Saitama Resona Bank Co. Ltd. (ญี่ปุ่น: Saitama Resona Bank Co. Ltd.) เป็นธนาคาร Metropolitan ภายใต้ Risona Holdings ของญี่ปุ่น สำนักงานใหญ่ตั้งอยู่ในเขต Urawa เมืองไซตามะจังหวัดไซตามะ

สรุป

ธนาคารไซตามะ Risona ซึ่งเป็น บริษัท ย่อยของ Risona Holdings ได้สืบทอดร้านค้าในจังหวัดไซตามะและสาขาในโตเกียวของ Rising Sun Bank เก่า

อยู่ในอันดับต้น ๆ ทั้งในด้านเงินฝากและสินเชื่อภายในจังหวัดไซตามะซึ่งเป็นพื้นที่ธุรกิจหลัก

127 จาก 132 ร้านค้าของใครบางคนตั้งอยู่ในจังหวัดไซตามะร้านค้านอกจังหวัดไซตามะคือสาขาโตเกียว "Seven Days Plaza Ikebukuro (Ikebukuro Office of Saitama Sales Department)" ใน Ikebukuro Toshima District Tokyo ซึ่งมีความสัมพันธ์ใกล้ชิดกับจังหวัด Saitama และสำนักงานธุรกิจนิติบุคคลในเมือง Takasaki และเมือง Ota จังหวัดกุนมะ "สำนักงาน Takasaki Enterprise (สาขา Honzhuang สาขา Takasaki)" "สำนักงาน Ota Enterprise (สาขา Kumagaya สาขา Ota Office)" เป็นต้น

เนื่องจากธนาคารไซตามะในอดีตได้รับการสืบทอดมา จึงเป็นสถาบันการเงินที่กำหนดสำหรับ 61 เขตปกครองตนเองในจังหวัดไซตามะและเขตปกครองตนเอง 64 แห่งในจังหวัด นอกจากบริการของพนักงานที่ประจำการอยู่ในสำนักงานและลานบริการหมู่บ้าน Machimura ในเขตเมืองบางแห่งแล้ว สำนักงาน Machimura ในเมือง ลานบริการ และพื้นที่โดยรอบส่วนใหญ่ในจังหวัดไซตามะยังมีตู้เอทีเอ็ม

ร้านของเราตั้งอยู่ในเขต Urawa เมืองไซตามะในชื่อ "แผนกขายไซตามะ" ซึ่งเดิมเป็นแผนกขายหลักของธนาคารไซตามะดังนั้นพื้นที่พื้นของห้องธุรกิจ (หน้าต่างล็อบบี้) จึงเทียบได้กับแผนกขายหลักของธนาคารยักษ์ อาคารยังได้รับรางวัล BCS ในปี 1977

ร้านค้าส่วนใหญ่ใช้อาคารที่ดินในยุคไซตามะธนาคารนอกเหนือจากสาขาโตเกียวและสาขาไซตามะ Shinduxin ที่จัดตั้งขึ้นใหม่ในยุค Rising Sun Bank นอกจากนี้หน่วยงานของเรามีหน้าที่บางอย่างใน Risona Holdings Tokyo Honshu

เนื่องจากเป็นฐานที่มั่นภายในของจังหวัดไซตามะที่สืบทอดธนาคาร Rising Sun เก่าอัตราส่วนทางการเงินส่วนบุคคลเช่นสินเชื่อเพื่อที่อยู่อาศัยก็สูงเช่นกันดังนั้นอัตราส่วนหนี้เสียจึงต่ำอัตราส่วนหนี้สินต่อทุน ณ เวลาที่ก่อตั้งอยู่ที่ประมาณ 7% (ประมาณ 10.78% ณ เวลาที่มีบัญชีขั้นสุดท้ายขั้นกลางในปี 2552 (21 ปีที่ Heisei) และเป็นธนาคารที่ยอดเยี่ยมเพียงแห่งเดียวในกลุ่ม Risona

เนื่องจากหนึ่งในรุ่นก่อนคือ Saitama Bank เก่าเป็น Metropolitan Bank จึงเป็น BANCS Franchise Bank แต่อยู่ใน "ธนาคารภูมิภาค / อื่น ๆ " ในการจัดประเภทธนาคารของ FFA เมื่อเทียบกับธนาคารในเมืองอื่น ๆ อีกสี่แห่ง (Mizuho Bank Mitsubishi UFJ Bank Sumitomo Mitsui Bank Risona Bank) อยู่ภายใต้การดูแลโดยตรงของ FFA ธนาคารเช่นเดียวกับธนาคารในท้องถิ่นอยู่ภายใต้การดูแลของสำนักการเงินคันโต

