ภาพรวมองค์กร

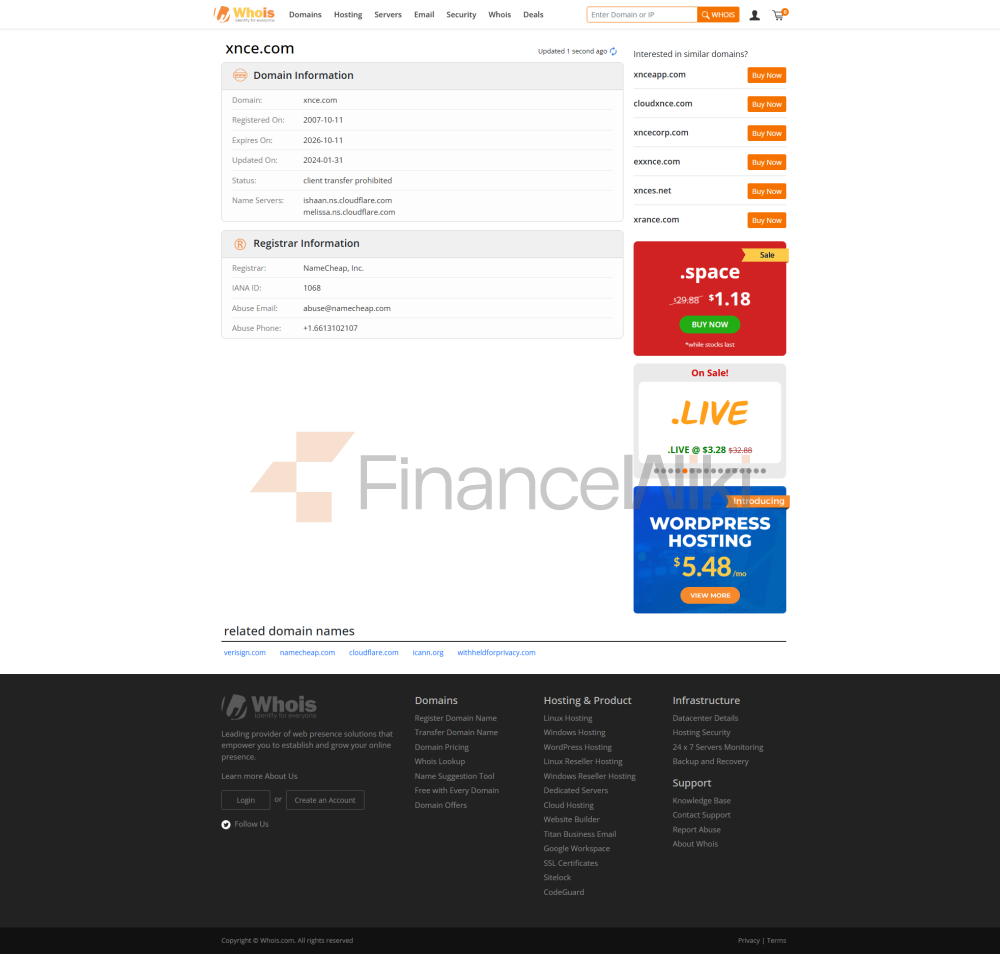

NCE ดำเนินงานภายใต้ชื่อการค้าของ NCE SC Inc. โดยมุ่งเน้นที่การให้บริการธุรกรรมทางการเงินที่หลากหลายแก่ผู้ค้าทั่วโลก ก่อตั้งขึ้นใน 2007 และมีสำนักงานใหญ่ใน เซเชลส์ NCE เป็นที่รู้จักกันดีในอุตสาหกรรมการเงินสำหรับเครื่องมือการซื้อขายที่หลากหลายและแพลตฟอร์มเทคโนโลยีที่เป็นนวัตกรรม บริษัท มีทุนจดทะเบียน $ 1,000,000 และถือ ใบอนุญาตธุรกิจแลกเปลี่ยนเงินตราต่างประเทศค้าปลีก (หมายเลขใบอนุญาต: SD112) ที่ออกโดย Seychelles Financial Services Authority (FSA) ทีมผู้บริหารและที่ปรึกษาของ NCE ประกอบด้วยผู้เชี่ยวชาญที่มีประสบการณ์ในอุตสาหกรรมเพื่อให้มั่นใจว่า บริษัท มีมาตรฐานสูงในการปฏิบัติตามและการบริหารความเสี่ยง

ข้อมูลด้านกฎระเบียบ NCE ถูกควบคุมโดย Seychelles Financial Services Authority (FSA) และอยู่ในหมวดหมู่ของกฎระเบียบนอกชายฝั่ง ในฐานะสถาบันการเงินที่มีการควบคุม NCE ปฏิบัติตามกฎระเบียบต่อต้านการฟอกเงิน (AML) และการต่อต้านการก่อการร้ายทางการเงิน (CFT) อย่างเข้มงวด เงินทุนของลูกค้าถูกแยกออกจากสินทรัพย์ของ บริษัท และเก็บไว้ในสถาบันการเงินที่ได้รับการยอมรับทั่วโลก ซึ่งหมายความว่าความปลอดภัยของเงินทุนของลูกค้าได้รับการรับรองอย่างเต็มที่ นอกจากนี้ NCE ยังได้รับการตรวจสอบอย่างสม่ำเสมอจากหน่วยงานกำกับดูแลเพื่อให้แน่ใจว่าการดำเนินงานของพวกเขาเป็นไปตามมาตรฐานสูงสุด

