ภาพรวมธุรกิจ

Ameriprise Financial Inc. ซึ่งเป็น บริษัท ที่ให้บริการทางการเงินที่หลากหลายและ บริษัท โฮลดิ้งธนาคารมีสำนักงานใหญ่ในมินนิอาโปลิสมินนิโซตาสหรัฐอเมริกาและจดทะเบียนในเดลาแวร์ (เดลาแวร์) ให้บริการผลิตภัณฑ์และบริการด้านการวางแผนทางการเงินรวมถึงการบริหารความมั่งคั่งการจัดการสินทรัพย์การประกันภัยเงินรายปีและการวางแผนอสังหาริมทรัพย์

ประวัติความเป็นมา Metong Financial ซึ่งเป็นหน่วยงานที่ปรึกษาทางการเงินของ American Express ได้แยกตัวออกเป็น บริษัท อิสระในเดือนกันยายน 2548 มากกว่า 80% ของรายได้ของ บริษัท ณ เดือนเมษายน 2565 มาจากการบริหารความมั่งคั่งMeitong Financial อยู่ในอันดับที่ 245 จากการจัดอันดับ Fortune 500 ในปี 2565 เป็นนายหน้าซื้อขายหลักทรัพย์อิสระรายใหญ่อันดับที่ 9 ตามปริมาณสินทรัพย์ภายใต้การบริหารและเป็นหนึ่งใน 25 ผู้จัดการสินทรัพย์ที่ใหญ่ที่สุดในโลกอันดับที่ 8 ในสินทรัพย์กองทุนรวมระยะยาวของสหรัฐอเมริกาอันดับที่ 4 ในกองทุนค้าปลีกของสหราชอาณาจักรและอันดับที่ 27 ในการจัดการสินทรัพย์ทั่วโลก

