탄자니아 농업 개발 은행(TADB)은 탄자니아의 농민 봉사 은행입니다. 정부는 워킹 펀드로 미화 5억 달러(8500억 TSh)를 기부했습니다.

활성

TADB

Certificação oficial 탄자니아

탄자니아10-15 ano

Sítio Web oficial

Atualizado em 2025-04-10 14:09:02

Classificação actual das empresas

5.00

Classificação industrial

Informações básicas

Informações regulamentares

( 탄자니아 )

감독중

estado actual

감독중

Estado regulatório

탄자니아

Número regulamentar

--

Tipo de matrícula

--

Instituição licenciada

TANZANIA AGRICULTURAL DEVELOPMENT BANK LIMITED

Endereço da instituição licenciada

P. O. BOX 63372, DAR ES SALAAM

E- mail da instituição licenciada

INFO@TADB.CO.TZ

Sítio Web da instituição licenciada

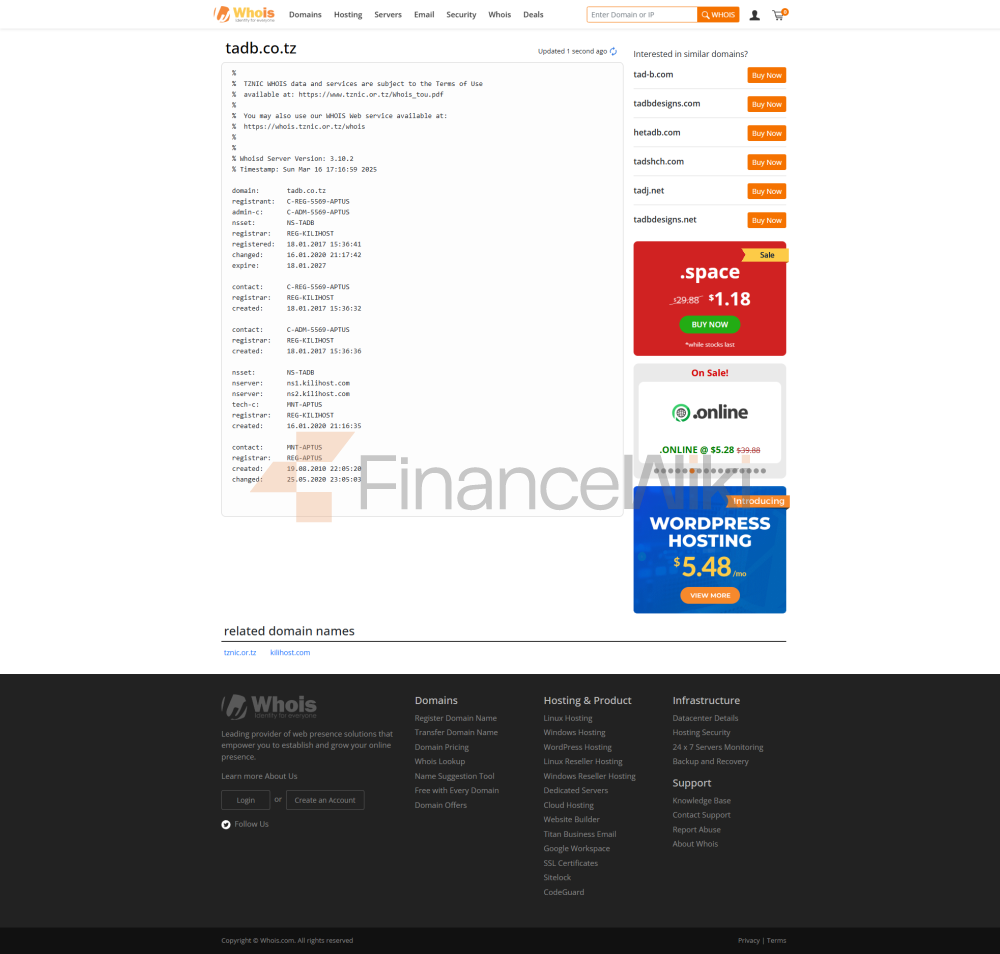

https://www.tadb.co.tz/

Telefone da instituição licenciada

+255 22 292 3501-2

Tipo de certificado

공유 없음

Hora de entrada em vigor

--

Tempo de expiração

--

Avaliação das empresas/Exposição

Escrever comentários/Exposição

5.00

0avaliar/

0Exposição

Escrever comentários/Exposição

TADB Introdução à Empresa

TADB Segurança Empresarial

https://www.tadb.co.tz/

TADB Q&A

질문

Redes sociais

Notícias e informações

Declaração de risco

Finance.Wiki는 이 웹사이트에 포함된 데이터가 실시간이거나 정확하지 않을 수 있음을 알려드립니다. 본 웹사이트의 데이터 및 가격은 반드시 마켓이나 거래소에서 제공하는 것은 아니며, 마켓메이커가 제공할 수 있으므로 가격이 정확하지 않을 수 있으며 실제 시장 가격 추세와 다를 수 있습니다. 즉, 가격은 시장 추세를 반영하는 지표 가격일 뿐이며 거래 목적으로 사용되어서는 안 됩니다. Finance.Wiki와 이 웹사이트에 포함된 데이터 제공자는 귀하의 거래 행위 또는 이 웹사이트에 포함된 정보에 대한 의존으로 인해 발생한 손실에 대해 책임을 지지 않습니다.