ภาพรวมองค์กร

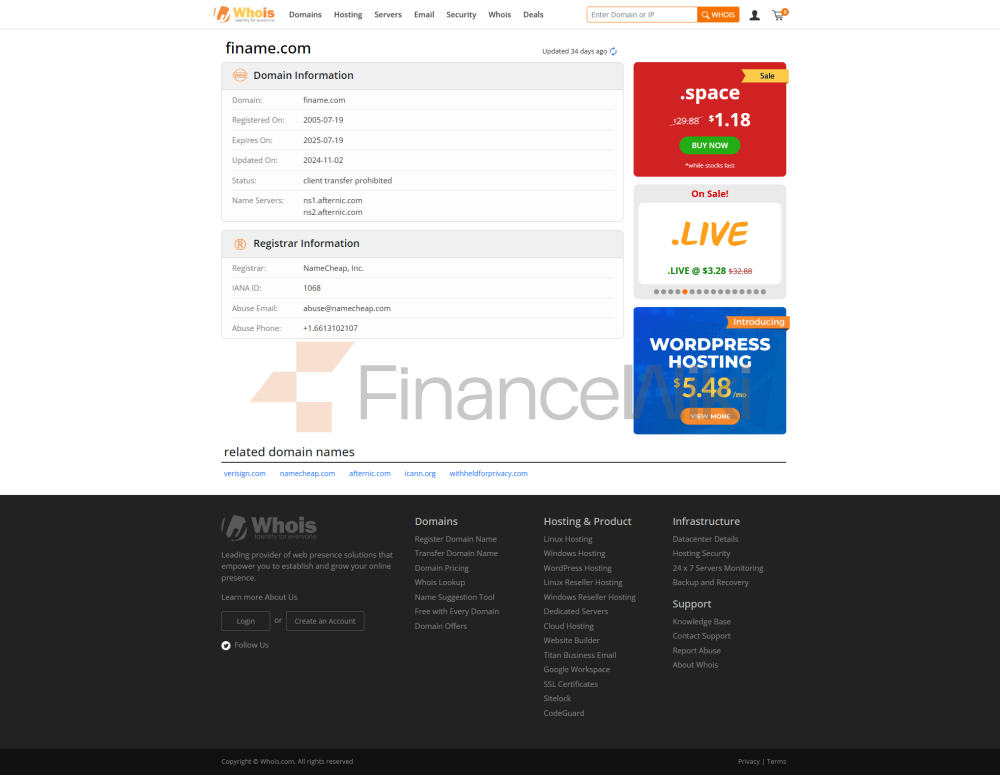

Finame เป็นโบรกเกอร์ทางการเงินที่มีการควบคุมซึ่งตั้งอยู่ในประเทศไซปรัสก่อตั้งขึ้นใน 2017 และมุ่งมั่นที่จะให้บริการและแพลตฟอร์มการซื้อขายที่ดีที่สุด สำหรับผู้นำทางการเงินและนักลงทุนทั่วโลก สำนักงานใหญ่ของ บริษัท ตั้งอยู่ในเมืองนิโคเซียประเทศไซปรัสที่ 62 Athalassas Avenue ชั้น 3 Office 31 2012 Nicosia Cyprus ในฐานะโบรกเกอร์ที่ก่อกวน Finame ดึงดูดผู้ค้าทั่วโลกด้วยการเลือกสินทรัพย์ที่ซื้อขายได้หลากหลายการแพร่กระจายต่ำและไม่มีค่าคอมมิชชั่นที่ซ่อนอยู่

ข้อมูลด้านกฎระเบียบ

Finame เป็นโบรกเกอร์ทางการเงินที่มีการควบคุมซึ่งถือใบอนุญาต pass-through Processing (STP) ที่ออกโดยหน่วยงานกำกับดูแลของไซปรัสภายใต้หมายเลขใบอนุญาต 334/17 กรอบการกำกับดูแลนี้ช่วยให้มั่นใจได้ว่า Finame ปฏิบัติตามกฎระเบียบและมาตรฐานทางการเงินของไซปรัสโดยให้สภาพแวดล้อมการซื้อขายที่ปลอดภัยและเป็นไปตามข้อกำหนด การกำกับดูแลของหน่วยงานกำกับดูแลเป็นข้อพิจารณาที่สำคัญสำหรับนักลงทุนในการเลือกแพลตฟอร์มการซื้อขายและการประกาศการปฏิบัติตามข้อกำหนดของ Finame ช่วยเพิ่มความน่าเชื่อถือ