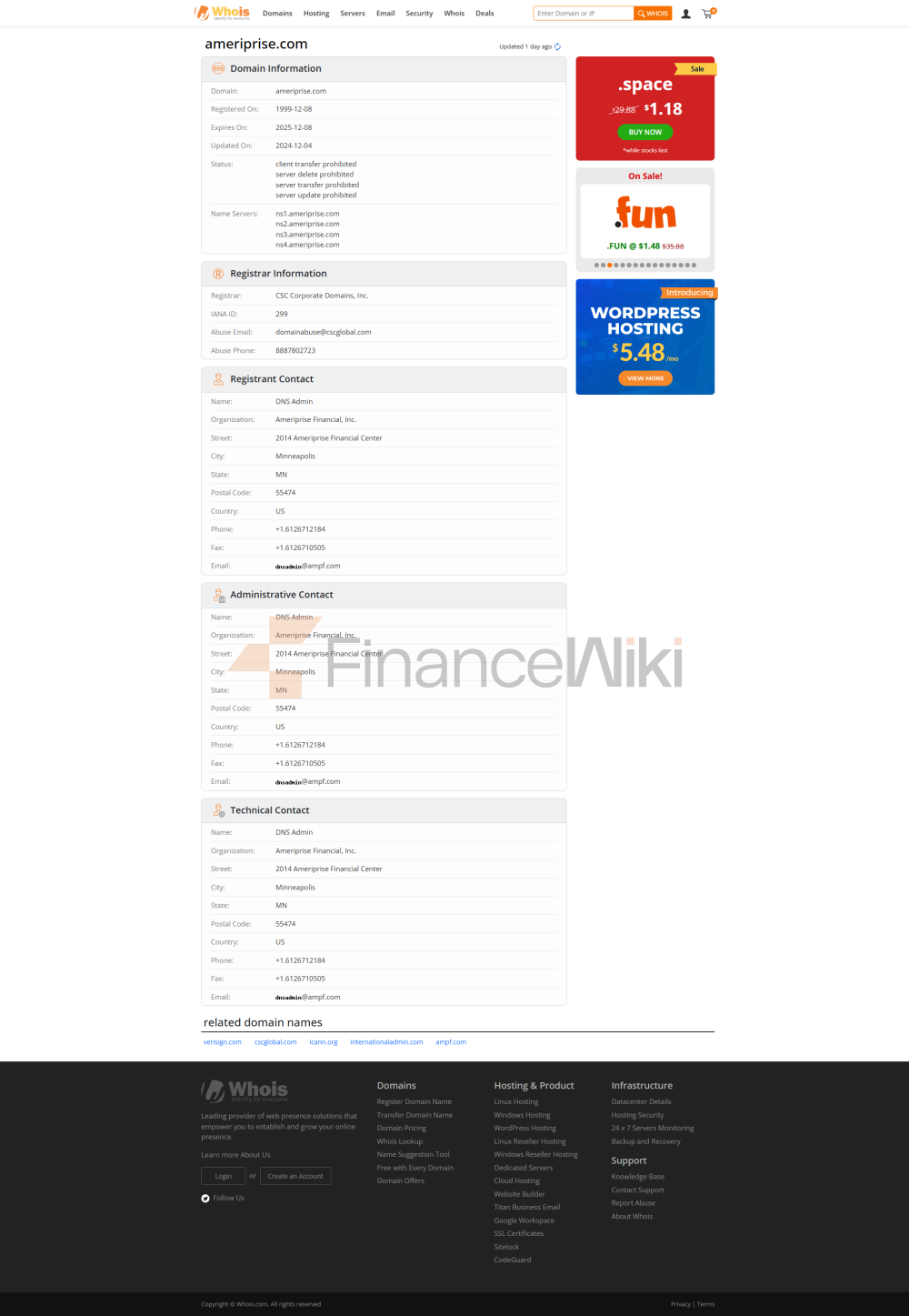

ข้อมูลพื้นฐาน - ชื่อเต็มของ บริษัท: Ameriprise Financial AG - ก่อตั้งขึ้น: กันยายน 2548 - สำนักงานใหญ่ที่ตั้ง: Minneapolis Minn. USA - ทุนจดทะเบียน: ไม่เปิดเผยต่อสาธารณะ - ใบอนุญาตกำกับดูแล: National Futures Association (NFA) ข้อบังคับ หมายเลขใบอนุญาต 0558308 - ประวัติผู้บริหาร: ไม่เปิดเผยรายละเอียด - ทีมที่ปรึกษา: ไม่เปิดเผยรายละเอียด - สมาชิกสมาคมอุตสาหกรรม: ไม่เปิดเผยรายละเอียด - ประกาศการปฏิบัติตาม: บริษัท ดำเนินงานอย่างเคร่งครัดตามข้อกำหนดของหน่วยงานกำกับดูแลด้านการเงินของสหรัฐอเมริกาเพื่อให้แน่ใจว่ากิจกรรมทางธุรกิจทั้งหมดเป็นไปตามกฎหมายและข้อบังคับ - สถาปัตยกรรมองค์กร: ใช้สถาปัตยกรรมบริการทางการเงินที่หลากหลายซึ่งครอบคลุมพื้นที่ธุรกิจหลายแห่งเช่นการบริหารความมั่งคั่งการจัดการสินทรัพย์การประกันภัยและอื่น ๆ - โครงสร้างทุน: ไม่เปิดเผยรายละเอียด

ธุรกิจหลักของ Matton Financialธุรกิจหลักครอบคลุมพื้นที่ดังต่อไปนี้: 1. การบริหารความมั่งคั่ง: ให้บริการบริหารความมั่งคั่งที่ปรับแต่งได้สำหรับบุคคลและสถาบันที่มีรายได้สูง รวมถึงการจัดสรรสินทรัพย์ การจัดการพอร์ตโฟลิโอ และการควบคุมความเสี่ยง 2. การจัดการสินทรัพย์: จัดการพอร์ตสินทรัพย์ที่หลากหลาย รวมถึงหุ้น พันธบัตร กองทุน และผลิตภัณฑ์ทางการเงินอื่นๆ 3. การประกันภัยและเงินรายปี: ให้บริการประกันชีวิต ประกันสุขภาพ และผลิตภัณฑ์เงินรายปีเพื่อช่วยให้ลูกค้าบรรลุเป้าหมายทางการเงินระยะยาว 4.การวางแผนมรดก: ช่วยเหลือลูกค้าในการวางแผนและจัดการมรดกเพื่อให้แน่ใจว่าการสืบทอดทรัพย์สินเป็นไปอย่างราบรื่น

โครงสร้างพื้นฐานทางเทคนิค - ซอฟต์แวร์การซื้อขาย: แอพพลิเคชั่นการซื้อขายสำหรับอุปกรณ์ iOS และ Android ที่รองรับโหมดออฟไลน์การเข้าถึงข้อมูลแบบเรียลไทม์ เครื่องมือวาดภาพขั้นสูงและตัวชี้วัดการวิเคราะห์ตลาดมากกว่า 30 ตัว - ระบบปฏิบัติการ: ใช้ระบบปฏิบัติการที่เสถียรและเชื่อถือได้เพื่อให้แน่ใจว่าการทำงานที่ราบรื่นของกระบวนการธุรกรรม - ความปลอดภัยของข้อมูล: ปกป้องข้อมูลลูกค้าจากการเข้าถึงโดยไม่ได้รับอนุญาตผ่านเทคโนโลยีการเข้ารหัสและมาตรการรักษาความปลอดภัยอื่น ๆ

