United Arab Bank, 1975 yılında Birleşik Arap Emirlikleri, Sharjah Emirliği 'nde özel bir anonim şirket olarak kuruldu. UAB, BAE' nin büyüyen ticari ve endüstriyel üssüne olgun, lider bir finansal çözüm sağlayıcısı olarak tanınmaktadır. Bankanın yasal formu, Sharjah Emirliği Hükümdarı Majesteleri tarafından yayınlanan 29 Temmuz 1982 tarihli 17 / 82 sayılı Emir Kararı uyarınca bir kamu anonim şirketine dönüştürüldü. 21 Mart 2005 'te bankanın ihraç ettiği hisse senedi Abu Dabi Menkul Kıymetler Borsası' nda listelendi. İslami bankacılık çözümlerine ek olarak UAB, müşterilere ticaret finansmanı, perakende bankacılığı ve hazine hizmetleri de dahil olmak üzere eksiksiz bir kurumsal ve kurumsal bankacılık hizmetleri paketi sunar ve böylece bankayı ana kurumsal müşteri tabanı için tercih edilen ortak olarak konumlandırır. 31 Aralık 2015 tarihi itibariyle banka, piyasa değeri ile BAE 'de halka açık bankalar arasında 11. sırada yer aldı. Aralık 2007' de UAB, Katar 'ın en büyük özel bankası olan Ticaret Bankası' nın% 40 hissesini satın almasının ardından bankacılık ittifakının bir parçası oldu. UAB 'ın sonraki yıllardaki güçlü mali performansı, Katar Bankası ile stratejik ittifakının faydalarını gösteriyor. Türkiye' deki Umman Ulusal Bankası (NBO) ve Alternatif Bank ile benzer ittifaklara sahip ticari bankaya sahip olmak, böylece ilerlerken üç bankanın da güçlü bir şekilde büyümesi için sağlam bir platform sağlıyor. Banka, Moody 's tarafından Baa2 olarak istikrarlı bir görünümle derecelendirilmiştir.

Aktif

United Arab Bank

resmi sertifikasyon Birleşik Arap Emirlikleri

Birleşik Arap Emirlikleri20 yıl

Resmi web sitesi

Güncellendi 2025-04-10 12:01:51

Mevcut İşletme Derecelendirmesi

5.00

Sektör derecelendirmesi

Temel bilgiler

işletmenin tam adı

United Arab Bank

ülke

Birleşik Arap Emirlikleri

Kurumsal sınıflandırma

Kayıt zamanı

1975

çalışma durumu

Aktif

düzenleyici bilgiler

( Birleşik Arap Emirlikleri )

Düzenlenmiş

mevcut durum

Düzenlenmiş

düzenleyici devlet

Birleşik Arap Emirlikleri

düzenleyici numara

--

Lisans türü

--

lisans sahibi

United Arab Bank

Lisans Sahibi Adresi

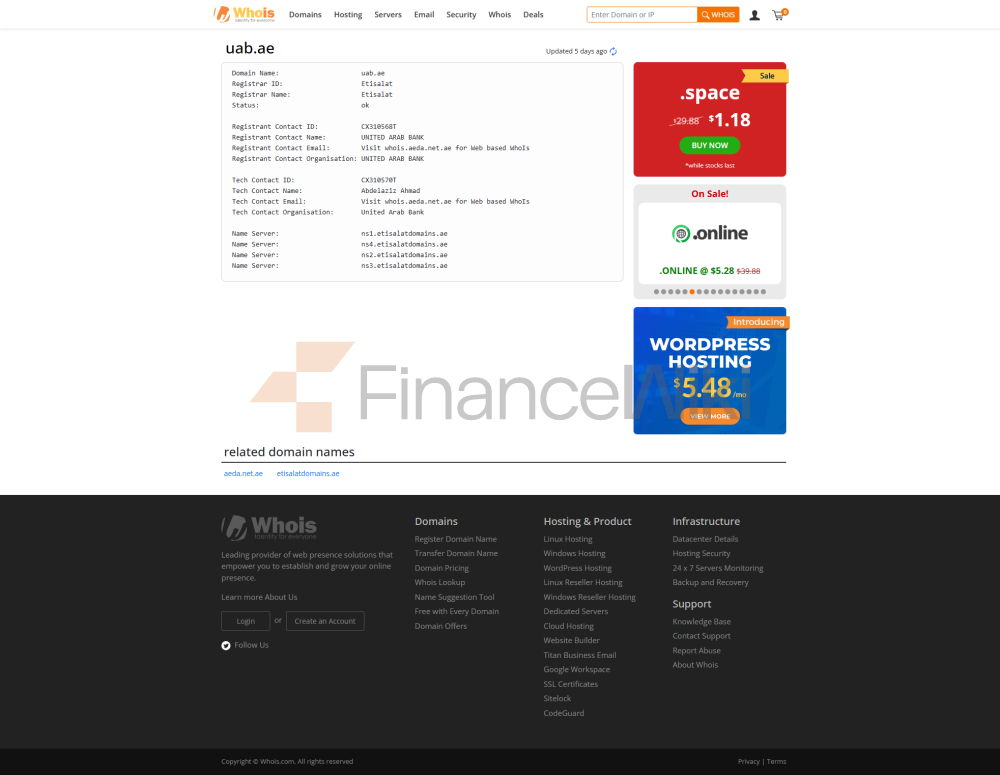

UAB Tower, Al Majaz Street, Buhaira Corniche, Sharjah, United Arab Emirates

Lisanslı Kurum Posta Kutusu

--

Lisans sahibi web sitesi

http://www.uab.ae/

Lisans sahibi telefon

--

Sermaye türü

Paylaşım Yok

Etkili zaman

--

Son kullanma süresi

--

işletme değerlendirmesi/maruz kalma

Bir inceleme yaz/maruz kalma

5.00

0değerlendirme/

0maruz kalma

Bir inceleme yaz/maruz kalma

United Arab Bank Şirket tanıtımı

United Arab Bank Kurumsal Güvenlik

http://www.uab.ae

United Arab Bank Soru-Cevap

Bir soru sor

sosyal medya

Haberler

Risk uyarısı

Finance.Wiki size bu web sitesinde yer alan verilerin gerçek zamanlı veya doğru olmayabileceğini hatırlatır. Bu web sitesindeki veriler ve fiyatlar mutlaka piyasa veya borsa tarafından sağlanmayabilir, ancak piyasa yapıcılar tarafından sağlanmış olabilir, dolayısıyla fiyatlar doğru olmayabilir ve gerçek piyasa fiyat trendlerinden farklı olabilir. Yani fiyat yalnızca piyasa eğilimini yansıtan gösterge niteliğinde bir fiyattır ve ticari amaçla kullanılmamalıdır. Finance.Wiki ve bu web sitesinde yer alan verilerin sağlayıcısı, ticari davranışınızdan veya bu web sitesinde yer alan bilgilere güvenmenizden kaynaklanan hiçbir kayıptan sorumlu değildir.