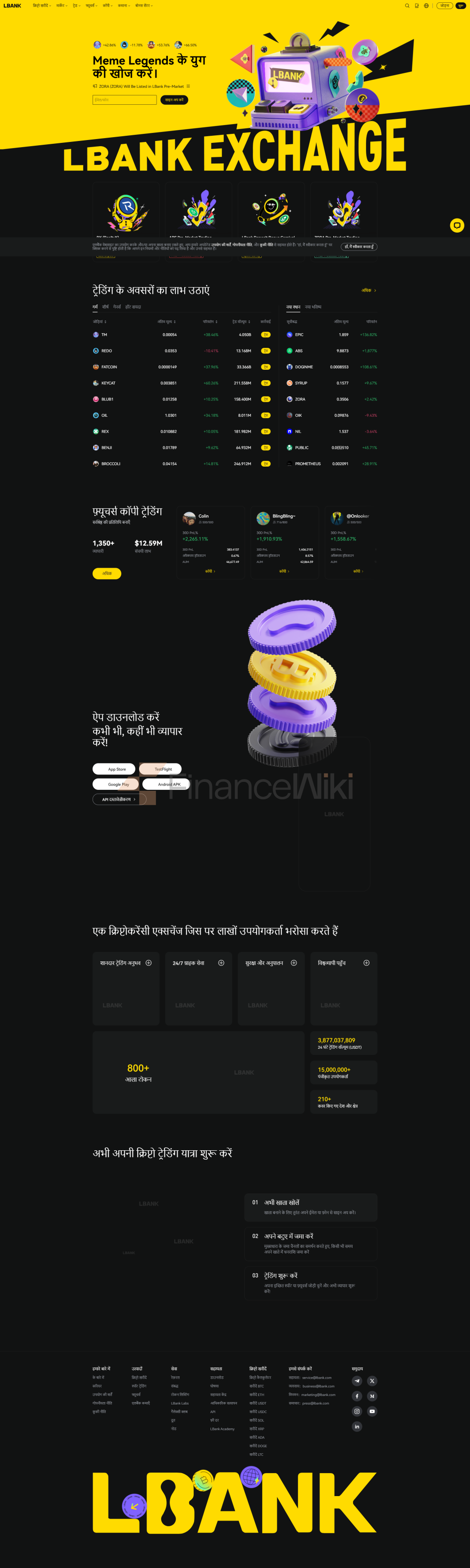

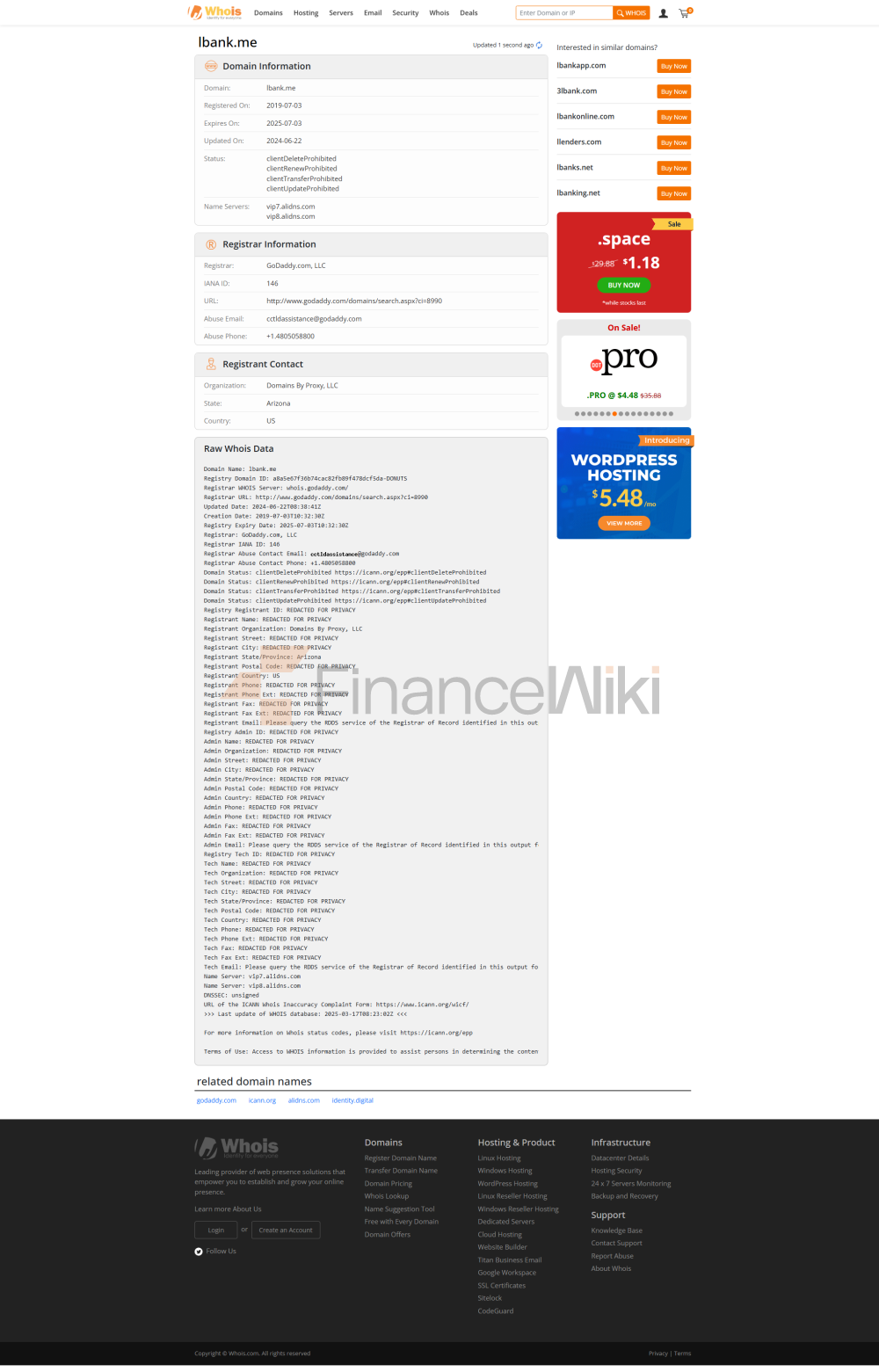

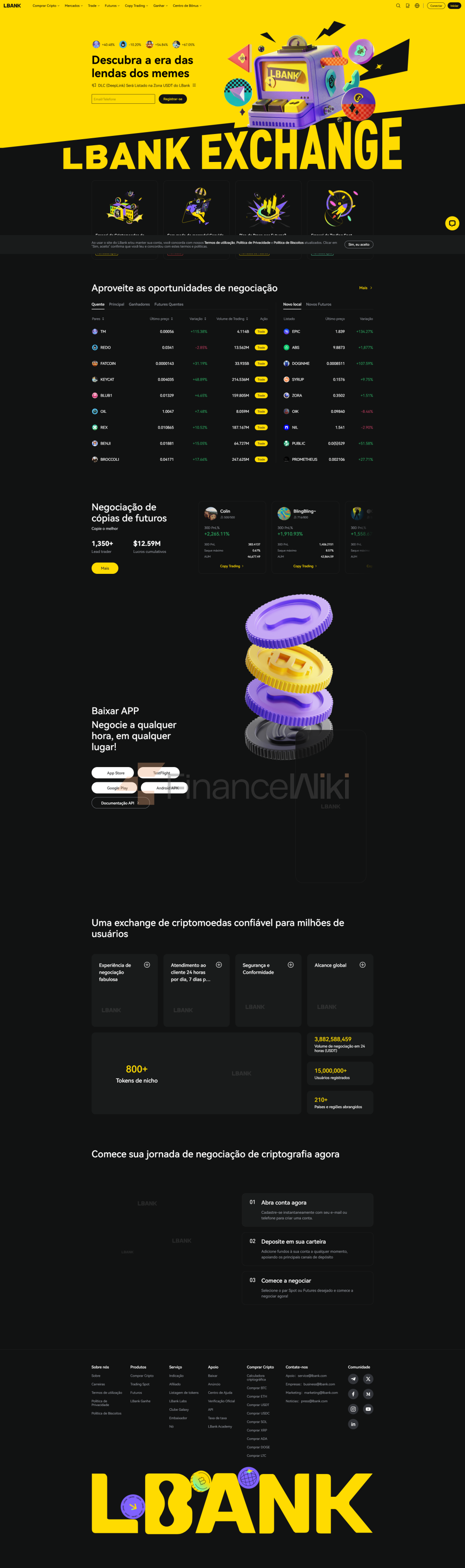

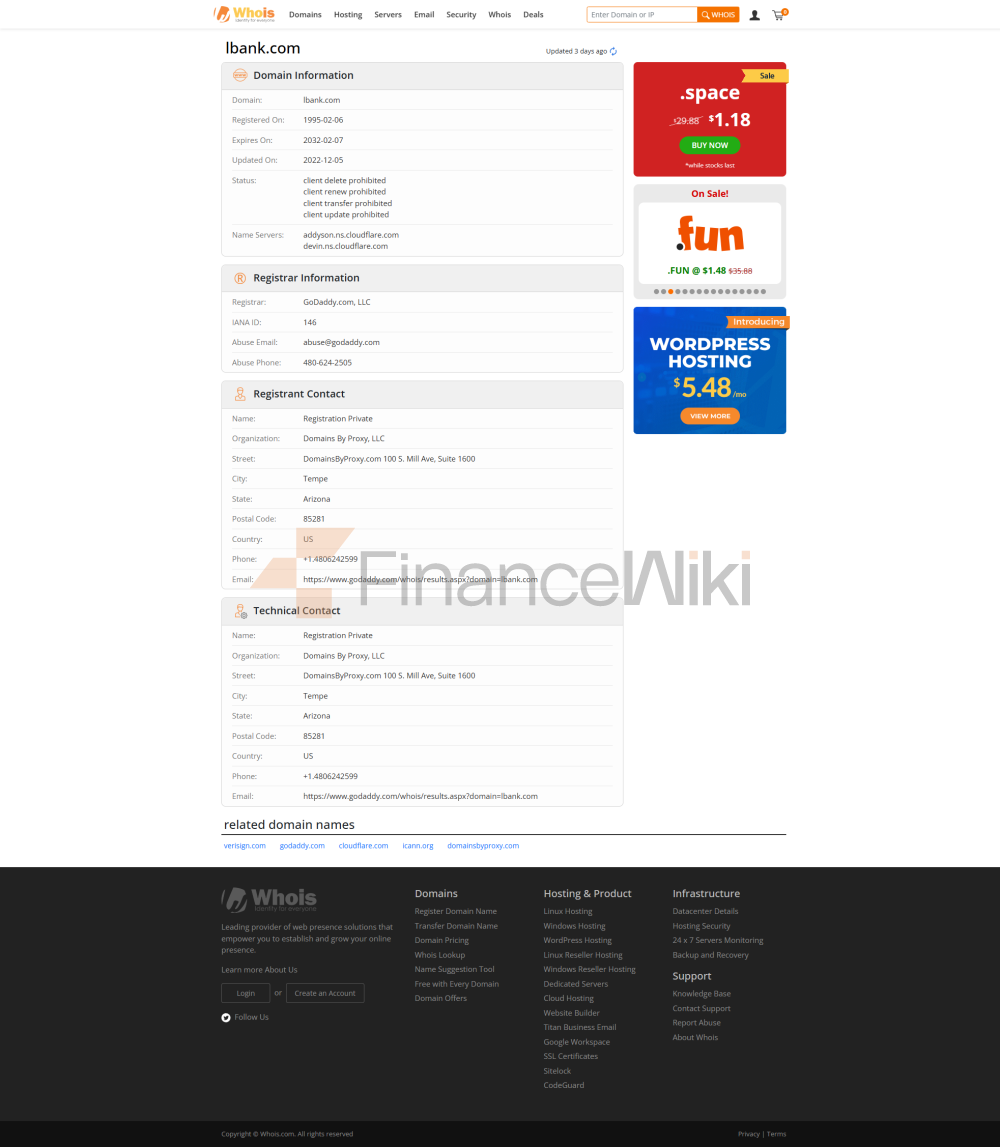

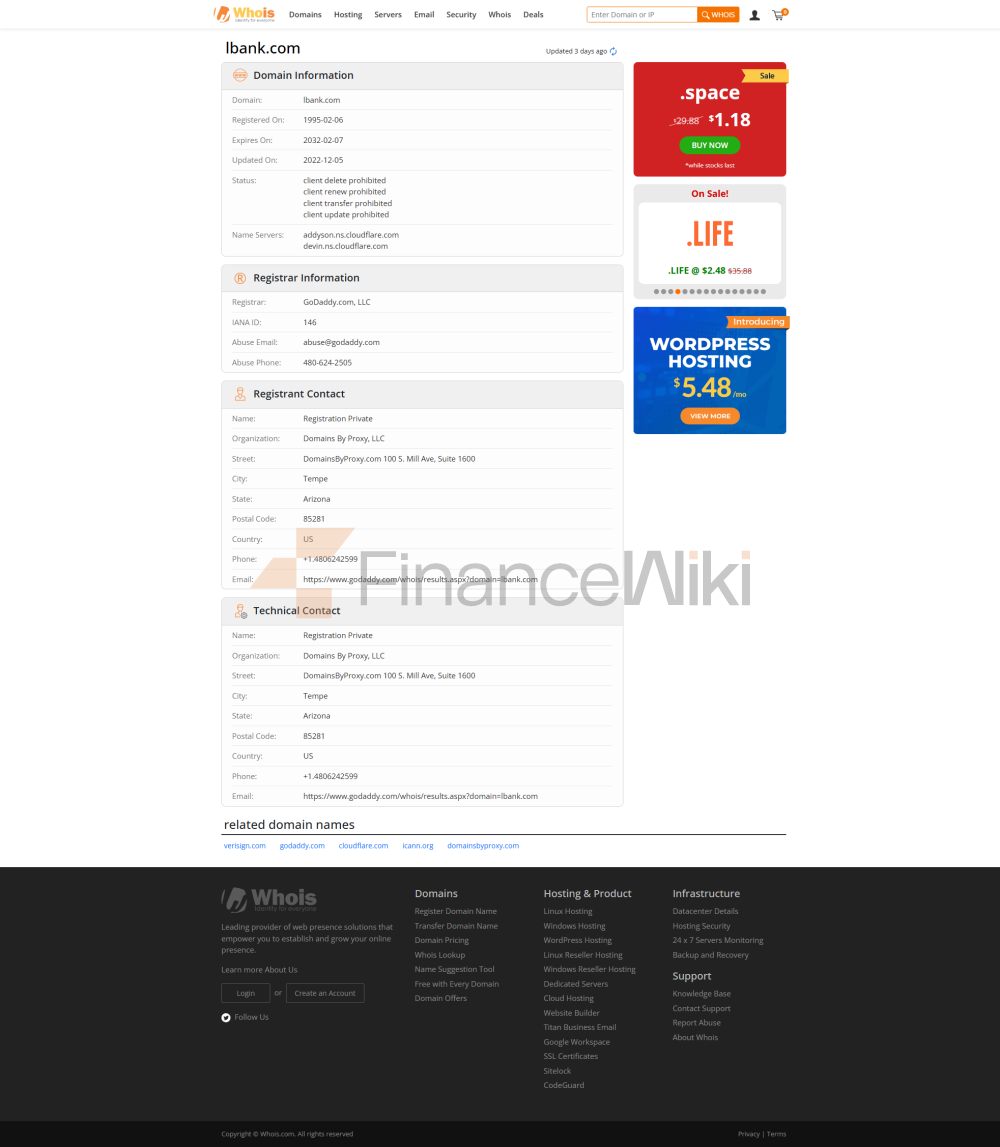

LBank เป็นแพลตฟอร์มการแลกเปลี่ยนแบบรวมศูนย์ที่จัดตั้งขึ้นในฮ่องกงก่อตั้งขึ้นในปี 