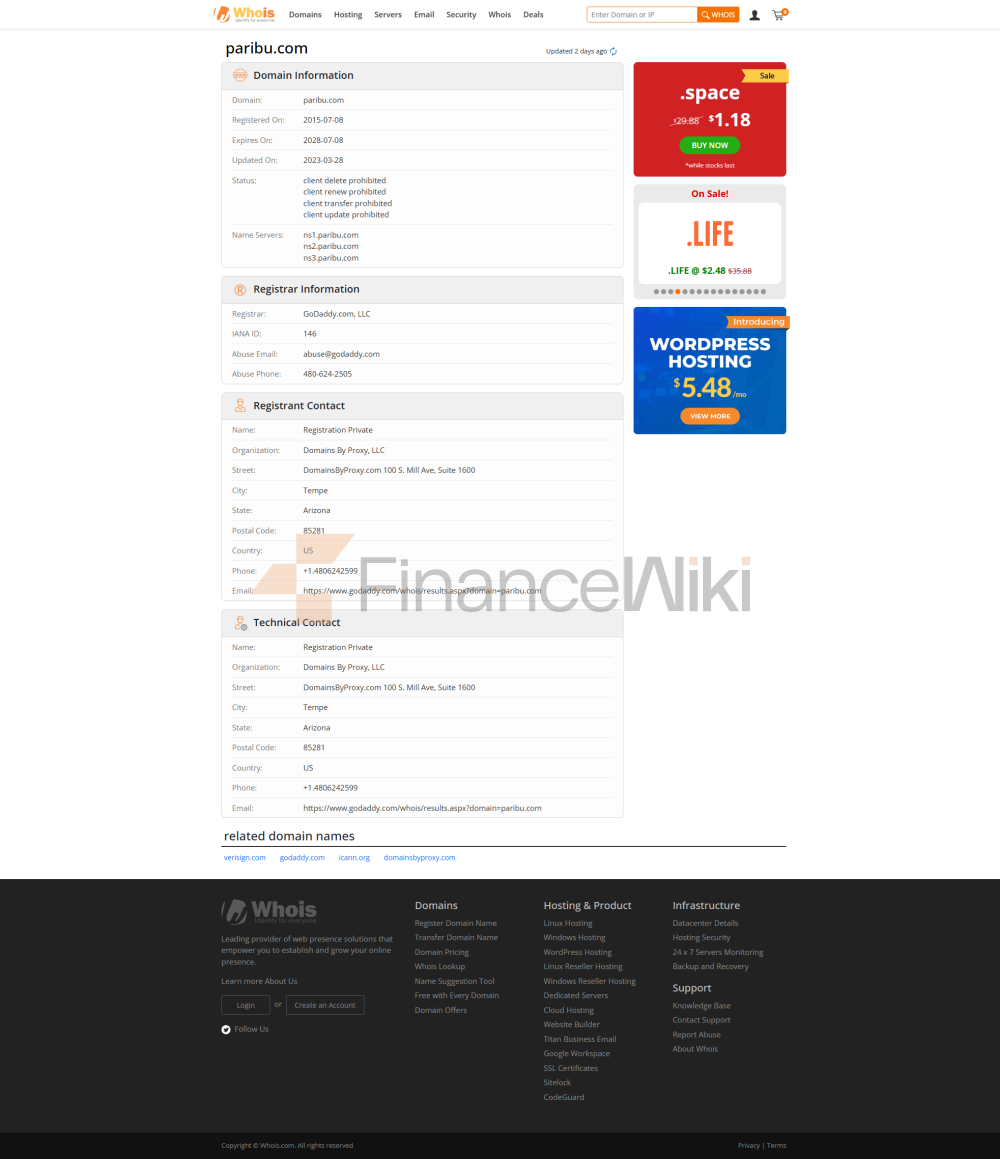

Paribu ซึ่งเป็นแพลตฟอร์มการซื้อขาย cryptocurrency ชั้นนำของตุรกีเปิดตัวเมื่อวันที่ 14 กุมภาพันธ์ 2017 และมีผู้ใช้มากกว่า 6 ล้านคนให้บริการซื้อขายที่รวดเร็วง่ายและปลอดภัยใน Paribu สามารถซื้อและขาย cryptocurrencies ได้หลายสิบรายการรวมถึง Bitcoin และสามารถทำธุรกรรม cryptocurrency และฝากและถอน TL 24/7 Paribu อำนวยความสะดวกในการซื้อขาย cryptocurrency ผ่านแผนกสนับสนุน 24/7

- 24/7 การประมวลผลและการสนับสนุนอย่างรวดเร็ว

- 24/7 การฝากและถอนลีร่าตุรกี 24/7 จาก Akbank Ziraat Bank Yap Kredi Bank Vakfbank Fibabanka Türkiye Finans Bank และ esh Bank

- การทำธุรกรรมกับการโอนเงินทางอิเล็กทรอนิกส์ผ่านธนาคารทั้งหมดในช่วงเวลาทำงาน

- ไม่มีขีด จำกัด ล่างสำหรับ cryptocurrencies นับสิบที่เลือกโดยการตรวจสอบคุณสมบัติพื้นฐานและทางเทคนิค

- TL และ cryptocurrency เงินฝาก

- โครงสร้างพื้นฐานสำหรับการทำธุรกรรมขนาดใหญ่และการซื้อขายที่รวดเร็ว

- แอปพลิเคชั่นมือถือที่ใช้งานง่าย (IOS-Android)

- ข้อได้เปรียบในการซื้อขายที่รวดเร็วและใช้งานได้จริงสำหรับแอปพลิเคชันเดียว

- ความโปร่งใสของการซื้อขายในตลาด

ธันวาคม 2017: 5,800 BTC ปริมาณการซื้อขายอันดับที่ 16 ในรายการ CoinMarketCap-World

20 มีนาคม 2020: 9,900 BTC ปริมาณการซื้อขาย

1 เมษายน 2020: อันดับที่ 1 ของโลกด้วย 15 ล้าน WAVES

4 พฤษภาคม 2020: อันดับที่ 1 ของโลกด้วยปริมาณการซื้อขาย HOT $ 12 ล้าน

5 20204 มีนาคม: อันดับที่ 2 ของโลกด้วยปริมาณการซื้อขาย CHZ ที่ 1.4 ล้านเหรียญสหรัฐ

14 มีนาคม 2564: อันดับที่ 3 ของโลกด้วยปริมาณการซื้อขาย 1.5 พันล้านเหรียญสหรัฐ

16 เมษายน 2564: 2.79 พันล้านเหรียญสหรัฐ ปริมาณการซื้อขาย