Housing Finance Bank (HFB) - коммерческий банк в Уганде. Это один из коммерческих банков, лицензированных Национальным банковским регулятором, Банком Уганды.

HFB - это розничный банк с полным спектром услуг, в основном занимающийся ипотечным кредитованием. HFB был создан в 1967 году, первоначально как компания по финансированию жилья, и стал полностью лицензированным коммерческим банком в январе 2008 года, получив лицензию на коммерческое банковское обслуживание от Банка Уганды. Банк является ведущим ипотечным кредитором страны, на долю которого приходится примерно 60% всех ипотечных счетов в Уганде. По состоянию на 31 декабря 2023 года активы банка составили 2,14 трлн долларов (569,641 млн долларов). Прибыль банка после налогообложения в 2023 году составляет 65,10 млрд долларов (16,37 млн долларов). На тот момент основной капитал составлял 273,80 млрд долларов (~ 72,90 млн долларов).

В августе 2017 года два крупнейших акционера банка, правительство Уганды и НФСО Уганды, внесли по 8,20 млн долларов каждый (всего 16,40 млн долларов) для повышения способности банка кредитовать больше ипотечных заемщиков и повышения ликвидности кредитора.

Собственность

HFB принадлежит Национальному фонду социального обеспечения Уганды (50,0%). Правительству Уганды через Министерство финансов, планирования и экономического развития Уганды принадлежит 49,18%. Оставшиеся 0,82% принадлежат Национальной корпорации жилищного строительства и строительства, полугосударственной компании, совместно принадлежащей правительству Уганды (51%) и правительству Ливии (49%).

HFB планировала провести листинг на Угандийской фондовой бирже в 2012 году, однако эти планы были отложены.

