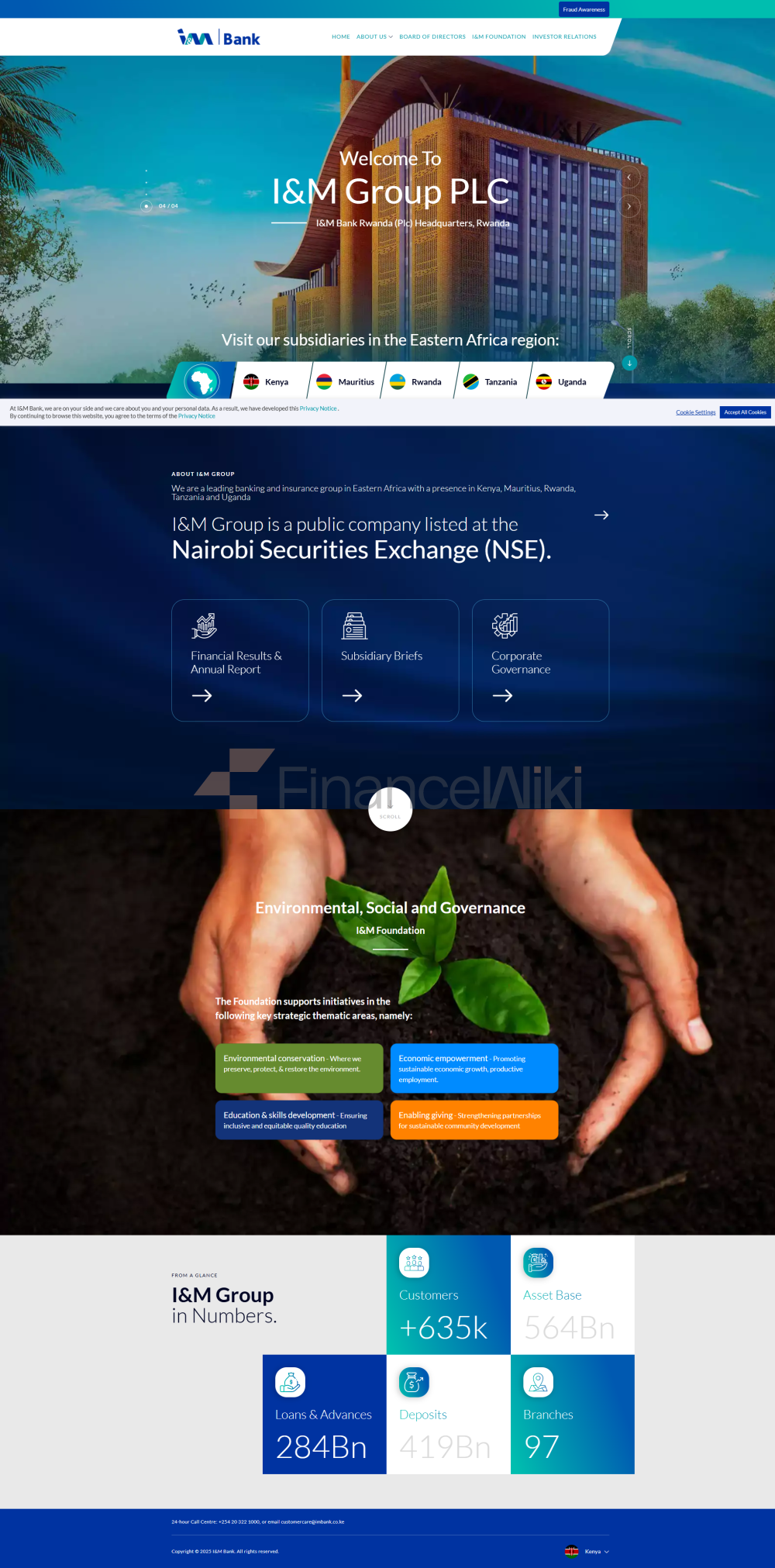

I & M Bank Kenya Limited, Doğu Afrika Topluluğunun en büyük ekonomisi olan Kenya 'da ticari bir bankadır. Kenya Merkez Bankası, Merkez Bankası ve Ulusal Bankacılık Denetleme Otoritesi tarafından lisanslanmıştır.