2558 และมีสำนักงานในหมู่เกาะบริติชเวอร์จินสหรัฐอเมริกาออสเตรเลียและแคนาดา ผู้ใช้สามารถซื้อและขาย cryptocurrencies ที่สำคัญเช่น Bitcoin เทียบกับ Ethereum ในสกุลเงิน fiat มากกว่า 50 สกุลเงินและวิธีการชำระเงินมากกว่า 20 วิธี บริษัท มีใบอนุญาตประกอบธุรกิจสำหรับ National Futures Association Australian Trading Report and Analysis Center และธุรกิจบริการการเงินของแคนาดา

ผลิตภัณฑ์ของ LBank ประกอบด้วย: การซื้อขายแบบสปอตและมาร์จิ้น ฟิวเจอร์สและตัวเลือก cryptocurrency การจำนำ โทเค็นที่ไม่สามารถถูกแทนที่ได้และการซื้อขาย ETF สำหรับสินทรัพย์ cryptocurrencyบริการอื่น ๆ ได้แก่ การซื้อขายแบบ peer-to-peer (P2P) การซื้อขายแบบกริดและการฝากเงินแบบยืดหยุ่นและล็อคอิน

ระบบนิเวศก่อตั้งขึ้นโดย Allen Wei อดีตนักพัฒนาไอทีและปัจจุบันเป็น CEO ของ LBank เขาได้รับแรงบันดาลใจและสร้างโครงการหลังจากอ่านเอกสารไวท์เปเปอร์เกี่ยวกับ Bitcoin และ blockchain

