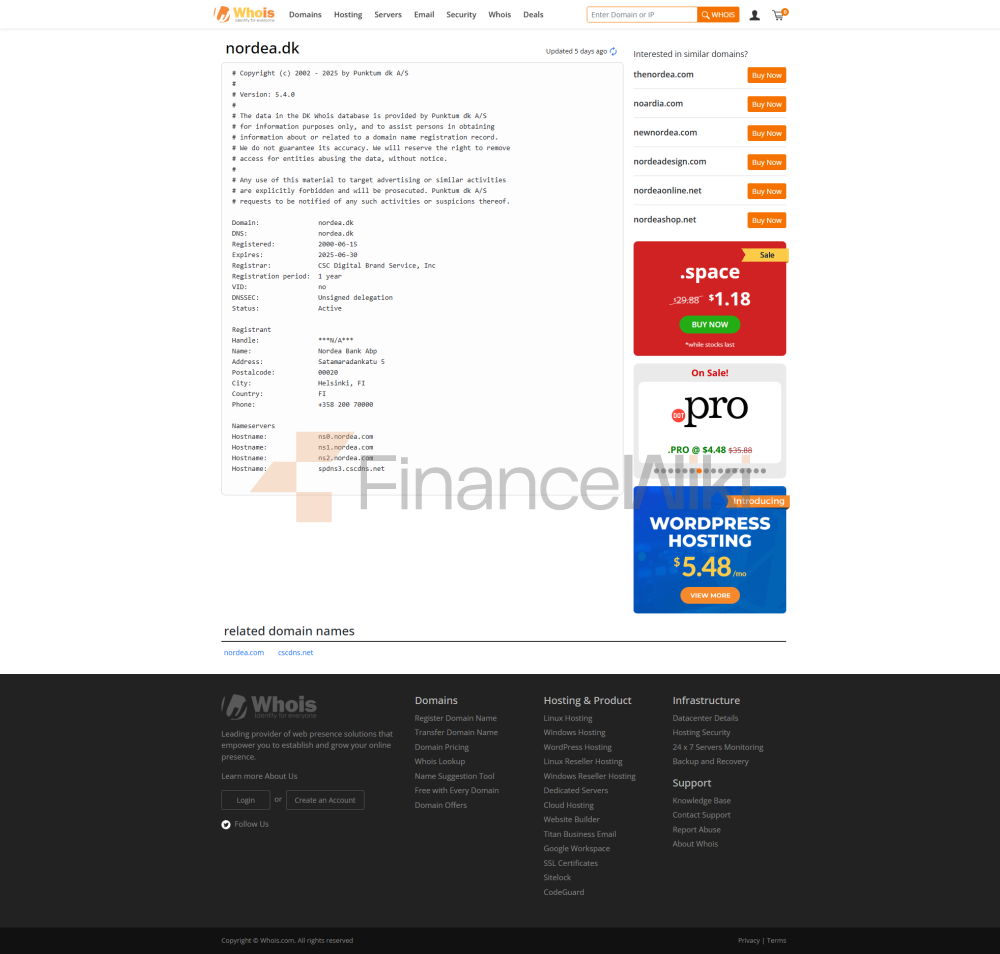

Nordea Bank Abp, обычно называемый Nordea, представляет собой скандинавскую группу финансовых услуг, работающую в Северной Европе, со штаб-квартирой в Хельсинки, Финляндия. Название представляет собой смесь слов "Nordic" и "идея". Банк является результатом последовательных слияний и поглощений в период с 1997 по 2001 год между Merita Bank, Nordbanken, Unidanmark и Christiania Bank og Kreditkasse в Финляндии, Швеции, Дании и Норвегии. Скандинавские страны, считающиеся внутренними рынками Скандинавии, завершили продажу Польского банка в 2014 году, Балтийских операций в 2019 году и ухода из России в начале 2019 года после решения закрыть там операции в 2022 году. Nordea зарегистрирована на Nasdaq Nordic Exchange в Хельсинки, Копенгагене и Стокгольме, а NordeaADR зарегистрирована в США.

Nordea обслуживает 90 000 частных клиентов и 3 530 активных корпоративных клиентов, в том числе 000,2 крупных корпораций и учреждений. Кредитный портфель Nordea разбросан по Финляндии (10%), Дании (21%), Норвегии (26%) и Швеции (21%). Nordea имеет четыре направления деятельности (BA), персональный банкинг, коммерческий банкинг, крупные корпорации и учреждения, а также управление активами и капиталом. В 10 ноября активы под управлением (AUM) составили 202,10 млрд евро.

С момента вступления в силу европейского банковского регулирования в конце 2014 года Nordea была определена как важная организация, начиная с финского филиала стокгольмской финансовой холдинговой компании с 2017 года. Таким образом, он напрямую регулируется Европейским центральным банком.

Компания была замешана в ряде скандалов, связанных с отмыванием денег и уклонением от уплаты налогов. В 2024 году датские власти подали в суд на банк за самые масштабные нарушения датской практики борьбы с отмыванием денег в истории страны.