Genel Bakış

Eylül 2019 itibariyle bankanın toplam aktif değeri 2,52 milyar doların (261 milyar Kenya şilini) ve hissedarların öz varlığı yaklaşık 424 milyon dolardı (44 milyar Kenya şilini). Eylül 2019 itibariyle banka, toplam aktifler açısından o sırada ülkedeki 40 lisanslı banka arasında 8. sırada yer aldı. I & M Bank, hem büyük hem de küçük kurumsal müşterilere orta ve büyük ölçekli şirketler ve premium müşterilere odaklanan bireylere bankacılık hizmetleri sunmaktadır. I & M, Giro Bank 'ın satın alınmasının ardından Tier 1' e de taşındı.

Tarih

Bankanın tarihi, Yatırım ve İpotek Limited 'in Nairobi bölgesindeki iş adamlarına kişiselleştirilmiş finansal hizmetler sağlayan özel bir şirket olarak kurulduğu 1974 yılına kadar uzanıyor. 1980 'de I & M (o zamanki şirket), Bankacılık Yasası kapsamında bir Finansal Kurum Grubu olarak tescil edildi. Kenya Merkez Bankası' nın (ülkenin bankacılık düzenleyicisi) düzenlemelerindeki değişikliklerin ardından, I & M 1996 'da bir ticari banka oldu.

2002' de, Nairobi 'nin Merkezi İş Bölgesi' ndeki Kenyatta Caddesi 'nde I & M Bank Building olarak bilinen 16 katlı bir cam ve çelik gökdelen açıldı. Ertesi yıl, I & M Bank, I & M' nin şube ağını, müşteri tabanını ve yönetim altındaki varlıklarını genişleterek Kenya 'nın Biashara Bank Limited' ini satın aldı.

2007 'de, iki Uluslararası Kalkınma Finansal Kurum Grubu, DEG ve PROPARCO, I & M Bank' ta% 11,96 hisseye sahip olmak için yaklaşık 4,50 milyon dolar yatırım yaptı. Bu hissedarlık oranı daha sonra% 19,7 'ye yükseltildi.

2008' de I & M Bank, Mauritius 'un First City Bank Limited' inde (FCB)% 50 hisseye sahip oldu. FCB o zamandan beri kendisini First Bank of Mauritius olarak yeniden adlandırdı. 2010 yılında I & M Bank, Tanzanya CF United Bank 'ta bir kontrol hissesi satın aldı. Bundan sonra, CF United Bank, I & M Bank (Tanzanya) olarak yeniden adlandırıldı.

Temmuz 2012 'de, I & M Banking Group, açıklanmayan bir miktar için ülkenin en büyük ikinci ticari bankası olan Ruanda Ticaret Bankası' nda (BCR) bir kontrol hissesi satın aldı

Ağustos 2013 'te BCR, I & M Bank Ruanda olarak yeniden adlandırıldı.

2013' te I & M Bank, Grubun tüm işletmeleri ve yan kuruluşları için holding şirketi olarak I & M Holdings Limited 'i kurdu. Holdingin hisseleri, I & M sembolü altında Nairobi Menkul Kıymetler Borsası' nda listelenir ve halka açık olarak işlem görür.

2020 'de 1 Park Avenue, I & M Banks' ın yeni merkezi olarak açıldı. Bina, Nairobi 'deki First Park Avenue ve Limru Road kavşağında yer almaktadır.

