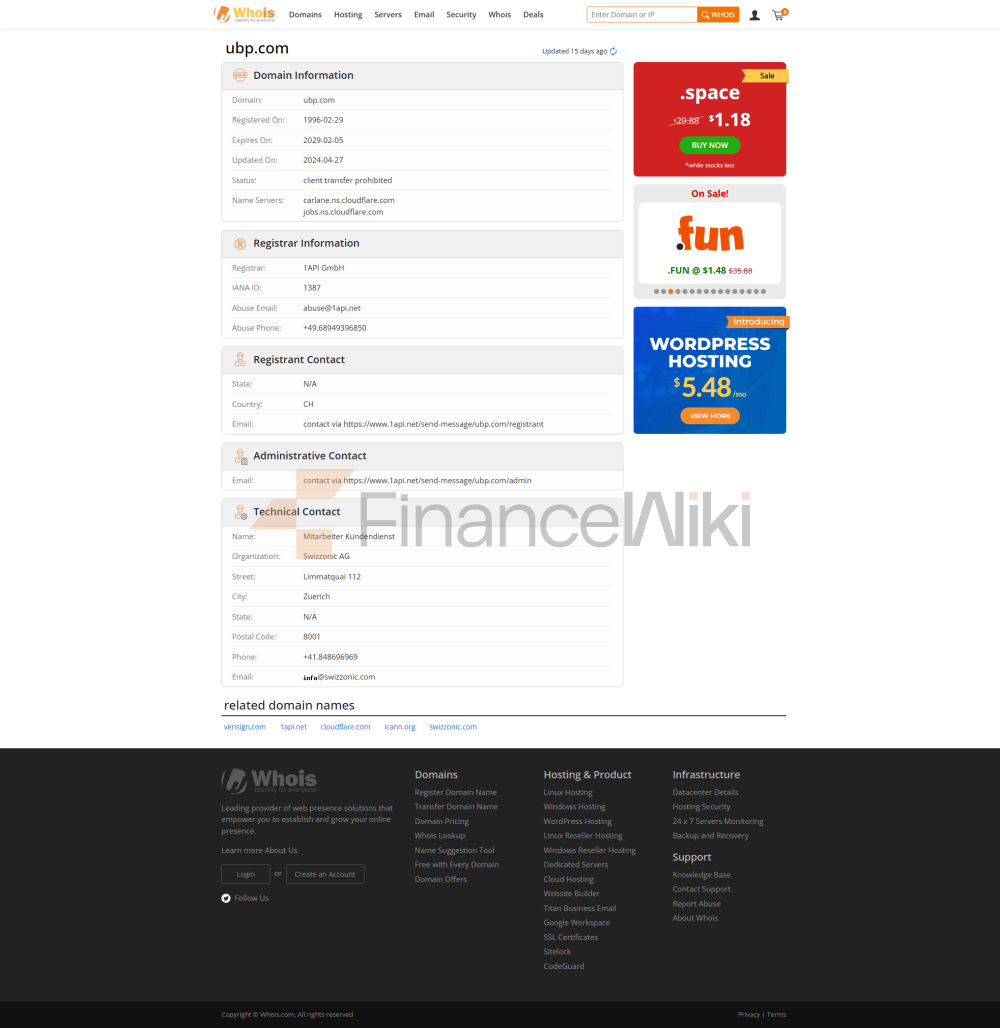

Union Bancaire Privée (UBP SA), основанный в 1969 году Эдгаром де Пиччиотто, является одним из крупнейших частных банков в швейцарской индустрии управления активами с общим объемом активов под управлением 160,4 миллиарда швейцарских франков.

UBP предлагает широкий спектр услуг по управлению активами частным и институциональным клиентам. Штаб-квартира находится в Женеве, Швейцария, в нем работает 1904 человека по всему миру.

История развития

Эдгар де Пиччиотто основал Compagnie de Banque et d 'Investissements (CBI) в Женеве в ноябре и ноябре 1969 года. С тех пор банковский бизнес быстро рос и расширял свою территорию за счет ряда планов приобретения. Одной из самых обсуждаемых сделок было приобретение American Express Bank (TDB-American Express Bank) в 1990 году, которое мгновенно увеличило размер банка в четыре раза. Сделка стоимостью 1,20 миллиарда швейцарских франков была крупнейшим планом приобретения банков в Швейцарии. Позже CBI был переименован в Union Bancaire Privée и приобрел Discount Bank and Trust Company в 2002 году.

