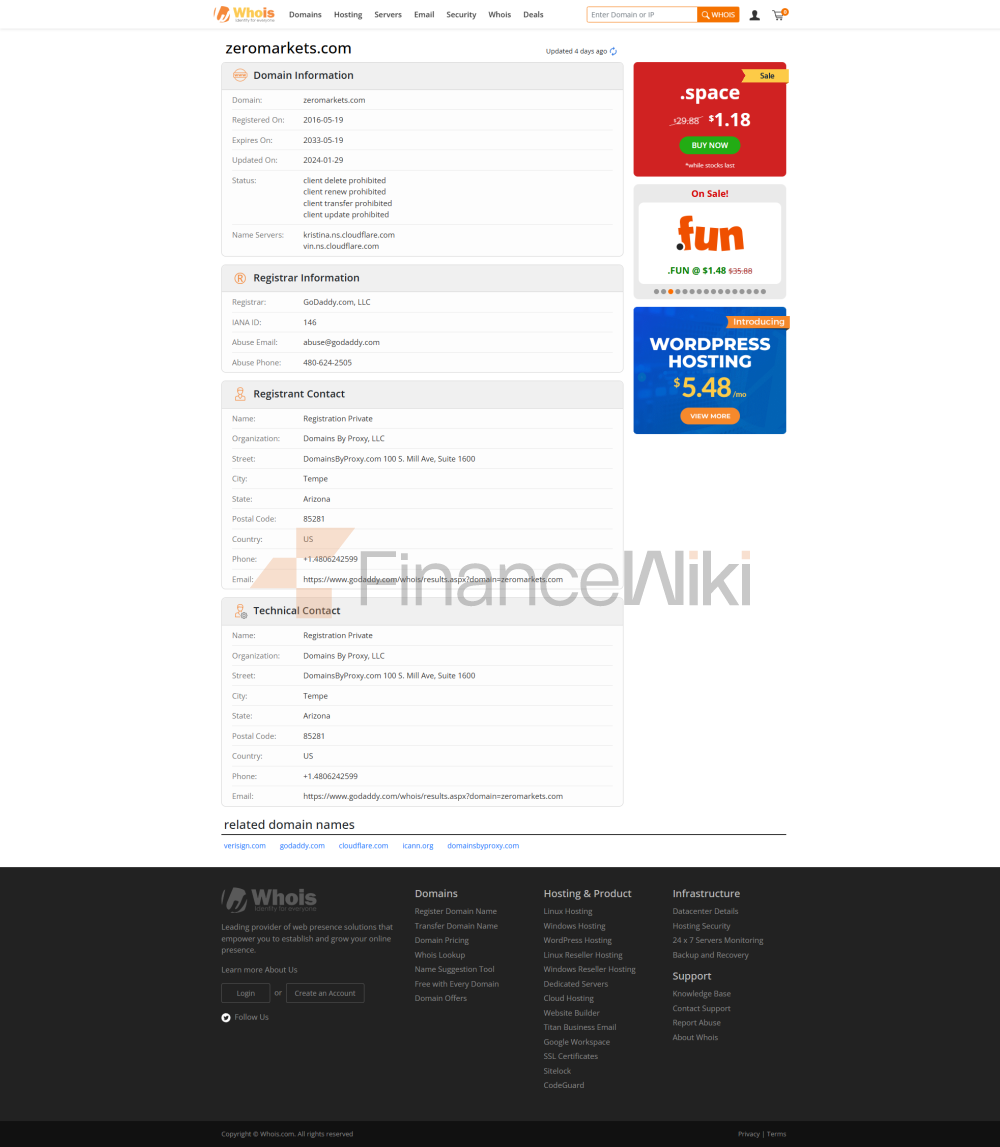

- 2016년 Saint Vincent and the Grenadines에서 설립되었으며 등록된 자본은 50만 Saint Vincent 달러입니다.

- 글로벌 금융 브로커로 자리 잡은 이 회사의 사업은 외환, 상품 및 암호화폐와 같은 여러 자산을 다룹니다.

- 라이센스 유형: Saint Vincent에 있는 FSA(금융 마렉트 기관)의 MM 라이센스(No. 569807)를 보유합니다. 그것은 역외 감독 하에 있으며 FCA 및 ASIC와 같은 주류 기관에 비해 감독이 약합니다.

- 준수 성명: AML 자금 세탁 방지 및 KYC 고객 식별 규칙을 따르겠다는 약속이지만 역외 감독에는 자본 격리에 대한 필수 요건이 부족하며 고객 자금의 안전도 의심스럽습니다.

- 외환: 40 개 이상의 통화 쌍, 주요 통화(EUR/USD), 소액 및 신흥 통화를 포함합니다. 상품: 금, 은, 원유, 천연 가스 및 기타 현물 및 및 주식: S&P 500, Dow Jones 인덱스 및 일부 개별 주식 CFD.

- 높은 레버리지: 1:500(Forex/Comties), 수익 및 리스크를 증폭시킵니다.

- 이슬람 계정: 스왑 프리, 샤리아 호환.

- MetaTrader4/5(MT4/MT5): MT4: 초보자에게 적합한 기본 거래 기능. MT5: 다중 자산 거래, 고급 차트 작성 및 알고리즘 거래(EA)를 지원합니다.

- 멀티 엔드 포인트 호환성: Windows, iOS, Android, 웹의 전체 범위.

- 교육 리소스: 비디오 튜토리얼, 거래 가이드, 시장 분석 보고서.

- 위험 통제 도구: 손실 중지/이익 주문 받기, 계정 네거티브 균형 보호.

- AIoT 위험 모니터링: 실시간 데이터 분석 및 비정상 거래 경고. 스트레스 테스트: 시스템 안정성에 대한 정기적인 평가이지만 구체적인 결과는 발표되지 않았습니다.

- 상품 폭: 외환, 상품, 암호화폐 및 주식 지수와 같은 6대 자산 클래스를 다룹니다.

- 높은 레버리지 전략: 높은 리스크 식욕을 가진 거래자를 유치합니다. 이슬람 계정: 시장 부문 경쟁력.

- 국제 금융 연구소(IFC): Fintech 혁신을 주도합니다.

- 기술 업그레이드 : 거래 시스템을 최적화하고 AI 거래 도구를 도입할 계획입니다.

- 시장 확장 : 아시아 및 라틴 아메리카와 같은 신흥 시장으로 확장합니다.

규제 정보(위험 경고) :

핵심 비즈니스 및 거래 상품

거래 가능 자산 :

계정 기능 :

거래 플랫폼 및 기술 시설

플랫폼 지원 :

기술적 이점 :

- 짧은 지연 시간 실행: 최적화된 서버 네트워크, 주문 실행 속도

준수 위험 통제 및 분쟁 지점

위험 통제 시스템 :

잠재 위험 :

- 해외 규제 취약성: FSA는 자본 격리를 의무화하지 않고 숨겨진 레버리지: 1:500 레버리지 미만에서 시장 변동은 쉽게 청산으로 이어질 수 있습니다.

시장 포지셔닝 및 경쟁 우위

핵심 우위 :

파트너 :

<강함> 전략적 방향 :

ZEROMARKETS는 차별화된 판매 포인트로 <강력> 높은 레버리지, 다중 자산 커버리지 이슬람 계정 해외 규제 배경 제한된 투명성 은 핵심 위험을 내포하고 있습니다. MT4 FCA 및 ASIC와 같은 주류 규제 대상 플랫폼을 선택하는 것이 좋습니다.