ผลิตภัณฑ์การซื้อขาย NCE ให้บริการ เครื่องมือทางการเงินมากกว่า 80 รายการ ซึ่งครอบคลุมสินทรัพย์ประเภทต่อไปนี้:

- Forex : รวมถึงคู่สกุลเงินหลัก (เช่น EUR / USD GBP / USD) และคู่สกุลเงินในตลาดเกิดใหม่

- สินค้าโภคภัณฑ์ : ครอบคลุมสินค้าโภคภัณฑ์ที่สำคัญเช่นทองคำเงินน้ำมันดิบ

- ดัชนี : เสนอการซื้อขายในดัชนีสำคัญทั่วโลก (เช่น US 30 UK 100)

- หุ้น : รองรับการซื้อขายหุ้นของ บริษัท ชั้นนำของโลก

- cryptocurrencies : ให้การซื้อขายสำหรับ cryptocurrencies หลักเช่น Bitcoin (BTC) Ethereum (ETH)

ซอฟต์แวร์การซื้อขาย NCE นำเสนอแพลตฟอร์มการซื้อขาย MetaTrader 5 (MT5) ที่รองรับการทำธุรกรรมบนเดสก์ท็อปมือถือและเว็บ MT5 เป็นที่รู้จักกันดีในด้านคุณสมบัติที่ทรงพลังและส่วนต่อประสานที่ใช้งานง่ายช่วยให้ผู้ค้าได้รับข้อมูลการตลาดแบบเรียลไทม์เครื่องมือวิเคราะห์ทางเทคนิคและความสามารถในการซื้อขายอัตโนมัตินอกจากนี้ NCE ยังมี FIX Application Interface (API) เพื่อช่วยให้สถาบันและผู้ค้ามืออาชีพเปิดใช้งานการทำธุรกรรมอัตโนมัติ

วิธีการฝากและถอน NCE รองรับการฝากและถอนหลายวิธีรวมถึง UnionPay Payments และ การโอนเงินผ่านธนาคาร (รองรับ USD EUR GBP และ Zloty Poland) ไม่มีค่าธรรมเนียมการจัดการสำหรับการฝากและถอนและเวลาดำเนินการคือ การฝากทันที และ การถอนให้เสร็จสิ้นภายใน 1 วันทำการ จำนวนเงินฝากขั้นต่ำของ NCE คือ $ 100 .

การสนับสนุนลูกค้า NCE ให้บริการลูกค้าที่ครอบคลุมในรูปแบบของการสนับสนุนรวมถึง:

- แชทออนไลน์ : การแก้ปัญหาแบบเรียลไทม์

- อีเมล : support@ncemarkets.com

- แบบฟอร์มการติดต่อ : ส่งคำถามผ่านเว็บไซต์อย่างเป็นทางการ ทีมสนับสนุนลูกค้ามุ่งมั่นที่จะให้บริการที่มีประสิทธิภาพและเป็นมืออาชีพแก่ผู้ค้า

ธุรกิจและบริการหลัก ธุรกิจหลักของ NCE รวมถึงการซื้อขายแลกเปลี่ยนเงินตราต่างประเทศการซื้อขายสินค้าโภคภัณฑ์การซื้อขายดัชนีและการซื้อขายสกุลเงินดิจิตอลบริษัท ตอบสนองความต้องการที่หลากหลายของผู้ค้าที่แตกต่างกันผ่านเครื่องมือการซื้อขายที่หลากหลายและเงื่อนไขการซื้อขายที่ยืดหยุ่นนอกจากนี้ NCE ยังมีฟังก์ชั่นการซื้อขายทางสังคม ที่ช่วยให้ผู้ค้ามือใหม่สามารถติดตามกลยุทธ์ของผู้ค้าที่ประสบความสำเร็จ

โครงสร้างพื้นฐานด้านเทคโนโลยี โครงสร้างพื้นฐานด้านเทคโนโลยีของ NCE ซึ่งมีศูนย์กลางอยู่ที่ ความพร้อมใช้งานสูงและเวลาแฝงต่ำ สามารถจัดการธุรกรรมจำนวนมากโดยไม่ส่งผลกระทบต่อประสิทธิภาพ บริษัท ใช้ศูนย์ข้อมูลขั้นสูงและมาตรการรักษาความปลอดภัยทางไซเบอร์เพื่อให้มั่นใจในความปลอดภัยของข้อมูลและเงินทุนของผู้ค้า นอกจากนี้แพลตฟอร์มการซื้อขายของ NCE ยังปรับประสบการณ์ผู้ใช้ให้เหมาะสมและรองรับการซื้อขายหลายภาษาและหลายสกุลเงิน

