Perfil Corporativo

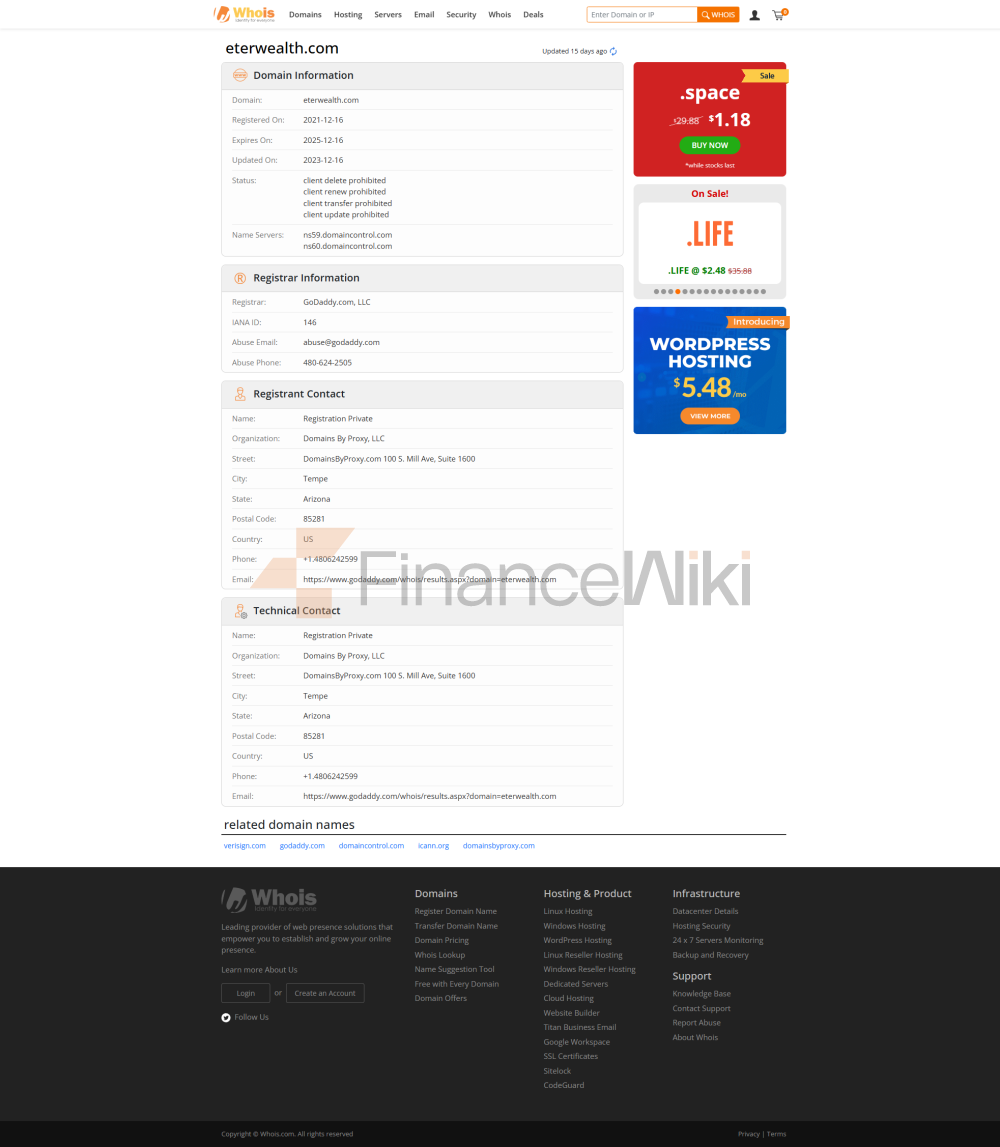

A Eterrich é um provedor financeiro estabelecido em 2021 e registrado nos Estados Unidos . A empresa se concentra em fornecer aos traders uma ampla gama de serviços de negociação de instrumentos financeiros, incluindo Forex, Metais, Criptomoedas, Energia e Índices, entre outros. Embora afirme fornecer aos clientes uma experiência de negociação conveniente por meio da plataforma MT5, sua falta de autorização regulatória e transparência atraiu a atenção do mercado. A Eterrich não está atualmente autorizada ou regulamentada por nenhuma autoridade reguladora. Embora afirme possuir a licença National Futures Association (NFA) , a licença não é autorizada, o que levanta ainda mais questões sobre sua legalidade. Os investidores devem ter extrema cautela ao escolher trabalhar com este corretor para garantir sua conformidade. Eterrich Oferece uma ampla gama de instrumentos financeiros para os traders escolherem, incluindo: A Eterrich usa a plataforma MetaTrader 5 (MT5) , que suporta dispositivos desktop e móveis e é conhecida por sua velocidade de execução eficiente e ricas ferramentas de análise técnica. Até 2023 , nenhuma informação clara foi fornecida sobre os métodos de depósito e retirada da Eterrich. O suporte ao cliente está disponível apenas via e-mail 24 / 7 , e há falta de outros canais de comunicação, como telefone ou Chat ao vivo. A atividade principal da Eterrich é fornecer aos traders serviços de negociação para uma variedade de instrumentos financeiros, incluindo câmbio, metais, criptomoedas, energia e índices. Seus principais serviços giram em torno da plataforma MT5 , dedicada a fornecer aos clientes uma ampla gama de opções de negociação. A infraestrutura técnica da EterRiqueza depende principalmente da plataforma MT5 , que é conhecida por sua velocidade de execução eficiente e ricas ferramentas analíticas. EterRiqueza carece de uma declaração de conformidade clara e sistema de controle de risco, e sua licença NFA não autorizada aumenta ainda mais o risco potencial. Os investidores devem considerar cuidadosamente ao escolher fazer parceria com este corretor. EterRiqueza Vantagem competitiva limitada. Suas vantagens potenciais incluem: No entanto, a falta de mandato regulatório e transparência prejudicou seriamente sua competitividade no mercado. Eterrich fornece suporte limitado ao cliente e se comunica com os traders apenas por e-mail. Falta de suporte multilíngue e recursos educacionais, o que pode ser prejudicial para os traders que precisam de ajuda imediata ou aprimoramento de conhecimento. A partir de 2023 , as informações sobre a responsabilidade social e as práticas ESG da EterRiqueza não estão disponíveis publicamente. A EterRiqueza não tornou públicas suas informações de cooperação estratégica. Devido à falta de divulgação de informações necessárias, a saúde financeira da EterRiqueza é difícil de avaliar. Dadas as informações atuais, o futuro roteiro de A eternidade não é clara. Os investidores devem ter cautela ao considerar fazer parceria com esta corretora. EterRiqueza Como uma corretora que oferece serviços de negociação em uma variedade de instrumentos financeiros, apesar de ter a ampla funcionalidade da plataforma MT5, sua falta de autoridade regulatória e transparência representa um desafio significativo para sua credibilidade no mercado. Os investidores devem garantir a conformidade e evitar riscos latentes ao escolher fazer parceria com esta corretora. Informações Regulamentares

Negociação de produtos

Software de negociação

Métodos de depósito e retirada

Suporte ao cliente

Principais negócios e serviços

Infraestrutura Técnica

sistema de conformidade e controle de risco

Posicionamento de mercado e vantagem competitiva

Suporte ao cliente e capacitação

Responsabilidade social e ESG

Ecologia de Cooperação Estratégica

Saúde financeira

Roteiro Futuro

RESUMO