ملف الشركة

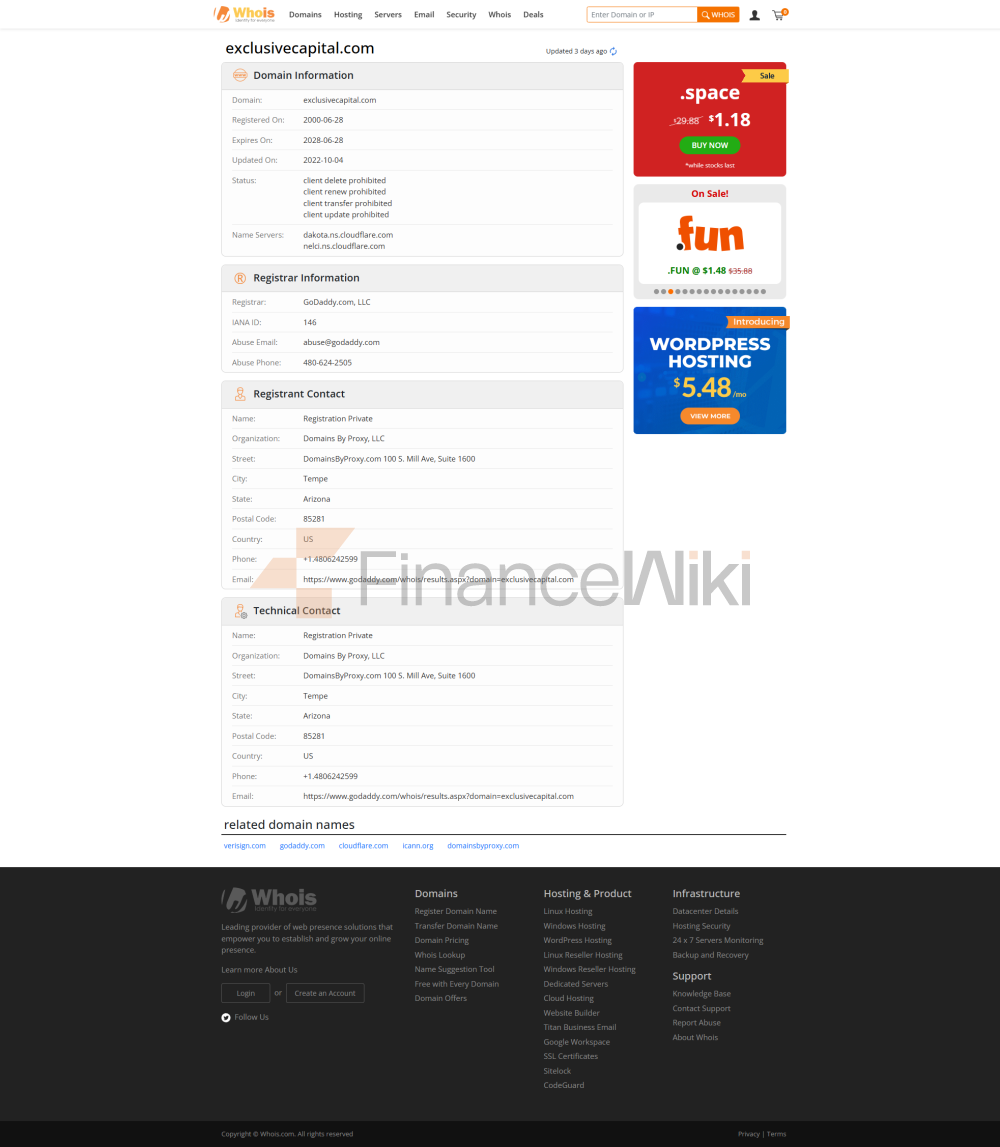

الاسم الكامل : Exclusive Change Capital Ltd تأسست : 2017 موقع المقر الرئيسي : ليماسول ، قبرص رأس المال المسجل : لم يكشف عنه رخصة تنظيمية : ترخيص مرور STP صادر عن هيئة الأوراق المالية والبورصات القبرصية (CySEC) (رقم الترخيص: 330 / 17) خلفية تنفيذية : لم يكشف عنه الفريق الاستشاري : لم يكشف عنه أعضاء اتحاد الصناعة : بيان الامتثال غير المعلن عنه : وفقًا للمتطلبات التنظيمية لـ CySEC ، تلتزم Exclusive Capital بضمان أن أموال العملاء آمنة ، وأن تكون أنشطة التداول شفافة وموثوقة. هيكل الشركة : هيكل الأسهم غير المعلن عنه >: Undisclosed

Exclusive Capital هي وسيط مالي مسجل في قبرص ، مع التركيز على تزويد العملاء بخدمات التداول للمنتجات المالية مثل العملات الأجنبية والعقود مقابل الفروقات (CFDs). توفر الشركة مجموعة متنوعة من أدوات ومنصات التداول من خلال موقعها الرسمي على الإنترنت ، وهي مكرسة لخلق بيئة تداول فعالة وشفافة للمستثمرين.

