Name & Background:

Standard Chartered Bank (Hong Kong) Limited, a wholly owned subsidiary of the Standard Chartered Group, was established in 1853 and has an office in the United Kingdom with 1,736 employees. London is their headquarters and a key hub for their business. They also manage a number of private and international banking businesses here.

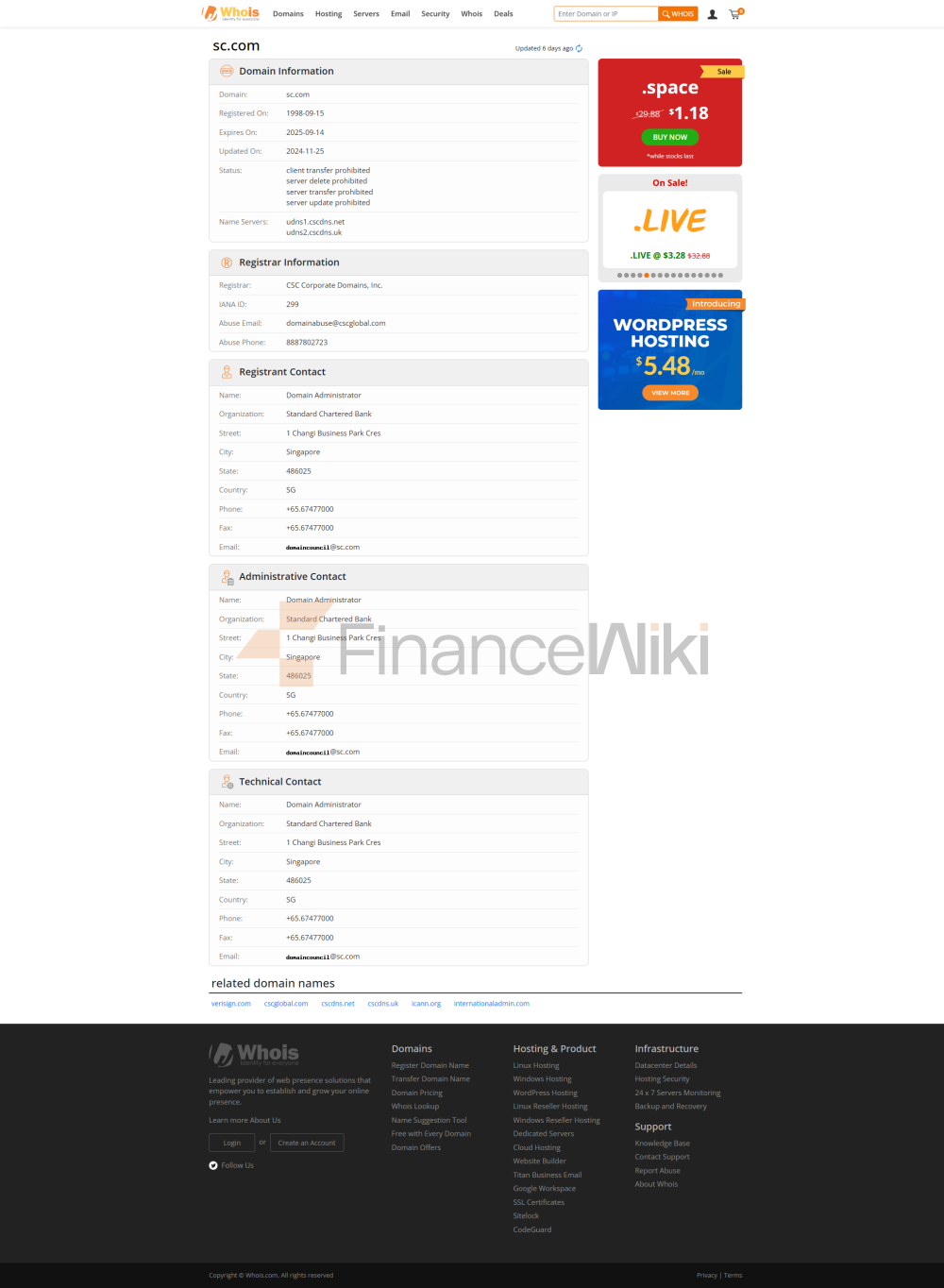

Registration details of Standard Chartered Bank, Standard Chartered Bank and its subsidiaries:

Standard Chartered Bank is a limited liability company incorporated in the United Kingdom with company number 966425 and registered office address at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is an indirect subsidiary of Standard Chartered Bank, incorporated in the United Kingdom under the Royal Charter of 1853 with a limited liability company reference number ZC18. Standard Chartered Bank's headquarters in the UK is located at 1 Basinghall Avenue, London, EC2V 5DD. In the UK, Standard Chartered is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Standard Chartered's shareholder background is made up of both public shareholders and institutional investors, and its shares are listed on the London and Hong Kong stock exchanges. As a company, Standard Chartered Bank plays a key market role due to its international character and close integration with Hong Kong's local financial system.

Location:

Standard Chartered Bank (Hong Kong) is headquartered at 32nd Floor, Standard Chartered Bank Building, 4-4A Des Voeux Road Central, Central, but Standard Chartered Bank Building was sold to Hang Lung Group in 1992.

Scope of Services:

Standard Chartered Bank offers a wide range of banking services in Hong Kong and other parts of the world, with a significant presence in Asia, Africa and the Middle East. Its services cover a wide range of sectors, including personal banking, commercial banking and corporate banking. Standard Chartered has a wide range of offline outlets and ATMs in Hong Kong to meet the needs of different customer groups. Banks are also actively promoting digital transformation to improve the convenience of online services. Standard Chartered's ATMs are located in Hong Kong's major business districts to help its customers manage their money more conveniently.

Regulatory & Compliance:

HSBC (Hong Kong) is regulated by the Hong Kong Monetary Authority (HKMA) and strictly complies with regulatory requirements in Hong Kong and around the world. Banks follow stringent regulations such as capital adequacy, liquidity, anti-money laundering and customer protection to ensure robust operations.

Financial Health:

Standard Chartered Bank's financial performance is solid and its capital adequacy ratio is high, in line with international banking regulatory requirements. The bank's non-performing loan ratio is kept within a reasonable range, and it has a rigorous loan review process and risk management capabilities. The liquidity coverage ratio has also remained at a healthy level, which has helped banks maintain good liquidity in the event of a financial crisis.

1. Deposit products

current account

interest rate: Demand deposit rates are usually lower, adjusted according to market rates, and the reference rate in 2024 is around 0.01%-0.05% (depending on the account type).

Features: Flexible access to funds, suitable for daily trading and liquidity management.

Time Deposit

interest rate: The interest rate fluctuates depending on the tenor, and the interest rate for 3-month to 12-month time deposit is about 1.5%-4.0%.(2024 Market Reference).

Features:

short-term (1-6 months), medium-term (6-12 months), long-term (more than 1 year) are optional.

High Interest Rate: Additional interest rate may be increased for new funds or large deposits (e.g. above HK$1 million).

High-Yield Savings Account<

ul style="list-style-type: disc" type="disc">interest rate: Tiered interest rate design, The higher the deposit amount or if certain conditions are met (e.g. payroll credit), the higher the interest rate (up to 3.5%-4.5%).

Features:

minimum average daily balance requirement (e.g. HK$100,000).

Some account linked credit cards or investment products are eligible for additional interest rate markups.

Certificate of Deposit (CD)

minimum deposit amount: usually from HK$100,000 or equivalent in foreign currency.

Interest rate: Higher than ordinary time deposit, the interest rate of 6-month to 5-year large certificates of deposit is about 2.5%-5.0% (adjusted according to market conditions).

Features:

fixed term, early withdrawal may face penalty interest.

Suitable for medium to long-term prudent investors.

2. Mortgage Loan

Mortgage Loan

interest rate:

H (HIBOR pegged): H+1.3% to H+1.8% (2024 reference).

P (Prime Rate pegged) :P -2.5% to P-2.0% (P is now around 5.875%).

Threshold:

minimum loan amount of HK$1,000,000, maximum loanable property valuation of 50%-60% (depending on income and credit rating).

Proof of income (e.g. tax bill, bank statement) is required.

Repayment Options:

equal principal and interest (fixed monthly repayment).

Flexible repayment (e.g. only interest in the first year, and repayment of principal and interest in the later period).

Auto Loan <

ul style="list-style-type: disc" type="disc">interest rate: 2.5%-6.0% (depending on the loan term and customer credit status).

