0

แอคทีฟ

AfDB

การรับรองอย่างเป็นทางการ ไอวอรี่โคสต์

ไอวอรี่โคสต์20 ปี

เว็บไซต์อย่างเป็นทางการ

อัปเดตที่ 2024-11-07 17:26:54

คะแนนองค์กรปัจจุบัน

5.00

การจัดอันดับอุตสาหกรรม

ข้อมูลพื้นฐาน

ชื่อเต็มขององค์กร

African Development Bank

ประเทศ

ไอวอรี่โคสต์

การจำแนกประเภทธุรกิจ

เวลาลงทะเบียน

1964

สถานะธุรกิจ

แอคทีฟ

ข้อมูลการกำกับดูแล

การประเมินองค์กร/การเปิดรับ

เขียนรีวิว/การเปิดรับ

5.00

0การประเมินผล/

0การเปิดรับ

เขียนรีวิว/การเปิดรับ

AfDB แนะนำองค์กร

AfDB ความปลอดภัยขององค์กร

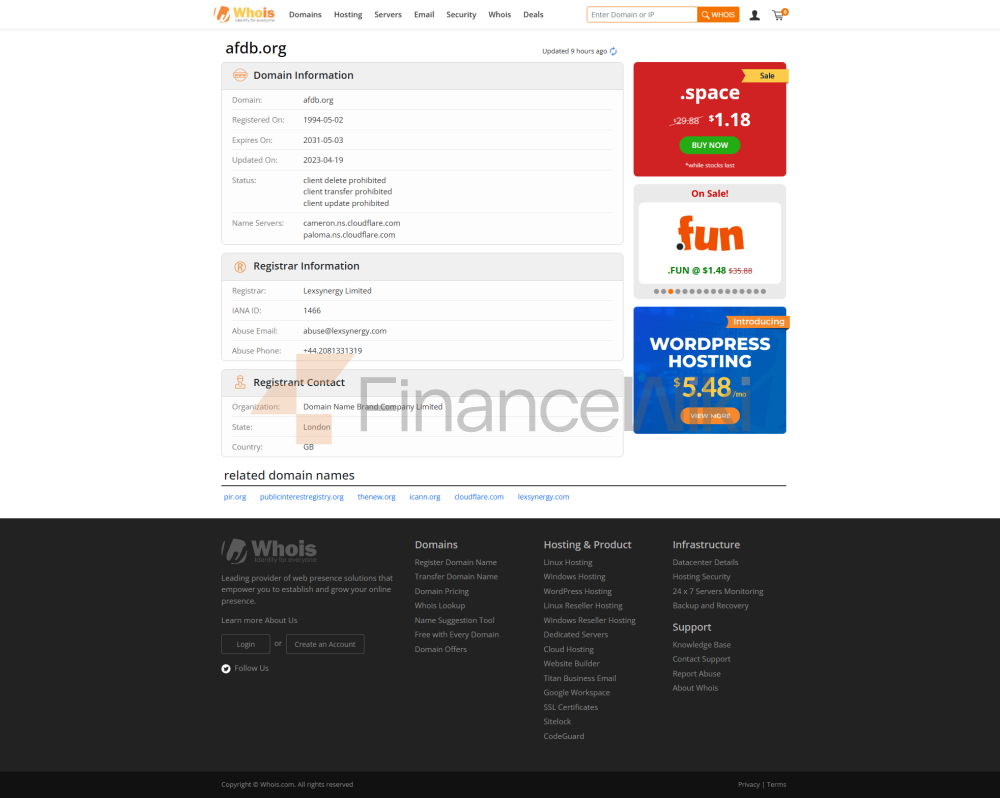

https://www.afdb.org/en

AfDB Q&A

ถามคำถาม

สื่อสังคมออนไลน์

Far Eastern Int'l BankFar Eastern

แอคทีฟ

Standard Chartered Bank (Hong Kong) LimitedStandard Chartered Bank

แอคทีฟ

The Hongkong and Shanghai Banking Corporation LimitedHSBC

แอคทีฟ

Sumitomo Mitsui Trust Bank, Ltd.Sumitomo Mitsui Trust Bank

แอคทีฟ

CIM Bank CIM Bank

แอคทีฟ

The Kingdom Bank The Kingdom Bank

แอคทีฟ

ข้อมูลข่าวสาร

เคล็ดลับความเสี่ยง

Finance.Wiki เตือนคุณว่าข้อมูลที่มีอยู่ในเว็บไซต์นี้อาจไม่ใช่ข้อมูลแบบเรียลไทม์หรือแม่นยำ ข้อมูลและราคาบนเว็บไซต์นี้ไม่จำเป็นต้องมาจากตลาดหรือการแลกเปลี่ยน แต่อาจได้มาจากผู้ดูแลสภาพคล่อง ดังนั้นราคาจึงอาจไม่ถูกต้องและอาจแตกต่างจากแนวโน้มราคาตลาดที่เกิดขึ้นจริง กล่าวคือ ราคาเป็นเพียงราคาบ่งชี้ซึ่งสะท้อนถึงแนวโน้มของตลาด และไม่ควรใช้เพื่อจุดประสงค์ทางการค้า Finance.Wiki และผู้ให้บริการข้อมูลที่มีอยู่ในเว็บไซต์นี้ไม่รับผิดชอบต่อความสูญเสียใด ๆ ที่เกิดจากพฤติกรรมการซื้อขายของคุณหรือการพึ่งพาข้อมูลที่มีอยู่ในเว็บไซต์นี้