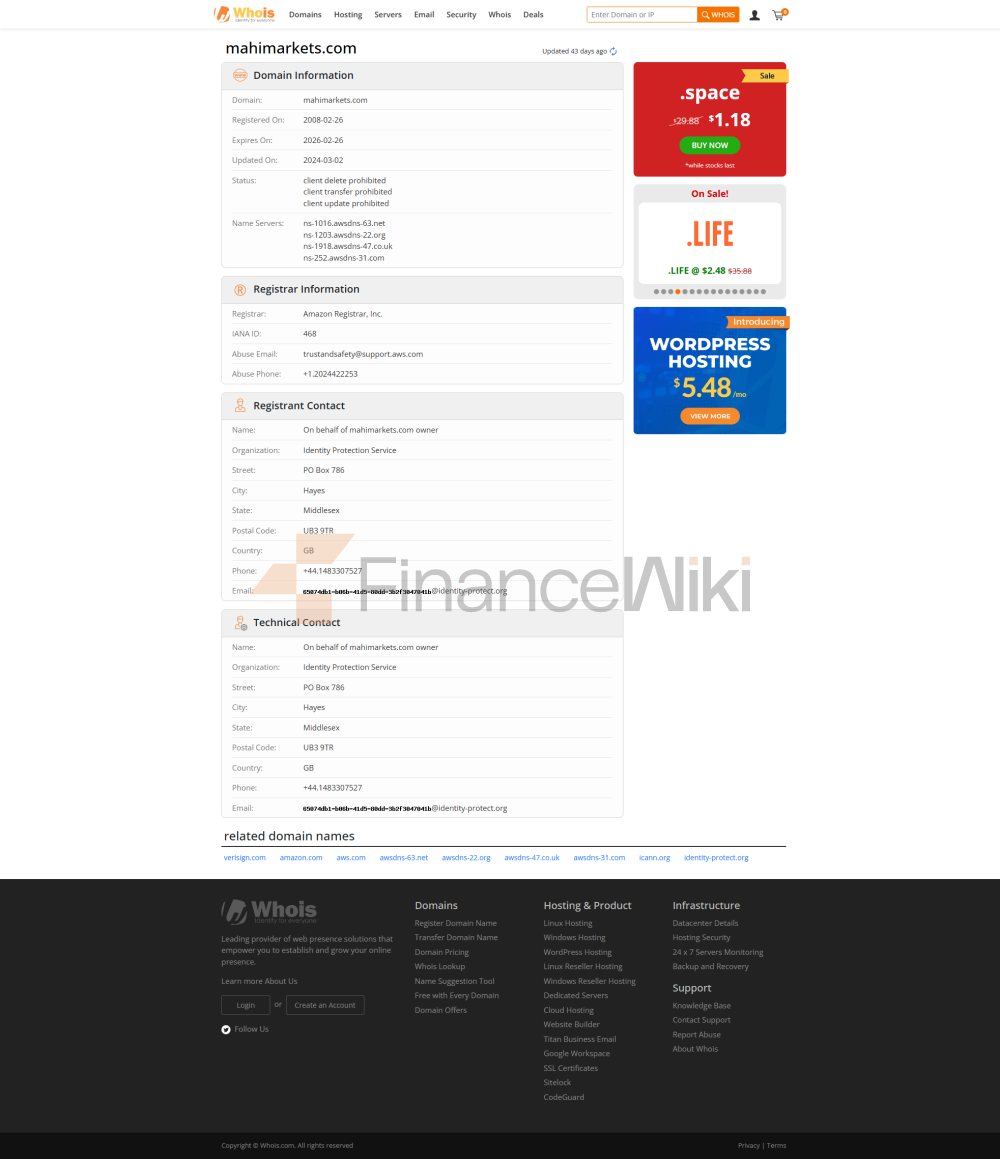

MahiFX ก่อตั้งขึ้นในปี 2010 เป็น บริษัท นายหน้าซื้อขายหลักทรัพย์ในกรุงลอนดอนที่มีสำนักงานใหญ่ในนิวซีแลนด์และสหราชอาณาจักร MahiFX ปัจจุบันถือใบอนุญาตผ่านจากหน่วยงานกำกับดูแลด้านการเงินของสหราชอาณาจักร (ระเบียบหมายเลข 751019) MahiFX นำเสนอผลิตภัณฑ์ที่หลากหลายที่สร้างขึ้นโดยทีมงานที่มีประสบการณ์: MFX Compass MFX Vector และ MFX Trade

เครื่องมือทางการตลาด

MahiFX ให้บริการนักลงทุนมากกว่า 100 คู่สกุลเงินแลกเปลี่ยนเงินตราต่างประเทศและโลหะมีค่าเป็นผลิตภัณฑ์ทางการเงินที่สำคัญ

เงินฝากขั้นต่ำ

MahiFX ให้นักลงทุนรายย่อยมีบัญชีซื้อขายที่ไม่มีค่าคอมมิชชั่นสเปรดเท่านั้นและไม่มีข้อกำหนดการฝากขั้นต่ำนอกจากนี้ยังมีบัญชีที่ออกแบบมาสำหรับความต้องการเฉพาะเช่นบัญชีสถาบันและบัญชีมืออาชีพ

การใช้ประโยชน์จาก MahiFX

เมื่อทำการซื้อขายกับ MahiFX New Zealand เลเวอเรจการซื้อขายสูงสุดคือ 1:100 คู่สกุลเงินหลักคือ 1:30 คู่สกุลเงินรองคือ 1:20 และสินค้าโภคภัณฑ์คือ 1:10 เมื่อทำการซื้อขายกับหน่วยงาน MahiFX UK

สเปรดและค่าคอมมิชชัน

