ภาพรวมธุรกิจ

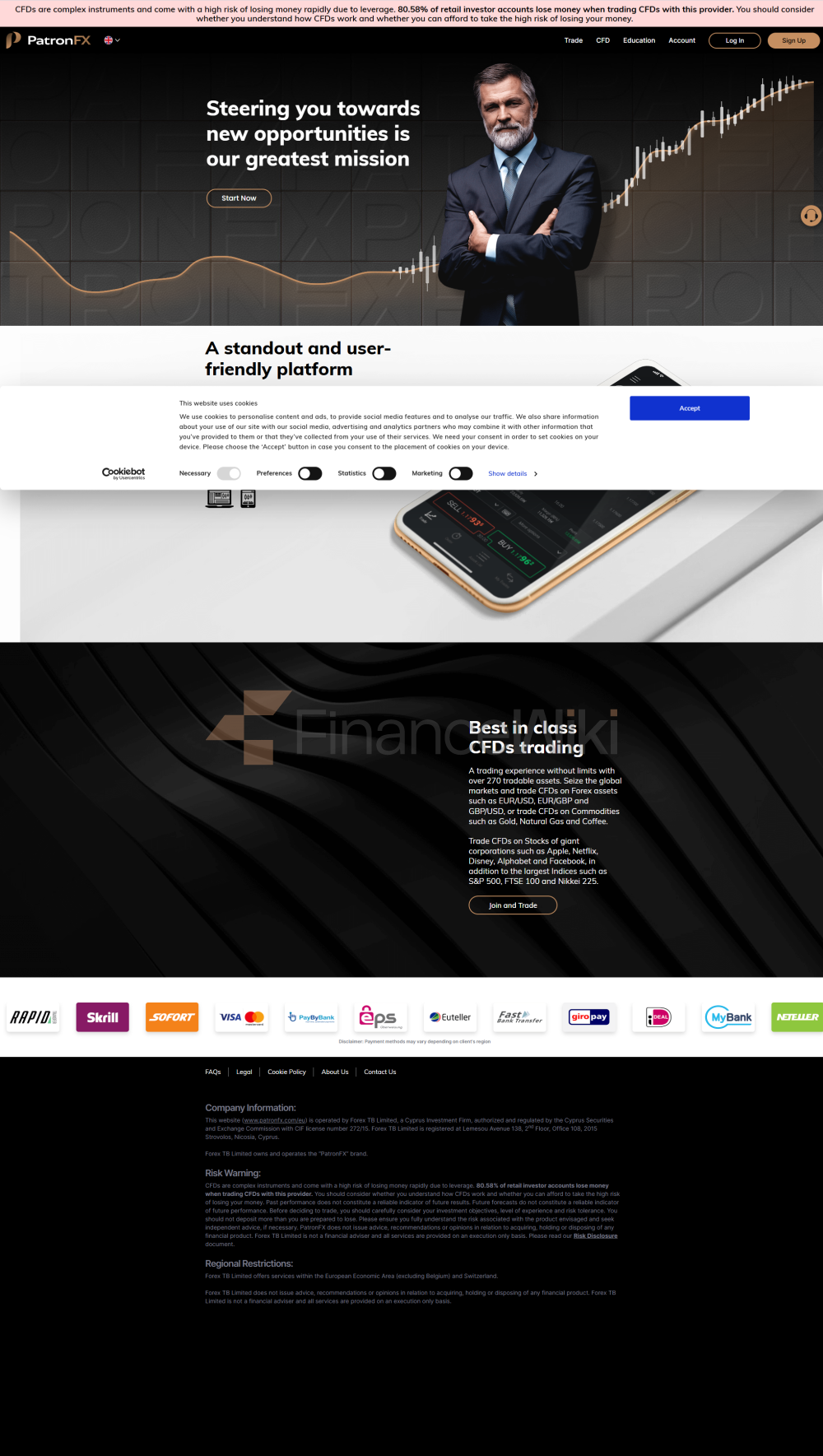

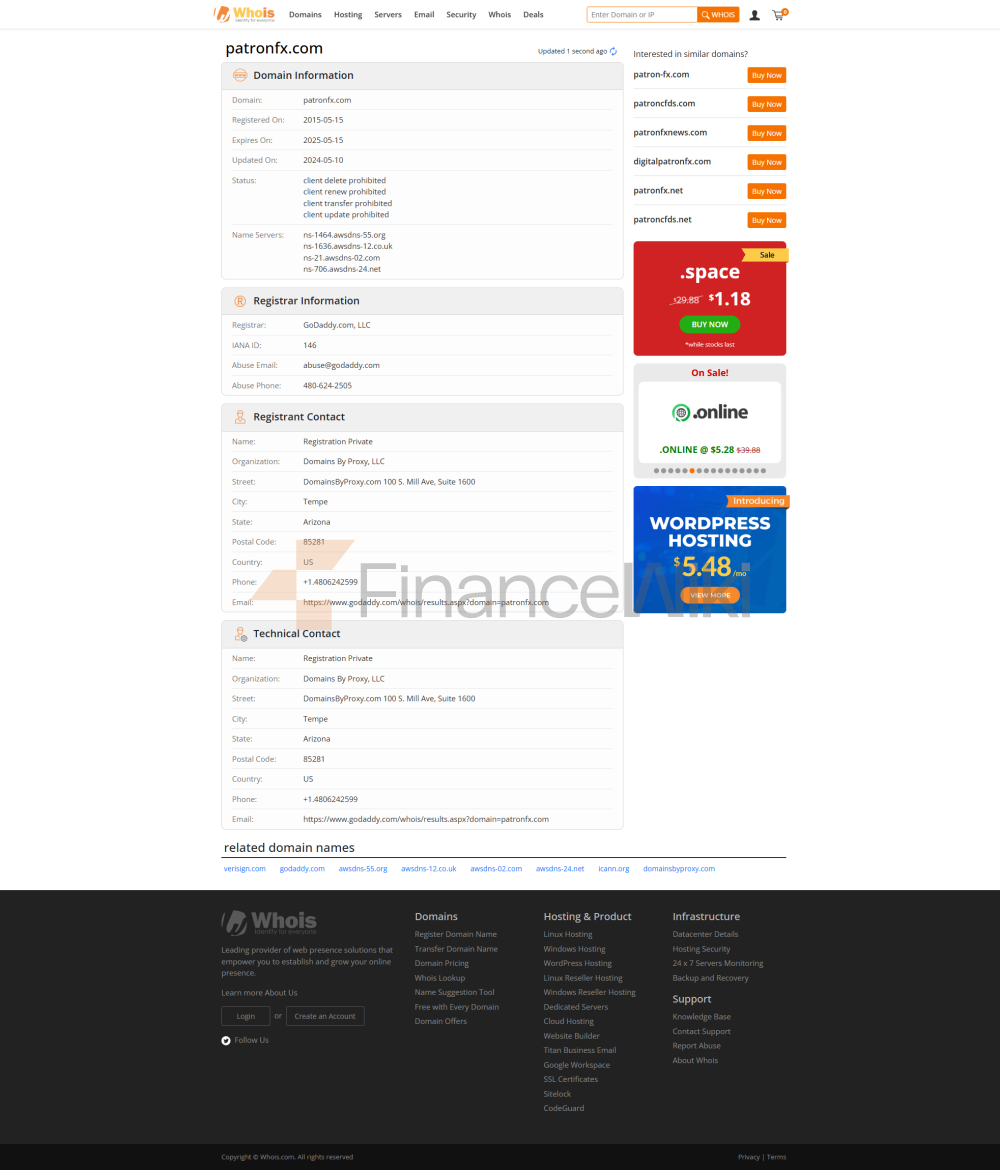

PatronFX เป็น บริษัท นายหน้าซื้อขายหลักทรัพย์ออนไลน์ที่มีการควบคุมซึ่งก่อตั้งขึ้นในปี 2558 และมีสำนักงานใหญ่ในนิโคเซียประเทศไซปรัส PatronFX เป็นเจ้าของโดย Forex TB Limited เป็นแพลตฟอร์มบริการทางการเงินที่อุทิศตนเพื่อให้นักลงทุนทั่วโลกมีความหลากหลาย บริษัท ให้บริการซื้อขายเครื่องมือทางการเงินที่หลากหลายรวมถึงการแลกเปลี่ยนเงินตราต่างประเทศสินค้าโภคภัณฑ์หุ้นดัชนีสัญญาความแตกต่าง (CFD) และ cryptocurrencies เว็บไซต์ของ PatronFX รองรับภาษาอังกฤษเยอรมันดัตช์โปแลนด์และอิตาลีเพื่อตอบสนองความต้องการของนักลงทุนในภูมิภาคต่าง ๆ

