نبذة عن الشركة

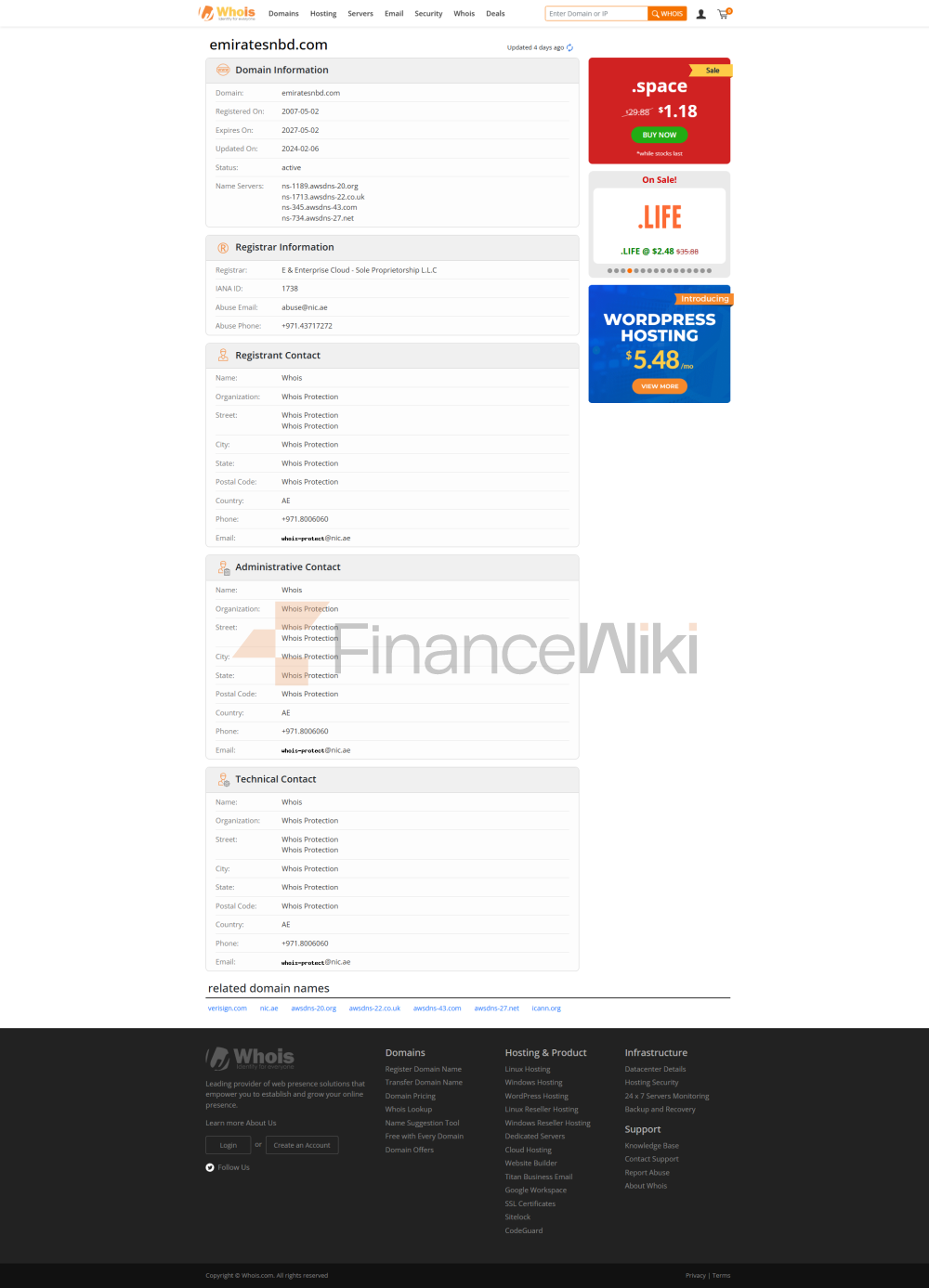

بنك الإمارات دبي الوطني ش.م.ع (يشار إليه فيما يلي باسم "بنك الإمارات دبي الوطني") هو بنك مملوك للدولة في دولة الإمارات العربية المتحدة ، ومقره في دبي. كواحد من أكبر المجموعات المصرفية في الشرق الأوسط من حيث الأصول ، يلتزم بنك الإمارات دبي الوطني بتقديم خدمات مالية شاملة للعملاء من الأفراد والشركات والمؤسسات. تأسس البنك في 6 مارس 2007 من خلال اندماج بنك دبي الوطني و بنك الإمارات الدولي (EBI) . اعتبارًا من 31 ديسمبر 2020 ، بلغ إجمالي أصوله 698 مليار درهم ، وبلغ حجم ودائعه 464 مليار درهم ، وبلغ إجمالي إيراداته 23.21 مليار درهم ، وبلغ صافي أرباحه 7 مليارات درهم. يعمل لدى البنك حاليًا أكثر من 9000 موظف في 70 دولة حول العالم ، ولديه مكاتب تمثيلية في الصين وإندونيسيا وأماكن أخرى ، مما يزيد من نفوذه الدولي.

المعلومات التنظيمية

بنك الإمارات دبي الوطني هو مجموعة مؤسسات مالية تحت إشراف البنك المركزي لدولة الإمارات العربية المتحدة (CBUAE) ويحمل رخصة مصرفية شاملة. كبنك مملوك للدولة ، يتم تنظيم عملياته بشكل صارم لضمان الاستقرار المالي والامتثال. على الرغم من أن بنك الإمارات دبي الوطني لا يشارك مباشرة في خدمات الوساطة ، إلا أن وظائفه المصرفية تخضع للإشراف والتوجيه من قبل البنك المركزي الإماراتي ، مما يضمن امتثال خدماته المالية للمعايير الدولية.

الأعمال والخدمات الأساسية

بنك الإمارات دبي الوطني تغطي الأعمال الأساسية المجالات التالية:

1. الخدمات المصرفية الشخصية

- حسابات التوفير والتحقق : تقدم مجموعة متنوعة من أنواع الحسابات لتلبية احتياجات العملاء المختلفة.

- القروض الشخصية : تشمل القروض الاستهلاكية وقروض السيارات وقروض الائتمان الشخصية.

- بطاقات الائتمان : مجموعة واسعة من الخيارات ، بما في ذلك نقاط المكافآت وعروض السفر واسترداد النقود.

2. الخدمات المصرفية للشركات