MahiFX ไม่เรียกเก็บค่าคอมมิชชั่นสำหรับแต่ละธุรกรรมและค่าใช้จ่ายในการทำธุรกรรมทั้งหมดจะรวมอยู่ในสเปรด EURUSD มีสเปรดเฉลี่ย 1 จุดซึ่งไม่ใช่จุดต่ำสุด แต่เป็นสเปรดที่ค่อนข้างแข่งขันได้ในใบเสนอราคาอุตสาหกรรมMahiFX จะเรียกเก็บดอกเบี้ยข้ามคืนสำหรับตำแหน่งที่ถือไว้นานกว่าหนึ่งวันและเครื่องมือแต่ละรายการจะเรียกเก็บข้อเสนอที่แตกต่างกันสำหรับตำแหน่งข้ามคืน

แพลตฟอร์มการซื้อขาย

MahiFX นำเสนอแพลตฟอร์มการซื้อขายที่หลากหลายสำหรับผู้ค้า รวมถึงสามแพลตฟอร์มการซื้อขายที่พัฒนาขึ้นเอง: MFX Compass MFX Vector MFX Echo และแพลตฟอร์มการซื้อขาย MT4 ที่ได้รับการยอมรับอย่างสูงในปัจจุบันแพลตฟอร์มการซื้อขาย MahiFX มีลักษณะของเวลาและการกำหนดราคาแบบไดนามิกคำสั่งซื้อที่ จำกัด หลายรายการและรูปแบบการซื้อขาย การผสมผสานกับผลิตภัณฑ์ MFX Echo และ MFX Compass ช่วยเพิ่มความสามารถทั้งหมดและช่วยให้ผู้ค้าสามารถใช้ประโยชน์จากการวิเคราะห์ที่แข็งแกร่งและการจัดการความเสี่ยง

การฝากและถอนเงิน

MahiFX สนับสนุนผู้ค้าในการอัดฉีดเงินเข้าสู่บัญชีซื้อขายจริงผ่านการโอนเงินผ่านบัตรเครดิต VISA / MasterCard