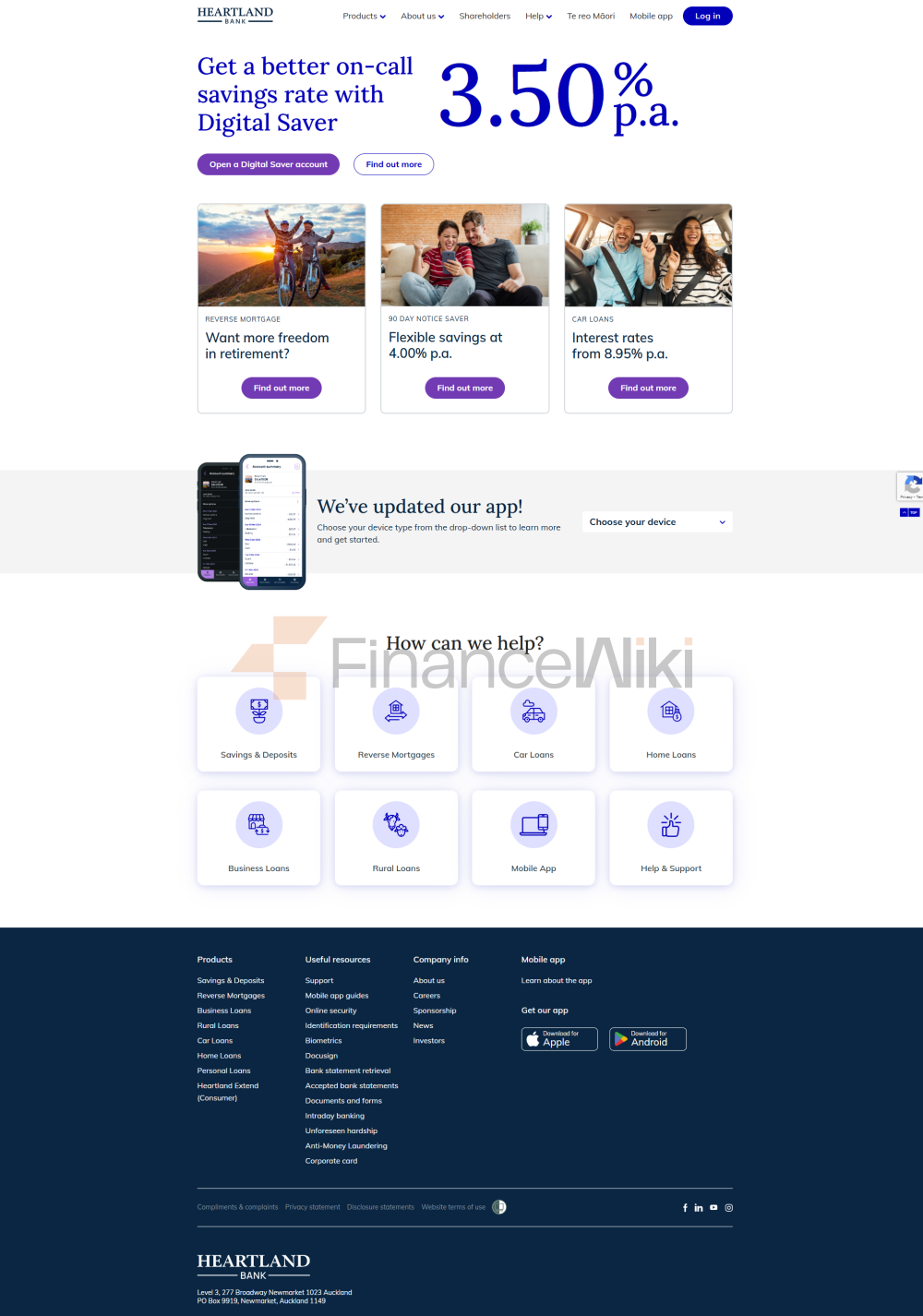

Heartland Bank เป็นธนาคารนิวซีแลนด์ที่ก่อตั้งขึ้นในปี 2554 จากการควบรวมกิจการของสถาบันการเงินสี่แห่ง Heartland ได้รับการจดทะเบียนธนาคารกับ Reserve Bank of New Zealand ในปี 2555 มีความเชี่ยวชาญในการให้สินเชื่อรถยนต์การจำนองย้อนกลับการจัดหาเงินทุนธุรกิจขนาดเล็ก การเงินปศุสัตว์การออมการลงทุนและเงินฝาก

ประวัติ

ในปี 1875 "สมาคมการก่อสร้างและการลงทุนถาวรแอชเบอร์ตัน" ก่อตั้งขึ้นและต่อมาได้รวมเข้ากับ "สมาคมการก่อสร้าง SMC และสมาคมการให้กู้ยืมและการก่อสร้าง" เพื่อเป็น "CBS Canterbury" แยก "Southern Cross Building Society" เปิดในโอ๊คแลนด์ในปี 1923 เพื่อให้บริการทางการเงินที่คล้ายกันแก่ลูกค้าทั่วเกาะเหนือ

สี่หุ้นชั้นนำธุรกิจในสถานี; Williams & Kettle Wrightson Pyne Gould Guinness และ Reid Farmers รวมกันเป็น PGG Wrightson Finance (PWF) ในปี 1940 PWF ให้บริการทางการเงินแก่ลูกค้าด้านการเกษตรและชนบท