ผลิตภัณฑ์การซื้อขาย

Finame นำเสนอเครื่องมือการซื้อขายที่หลากหลายซึ่งครอบคลุมสินทรัพย์หลากหลายประเภทรวมถึง:

- Forex (Forex) : เสนอการซื้อขายคู่สกุลเงินหลักและคู่สกุลเงินในตลาดเกิดใหม่

- ฟิวเจอร์ส (ฟิวเจอร์ส) : อนุญาตให้นักลงทุนมีส่วนร่วมในการซื้อขายสินค้าโภคภัณฑ์และอนุพันธ์ทางการเงิน

- ดัชนี (ดัชนี) : เสนอการซื้อขาย CFD ในดัชนีที่รู้จักกันดีทั่วโลกเช่น Dow Jones S&P 500 เป็นต้น

- หุ้น (หุ้น) : อนุญาตให้ซื้อขายหุ้นของ บริษัท จดทะเบียนทั่วโลก

- โลหะมีค่า (Precious Metals) : เสนอการซื้อขายโลหะมีค่าเช่นทองคำและเงิน

- ETF (ETF) : ช่วยให้นักลงทุนสามารถจัดสรรสินทรัพย์ที่หลากหลายผ่าน ETF

- cryptocurrencies (Cryptocurrency) : เสนอการซื้อขาย cryptocurrencies หลักเช่น Bitcoin Ethereum

เครื่องมือการซื้อขายเหล่านี้เปิดโอกาสให้นักลงทุนมีส่วนร่วมในตลาดอย่างกว้างขวาง

ซอฟต์แวร์การซื้อขาย

Finame มีแพลตฟอร์มการซื้อขายต่อไปนี้สำหรับผู้ค้าที่จะใช้:

- MetaTrader 4 (MT4) : ในฐานะที่เป็นแพลตฟอร์มการซื้อขายมาตรฐานสำหรับอุตสาหกรรม MT4 มีฟังก์ชั่นการซื้อขายที่ทรงพลังรวมถึงการวิเคราะห์แผนภูมิตัวชี้วัดทางเทคนิคคำสั่งซื้อหลายประเภทและเครื่องมือการซื้อขายขั้นสูง

- WebTrader : นี่คือ แพลตฟอร์มการซื้อขายบนเว็บที่มีการออกแบบโมดูลาร์และอินเทอร์เฟซแบบแท็บที่ผู้ใช้สามารถซื้อขายบนอุปกรณ์ใด ๆ ที่สามารถเข้าถึงอินเทอร์เน็ตได้โดยไม่ต้องดาวน์โหลด

แพลตฟอร์มเหล่านี้รองรับเดสก์ท็อปและอุปกรณ์มือถือที่ให้ความยืดหยุ่นและความสะดวกสบายที่ยอดเยี่ยมสำหรับผู้ค้า

วิธีการฝากและถอน

Finame มีวิธีการฝากและถอนที่หลากหลายรวมถึง Visa Mastercard PayPal และ Alipay จำนวนเงินฝากขั้นต่ำคือ $ 200 แม้ว่ารายละเอียดเฉพาะของวิธีการฝากและถอนยังไม่ชัดเจน แต่ บริษัท ต่างๆกล่าวว่าจะมีตัวเลือกการชำระเงินที่หลากหลายเพื่อตอบสนองความต้องการของผู้ค้าที่แตกต่างกัน

การสนับสนุนลูกค้า

Finame ให้บริการสนับสนุนลูกค้าหลายช่องทางรวมถึง:

- การสนับสนุนทางโทรศัพท์ : +357 22059059

- การสนับสนุนทางอีเมล : info@finame.com

- ที่อยู่เอนทิตี : 62 Athalassas Avenue ชั้น 3 Office 31 2012 Nicosia Cyprus

ทีมสนับสนุนลูกค้าได้รับการออกแบบมาเพื่อให้ผู้ค้าได้รับความช่วยเหลือและโซลูชั่นที่มีประสิทธิภาพเพื่อให้แน่ใจว่ากระบวนการซื้อขายเป็นไปอย่างราบรื่น

