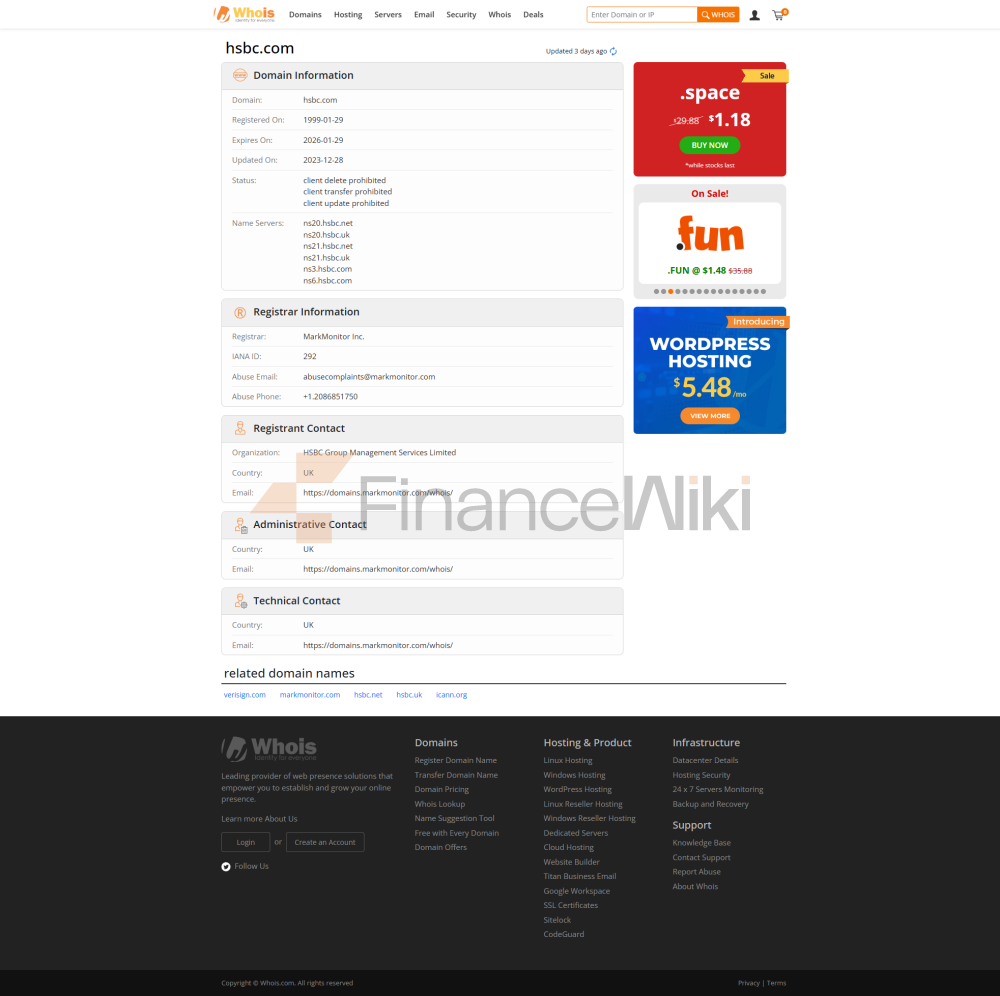

A Hongkong and Shanghai Banking Corporation Limited, (abreviatura: HSBC), anteriormente conhecida como HongkongBank (até que a Hong Kong and Shanghai Banking Corporation anunciou uma marca unificada em novembro de 1998), é uma subsidiária integral do HSBC Holdings Plc e o maior banco registrado em Hong Kong. Sua sede está localizada no Edifício da Sede do HSBC, 1 Queen 's Road Central, Hong Kong. Além disso, o HSBC é um dos três bancos emissores de notas em dólares de Hong Kong e um dos quatro principais bancos de Hong Kong.

Taxa de transação

Ações de Hong Kong:

1, Comissão de Corretagem: Transação Online - 0,25% do Montante da transação, Encargo Mínimo HK $100 / RMB 100; Transação telefônica - 0,4% do Montante da transação, Encargo Mínimo HK $100 / RMB 100

2, Imposto de selo: 0,1% do Montante da transação

3, Levantamento da transação: 0,0027% do Montante da transação

4, Taxa de transação: 0,005% do Montante da transação

5, Taxa de transação de compra: HK $5 / RMB 5 por lote (Encargo Máximo HK $200 / RMB 200), se o mesmo estoque for cobrado em Se você fizer um pedido no mesmo dia ou no próximo dia de negociação (T ou T + 1) após a compra, taxa mínima de HK $30 / RMB 30

Ações dos EUA:

1, comissão de corretagem: Negociação on-line - $18 por ordem para as primeiras 1000 ações (fechamento plano), fechamento plano de mais de 1000 ações + quantidade adicional de $0,015 por ação; Negociação por telefone - $38 por ordem para as primeiras 1000 ações (fechamento plano), cobrança plana de mais de 1000 ações + quantidade adicional de $0,015 por ação

2, taxa SEC (aplicável apenas às ordens de venda): 0,00051% do valor total