المعلومات التنظيمية

يتم تنظيم Exclusive Capital من قبل هيئة الأوراق المالية والبورصات القبرصية (CySEC) وتحمل ترخيص STP Pass-Through (رقم الترخيص: 330 / 17). هذا يعني أن الشركة تتبع الإطار التنظيمي الصارم لـ CySEC ، المصمم لحماية مصالح المستثمرين وضمان الامتثال لأنشطة التداول.

- أمان الأموال : يتم تنظيم أموال حساب تداول المستثمرين وحمايتها بواسطة CySEC ، وإيداع الأموال هو مسؤولية بنك حفظ مستقل.

- شفافية المعاملات : يضمن نموذج STP تمرير طلبات العملاء مباشرة إلى مزودي السيولة ، وتجنب التدخل الوسيط.

- المناطق المحظورة : لا تقدم Exclusive Capital خدمات إلى ولايات قضائية محددة مثل الولايات المتحدة وكندا واليابان والمملكة المتحدة وما إلى ذلك

حتى في ظل إطار تنظيمي مع امتثال عالٍ ، يحتاج المستثمرون إلى الانتباه إليه ما إذا كان يتم فتح حساب تداول في ولاية قضائية منظمة.

منتجات التداول

تقدم Exclusive Capital مجموعة متنوعة من أدوات التداول المالية التي تغطي الأسواق التالية:

- Forex : تشمل أزواج العملات الرئيسية (على سبيل المثال EUR / USD ، USD / JPY) وأزواج العملات الثانوية.

- المعادن الثمينة : يقدم التداول الفوري للذهب (XAUUSD) والفضة (XAGUSD).

- النفط الخام : يدعم تداول العقود مقابل الفروقات للنفط الخام الأمريكي (USOIL) ونفط خام برنت (BRENT).

- المؤشر : يغطي المؤشرات العالمية الرئيسية مثل S & P 500 (US500) و DAX الألماني (GER30) و Nikkei 225 (N225).

- العملات المشفرة : يقدم التداول على مجموعة متنوعة من أزواج العملات الرقمية مثل Bitcoin (BTC / USD) و Ethereum (ETH / USD).

اعتبارًا من عام 2024 ، تقدم Exclusive Capital أكثر من 45 زوجًا من العملات الأجنبية و منتجات CFD متعددة .

برامج التداول

تقدم Exclusive Capital للمتداولين منصتي تداول:

- MetaTrader 5 (MT5) : يدعم التداول متعدد المنصات على سطح المكتب والجوال ، ويوفر ثروة من المؤشرات الفنية وأدوات الرسوم البيانية للمتداولين المحترفين.

- NetDania : منصة تداول قائمة على السحابة توفر بيانات السوق في الوقت الفعلي وواجهة مستخدم موجزة.

بالإضافة إلى ذلك ، تقدم الشركة تطبيقات جوال مخصصة للمتداولين عبر الأجهزة المحمولة ، تدعم أجهزة iOS و Android.

طرق الإيداع والسحب

تقدم Exclusive Capital طرق الإيداع والسحب بما في ذلك:

- بطاقات الائتمان / الخصم : Visa و MasterCard.

- التحويل البرقي : يدعم التحويلات المصرفية بعملات متعددة.

- منصات الدفع التابعة لجهات خارجية : بما في ذلك Skrill و WebMoney و Neteller.

عادةً ما تكتمل عمليات الإيداع والسحب في غضون 1-3 أيام عمل ، اعتمادًا على طريقة الدفع ونوع العملة.

دعم العملاء

تقدم Exclusive Capital خدمات دعم عملاء متعددة اللغات بما في ذلك:

- الدردشة عبر الإنترنت : الرد على استفسارات العملاء في الوقت الحقيقي.

- دعم البريد الإلكتروني : اتصل بفريق الدعم عبر info@exclusivegoldfx.com.

- قاعدة المعرفة : يوفر الموقع الرسمي أدلة تداول مفصلة وأسئلة متكررة (FAQs).

يعد فريق دعم العملاء بالرد على استفسارات العملاء في غضون 24 ساعة.