ซึ่งแตกต่างจากธุรกิจอื่น ๆ ในกลุ่ม Risona Saitama Risona Bank ได้เพิ่มมาสคอต Saitama County "KOBATON" ในการออกแบบกระเป๋าเงินสดนามบัตรบัตรการเงินและอื่น ๆ

ผลกระทบของการสนับสนุนทางการเงินพิเศษของ Risona Bank

ในเดือนพฤษภาคม 2546 (ปีที่ 15 ของ Heisei) Risona Bank ได้ยื่นคำร้องต่อคณะรัฐมนตรีของ Koizumi สำหรับการฉีดเงินทุนเชิงป้องกันตามมาตรการ 1 ของมาตรา 102 ของกฎหมายประกันทองคำล่วงหน้า Risona Bank เป็นของกลางอย่างมากหลังจากที่รัฐบาลบริจาคเงิน 1 ล้านล้านเยนเพื่อซื้อหุ้น

เนื่องจากมาตรการดังกล่าวมุ่งเป้าไปที่ Risona Bank ไซตามะนิวส์จึงไม่ได้กล่าวถึงผลกระทบต่อเศรษฐกิจของจังหวัดกับหนังสือพิมพ์ท้องถิ่น (จังหวัดไซตามะ) ของหนังสือพิมพ์แห่งชาตินักวิเคราะห์ทางการเงินและผู้ที่เกี่ยวข้องในอุตสาหกรรมเชื่อว่า Risona Bank อาจถูกขายหรือเป็นอิสระโดยการควบคุม และ Yoshihiko Tsuchiya ผู้ว่าราชการจังหวัดไซตามะในขณะนั้นซึ่งมีอำนาจของหน่วยงานทางการเงินที่กำหนดของจังหวัดไซตามะก็อยู่ในวันที่ 20 พฤษภาคม 2546 (Heisei 15) นอกจากนี้ยังไม่ได้แสดงความคิดเห็นในเชิงบวกอย่างอิสระในงานแถลงข่าวปกติ

อย่างไรก็ตาม ณ สิ้นเดือนพฤษภาคม 2546 (ปีที่ 15 ของเฮเซ) ประธานาธิบดีคาวาดะเคนจิแห่งริโซนาโฮลดิ้งส์เสนอต่อรัฐบาลเกี่ยวกับแผนการดำเนินงานที่ดีซึ่งรวมถึงการลดเงินเดือน 30% และการเลิกจ้างสมาชิกธนาคารของริโซนาโฮลดิ้งส์ สุนทรพจน์ "นโยบายการดำเนินงานโดยรวมของกลุ่มริโซนาจะอยู่ภายใต้การดูแลของรัฐ" ยังบอกเป็นนัยว่าจะไม่มีการเปลี่ยนแปลงครั้งใหญ่ในด้านการดำเนินงาน ซึ่งเป็นเครื่องหมายคำถามสำหรับการทดสอบความจำที่เป็นอิสระของธนาคารริโซนา

ในเดือนสิงหาคมของปีเดียวกันสถาบันประกันทองคำล่วงหน้าผ่านการแลกเปลี่ยนหุ้น Risona Bank เป็นของกลางอย่างมีนัยสำคัญ

การเปลี่ยนแปลงทางการเงินที่หนาแน่นในระดับภูมิภาค

ในเดือนพฤศจิกายน 2546 (ปีที่ 15 ของ Heisei) ผู้ว่าการจังหวัดไซตามะ Kiyoji Ueda และนายกเทศมนตรีเมืองไซตามะ Soichi Aikawa กล่าวว่าในความร่วมมือกับการปรับโครงสร้างองค์กรในอนาคตของกลุ่ม Risona วางแผนที่จะรับส่วนของ Saitama Risona Bank จาก Risona Holdings และเปลี่ยนธนาคารให้เป็น "County People's Bank" แต่แนวคิดดังกล่าวไม่สามารถรับรู้ได้ภายใต้หัวข้อต่าง ๆ เช่นมุมมองเกี่ยวกับการใช้เงินทุนสาธารณะและข้อดีและข้อเสียของการรวมเข้ากับธนาคาร Musashino ในเขตแผ่นดินใหญ่