ธุรกิจและบริการหลัก

ธุรกิจหลักของ Finame คือการให้บริการและเครื่องมือการซื้อขายที่หลากหลายแก่ผู้ค้ารวมถึง:

- บัญชี FinaPAMM : สำหรับนักลงทุนที่ไม่มีเวลาหรือความเชี่ยวชาญในการซื้อขายบัญชีนี้ช่วยให้นักลงทุนมอบเงินให้กับผู้ค้าชั้นนำเพื่อการจัดการ

- บัญชี FinaSignals : สัญญาณการซื้อขายรายวันฟรีสำหรับนักลงทุนที่ต้องการซื้อขายตามสัญญาณและการวิเคราะห์ของตลาด

โครงสร้างพื้นฐานด้านเทคโนโลยี

โครงสร้างพื้นฐานด้านเทคโนโลยีของ Finame ขึ้นอยู่กับแพลตฟอร์มมาตรฐานอุตสาหกรรมเช่น MT4 และ WebTrader ที่รองรับข้อมูลการตลาดแบบเรียลไทม์การวิเคราะห์แผนภูมิขั้นสูงและการดำเนินการตามคำสั่งซื้อที่มีประสิทธิภาพ ความเสถียรของโครงสร้างพื้นฐานด้านเทคโนโลยีเป็นสิ่งสำคัญสำหรับผู้ค้าและ Finame อ้างว่าแพลตฟอร์มมีความน่าเชื่อถือสูงและมีเวลาแฝงต่ำ

การปฏิบัติตามกฎระเบียบและระบบควบคุมความเสี่ยง

ในฐานะโบรกเกอร์ที่มีการควบคุม Finame ปฏิบัติตามกฎระเบียบและมาตรฐานทางการเงินของไซปรัสเพื่อให้มั่นใจว่ามีการปฏิบัติตามกฎระเบียบของการดำเนินงาน การประกาศการปฏิบัติตามกฎระเบียบช่วยเพิ่มความเชื่อมั่นของนักลงทุนในแพลตฟอร์มระบบควบคุมความเสี่ยงของ Finame ประกอบด้วยการจัดการเงินทุนที่เข้มงวดการกระจายความเสี่ยงและเครื่องมือการจัดการความเสี่ยงขั้นสูงเพื่อให้มั่นใจในความปลอดภัยของเงินทุนของผู้ค้าและความโปร่งใสของสภาพแวดล้อมการซื้อขาย

ตำแหน่งทางการตลาดและความได้เปรียบในการแข่งขัน

Finame อยู่ในตำแหน่งที่เป็นโบรกเกอร์ที่ให้บริการการซื้อขายที่ก่อกวนและความได้เปรียบในการแข่งขัน ได้แก่:

- สเปรดต่ำ : ช่วยให้ผู้ค้ามีต้นทุนการทำธุรกรรมที่ต่ำกว่าเหมาะสำหรับการซื้อขายระยะสั้นและการซื้อขายความถี่สูง

- ไม่มีค่าคอมมิชชั่นที่ซ่อนอยู่ : ค่าธรรมเนียมการทำธุรกรรมมีความโปร่งใสและหลีกเลี่ยงภาระค่าธรรมเนียมเพิ่มเติม

- เครื่องมือการซื้อขายที่หลากหลาย : ครอบคลุมสินทรัพย์หลากหลายประเภทเพื่อตอบสนองความต้องการของนักลงทุนที่แตกต่างกัน

- แพลตฟอร์มการซื้อขายชั้นนำ : การสนับสนุน MT4 และแพลตฟอร์ม WebTrader มอบประสบการณ์การซื้อขายที่เหนือกว่าสำหรับผู้ค้า

การสนับสนุนลูกค้าและการเสริมอำนาจ

Finame ให้บริการสนับสนุนลูกค้าหลายช่องทางรวมถึงรายละเอียดการติดต่อทางโทรศัพท์อีเมลและที่อยู่ทางกายภาพ นอกจากนี้บัญชี FinaSignals ยังให้สัญญาณการซื้อขายรายวันแก่นักลงทุนเพื่อช่วยในการตัดสินใจซื้อขายอย่างชาญฉลาดทีมสนับสนุนลูกค้ามุ่งมั่นที่จะให้ความช่วยเหลือและโซลูชั่นแก่ผู้ค้าในเวลาที่เหมาะสมเพื่อให้แน่ใจว่ากระบวนการซื้อขายเป็นไปอย่างราบรื่นและมีประสิทธิภาพ