الأعمال والخدمات الأساسية

يتمثل العمل الأساسي لشركة Exclusive Capital في تقديم خدمات تداول العقود مقابل الفروقات للمستثمرين الأفراد والمؤسسات ، والتي تغطي أسواق العملات الأجنبية والمعادن الثمينة والنفط الخام والمؤشرات والعملات المشفرة. تلبي الشركة احتياجات مختلف المستثمرين من خلال منصة التداول المتقدمة تقنيًا وأدوات التداول المتنوعة.

- المزايا الفنية : تدعم منصة MT5 التداول الآلي والتحليل الفني المعقد ، مناسب للمتداولين المحترفين.

- إدارة المخاطر : يوفر أدوات وقف الخسارة وجني الأرباح لمساعدة العملاء على إدارة مخاطر التداول.

البنية التحتية للتكنولوجيا

تعتمد Exclusive Capital على البنية التحتية التكنولوجية الرائدة في الصناعة ، بما في ذلك:

- وضع تمرير STP : يضمن تمرير طلبات العميل مباشرة إلى مزودي السيولة ، مما يقلل من تأخيرات التداول.

- دعم الحوسبة السحابية : تعتمد منصة NetDania على السحابة ويوفر تجربة تداول فعالة.

- الأمن السيبراني : استخدام تقنية تشفير SSL لحماية أمان بيانات العملاء.

نظام الامتثال ومراقبة المخاطر

- عملية الامتثال : وفقًا لمتطلبات CySEC ، يتم اعتماد عمليات صارمة لإدارة المخاطر والامتثال.

- عزل المخاطر : يتم تخزين أموال العملاء بمعزل عن الصناديق التشغيلية للشركة لضمان سلامة الأموال.

- نظام التحكم في مخاطر AIoT : المراقبة في الوقت الفعلي لتقلبات السوق وسلوك التداول غير الطبيعي من خلال الذكاء الاصطناعي وتكنولوجيا إنترنت الأشياء.

وضع السوق و الميزة التنافسية

يتمثل وضع Exclusive Capital في السوق في تزويد المستثمرين العالميين بمنصة تداول CFD شفافة وموثوقة. تشمل مزاياها التنافسية ما يلي:

- أدوات التداول المتنوعة : أدوات التداول التي تغطي الأسواق المالية الرئيسية.

- منصة التداول الفعالة : توفر MT5 و NetDania للمتداولين خيارات تداول مرنة.

- إطار تنظيمي صارم : يضمن إشراف CySEC سلامة أموال العملاء وشفافية المعاملات.

المسؤولية الاجتماعية و ESG

تلتزم Exclusive Capital بتعزيز التنمية المستدامة والوفاء بالمسؤولية الاجتماعية من خلال:

- التدابير البيئية : اعتماد الطاقة الخضراء لدعم عمليات مركز البيانات.

- برنامج التعليم : موارد تعليم التداول المجانية لـ المتداولون المبتدئون.

- دعم المجتمع : تبرعات منتظمة للجمعيات الخيرية العالمية لدعم البرامج التعليمية والطبية.

بيئة التعاون الاستراتيجي

أنشأت Exclusive Capital شراكات إستراتيجية مع العديد من مجموعات المؤسسات المالية وشركات التكنولوجيا المعروفة ، بما في ذلك:

- مزودي السيولة : التعاون مع البنوك الدولية الكبرى ومجموعات المؤسسات المالية لضمان عمق السوق والسيولة.

- منصة الدفع : تتعاون مع منصات الدفع المشهورة عالميًا مثل Skrill و WebMoney لتوفير خدمات إيداع وسحب مريحة.

- مزود التكنولوجيا : يتعاون مع شركات التكنولوجيا مثل NetDania لتحسين تجربة التداول.

الصحة المالية

لم يتم الكشف عن الصحة المالية لشركة Exclusive Capital علنًا ، ولكن بصفتها وسيطًا منظمًا لـ CySEC ، فإنها تخضع لتقارير مالية منتظمة ومراجعة تنظيمية.

خارطة الطريق المستقبلية

تخطط Exclusive Capital لتوسيع نطاق أعمالها في المستقبل ، بما في ذلك:

- أدخل الأسواق الناشئة : استكشف فرص السوق في آسيا والشرق الأوسط.

- تحسين منصة التداول : تحسين تجربة المستخدم من خلال تقديم المزيد من الميزات التقنية.

- أدوات تداول غنية : خطط لإضافة المزيد من المنتجات المالية مثل السندات والخيارات.