หลังจาก Risona Panic สิ้นสุดลง Saitama Risona Bank ได้เปิดตัว "โครงการปรับปรุงการทำงานของธนาคารสัมพันธ์ (ธนาคารสัมพันธ์)" กับ "การส่งเสริมการเงินที่มีความหนาแน่นทางภูมิศาสตร์" ด้วยวิธีนี้ธนาคารจะให้สินเชื่อเพื่อที่อยู่อาศัยแก่ผู้อยู่อาศัยในจังหวัดไซตามะและขยายสายผลิตภัณฑ์ทางการเงิน SME และอื่น ๆ เพื่อเสริมความแข็งแกร่งให้กับบริการทางการเงินในภูมิภาค นอกจากนี้ธนาคารไซตามะ Risona ยังออกหนังสือเล่มเล็ก "Saitama Risona TODAY" ซึ่งมีการเปิดเผยข้อมูลสาธารณะของธนาคารและหัวข้อภายในจังหวัดไซตามะรวมถึง "Color 5L" ของ Second Life Intelligence Chronicle ซึ่งเผยแพร่ความไว้วางใจในการลงทุนการส่งเสริมการขายสินค้าประกันเงินรายปีและการพูดคุยกับคนดัง

ร้านค้า

ร้านปัจจุบัน (สาขาไซตามะ) (สาขาไซตามะเก่า→สาขา Urawa เก่า→สาขาไซตามะเก่า)

สาขา Urawa Central (สาขา Urawa ของธนาคาร Wuzhou เก่า สาขาเดิมของธนาคารไซตามะเก่า)

สาขา Kawakoshi (สาขาเดิมของธนาคารแห่งชาติที่แปดสิบห้า)

ในบรรดาร้านค้าที่มีคนอยู่ในจังหวัดไซตามะของ Old Rising Sun Bank ไซตามะ Risona Bank สืบทอดร้านค้า 108 แห่งนอกเหนือจากสาขา Urawa ที่เปิดขึ้นเพื่อให้ Risona Bank สืบทอด (เทียบเท่ากับหนึ่งในสามของจำนวนร้านค้าทั้งหมดของ Old Rising Sun Bank) รวมถึงสาขา Otutachi Central สาขา Ikebukuro Dongkou สาขา Shinjuku Station Mae (2004) ปิดร้านวันที่ 17 กันยายน) 3 ร้านค้า ฐานที่มั่นระดับสาขานอกจังหวัดไซตามะมีเพียงสาขาโตเกียวเท่านั้นธนาคารไซตามะ ริโซนา มีร้านค้าเพียงแห่งเดียวและฐานที่มั่นของสำนักงานไร้คนขับ (ATM) น้อยที่สุดในห้าองค์ประกอบของแฟรนไชส์ BANCS ซึ่งอยู่ในระดับเดียวกับธนาคารในท้องถิ่นเท่านั้น นอกจากนี้ ATM ของธนาคารและธนาคารริโซนายังสามารถแชร์สมุดบัญชีเงินฝากและบัตร ATM ของทั้งสองฝ่ายได้ แต่บริการบางอย่างมีข้อ จำกัด สำหรับการทำธุรกรรมกับ Kansai Future Bank และ Hong Kong Bank การใช้ค่าธรรมเนียมการจัดการแบบเต็มเวลาเช่นเดียวกับ Risona Bank ถือเป็นธุรกรรมภายในธนาคาร

ตั้งแต่ปี 2004 (Heisei 16) หน้าต่างร้านค้าทั้งหมดยกเว้น Higasando Agency ในเมือง Bando (ยกเลิกในเดือนมีนาคม 2550 (Heisei 19)) จะขยายเป็น 5 โมงเย็น