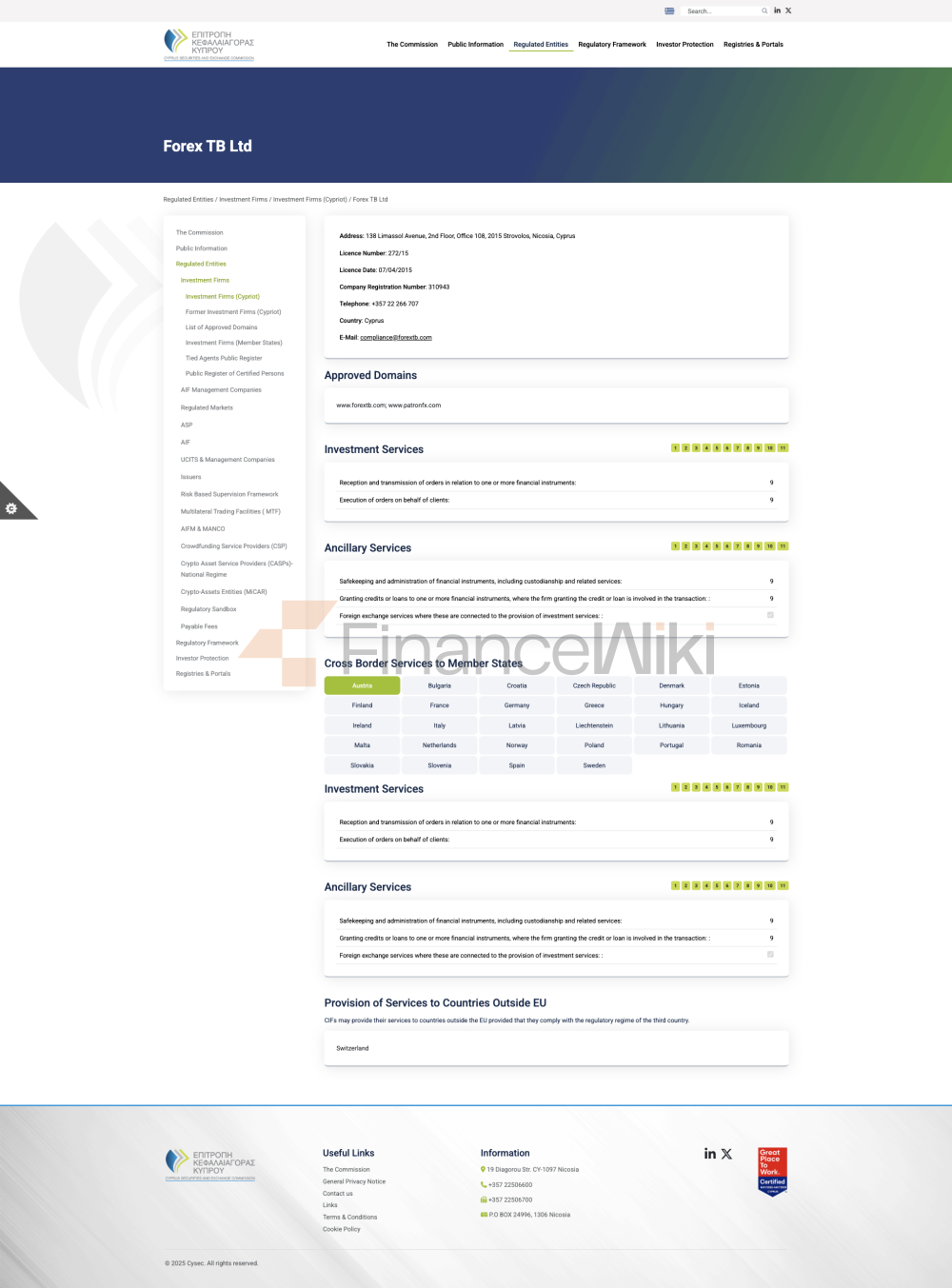

ข้อมูลด้านกฎระเบียบ PatronFX ได้รับการควบคุมอย่างเข้มงวดโดยสำนักงานคณะกรรมการกำกับหลักทรัพย์และตลาดหลักทรัพย์แห่งไซปรัส (CySEC) ด้วยหมายเลขทะเบียน 272/15บริษัท ยึดมั่นในการปฏิบัติตามกฎระเบียบเสมอสร้างความมั่นใจในความปลอดภัยของเงินทุนของลูกค้าและให้สภาพแวดล้อมการซื้อขายที่โปร่งใสในฐานะโบรกเกอร์ที่มีการควบคุม PatronFX ได้รับการตรวจสอบอย่างสม่ำเสมอโดย CySEC เพื่อให้แน่ใจว่ากิจกรรมทางธุรกิจเป็นไปตามข้อกำหนดของกฎระเบียบตลาดการเงินของสหภาพยุโรป บทบัญญัติที่เกี่ยวข้องของ MiFID II และพระราชบัญญัติ Dodd-Frank

ผลิตภัณฑ์การซื้อขาย PatronFX นำเสนอเครื่องมือทางการเงินมากกว่า 270 รายการซึ่งครอบคลุมประเภทสินทรัพย์ดังต่อไปนี้:

- Forex (Forex) : รวมถึงคู่สกุลเงินหลัก (เช่น EUR / USD GBP / USD) คู่สกุลเงินข้ามและสกุลเงินในตลาดเกิดใหม่

- สินค้าโภคภัณฑ์ : ครอบคลุมน้ำมันดิบทองคำเงินและก๊าซธรรมชาติ ฯลฯ

- หุ้น : ข้อเสนอ CFD สำหรับหุ้นระดับโลกที่มีชื่อเสียงเช่น Apple Google Microsoft และอื่น ๆ