การปฏิบัติตามกฎระเบียบและระบบควบคุมความเสี่ยง NCE ปฏิบัติตามข้อกำหนดด้านกฎระเบียบของเซเชลส์ไฟแนนเชียลเซอร์วิส (FSA) อย่างเคร่งครัดเพื่อให้มั่นใจว่าการดำเนินงานถูกต้องตามกฎหมายและโปร่งใส กรอบการบริหารความเสี่ยงของ บริษัท ประกอบด้วย:

- การควบคุมการใช้ประโยชน์ : ให้อัตราส่วนเลเวอเรจที่ยืดหยุ่นตามมูลค่าสุทธิของบัญชีสูงสุด 1: 1,000 (สำหรับบัญชีขนาดเล็ก)

- การแยกเงินทุน : เงินของลูกค้าถูกแยกออกจากสินทรัพย์ของ บริษัท อย่างสมบูรณ์

- การตรวจสอบเป็นระยะ : การตรวจสอบการปฏิบัติตามกฎระเบียบและการบริหารความเสี่ยงของ บริษัท เป็นระยะโดยผู้ตรวจสอบบุคคลที่สาม

ตำแหน่งทางการตลาดและความได้เปรียบในการแข่งขัน ข้อได้เปรียบในการแข่งขันที่สำคัญของ NCE ในการซื้อขายทางการเงิน ได้แก่:

- เครื่องมือการซื้อขายที่หลากหลาย : ครอบคลุมสินทรัพย์หลายประเภท

- เงื่อนไขการซื้อขายที่ยืดหยุ่น : รวมถึงสเปรดแบบลอยตัวและตัวเลือกค่าคอมมิชชันที่หลากหลาย

- การสนับสนุนทางเทคนิคที่แข็งแกร่ง : แพลตฟอร์ม MT5 และ FIX API มอบประสบการณ์การซื้อขายที่เหนือกว่า

- การจัดการความเสี่ยงที่เข้มงวด : มั่นใจในความปลอดภัยของเงินทุนของลูกค้าและความโปร่งใสในการทำธุรกรรม

การสนับสนุนลูกค้าและการเสริมอำนาจ NCE เพิ่มขีดความสามารถให้กับลูกค้าในหลาย ๆ ด้าน:

- บัญชีทดลอง : ให้สภาพแวดล้อมการเรียนรู้ที่ปราศจากความเสี่ยงสำหรับมือใหม่

- ปฏิทินเศรษฐกิจ : แจ้งเตือนเหตุการณ์ทางเศรษฐกิจที่สำคัญและการเปลี่ยนแปลงของตลาด

- การซื้อขายทางสังคม : ให้สามเณรทำตามกลยุทธ์ของเทรดเดอร์ที่ประสบความสำเร็จ

- ทรัพยากรการศึกษา : ทรัพยากรการศึกษาที่ให้การวิเคราะห์ตลาดและกลยุทธ์การซื้อขาย

ความรับผิดชอบต่อสังคมกับ ESG NCE ให้ความสำคัญกับความเป็นอยู่ที่ดีของลูกค้าเสมอเติมเต็มความรับผิดชอบต่อสังคมผ่านการปฏิบัติตามกฎระเบียบและการสื่อสารที่โปร่งใส

นิเวศวิทยาการทำงานร่วมกันเชิงกลยุทธ์ NCE ได้สร้างพันธมิตรเชิงกลยุทธ์กับสถาบันการเงินและแพลตฟอร์มเทคโนโลยีชั้นนำของโลกเพื่อเพิ่มประสิทธิภาพสภาพแวดล้อมการซื้อขายและประสบการณ์ของลูกค้าความร่วมมือเหล่านี้ครอบคลุมโซลูชั่นการชำระเงินเทคโนโลยีแพลตฟอร์มและการสนับสนุนบริการ

สุขภาพทางการเงิน NCE อยู่ในสถานะทางการเงินที่แข็งแกร่งด้วยทุนจดทะเบียนที่เพียงพอและอยู่ภายใต้การตรวจสอบของบุคคลที่สามเป็นประจำ บริษัท ให้ความสำคัญกับสุขภาพของงบดุลเพื่อให้มั่นใจว่าสามารถให้บริการที่มีเสถียรภาพแก่ลูกค้าท่ามกลางความผันผวนของตลาด

แผนงานในอนาคต NCE ยังคงมุ่งมั่นที่จะสร้างสรรค์นวัตกรรมทางเทคโนโลยีและการขยายผลิตภัณฑ์ด้วย แผนในอนาคตรวมถึง:

- ขยายเครื่องมือการซื้อขายไปยังตลาดเกิดใหม่มากขึ้น

- เพิ่มประสิทธิภาพ FIX API และฟังก์ชั่นการซื้อขายทางสังคม

- เสริมสร้างความร่วมมือเชิงกลยุทธ์กับสถาบันการเงินทั่วโลก