- قروض الأعمال : توفر حلول تمويلية للشركات الصغيرة والمتوسطة والمؤسسات الكبيرة.

- خدمات إدارة النقد : تساعد الشركات على تحسين التدفق النقدي والتمويل اليومي.

- تمويل التجارة : يدعم احتياجات التجارة الدولية ، بما في ذلك خطابات الاعتماد والضمانات.

3. خدمات الاستثمار

- إدارة الأصول : توفر خدمات إدارة المحافظ وإدارة الثروات.

- منتجات الاستثمار : تغطي استثمارات الصناديق المشتركة والأسهم والسندات.

4. الخدمات المصرفية الرقمية

- الخدمات المصرفية عبر الإنترنت : توفر خدمات مريحة لإدارة الحساب.

- تطبيق الخدمات المصرفية عبر الهاتف المحمول : يدعم المعاملات المصرفية في أي وقت وفي أي مكان.

5. خدمات صرف العملات الأجنبية

- تحويل الأموال الدولي : يوفر تحويلات سريعة عبر الحدود من خلال خدمات مثل DirectRemit والتحويل البرقي وويسترن يونيون.

- بطاقة أموال السفر : بطاقة GlobalCash تدعم 15 عملة ، مصممة للسفر الدولي.

البنية التحتية التقنية

اعتمد بنك الإمارات دبي الوطني نظامًا متقدمًا للتحكم في مخاطر إنترنت الأشياء ، والذي يجمع بين الذكاء الاصطناعي وتكنولوجيا إنترنت الأشياء لمراقبة مخاطر المعاملات في الوقت الفعلي وضمان سلامة أموال العملاء. تشتمل بنيتها التحتية التقنية أيضًا على تقنية blockchain لتحسين عمليات النقل عبر الحدود وتنفيذ العقود الذكية. بالإضافة إلى ذلك ، تدعم المنصة الرقمية للبنك المصادقة البيومترية لتعزيز أمان مصادقة العملاء.

نظام الامتثال ومراقبة المخاطر

يلتزم بنك الإمارات دبي الوطني بصرامة بالمتطلبات التنظيمية للبنك المركزي الإماراتي وقد أنشأ نظامًا شاملاً للامتثال ومراقبة المخاطر. يؤكد بيان الامتثال الخاص به على الضوابط الصارمة على مكافحة غسيل الأموال (AML) وتمويل الإرهاب (CFT) وخصوصية البيانات. بالإضافة إلى ذلك ، يضمن البنك فعالية إطار إدارة المخاطر الخاص به من خلال عمليات التدقيق المنتظمة واختبار الإجهاد.