Acqumary

Eylül 2015' te I & M Holdings, Giro Ticaret Bankası 'nı satın almaya ve operasyonlarını I & M Bank Limited ile birleştirmeye başladı. Düzenleyici onay gerektiren süreç, Şubat 2017 'de Giro Ticaret Bankası' nın bankacılık lisansından vazgeçip I & M Bank Kenya 'nın bir parçası olmasıyla sona erdi.

Branch Network

- Kenyatta Caddesi Şubesi - I & M Bank Tower, Kenyatta Caddesi, Nairobi

- Karen Şubesi - Karen Ofis Parkı, Langata Yolu, Karen, Nairobi

- 2. Ngong Caddesi Şubesi - I & M Bank House, 2nd Ngong Caddesi, Nairobi

- Sarit Centre Branch - 1st Floor, Sarit Centre, Westlands, Nairobi

- Biashara Caddesi Şubesi - Ansh Square, Biashara Caddesi, Nairobi Endüstriyel Şube - Kairobi, Chanwe Road, Ngamli Road > South Road, Nairobi

- Valley Arcade Branch - Kenol Kieve Station, Gitanga Road, Nairobi

- Panari Sky Centre Branch - Nairobi - Mombasa Road, Nairobi

- One Park Branch - 1 Park Avenue, Ground Floor (1st Parklands and Limuru Road jinter)

- Wilson Airport Branch - Pewin House, Wilson Airport, Nairobi

- Ongata Rongai Branch - Ground Floor, Maasai Mall, Ongata Rongai, Nairobi

- South C Branch - South C Alışveriş Merkezi, Nairobi

- Riverside Drive - 14 Riverside Drive, Nairobi Nyali Branch - NineCineCinex, Nyala max, Mombasa Branch Kisumu Şubesi - Bon Accord Evi, Oginga Odinga Caddesi, Kisumu

- Nakuru Şubesi - Polo Center, Kenyatta Caddesi, Nakuru

- Eldoret Şubesi - Zemin Kat, Zion Alışveriş Merkezi, Uganda Yolu, Eldoret

- Changamwe Şubesi - Mombasa Rafineri Yolu, Birinci Kat, Rafineri Binası

- Kisii Şubesi - Kraliyet Kulesi, Hastane Yolu, Kisii

- Malindi Şubesi - Birinci Kat, Çam Avlusu Binası, Lamu Yolu, Malindi

- Nyeri Şubesi - Zemin Kat, Nyaatha Plaza, Kimathi Yolu, Nyeri Thika Şubesi - 80, West Plaza, Tuskika Süpermarket 'nın karşısında, Sli / li > Alışveriş Merkezi Sarit Centre Seç Şubesi - Sarit Centre Yeni Kanadı, Alt Zemin Kat, Westlands

- Lavington Mall Şubesi - Zemin Kat, Lavington Mall, James Gichuru Road, Nairobi

- Kitale Şubesi - Zemin Kat, Mega Centre, Kitale / li >

- Lunga Lunga Şubesi - Zemin Kat, Lunga Lunga Alışveriş Merkezi, Lunga Lunga Yolu, Sanayi Bölgesi, Nairobi

- Yaya Center Şubesi - 4. Kat, Yaya Center, Nairobi Argwing Kodhek Yolu

- Gateway Mall Branch - Gateway Mall, Mombasa Road, Nairobi Syokimao Tren İstasyonu 'nun karşısında. Garden Mall - City Garden Mall, Thika, Nairobi Road Nanyli, Nanyli / Nanyli, Husli Road Off River Road, Nairobi

- Meru Branch - Ground Floor, P & K Plaza, Moi Avenue, Meru

- Eldama Park Branch - Eldama Park, Nairobi

- Dunga Road Branch - Dunga Road, Nairobi Sanayi Bölgesi

- Ridge Court Branch - Ridge Court, Parklands, Nairobi

- Haile Selassie Branch - Patel Samaj Building, Haile Selassie Avenue, Mombasa

- Spring Valley Branch - Nairobi Spring Valley Business Park Block B, Ground Floor.