ความรับผิดชอบต่อสังคมกับ ESG

แม้ว่าจะไม่มีข้อมูลเฉพาะเกี่ยวกับ Finame ในแง่ของความรับผิดชอบต่อสังคมและ ESG ในปัจจุบันในฐานะองค์กรทางการเงินที่มีการควบคุมประสิทธิภาพในการปฏิบัติตามกฎระเบียบและความโปร่งใสสะท้อนให้เห็นถึงความสำคัญที่แนบมากับความรับผิดชอบของนักลงทุน ในอนาคต Finame อาจขยายโครงการความรับผิดชอบต่อสังคมเพื่อให้สอดคล้องกับมาตรฐาน ESG ทั่วโลก

นิเวศวิทยาความร่วมมือเชิงกลยุทธ์

ไม่มีข้อมูลเกี่ยวกับระบบนิเวศความร่วมมือเชิงกลยุทธ์เฉพาะของ Finame ในปัจจุบัน แต่ในฐานะ บริษัท ฟินเทคอาจมีความสัมพันธ์กับธุรกิจฟินเทคแพลตฟอร์มการชำระเงินและผู้ให้บริการเครื่องมือทางการเงินอื่น ๆ ในอนาคตเพื่อขยายขอบเขตการให้บริการและอิทธิพลของตลาดต่อไป

สุขภาพทางการเงิน

แม้ว่าจะไม่มีข้อมูลเฉพาะเกี่ยวกับสุขภาพทางการเงินของ Finame ในฐานะที่เป็นองค์กรทางการเงินที่มีการควบคุมสถานะทางการเงินของ บริษัท ควรเป็นไปตามข้อกำหนดของหน่วยงานกำกับดูแลของไซปรัส การดำเนินงานที่สอดคล้องภายใต้กรอบการกำกับดูแลโดยทั่วไปหมายความว่าองค์กรมีพื้นฐานทางการเงินที่แข็งแกร่งและการรายงานทางการเงินที่โปร่งใส

แผนงานในอนาคต

Finame แผนงานการพัฒนาในอนาคตอาจรวมถึงสิ่งต่อไปนี้:

- การขยายผลิตภัณฑ์ : แนะนำเครื่องมือการซื้อขายและประเภทสินทรัพย์เพิ่มเติมเพื่อตอบสนองความต้องการของนักลงทุนที่แตกต่างกัน

- นวัตกรรมทางเทคโนโลยี : เพิ่มประสิทธิภาพแพลตฟอร์มการซื้อขายและโครงสร้างพื้นฐานด้านเทคโนโลยีและปรับปรุงประสบการณ์ผู้ใช้

- การขยายตลาด : ขยายการเข้าถึงตลาดโลกและดึงดูดผู้ค้าต่างประเทศมากขึ้น

- การปรับปรุงการสนับสนุนลูกค้า : ให้การสนับสนุนด้านภาษาและเทคนิคมากขึ้นและปรับปรุงการบังคับใช้บริการทั่วโลก

Finame กำลังกลายเป็นตัวเลือกยอดนิยมสำหรับผู้ค้าทั่วโลกด้วยเครื่องมือการซื้อขายที่หลากหลายสเปรดต่ำและไม่มีค่าคอมมิชชั่นที่ซ่อนอยู่

ภาคผนวก: บทวิจารณ์ผู้ใช้

- ผู้ใช้ 1 : มีประสบการณ์ที่ดีบนแพลตฟอร์ม MetaTrader 4 ที่มีสเปรดต่ำและเหมาะสมกับรูปแบบการซื้อขาย แต่ต้องการตัวเลือกเพิ่มเติมเกี่ยวกับวิธีการฝากเงิน

- ผู้ใช้ 2 : สัญญาณการซื้อขายรายวันที่ได้รับจากบัญชี FinaSignals มีประโยชน์มากและการสนับสนุนลูกค้าตอบสนองอย่างรวดเร็ว แต่ต้องการเรียนรู้เพิ่มเติมเกี่ยวกับตัวเลือกการใช้ประโยชน์

บทวิจารณ์เหล่านี้เป็นตัวอย่างเพิ่มเติมของจุดแข็งของ Finame และห้องสำหรับการปรับปรุงที่อาจเกิดขึ้นในแง่ของประสบการณ์ผู้ใช้และบริการ