- ดัชนี : รวมถึง S&P 500 ค่าเฉลี่ยอุตสาหกรรม Dow Jones Nasdaq และ FTSE 100 เป็นต้น

- cryptocurrencies : รองรับการทำธุรกรรมของ Bitcoin Ethereum และ cryptocurrencies หลักอื่น ๆ

ซอฟต์แวร์การซื้อขาย แพลตฟอร์มการซื้อขายหลักของ PatronFX คือ WebTrader ซึ่งเป็นแพลตฟอร์มการซื้อขายบนเว็บที่รองรับการทำงานบนเดสก์ท็อปและมือถือ แพลตฟอร์มนี้มาพร้อมกับคุณสมบัติที่หลากหลายรวมถึงการซื้อขายแบบคลิกเดียวใบเสนอราคาแบบเรียลไทม์การวิเคราะห์กรอบเวลาแบบหลายแผนภูมิและการซื้อขายอัตโนมัติ (รองรับการเขียน EA) ในขณะที่ PatronFX ไม่รองรับแพลตฟอร์ม MT4 หรือ MT5 โดยตรงแพลตฟอร์ม WebTrader มอบประสบการณ์ผู้ใช้ที่คล้ายคลึงกับแพลตฟอร์มหลักเหล่านี้

วิธีการฝากและถอนเงิน PatronFX รองรับวิธีการฝากและถอนเงินที่หลากหลายรวมถึง:

- บัตรเครดิต / บัตรเดบิต : รวม Visa และ MasterCard โดยไม่มีค่าธรรมเนียมการฝากเงิน

- e-wallet : รองรับวิธีการชำระเงินเช่น SafeCharge และ PPRO Group ซึ่งครอบคลุมตัวเลือกการชำระเงินมากกว่า 450 รายการ