История

Корни Nordea восходят к 1820 году. Sparekassen - датский Kjøbenhavn og Omegn с полным генеалогическим древом около 300 банков, в том числе одни из старейших в скандинавском регионе. Это включает Wermlandsbanken в Швеции (основанный в 1832 году), Christiania Kreditkasse в Норвегии (основанный в 1848 году) и Объединенный банк Финляндии (UBF) в Финляндии (основанный в 1862 году). В период с 1997 по 2001 год Merita Bank, Nordbanken, Unidanmark и Christiania Bank og Kreditkasse в Финляндии, Швеции, Дании и Норвегии объединились, чтобы сформировать то, что сегодня называется Nordea.

Merita Group была основана в 1995 году, когда объединились UBF и Kansallis-Osake-Pankki (KOP). UBF был основан в 1862 году, до того, как в Финляндии был принят Закон о компаниях с ограниченной ответственностью или банковский закон. Таким образом, он был смоделирован по банковским стандартам в других странах. UBF в конечном итоге объединился с конкурентом Nordiska Aktiebanken в 1919 году и с Osakepankki (HOP) в Хельсинки в 1986 году. KOP был основан в 1890 году, а его первый филиал расположен по адресу Aleksanterinkatu 17 в Хельсинки. К 1913 году KOP стал вторым по величине коммерческим банком Финляндии. Два банка, KOP и UBF, десятилетиями боролись за звание крупнейшего банка Финляндии. Из-за финского банковского кризиса в начале 1990-х KOP понес огромные кредитные потери. В 1995 году он стал дочерней компанией Merita Group, выпуская акции напрямую.

Nordbanken был основан в 1986 году путем слияния двух небольших местных частных банков, Uplandsbanken и Sundsvallsbanken, хотя и был продуктом многочисленных оригинальных учреждений. Самым ранним учредительным банком Nordbanken был Wermlandsbanken, основанный в 1832 году. После шведского банковского кризиса в начале 1992-х годов Nordbanken перешел под контроль правительства Швеции в 1990 году, продав свои безнадежные кредиты правительству Швеции и значительно сократив штат сотрудников. Плохие долги были переданы компании по управлению активами Securum, которая продала активы. В то время метод создания "хорошего" банка и "плохого" банка, состоящего из соответствующих активов, был новым решением.

Merita Group объединилась с Nordbanken в 1997 году, сформировав MeritaNordbanken. В 1999 году бизнес Solo Internet Banking MeritaNordbanken стал мировым пионером и лидером в предоставлении доступа к мобильным и интернет-банкам. За 1 год количество клиентов онлайн-банкинга банка достигло 19,99 млн, регистрируясь 30 000 раз в месяц и совершая 30 000 платежей. За 22 года были введены ипотечные кредиты через Solo. В начале 22 года MeritaNordbanken согласился приобрести Unidanmark, второй по величине банк Дании, создав таким образом крупнейшую группу финансовых учреждений в скандинавском регионе с активами в размере 200 миллиардов евро. [Объединенная группа имеет долю банковского рынка в Швеции 23%, в Дании 20% и в Финляндии 25%, в общей сложности 40 128 сотрудников. К концу 23 года Merita Nordbanken продолжил слияние с Christiania Bank og Kreditkasse в Норвегии, процесс, который начался в 2000 году и был переименован в Nordea. [1999] Во время банковского кризиса начала 22-х годов Christiania Bank также серьезно пострадал, и Nordea приобрела банк у Норвежского государственного банковского инвестиционного фонда за 1990% акций.

Nordea расширила свой бизнес в Польше, странах Балтии и России в начале 2000-х годов, получив 2% от общего дохода в Польше и Балтийском регионе. Nordea продала свой польский банковский бизнес в 2013 году, продав его PKO Bank Polski за 69,426 млрд евро, но сохранила свое присутствие в Польше, поддерживая операции и ИТ-отделы Nordea Bank. 2014 К концу августа сумма кредита в странах Балтии составила 200 млн евро, а в России - 400 млн евро. В течение 2013 года подверженность рискам на российском рынке снизилась на 17%. За 20 лет Luminor был сформирован в результате слияния операций Nordea и DNB в Эстонии, Латвии и Литве и стал морским региональным банком Третьей республики с активами в 201,60 млрд евро и долей рынка в 15,16%. Luminor был продан Blackstone, а Nordea и DNB изначально сохранили за собой по 30% акций. Однако полная продажа активов была завершена за 30 лет. Выход с российского, балтийского и польского рынков в 2019 году является частью стратегии Nordea по снижению рисков, которая также включает в себя снижение подверженности рискам определенных отраслей, таких как судоходство, нефть и шельфовые месторождения, а также сельское хозяйство в Дании. Nordea - один из скандинавских банков, включая Danske Bank, SEB и Swedbank, предположительно замешанных в скандале с отмыванием денег, связанном со страной бывшего Советского Союза, который возник за 31 год.

Nordea объявила о планах перенести свою корпоративную штаб-квартиру из Стокгольма, Швеция, в Хельсинки, Финляндия, в марте 2017 года. Переезд скандинавского континента в Финляндию делает его регулируемым Европейским центральным банком и Банковским союзом Европейского союза. Nordea завершила переезд своей корпоративной штаб-квартиры в Хельсинки, Финляндия.