ระบบการปฏิบัติตามและควบคุมความเสี่ยง Meitong Financial ได้กำหนดระบบการปฏิบัติตามและควบคุมความเสี่ยงที่เข้มงวด ซึ่งรวมถึง: 1. คำชี้แจงการปฏิบัติตามข้อกำหนด: บริษัทปฏิบัติตามกฎหมายและข้อบังคับของหน่วยงานกำกับดูแลด้านการเงินของสหรัฐฯ อย่างเคร่งครัด เพื่อให้มั่นใจว่ากิจกรรมทางธุรกิจทั้งหมดนั้นถูกกฎหมายและเป็นไปตามข้อกำหนด 2.ทีมควบคุมความเสี่ยง: ประกอบด้วยบุคลากรด้านการบริหารความเสี่ยงมืออาชีพ รับผิดชอบในการตรวจสอบและจัดการความเสี่ยงทางการเงินต่างๆ 3. เครื่องมือการบริหารความเสี่ยง: ใช้เครื่องมือและเทคโนโลยีการบริหารความเสี่ยงขั้นสูงเพื่อติดตามความผันผวนของตลาดและความเสี่ยงที่อาจเกิดขึ้นแบบเรียลไทม์ 4. การตรวจสอบการปฏิบัติตามข้อกำหนด: ดำเนินการตรวจสอบภายในและภายนอกอย่างสม่ำเสมอเพื่อให้มั่นใจถึงประสิทธิภาพของระบบควบคุมความเสี่ยง

ตำแหน่งทางการตลาดและความได้เปรียบในการแข่งขัน - ตำแหน่งทางการตลาด: ในฐานะบริษัทที่ให้บริการทางการเงินที่หลากหลาย Meitong Financial ให้บริการบุคคลที่มีรายได้สูงและลูกค้าสถาบันเป็นหลัก - ความได้เปรียบในการแข่งขัน: 1. ธุรกิจที่หลากหลาย: ครอบคลุมการบริหารความมั่งคั่ง การจัดการสินทรัพย์ การประกันภัย และสาขาอื่นๆ ให้บริการทางการเงินที่ครอบคลุมแก่ลูกค้า 2.ทีมงานมืออาชีพ: มีทีมบริการทางการเงินที่มีประสบการณ์ซึ่งสามารถให้บริการลูกค้าด้วยโซลูชั่นส่วนบุคคล 3.นวัตกรรมทางเทคโนโลยี: ปรับปรุงประสบการณ์การทำธุรกรรมของลูกค้าและความปลอดภัยของเงินทุนผ่านเทคโนโลยีการซื้อขายขั้นสูงและระบบควบคุมความเสี่ยง

การสนับสนุนลูกค้าและการเสริมอำนาจ - การสนับสนุนลูกค้า: ให้บริการสนับสนุนลูกค้าทุกสภาพอากาศรวมถึงโทรศัพท์แชทออนไลน์และอื่น ๆ วิธีการ - ทรัพยากรทางการศึกษา: จัดหาเครื่องมือและทรัพยากรการศึกษาการลงทุนที่หลากหลายเพื่อช่วยให้ลูกค้าพัฒนาความรู้ทางการเงินและทักษะการลงทุน - การจัดการบัญชี: ให้บริการลูกค้าด้วยการจัดการบัญชีอย่างมืออาชีพและคำแนะนำการลงทุนเพื่อให้แน่ใจว่าการจัดสรรสินทรัพย์ที่เหมาะสมที่สุด

ความรับผิดชอบต่อสังคมและ ESG Meitong Finance ตอบสนองความรับผิดชอบต่อสังคมอย่างแข็งขันโดยมุ่งเน้นที่ประสิทธิภาพในด้านสิ่งแวดล้อม (สิ่งแวดล้อม) สังคม (สังคม) และการกำกับดูแลกิจการ (การกำกับดูแล) และมุ่งมั่นที่จะส่งเสริมความก้าวหน้าทางสังคมและการปกป้องสิ่งแวดล้อมผ่านการลงทุนและบริการทางการเงินที่ยั่งยืน

กลยุทธ์การพัฒนาและแผนงานในอนาคต 1. การขยายธุรกิจ: วางแผนที่จะขยายรูปแบบธุรกิจในตลาดเอเชียและยุโรปเพิ่มเติมและเพิ่มอิทธิพลระดับโลก 2. นวัตกรรมทางเทคโนโลยี: ลงทุนในเทคโนโลยีทางการเงินอย่างต่อเนื่องเพื่อปรับปรุงประสิทธิภาพการทำธุรกรรมและประสบการณ์ของลูกค้า 3. การบริการลูกค้า: เพิ่มประสิทธิภาพการบริการลูกค้า เปิดตัวบริการทางการเงินที่เป็นส่วนตัวมากขึ้น 4. การพัฒนาที่ยั่งยืน: เสริมสร้างการลงทุนในด้าน ESG และส่งเสริมการพัฒนาที่ยั่งยืนของบริษัทและสังคม