- การโอนเงิน : ใช้ได้กับการฝากและถอนในจำนวนที่สูงขึ้น

จำนวนเงินฝากขั้นต่ำคือ € 250 สำหรับบัญชีพื้นฐานวิธีการถอนเงินรวมถึงการโอนเงินผ่านธนาคาร บัตรเครดิต Skrill และ Neteller ซึ่งไม่มีข้อกำหนดขั้นต่ำสำหรับการถอนบัตรเครดิตและ e-wallet

การสนับสนุนลูกค้า PatronFX ให้ข้อมูลติดต่อที่หลากหลายแก่ลูกค้ารวมถึง:

- การแชทสด : รองรับ 24/5 สำหรับการแก้ไขปัญหาเร่งด่วนอย่างรวดเร็ว

- การสนับสนุนทางโทรศัพท์ : สำหรับลูกค้าที่ต้องการการสื่อสารในเชิงลึก

- อีเมล : สำหรับการให้คำปรึกษาที่ไม่เร่งด่วนลูกค้าสามารถส่งอีเมลถึงinfo@patronfx.com

ทีมสนับสนุนลูกค้าประกอบด้วยนักวิเคราะห์ทางการเงินมืออาชีพและที่ปรึกษาการซื้อขายที่สามารถให้การวิเคราะห์ตลาดและคำแนะนำกลยุทธ์การซื้อขายแก่ลูกค้า

ธุรกิจและบริการหลัก ธุรกิจหลักของ PatronFX ประกอบด้วย:

- เครื่องมือทางการเงินที่หลากหลาย : ให้บริการซื้อขาย FX สินค้า หุ้น ดัชนี CFD และ cryptocurrencies

- ประเภทบัญชีที่ยืดหยุ่น : รวมถึงบัญชีพื้นฐานบัญชีทองคำบัญชีแพลตตินั่มและบัญชีวีไอพีเพื่อตอบสนองความต้องการของลูกค้าด้วยขนาดการซื้อขายและความเสี่ยงที่แตกต่างกัน

- การซื้อขายที่มีเลเวอเรจสูง : เลเวอเรจสำหรับลูกค้ารายย่อยสามารถเข้าถึง 1:30 ในขณะที่ลูกค้ามืออาชีพสามารถเพลิดเพลินกับเลเวอเรจได้สูงถึง 1: 400

- สเปรดต่ำและการซื้อขายที่ไม่มีค่าคอมมิชชัน : สเปรดต่ำสุดสำหรับ EUR / USD คือ 3.0 คะแนน สเปรดสำหรับบัญชีวีไอพีต่ำถึง 1.6 คะแนน และการซื้อขายทั้งหมดไม่มีค่าคอมมิชชั่น

โครงสร้างพื้นฐานทางเทคนิค โครงสร้างพื้นฐานทางเทคนิคของ PatronFX รวมถึงสิ่งต่อไปนี้:

- การดำเนินการธุรกรรม : ใช้เทคโนโลยีการประมวลผลแบบ pass-through (STP) เพื่อให้แน่ใจว่าคำสั่งซื้อขายจะถูกส่งตรงไปยังผู้ให้บริการสภาพคล่องและลดความล่าช้าในการทำธุรกรรม

- ความเสถียรของแพลตฟอร์ม : แพลตฟอร์ม WebTrader ได้รับการปรับให้เหมาะสมเพื่อรองรับการทำธุรกรรมความเร็วสูงและการถ่ายโอนข้อมูลการตลาดแบบเรียลไทม์

- ความปลอดภัยของข้อมูล : ใช้โปรโตคอลความปลอดภัยชั้นนำของอุตสาหกรรม (เช่นการเข้ารหัส SSL) เพื่อปกป้องข้อมูลลูกค้าและความปลอดภัยของธุรกรรม

ระบบการปฏิบัติตามกฎระเบียบและการควบคุมความเสี่ยง PatronFX ปฏิบัติตามข้อกำหนดของหน่วยงานกำกับดูแลอย่างเคร่งครัดและได้จัดตั้งระบบการปฏิบัติตามกฎระเบียบและการควบคุมความเสี่ยงที่ครอบคลุม:

- ระบบการจัดการความเสี่ยง : ปกป้องลูกค้าจากความเสี่ยงที่มากเกินไปผ่านการคำนวณมาร์จิ้นแบบไดนามิกและการควบคุมเลเวอเรจ

