회사 프로필

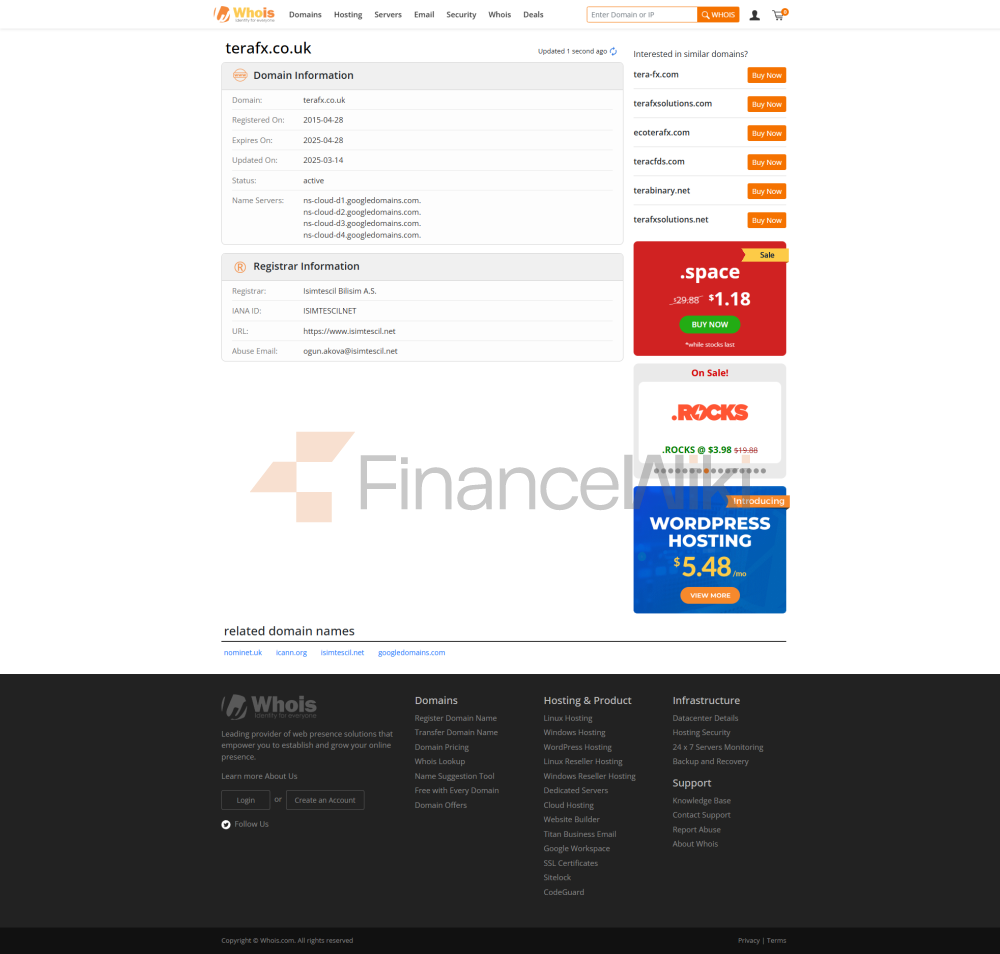

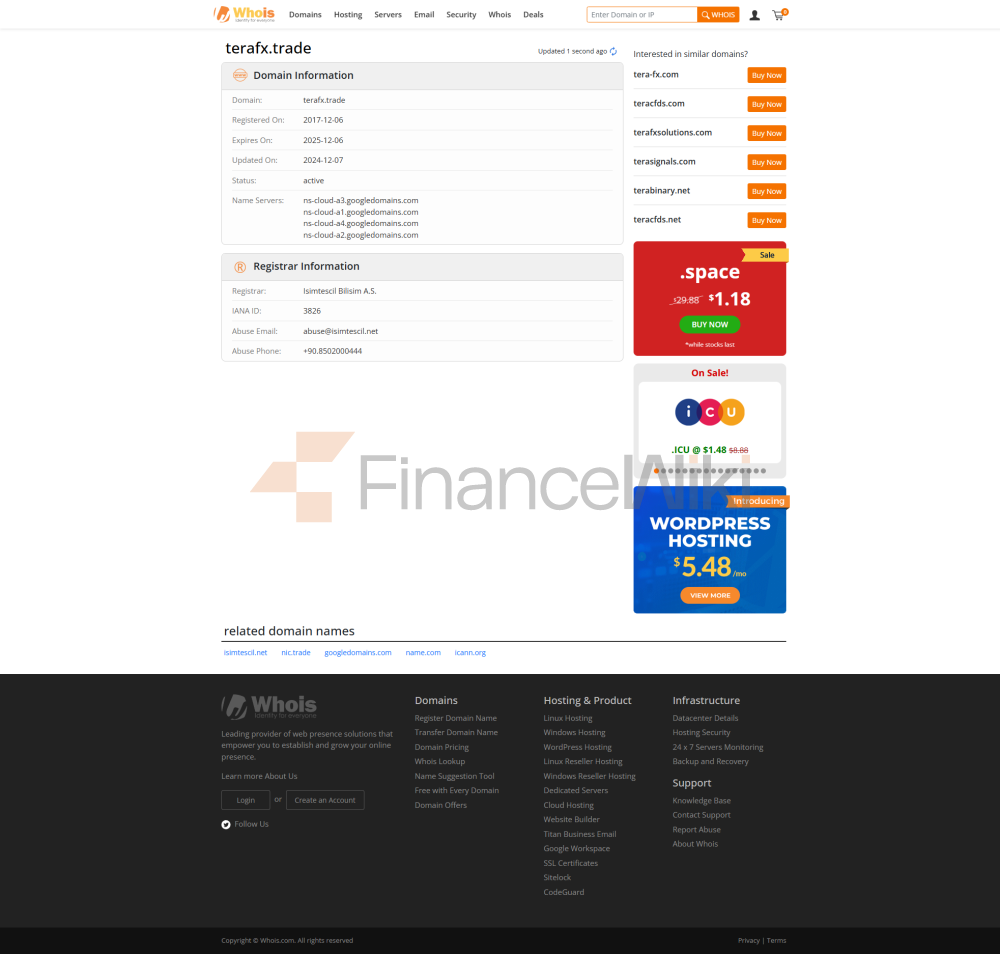

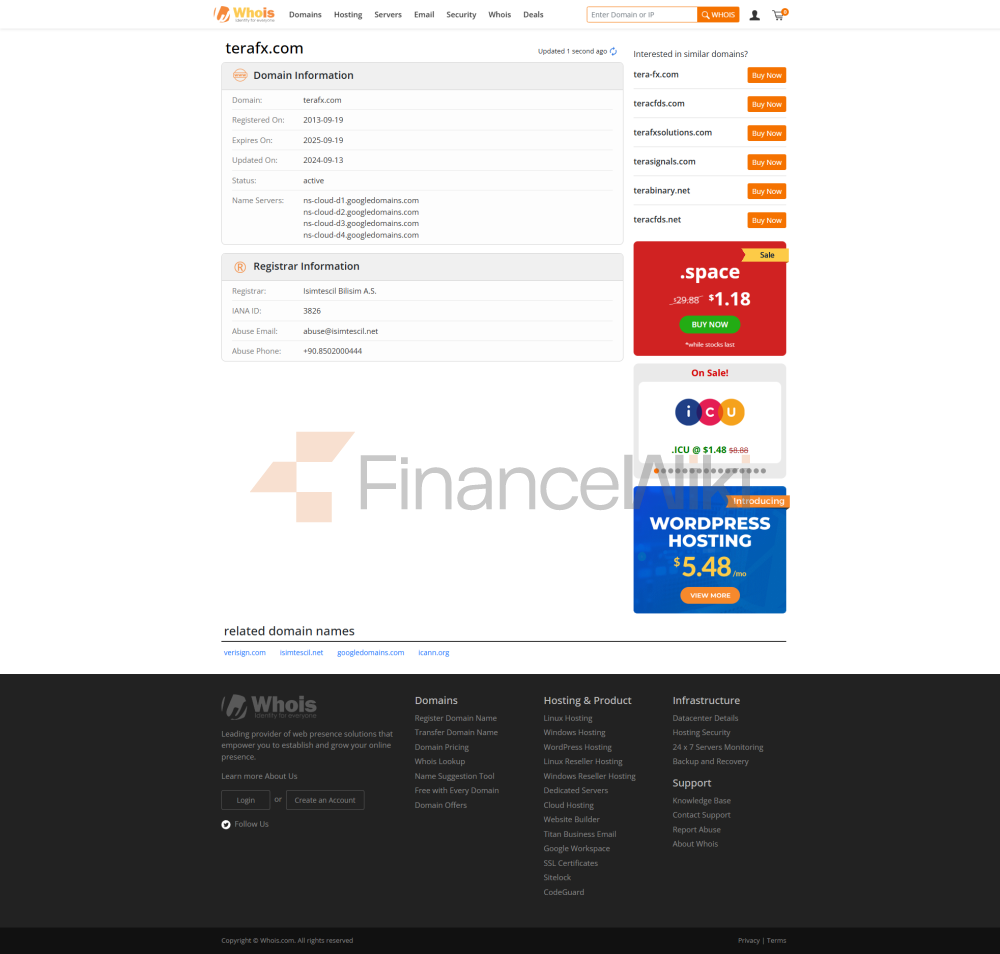

TeraFX · TeraFX는 2011년 영국에 설립된 외환 브로커로, 런던에 본사를 두고 있으며 등록 번호 7604372 및 폴란드 바르샤바에 있는 두 번째 사무실을 가지고 있습니다. 브로커는 주로 사용자에게 외환, 상품, 지수 및 스프레드 거래와 같은 금융 파생상품 거래 서비스를 제공합니다. TeraFX는 영국 금융 행동 당국(FCA)에 의해 등록 번호 564741 로 규제 정보 TeraFX · TeraFX는 영국 금융 행동 당국(FCA)이 규제하는 브로커입니다. 영국 금융 행동 기관의 공식 웹사이트를 통해 TeraFX는 실제로 이 규제하는 FCA는 세계에서 가장 엄격한 금융 규제 기관 중 하나이며, 브로커가 높은 수준의 운영 관행 및 고객 보호 조치를 준수하도록 보장합니다. TeraFX의 규제 번호는 564741 이며, 이는 합법적이고 규정을 준수하여 작동함을 나타냅니다.

거래 상품 TeraFX는 외환, 상품, 지수, 스프레드 베팅 등과 같은 금융 파생상품 거래 서비스를 포함한 다양한 거래 상품을 제공합니다.- 외환: 60개 이상의 외환 쌍을 제공합니다. EUR/USD, GBP/USD 등과 같은 주요 및 소액 통화 쌍을 포함합니다. 상품: 금, 은, 원유 등을 포함한 귀금속 및 에너지 상품의 거래를 제공합니다.

인출할 수 없음

인출할 수 없음