وضع السوق والميزة التنافسية

بصفته مجموعة مؤسسة مالية رائدة في الشرق الأوسط ، يبرز بنك الإمارات دبي الوطني في المنافسة الشرسة بالمزايا التالية:

- التغطية العالمية : مع شبكة أعمال دولية واسعة ، تتوفر الخدمات في الإمارات العربية المتحدة ومصر والهند ودول أخرى.

- أسعار صرف تنافسية : يوفر أسعار صرف بيع وشراء في الوقت الفعلي للعملات الرئيسية لتلبية احتياجات الصرف الأجنبي المتنوعة.

- دعم عملاء سريع وسريع الاستجابة : خدمة على مدار الساعة طوال أيام الأسبوع عبر الهاتف والبريد الإلكتروني و WhatsApp والمنصات عبر الإنترنت.

دعم العملاء وتمكينهم

يقدم بنك الإمارات دبي الوطني مجموعة متنوعة من قنوات الدعم لعملائه:

- الدعم عبر الهاتف : تتوفر خدمات متعددة اللغات ، ويمكن للعملاء الاتصال بالأرقام المحلية أو الدولية للاستفسار.

- الدعم عبر الإنترنت : أرسل الاستفسارات من خلال الموقع الرسمي وتطبيق الهاتف المحمول ، وتوقع تلقي رد في غضون 24 ساعة.

- WhatsApp Bank : استمتع باستفسارات الحساب سريعة الاستجابة ودعم المعاملات من خلال الاشتراك في الخدمة على + 971 600 540000.

المسؤولية الاجتماعية و ESG

يشارك بنك الإمارات دبي الوطني بنشاط في مشاريع المسؤولية الاجتماعية لدعم التعليم ، حماية البيئة وتنمية المجتمع. من خلال مبادرة "Go Green" ، يلتزم البنك بالحد من انبعاثات الكربون وتعزيز الممارسات المالية المستدامة. بالإضافة إلى ذلك ، يدعم البنك الاحتياجات التعليمية للطلاب الصغار من خلال برنامج المنح الدراسية ، مما يزيد من الوفاء بمسؤوليات المواطنة المؤسسية. أقام بنك الإمارات دبي الوطني شراكات طويلة الأمد مع العديد من مجموعات المؤسسات المالية في جميع أنحاء العالم ، بما في ذلك Standard Chartered و HSBC و Citibank. من خلال هذه الشراكات ، قام البنك بتوسيع شبكته العالمية وتحسين الخدمات المالية عبر الحدود. بالإضافة إلى ذلك ، دخل البنك في شراكة مع بنك الاحتياطي الهندي (RBI) لتوسيع وجوده في الهند.

الصحة المالية

اعتبارًا من 31 ديسمبر 2020 ، بلغ إجمالي أصول بنك الإمارات دبي الوطني 698 مليار درهم وصافي نسبة كفاية رأس المال 18.4 ٪ ، أعلى بكثير من الحد الأدنى لمتطلبات البنك المركزي الإماراتي. يشمل هيكل رأس مالها رأس المال الأساسي من المستوى الأول (87.70 مليار درهم) و رأس المال من المستوى الثاني (20.30 مليار درهم) ، مما يضمن سلامتها المالية.

خارطة الطريق المستقبلية

تتضمن خطط التطوير المستقبلية لبنك الإمارات دبي الوطني المجالات الرئيسية التالية:

- التحول الرقمي : مزيد من الاستثمار في blockchain والذكاء الاصطناعي وتقنيات البيانات الضخمة لتعزيز تجربة العملاء.

- التوسع الإقليمي : خطط لإضافة فروع في الأسواق الناشئة مثل الهند وإندونيسيا لتوسيع نطاق أعماله.

- التمويل المستدام : تعزيز المنتجات المالية الخضراء ودعم الانتقال إلى اقتصاد منخفض الكربون. أصبح بنك الإمارات دبي الوطني لاعباً رئيسياً في مجال الخدمات المالية في الشرق الأوسط والعالم من خلال خدماته المالية الشاملة وبنيته التحتية التكنولوجية المتقدمة ومكانته القوية في السوق. وقد أدى التزامه بدعم العملاء والمسؤولية الاجتماعية إلى تعزيز سمعته كمجموعة مؤسسات مالية مسؤولة.