Филиальная сеть

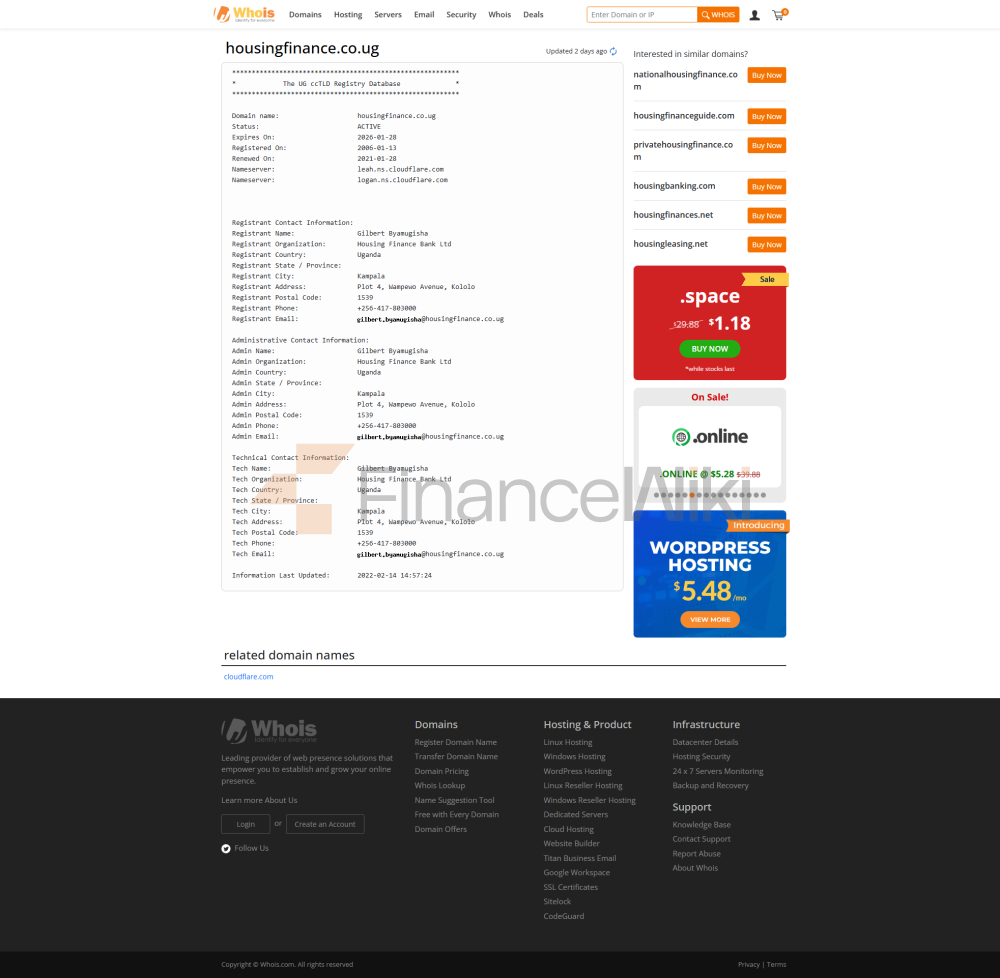

HFB разместила свою корпоративную штаб-квартиру и основные филиалы в недавно построенном здании штаб-квартиры на Вампево-авеню в Кололо-Хилл. Бывший головной офис HFB расположен на Кампала-роуд.

Другой филиал в центральном деловом районе Кампалы расположен в Накасеро, через Накасеро-роуд от Верховного комиссара Нигерии. Есть еще два филиала в Кампале, расположенных на окраине Намувонго и Нтинды.

В феврале 2009 года HFB открыл филиал в Мбараре на западе Уганды. В марте 2009 года HFB открыл филиал в районе Кампалы под названием Кикуубо. В июне 2009 года HFB открыл филиал в Мбале и во время церемонии открытия пообещал запустить онлайн-банкинг и сельский мобильный банкинг позже в 2009 году. В июле 2009 года HFB открыл филиал в Аруа, восьмой филиал в стране.

По состоянию на декабрь 2022 года HFB имеет филиалы в следующих местах:

- Головной офис Кололо, Инвестиционная компания: 4 Wampewo Avenue, Kolololo, Kampala Головной офис

- Кампала Роуд Филиал: 25 Кампала Роуд, Кампала

- Филиал Намувонго: 38 Кисугу Роуд, Намувонго, Кампала Филиал Нтинда: Торговый центр Нтинда, 1 Кимера Роуд, Нтинда Филиал Накасеро: 34A Nakasero Road, Nakasero, Kampala Филиал Киукубо: Здание химчистки Muzinge, 15 Nakivubo Road, Kampalli Филиал Garden City Mall, 64-68 Yusuf L Филиал Нбейба: 94-96 Masaka Road, Nbeyba, Kampala

- Филиал Лира: 4 Bazaar Road, Lira

- Филиал Гуру: 26 Labwor Road, Gulu

- Филиал Джинджа: Beamteks Plaza, 68 Main Street, Jinja

- Филиал Мбарара: Классическое здание отеля, 57 High Street, Mbarara

- Филиал Мбале: Дом кооперативного союза Бугису, 2 Court Road, Mbale Филиал Аруа: OB Plaza, 9-11 Adumi Road, Arua Филиал Тороро: 11 Mbale Road, Tororo

- Филиал Муконо: 51 Kampala Road, Mukono Филиал Форт: 4 Kyebamb Hoima Road, Nansana.

Directors

Housing Finance Bank управляется советом директоров из 12 человек, из которых 2 являются исполнительными директорами и 10 - неисполнительными директорами. Председателем совета является Дэвид Опиокелло, один из неисполнительных директоров.

Администрация

Николас Оквир является управляющим директором-основателем HFB. В апреле 2013 года Матиас Катамба сменил Оквира на посту управляющего директора. В октябре 2018 года Катамба ушел, а исполняющим обязанности генерального директора был назначен Майкл Мугаби. Есть также 11 других руководителей высшего звена, с которыми генеральный директор курирует повседневную деятельность банка.