วิวัฒนาการ

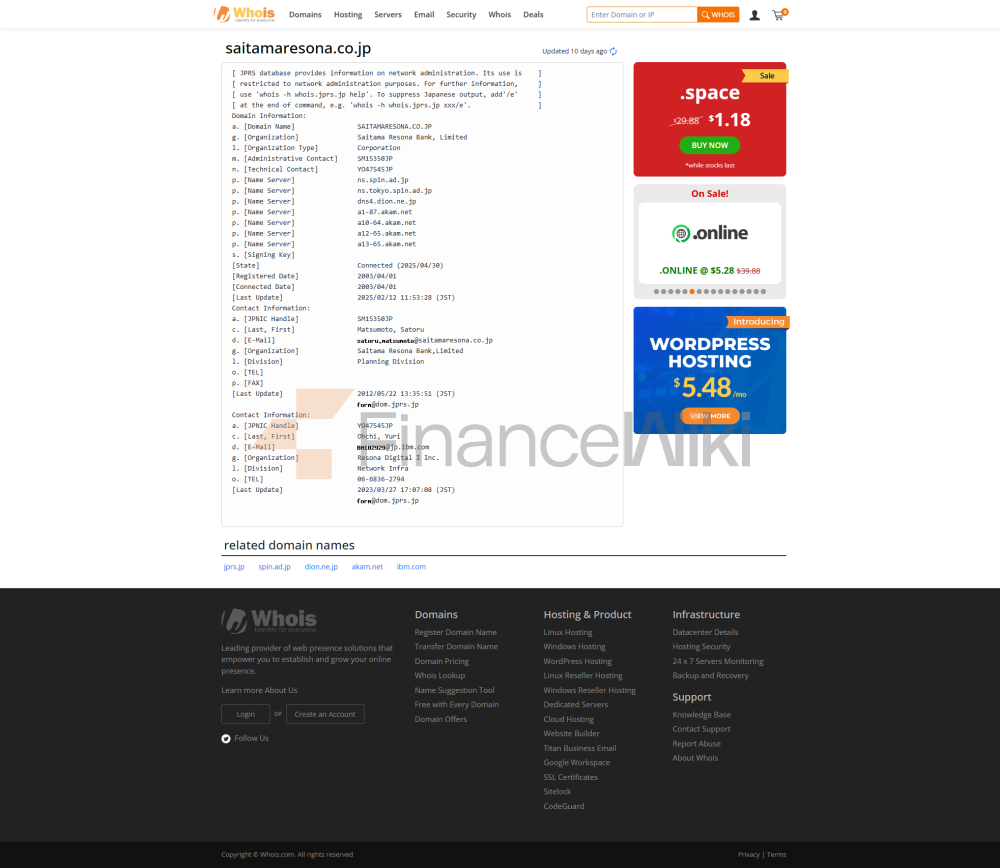

- 2002 (Heisei 14) 27 สิงหาคม: ธนาคารก่อตั้งขึ้นเป็น บริษัท ย่อยที่สมบูรณ์ของ Daiwa Silver Holdings Co. Ltd. (ปัจจุบันคือ Risona Holdings Co. Ltd.)

- 2003 (15 ปีของ Heisei)

- 1 มีนาคม: สืบทอดธุรกิจของ Rising Sun Bank Co. Ltd. (ยุบและรวมเข้ากับ Yamato Bank Co. Ltd. ในวันเดียวกัน)

- 3 มีนาคม: ธนาคารไซตามะ Risona เปิดทำการ

- 2009 (21 ปีของ Heisei) 24 พฤศจิกายน: สาขากลางของ Ohtomachi ย้ายไปที่ Houle Wenkyo-ku Tokyo และเปลี่ยนชื่อเป็นสาขาโตเกียว

- 2010 (Heisei 22) 6 พฤษภาคม: สำนักงานใหญ่โตเกียวย้ายไปที่ Fukagawa GATHARIA

- 2017 (Heisei 29) เมษายน: เมือง Takasaki จังหวัด Gunma และเมือง Ota ตั้งฐานธุรกิจนิติบุคคล "Takasaki Enterprise Office" "Ota Enterprise Office" เพื่อเข้าสู่คันโตเหนือเป็นครั้งแรก

- 2017 (Heisei 29) 1 พฤษภาคม: ใช้ระบบชื่อสถานีย่อยของสถานี Urawa Miyuen บนเส้นทาง Saitama Field Line ของ Saitama High-speed Railway ชื่อ "Walk with Urawa Miyuen สถานีที่ใกล้ที่สุดของ Saitama Risona Bank" .

- 2017 (Heisei 29) พฤศจิกายน: การจัดตั้งฐานที่มั่นธุรกิจใหม่ "Urawa Miyuen Outlet" ภายในจังหวัดไซตามะเป็นครั้งแรกนับตั้งแต่เริ่มธุรกิจในปี 2546

- 2018 (Heisei 30) ตุลาคม: การตั้งค่า "Outlet Lake Town"

ฐานที่มั่นในต่างประเทศ

ไม่มีฐานที่มั่นในต่างประเทศเนื่องจากส่วนใหญ่เปิดในจังหวัดไซตามะ ฐานที่มั่นในต่างประเทศของไซตามะดั้งเดิม (สำนักงานพนักงานของเซาเปาโล ฯลฯ) ถูกขายให้กับธนาคารมิตซูบิชิแห่งโตเกียวในปี 2544 (13 ปีแห่งเฮเซ) ในยุคเก่าของ Rising Sun Bank