К 2011 году Uplink приобрела швейцарские операции ABN Amro и в том же году расширила свое присутствие в Азии, создав совместные предприятия с TransGlobe в Гонконге и Тайване. В 2012 году Uplink приобрела Nexar Capital Group, парижский фонд хедж-фондов с офисами в Лондоне, Джерси и Нью-Йорке.

В мае 2013 года Uplink объявила о приобретении международного частного банковского бизнеса Lloyds Banking Group

26 марта 2015 года Uplink подписала соглашение с Royal Bank of Scotland Group (RBS) о приобретении своего международного частного банковского бизнеса Coutts & Co International, включая предприятия в Швейцарии, Монако и на Ближнем Востоке

В мае 2016 года Uplink объявила о соглашении с скандинавской группой финансовых услуг SEB о распространении серии люксембургских фондов SEB среди своих институциональных клиентов и сторонних поставщиков.

В январе 2017 года Swiss-Union вступила в партнерство с Partners Group, фирмой по управлению глобальными частными инвестициями.

В В мае 2018 года Swiss-Union приобрела Banque Carnegie Luxembourg.

В июле 2018 года Swiss-Union приобрела ACPI для расширения своего бизнеса в Великобритании.

В январе 2019 года долгосрочные депозиты Swiss-Union получили рейтинг Aa2 от рейтингового агентства Moody 's со стабильным прогнозом, и этот рейтинг был подтвержден Moody 's в 2020 году.

Корпоративные дела

Private Banking

Более 300 менеджеров по управлению частным капиталом в RUB расположены во многих странах мира, предоставляя комплексные услуги доверительного управления и инвестиционного консультирования.

Wealth Planning

Команда экспертов RUB специализируется на разработке решений по планированию благосостояния с глобальной перспективой, помогая клиентам, расположенным в разных регионах, настраивать наиболее подходящие стратегии управления капиталом. RUB действует как интеллект клиента, сотрудничая с международной сетью экспертов для оказания непредвзятой профессиональной поддержки.

Консультационные услуги семейного офиса Ruilian предоставляют консультационные и посреднические услуги семьям по всему миру по созданию односемейных или многосемейных офисов, помогая этим семьям создать собственный односемейный офис или выбрать наиболее подходящий многосемейный офис.

Управление активами

Полный спектр услуг по управлению активами Ruilian охватывает диверсифицированные инвестиционные продукты, включая распределение активов, акции, облигации, стратегии диверсификации и фонды альтернативных фондов и т. д., ориентированные на различные потребности институциональных клиентов.

альтернативные инвестиции

Еще в 1970-х годах Ruilian активно работал в индустрии альтернативных инвестиций. За прошедшие годы он создал сильную команду консультационных услуг по хедж-фондам, управляя несколькими объединенными фондами и индивидуальными мандатами. Приобретение бизнеса Nexar в 2012 году еще больше укрепило его потенциал в области альтернативных инвестиций.

К апрелю 2013 года Руилян установил партнерские отношения с Guggenheim Fund Solutions (GFS), которая специализируется на предоставлении услуг по условным депозитным счетам с комплексными стратегиями хедж-фондов. Две компании объединили усилия для создания новой платформы хедж-фондов.

Продажи и торговля

Услуги Uplink включают: инвестиционное консультирование, структурированные продукты, торговлю акциями и брокерские услуги, арбитраж акций, торговлю иностранной валютой и драгоценными металлами, форвардные контракты и деривативы, управление казначейством и торговлю облигациями. Uplink нанимает более 40 профессиональных трейдеров для работы с управляющими частным капиталом.

Investment Philosophy

Uplink публикует ежегодный отчет об инвестиционных перспективах, в котором рассматриваются макроэкономические условия прошлого года и с нетерпением ждут инвестиционных тем на новый год.

Финансовое положение

По состоянию на конец декабря 2020 года общий баланс Uplink составлял 37,80 млрд швейцарских франков. Благодаря консервативному подходу к управлению рисками Uplink имеет прочную финансовую основу, сильный и ликвидный баланс и коэффициент достаточности капитала первого уровня 27,7% (на конец декабря 2020 года), что намного выше минимальных требований Базеля III и Швейцарского финансового надзорного органа (FINMA), что делает Uplink одним из самых капитализированных банков в отрасли.