- การแยกเงินทุน : เงินของลูกค้าถูกเก็บไว้ในบัญชีทรัสต์แยกต่างหากเพื่อให้แน่ใจว่าแยกออกจากกองทุนดำเนินงานของ บริษัท

- การตรวจสอบตลาด : การตรวจสอบความผันผวนของตลาดแบบเรียลไทม์เพื่อให้มั่นใจถึงความเป็นธรรมและความโปร่งใสของสภาพแวดล้อมการซื้อขาย

ตำแหน่งทางการตลาดและความได้เปรียบในการแข่งขัน PatronFX มีข้อได้เปรียบในการแข่งขันในตลาดดังต่อไปนี้:

- ความหลากหลาย : จัดหาเครื่องมือทางการเงินหลายประเภทเพื่อตอบสนองความต้องการการลงทุนของผู้ค้าที่แตกต่างกัน

- ความยืดหยุ่น : ให้ลูกค้ามีตัวเลือกการซื้อขายที่ยืดหยุ่นผ่านประเภทบัญชีและอัตราส่วนเลเวอเรจที่หลากหลาย

- ต้นทุนต่ำ : การซื้อขายแบบไม่ใช้ค่าคอมมิชชันและสเปรดต่ำช่วยลดต้นทุนการทำธุรกรรม

การสนับสนุนลูกค้าและการเสริมอำนาจ PatronFX มุ่งมั่นที่จะช่วยให้ลูกค้าปรับปรุงความสามารถในการซื้อขายของพวกเขาผ่านการสนับสนุนลูกค้าที่มีคุณภาพและทรัพยากรทางการศึกษา:

- การสนับสนุนหลายภาษา : รองรับบริการลูกค้าและส่วนต่อประสานการซื้อขายในหลายภาษาเพื่อตอบสนองความต้องการของลูกค้าทั่วโลก

- ทรัพยากรทางการศึกษา : จัดทำรายงานการวิเคราะห์ตลาดกลยุทธ์การซื้อขายและการฝึกอบรมด้านการศึกษาเพื่อช่วยให้ผู้ค้ามือใหม่และมืออาชีพพัฒนาทักษะของพวกเขา

ความรับผิดชอบต่อสังคมด้วย ESG PatronFX ตอบสนองความรับผิดชอบต่อสังคมอย่างแข็งขันและสนับสนุนโครงการด้านสิ่งแวดล้อมและการศึกษาบริษัท ให้ความสำคัญกับการพัฒนาอย่างยั่งยืนใช้พลังงานสีเขียวในการดำเนินงานและมุ่งมั่นที่จะลดการปล่อยก๊าซคาร์บอน

นิเวศวิทยาความร่วมมือเชิงกลยุทธ์ PatronFX ได้เข้าร่วมเป็นพันธมิตรกับผู้ให้บริการชำระเงินที่มีชื่อเสียงหลายรายรวมถึง SafeCharge และ PPRO Group เพื่อนำเสนอตัวเลือกการฝากและถอนเงินที่หลากหลายซึ่งจะช่วยยกระดับประสบการณ์ของลูกค้า

สุขภาพทางการเงิน ตามข้อมูลสาธารณะ PatronFX ได้ดำเนินการอย่างแข็งแกร่งในการดำเนินงานตั้งแต่เริ่มก่อตั้งและอัตราส่วนความเพียงพอของเงินกองทุนเป็นไปตามข้อกำหนดด้านกฎระเบียบ บริษัท ส่งรายงานทางการเงินไปยังหน่วยงานกำกับดูแลอย่างสม่ำเสมอเพื่อให้เกิดความโปร่งใสและสุขภาพทางการเงิน

แผนงานในอนาคต PatronFX วางแผนที่จะขยายการเข้าถึงในตลาดโลกต่อไปในอนาคตเพิ่มความหลากหลายในการซื้อขายเครื่องมือทางการเงินและเพิ่มประสิทธิภาพโครงสร้างพื้นฐานด้านเทคโนโลยีเพื่อรองรับความต้องการการลงทุนของผู้ค้ามากขึ้น