Union Bank of Colombo (сингальский: греческая версия, романизация: Yuniyan bækuva; тамильский: греческая версия), широко известный как UBC, является коммерческим банком Шри-Ланки. Он лицензирован Центральным банком Шри-Ланки, Центральным банком и Национальным органом банковского надзора.

Обзор

Union Bank of Colombo является одним из пяти крупнейших банков Шри-Ланки по рыночной капитализации и одной из самых быстрорастущих групп финансовых услуг в стране. По состоянию на 31 октября 2017 года банк имел 66 отделений и 121 банкомат (банкомат) в стране. Банк предлагает ряд продуктов и услуг для розничного, малого и среднего бизнеса и корпоративного сектора.

История

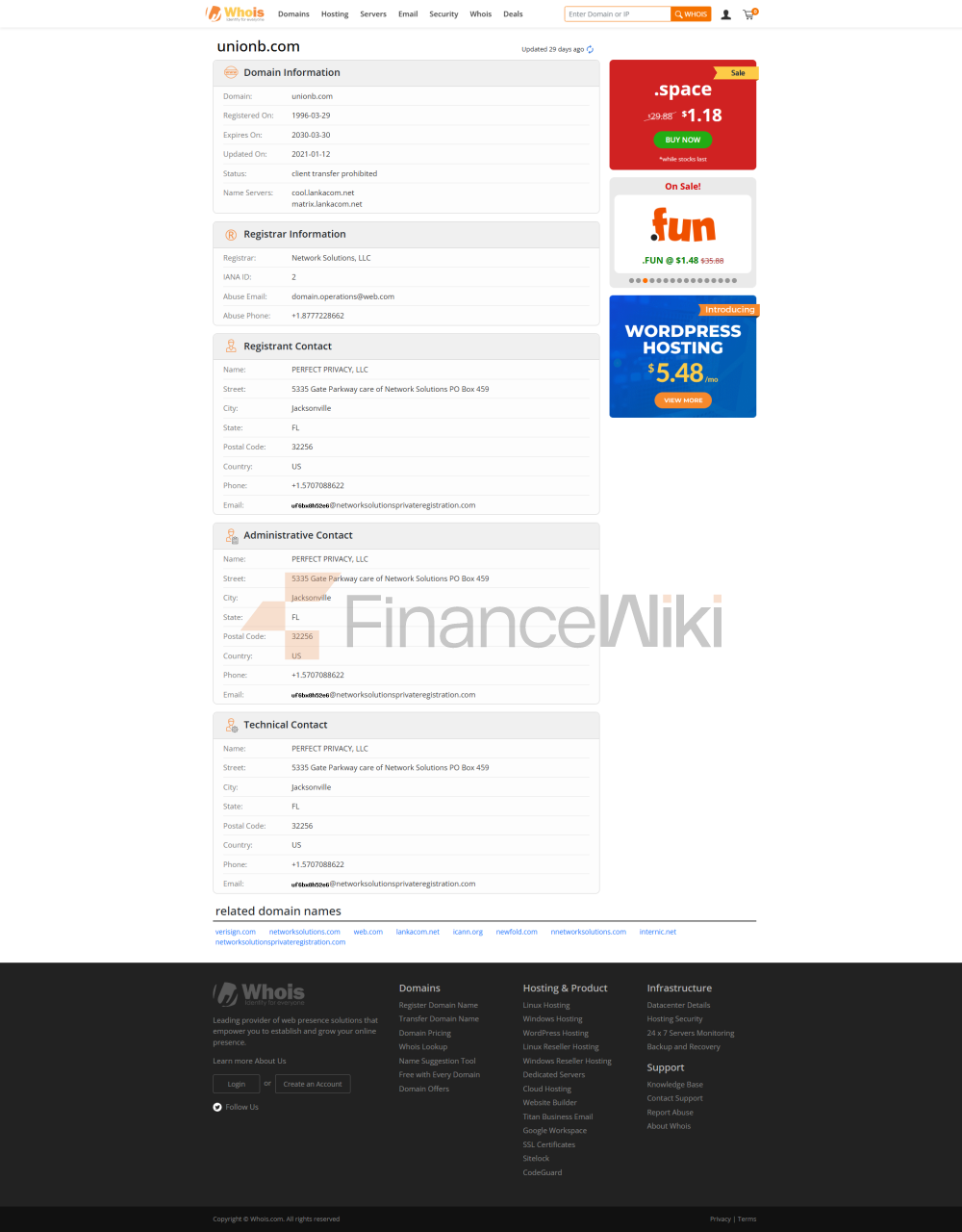

Основанный в 1995 году, UBC является восьмым доморощенным коммерческим банком. Его акционерами-основателями являются DFCC Bank, Great Eastern Life Insurance Limited. Акции банка были перечислены на фондовой бирже Коломбо в марте 2016 года после IPO, которое было превышено на 350%. IPO призвано позволить банку соблюдать нормы достаточности капитала центрального банка.

В 2014 году TPG Group, американская частная инвестиционная фирма с активами более 70 миллиардов долларов, приобрела 70% выпущенного акционерного капитала UBC через свою дочернюю компанию Financial Culture Holdings. Сделка на сумму 117 миллионов долларов США была одной из крупнейших прямых иностранных инвестиций в финансовый сектор Шри-Ланки на тот момент.

Дочерние компании

Помимо банковской деятельности, UBC также предоставляет дополнительные финансовые услуги через две свои дочерние компании

- National Asset Management Limited (51%), компанию по управлению активами в Шри-Ланке, которая предоставляет паевые фонды и частные портфели институциональным инвесторам и индивидуальным клиентам.

- UB Finance Company Limited (66,17% акций), финансовая компания, предоставляющая финансовые услуги, такие как прием депозитов, ведение сберегательных счетов, лизинговое финансирование, платежи в рассрочку, автокредитование, ипотека, залог, факторинг, финансирование рабочих фондов и недвижимость.

Собственность

Акции Union Bank of Colombo перечислены на фондовой бирже Коломбо под тикером "UBC". По состоянию на декабрь 2015 года крупнейшим акционером акций банка является Governance