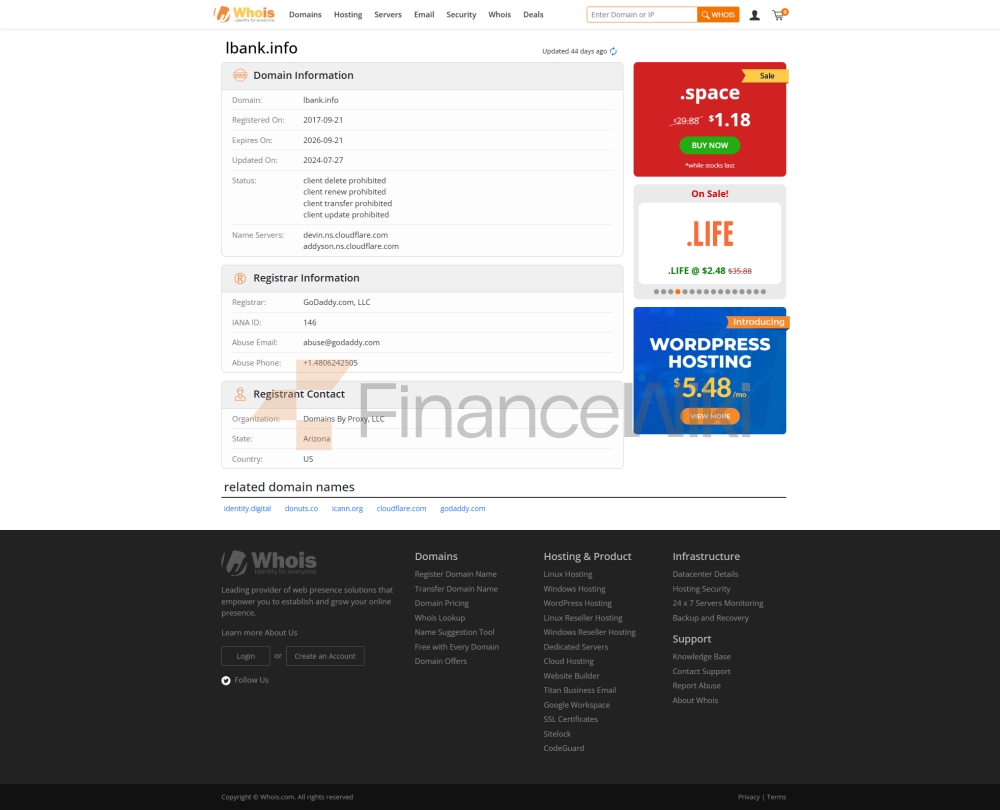

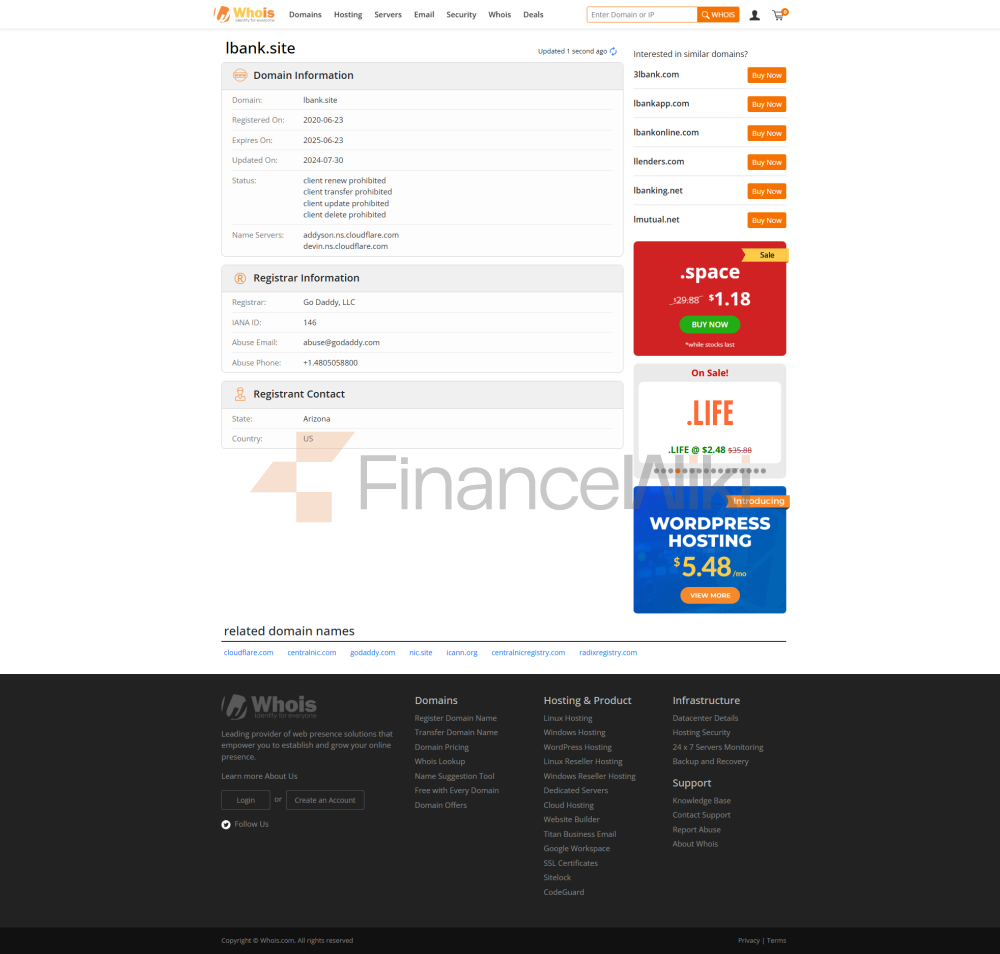

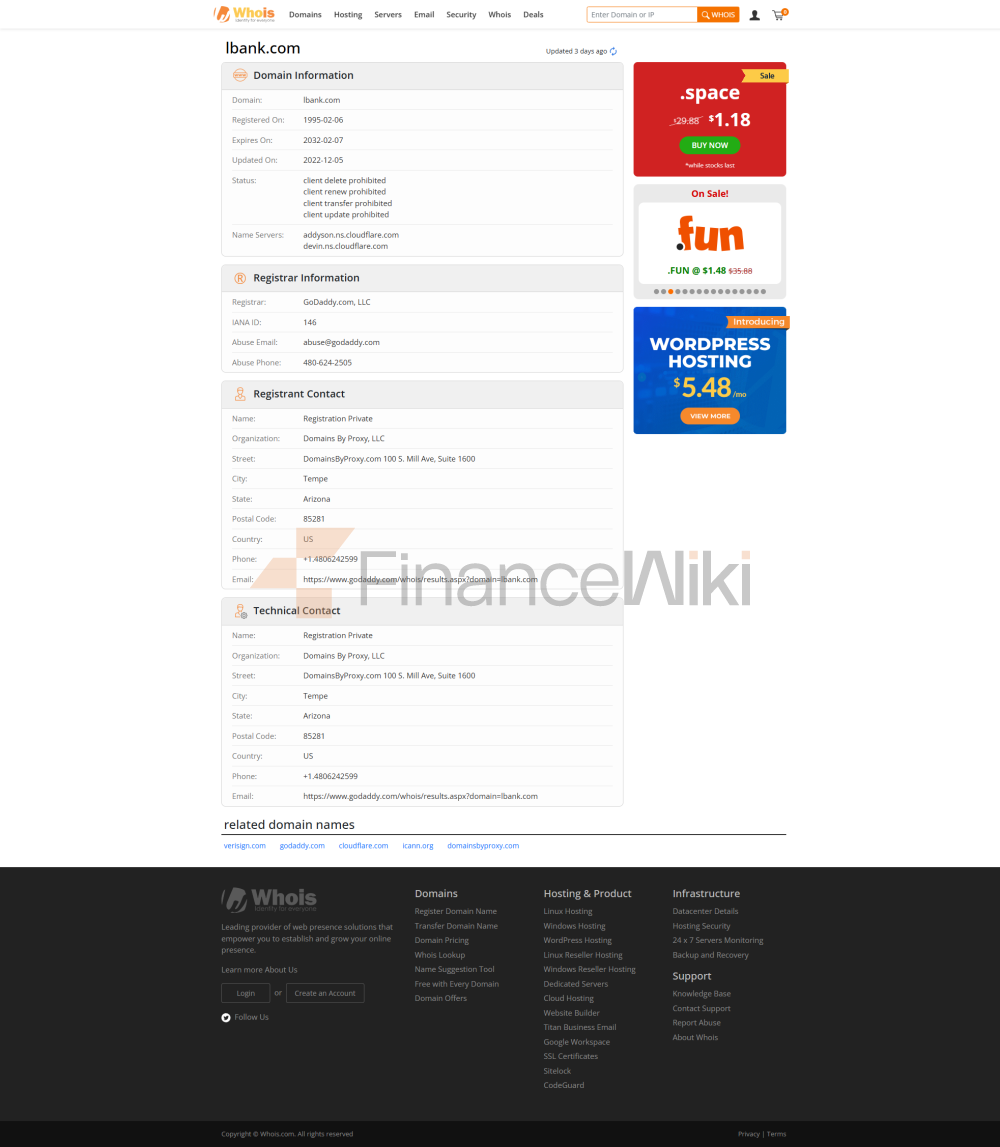

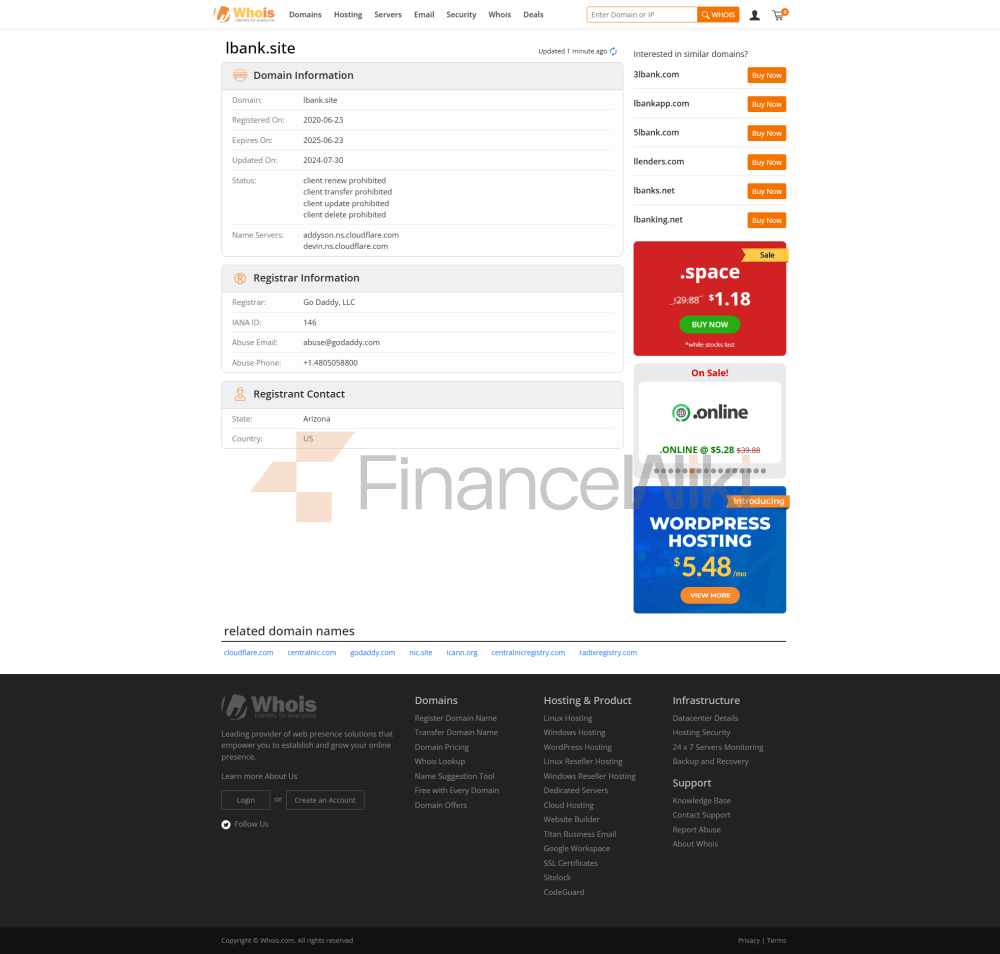

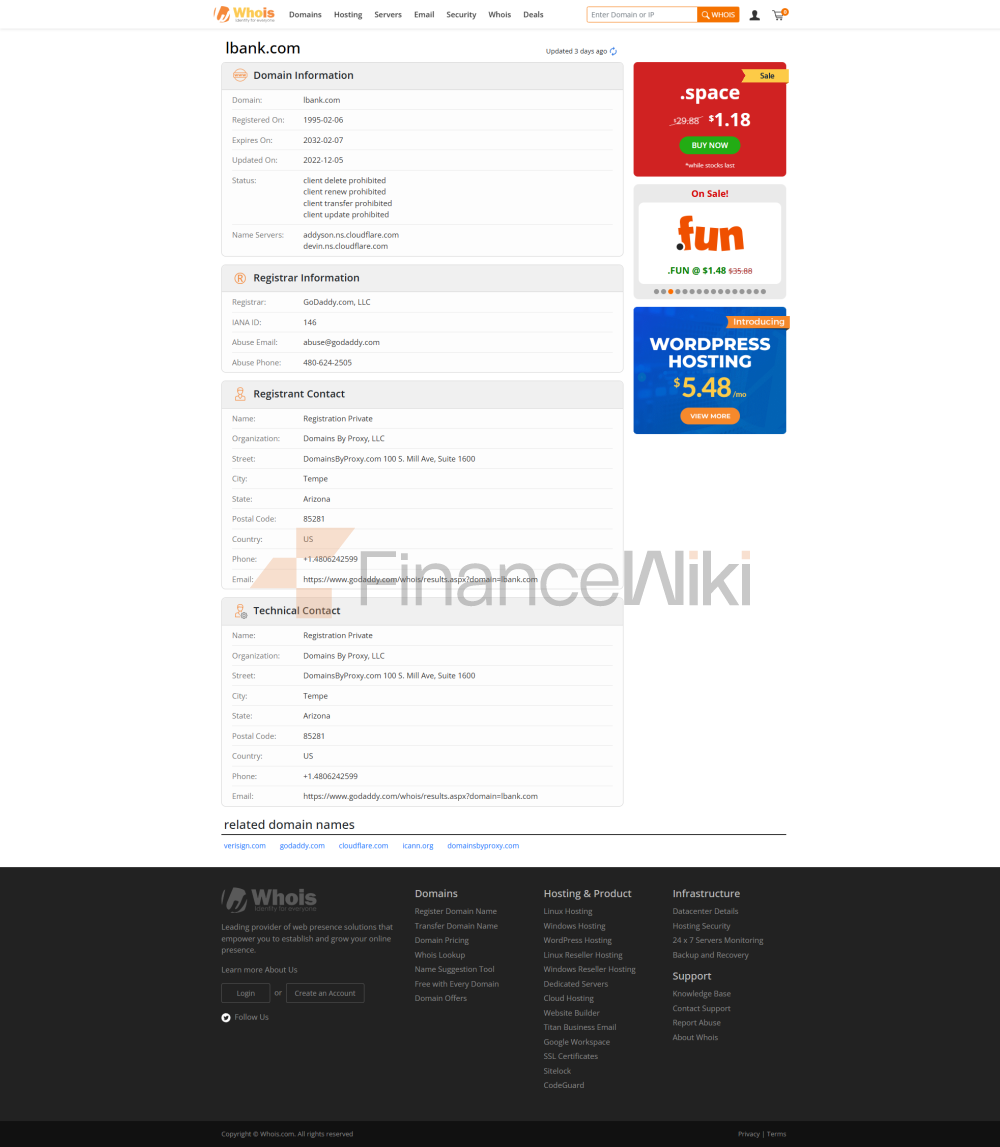

การแลกเปลี่ยนซึ่งตั้งอยู่ในฮ่องกงเป็นเจ้าของและดำเนินการโดย Superchains Network Technology Co. Ltd.

