O Bank Mega é licenciado e supervisionado pela Financial Services Authority e pelo Bank Indonesia, e o I Bank Mega é participante da garantia LPS

Ativo

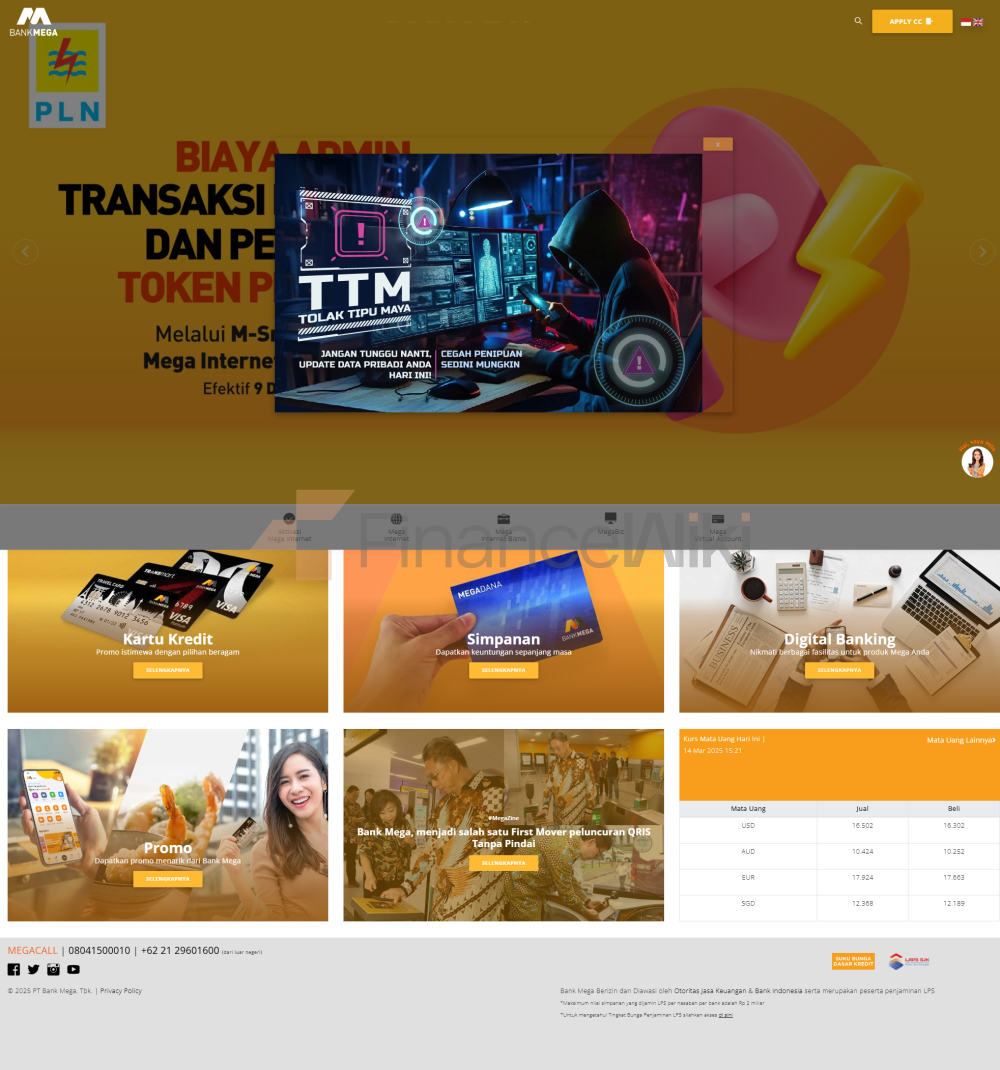

Bank Mega

Certificação oficial Indonésia

Indonésia20 ano

Sítio Web oficial

Atualizado em 2025-04-10 12:03:03

Classificação actual das empresas

5.00

Classificação industrial

Informações básicas

Nome completo da empresa

Bank Mega

país

Indonésia

Classificação das empresas

Hora de registo

1969

Estatuto da empresa

Ativo

Informações regulamentares

( Indonésia )