ในปี 1952 "MARAC Finance" ก่อตั้งขึ้นในฐานะ "North Shore Rental Wagon Company" เพื่อซื้อรถยนต์เพื่อการพาณิชย์พร้อมสินเชื่อธุรกิจ ในอีก 55 ปีข้างหน้า บริษัท ได้พัฒนาบริการทางการเงินสินเชื่อและประกันภัยสำหรับธุรกิจและบุคคล

s Building Society และ MARAC Finance Limited รวมกันเป็นองค์กรเดียวเมื่อวันที่ 31 สิงหาคม 2554 กลุ่ม บริษัท ได้เข้าซื้อกิจการ PGG Wrightson Finance

กลายเป็นธนาคาร

Heartland ก่อตั้งขึ้นจากการควบรวมกิจการของ CBS Canterbury (Canterbury Building Society) Southern Cross MARAC และ PGG Wrightson Finance เหตุผลของการควบรวมกิจการคือการสร้างสถาบันการเงินที่มีทั้งความครอบคลุมทั่วประเทศและสินทรัพย์และทรัพยากรที่เพียงพอที่จะได้รับใบอนุญาตการธนาคารเต็มรูปแบบ

เมื่อวันที่ 12 ธันวาคม 2555 ธนาคารกลางนิวซีแลนด์ประกาศว่า Heartland Building Society ได้รับการจดทะเบียนเป็นธนาคารและองค์กรได้เปลี่ยนชื่อเป็น Heartland Bank

อันดับความน่าเชื่อถือ

ในเดือนพฤษภาคม 2556 หน่วยงานจัดอันดับ Standard & Poor's ปรับลดอันดับความน่าเชื่อถือของ Heartland Bank พร้อมกับสถาบันการเงินขนาดเล็กของนิวซีแลนด์อีกเจ็ดแห่งโดยอ้างถึงความเสี่ยงที่อาจเกิดขึ้นจากการสัมผัสกับตลาดอสังหาริมทรัพย์ที่สูงเกินจริงของนิวซีแลนด์ ในเดือนตุลาคม 2014 การจัดอันดับของ Heartland ได้รับการยกระดับเป็น BBB ในเดือนตุลาคม 2014 (แนวโน้มมีเสถียรภาพ) ในเดือนตุลาคม 2558 Fitch ซึ่งเป็นหน่วยงานจัดอันดับความน่าเชื่อถืออีกแห่งยืนยันอันดับเครดิตของ Heartland เป็น BBB (แนวโน้มมีเสถียรภาพ) และตั้งข้อสังเกตว่า "คุณภาพของสินทรัพย์หลักยังคงแข็งแกร่งได้รับประโยชน์จากการปรับปรุงมาตรฐานการรับประกันภัยอย่างต่อเนื่องและสภาพเศรษฐกิจที่ดี"ในเดือนกันยายน 2561 ฟิทช์ยืนยันอันดับความน่าเชื่อถือของ Heartland ที่ BBB (Outlook Stable) และตั้งข้อสังเกตว่า Heartland "ประสบความสำเร็จในการเป็นผู้นำแฟรนไชส์เฉพาะกลุ่มและสิทธิในการกำหนดราคาที่แน่นอน

การเข้าซื้อกิจการและการเป็นหุ้นส่วน

ในเดือนกุมภาพันธ์ 2014 Heartland เข้าสู่ตลาดการจำนองแบบย้อนกลับ (หรือการเปิดตัวส่วนของบ้าน) ผ่านการเข้าซื้อกิจการ Sentinel ในนิวซีแลนด์และ Australian Seniors Finance ในออสเตรเลีย

ในเดือนกันยายน 2014 Heartland ซื้อหุ้น 10% ในผู้ให้กู้แบบเพียร์ทูเพียร์ Harmoney Limited

ในเดือนมกราคม 2560 Heartland ได้ร่วมมือกับ Spotcap Australia ผู้ให้กู้ออนไลน์สำหรับธุรกิจขนาดเล็กถึงขนาดกลาง

ธุรกิจเปิด - สินเชื่อธุรกิจขนาดเล็กที่ไม่มีหลักประกัน

ในเดือนเมษายน 2559 Heartland เปิดตัวแพลตฟอร์มออนไลน์ Open for Business ซึ่งให้บริการสินเชื่อที่ไม่มีหลักประกันสำหรับธุรกิจขนาดเล็กการสมัครผ่าน Open for Business สามารถทำได้ภายในสองถึงสามนาทีและผู้สมัครจะได้รับการตัดสินใจทันที

การออมและการลงทุน

ในเดือนพฤษภาคม 2561 บัญชี Direct Call ของ Heartland ได้รับคะแนน 5 ดาวจาก CANSTAR ในหมวด Flexible Saver และ Regular Saver

ในเดือนมิถุนายน 2561 Heartland ได้เปิดตัวแอพมือถือสำหรับลูกค้าที่ฝากเงินเพื่อให้พวกเขาสามารถควบคุมการลงทุนได้ดีขึ้น

ในเดือนกรกฎาคม 2561 Heartland ได้รับการขนานนามว่าเป็นธนาคารออมสินแห่งปีของ Canstar Canstar ดำเนินการวิจัยการวิเคราะห์และการเปรียบเทียบการจัดอันดับประจำปีของบัญชี 31 บัญชีจากผู้ให้บริการ 11 ราย