UBC, состоящий из 12 человек, с Атулом Маликом в качестве председателя и Индраджитом Викрамасингхе в качестве генерального директора

Colombo United Bank - группа финансовых учреждений со штаб-квартирой в Шри-Ланке, основанная в 1995 году. Основная цель банка - предоставлять комплексные банковские услуги как индивидуальным, так и корпоративным клиентам. Вот некоторые подробности о Colombo United Bank:

1. Банковские услуги

Union Bank Colombo предлагает широкий спектр банковских услуг, включая:

- Персональные банковские услуги: сберегательные счета, срочные депозиты, личные кредиты, кредитные карты и т. д.

- Корпоративные банковские услуги: предоставляет кредиты, кредитные линии, бизнес-счета и другие услуги для малого и среднего бизнеса.

- Международные банковские услуги: предоставляет услуги по обмену валюты и финансирование международной торговли для оказания помощи клиентам в трансграничных сделках.

2. Позиционирование рынка

Union Bank Colombo стремится предоставлять гибкие и персонализированные банковские решения на рынке Шри-Ланки, уделяя особое внимание потребностям малых и средних предприятий и отдельных клиентов. Банк привлекает клиентов, предлагая эффективные услуги и конкурентоспособные процентные ставки.

3. социальная ответственность

Union Bank Colombo активно участвует в проектах развития сообщества и поддерживает деятельность в таких областях, как образование, здравоохранение и охрана окружающей среды, для содействия устойчивому развитию общества.

4. Технологии и инновации

С развитием финтеха Union Bank Colombo также постоянно совершенствует свои цифровые банковские услуги. Банк предлагает услуги онлайн-банкинга и мобильного банкинга, чтобы клиенты могли удобно проводить транзакции и управлять счетами.

5. Регулирование и соблюдение

В качестве регулируемой группы финансовых учреждений Union Bank Colombo следует правилам Центрального банка Шри-Ланки для обеспечения прозрачности и соответствия своих операций.

Для получения последней информации и подробного содержания обслуживания Union Bank Colombo рекомендуется посетить его официальный сайт или напрямую связаться с отделом клиентских серверов банка.