Sob supervisão

estado actual

Sob supervisão

Estado regulatório

Indonésia

Número regulamentar

426

Tipo de matrícula

--

Instituição licenciada

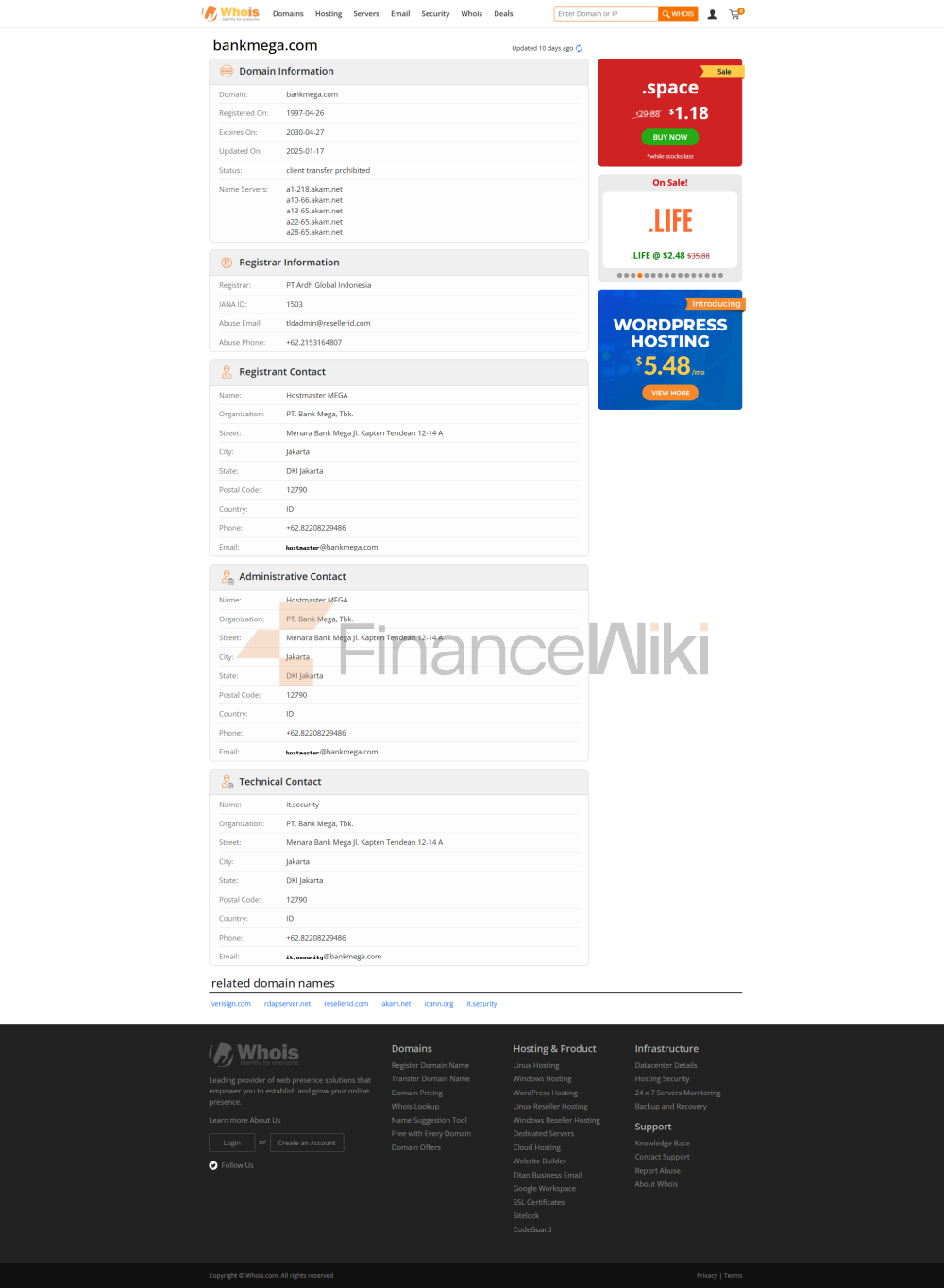

PT Bank Mega Tbk

Endereço da instituição licenciada

Menara Bank Mega Lt.15, Jl. Kapten Tendean Kav. 12-14 A, Jakarta 12790

E- mail da instituição licenciada

corsec@bankmega.com

Sítio Web da instituição licenciada

www.bankmega.com

Telefone da instituição licenciada

(021) 7917500

Tipo de certificado

Sem Compartilhamento

Hora de entrada em vigor

1992

Tempo de expiração

--

Avaliação das empresas/Exposição

Escrever comentários/Exposição

5.00

0avaliar/

0Exposição

Escrever comentários/Exposição

Bank Mega Introdução à Empresa

Bank Mega Segurança Empresarial

https://www.bankmega.com/

Bank Mega Q&A

질문

Redes sociais

Notícias e informações

Declaração de risco

Finance.Wiki lembra que os dados contidos neste site podem não ser em tempo real ou precisos. Os dados e preços neste site não são necessariamente fornecidos pelo mercado ou bolsa, mas podem ser fornecidos por criadores de mercado, portanto os preços podem não ser precisos e podem diferir das tendências reais dos preços de mercado. Ou seja, o preço é apenas um preço indicativo, refletindo a tendência do mercado, e não deve ser utilizado para fins comerciais. Finance.Wiki e o fornecedor dos dados contidos neste site não são responsáveis por quaisquer perdas causadas pelo seu comportamento comercial ou pela confiança nas informações contidas neste site.