ธุรกรรมนี้มีผู้ใช้เกือบ 7 ล้านคนจากกว่า 200 ประเทศ เนื่องจาก LBank ตั้งอยู่ในฮ่องกงจึงอาจมีข้อ จำกัด ทางกฎหมายในบางพื้นที่

การแลกเปลี่ยนแบบรวมศูนย์นี้รองรับ cryptocurrencies มากกว่า 120 คู่รวมถึงคู่การซื้อขายมากกว่า 180 คู่ สินทรัพย์ crypto ที่ร้อนแรงที่สุดบนแพลตฟอร์ม ได้แก่ BTC ETH LUNA MATIC FTM CRO DOGE และอื่น ๆ

การแลกเปลี่ยนเรียกเก็บค่าธรรมเนียมคงที่ 0.10% สำหรับคำสั่งซื้อที่รอดำเนินการและค่าธรรมเนียมการสั่งซื้อในขณะที่ค่าธรรมเนียมการถอนแตกต่างกันไปสำหรับ cryptocurrencies ต่าง ๆ ไม่จำเป็นต้องจ่ายค่าธรรมเนียมใด ๆ สำหรับการฝากเงิน

ผู้ใช้การแลกเปลี่ยนสามารถใช้กระบวนการซื้อขายแบบสปอตเพื่อแลกเปลี่ยน ETF ที่มีเลเวอเรจ ETF เป็นอนุพันธ์ ไม่จำเป็นต้องมีมาร์จิ้น LBank รองรับ 3x Long Leverage (3L) เทียบกับ 3x Short Leverage (3S)

ผู้ใช้สามารถใช้เลเวอเรจได้มากถึง 125 เท่าในการซื้อขาย crypto Futures รวมถึง BTCUSDT ETHUSDT FILUSDT และสัญญาถาวรหลายฉบับ นอกจากนี้การแลกเปลี่ยนยังมีมาร์จิ้นเต็มตำแหน่งและมาร์จิ้นตามตำแหน่ง