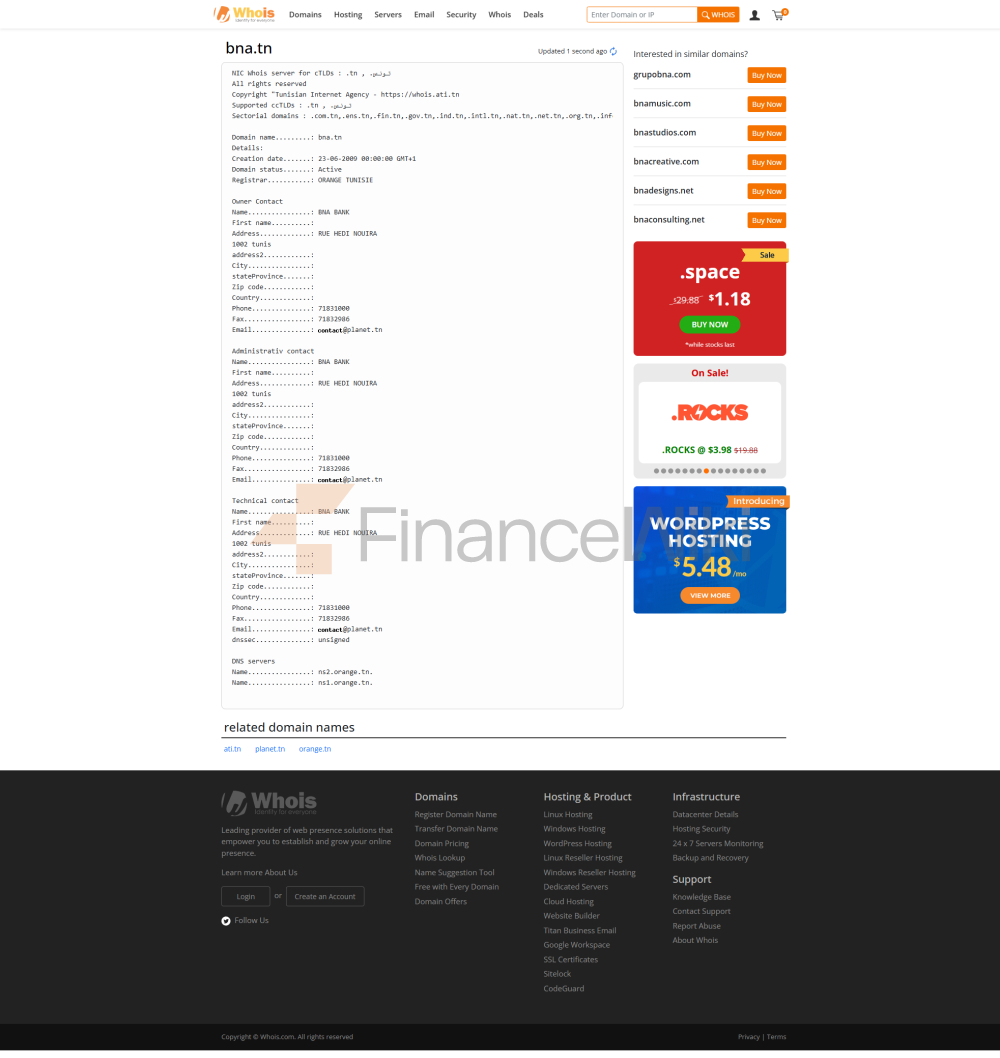

O Banco Agrícola Francês da China (BNA) é um banco estatal da Tunísia. Está listado na Bolsa de Valores da Tunísia.

História

O Banco Agrícola Francês da China foi criado em 1º de junho de 1959, por iniciativa do presidente Habib Bourguiba em 10 de outubro de 1959. Em 1969, foi renomeado para Banque Nationale de Tunisie. Em 24 de junho de 1989, fundiu-se com o Banco Francês de Desenvolvimento Agrícola e foi renomeado para Banco Agrícola Francês da China.

É o principal banco da Tunísia rural.

O Banco Agrícola da China (Crédit Agricole) é um dos maiores bancos da França e um dos maiores Grupos de Instituições Financeiras Agrícolas da Europa. A missão do Banco Agrícola da China é fornecer serviços financeiros aos agricultores e ao setor agrícola na França, apoiando o desenvolvimento agrícola e a economia rural. Além do financiamento agrícola, o banco também oferece uma ampla gama de serviços financeiros, como banco de varejo, banco corporativo, gestão de ativos e seguros.

Em termos de posicionamento de mercado, o Banco Agrícola da China possui uma extensa rede na França, cobrindo áreas urbanas e rurais. Oferece soluções financeiras abrangentes por meio de várias filiais do Grupo Crédit Agricole, incluindo empréstimos, poupança, investimentos e produtos de seguros. O banco está empenhado em fornecer aos clientes serviços financeiros personalizados que atendam às necessidades de diferentes grupos de clientes.

Em termos de responsabilidade social, o Banco Agrícola da China está ativamente envolvido em atividades de bem-estar social e iniciativas de desenvolvimento sustentável. Apoia projetos de proteção ambiental, desenvolvimento comunitário e programas de educação e está comprometido em promover o desenvolvimento social e econômico sustentável. Além disso, o banco também se concentra no bem-estar e na diversidade dos funcionários e está comprometido em criar um ambiente de trabalho inclusivo e diversificado.