Threshold:

minimum loan amount of HK$50,000, maximum loan price of 80%-90%.

A car purchase contract and proof of income are required.

Repayment options:

12-60 months instalments, with some options offering a low or final Balloon Payment.

Personal Loan <

ul style="list-style-type: disc" type="disc">interest rate: 4.5%-12.0% (APR, depending on credit score).

Threshold:

minimum monthly income of HK$15,000.

Unsecured and approved based on credit history and debt-to-income ratio (DTI).

Repayment options:

flexible terms (6-60 months).

Some products allow early repayment without penalty interest.

3. Features and Advantages

deposit:

foreign currency deposits are available in multiple currencies (USD, RMB, etc.) and may have higher interest rates than HKD.

Structured deposits are linked to market indices, providing capital protection + potential high-yield options.

Loan:

Green Mortgage Offer: Interest rate discount on the purchase of eco-certified property.

Fast online approval: Some loans can be submitted through the mobile app and pre-approved within 24 hours.

Quality of customer service:

Standard Chartered Bank has a variety of customer service channels, with 24/7 phone support and live chat services. Standard Chartered Bank provides multilingual support to ensure that customers from different cultural backgrounds are well served.

Security Measures:

Standard Chartered Bank has implemented strict measures in terms of the security of funds, such as deposit insurance and advanced anti-fraud technology. Real-time transaction monitoring, introduction of anti-fraud system. In addition, Standard Chartered Bank is also ISO 27001 certified to ensure the security of customer data and has not had any major data breaches.

Distinctive Services and Differentiation:

Standard Chartered is committed to meeting the needs of customers in different market segments. Provide students with a fee-free account to help young customers start financial planning. For the elderly, Standard Chartered has launched exclusive wealth management products to meet their needs for stable income. Standard Chartered also actively promotes green financial products, providing customers with ESG (environmental, social and governance) investment options, in response to the global trend of sustainable development.

In addition, Standard Chartered also provides private banking services for high-net-worth clients, providing personalized wealth management solutions to help clients maintain and increase the value of their assets.

Market Position and Accolades:

Standard Chartered Bank is one of the largest banks in the world with one of the largest banks in the world. Standard Chartered has also received several industry accolades, including the "Best Digital Bank" and "Most Innovative Bank" award, demonstrating its excellence in technological innovation and customer service.

Standard Chartered Bank

(Hong Kong) Limited is a commercial bank registered in Hong Kong, one of the three rotating chairman banks of the Hong Kong Association of Banks and one of the three major note-issuing banks in Hong Kong dollar (the other two being SHBC and Bank of China (Hong Kong)), and the current CEO is Huen Wai Yee, who has taken over since January 2017.

In 1859, Standard Chartered Bank of China commenced operations in Hong Kong.

In 1862, India's New Gold Mountain China Standard Chartered Bank began issuing Hong Kong dollar banknotes in Hong Kong.

In 1969, India's New Gold Mountain, China's Standard Chartered Bank and Standard Bank merged to form today's Standard Chartered Bank.

In 2000, Standard Chartered Bank acquired the Hong Kong operations of Chase Bank, including the Chase Manhattan Credit Card and the Manhattan id Credit Card, a co-branded card with Commercial Radio 2.

On July 1, 2004, Standard Chartered Bank completed the registration procedures in Hong Kong, and the Standard Chartered Bank Hong Kong Branch, "Manhattan Card Company Limited", Standard Chartered Finance (Hong Kong) Limited, Standard The business injections of Chartered International Trading Products Limited and "Chartered Capital Corporation Limited" were fully incorporated under Standard Chartered Bank (Hong Kong) Limited, which was incorporated in Hong Kong in March of that year. The Legislative Council has also amended the Legal Tender Banknotes Issuance Ordinance to transfer the banknote issuance authority of Standard Chartered Bank to Standard Chartered Bank (Hong Kong). For this reason, Standard Chartered Bank ceased to issue Hong Kong dollar banknotes from 1 January 2005 (SHBC and Bank of China (Hong Kong) continued to issue banknotes) until 1 January 2010, when a new version of the banknotes was issued.

In July 2005, Standard Chartered Bank (Hong Kong) announced that it had signed a five-year partnership agreement with Hong Kong Disneyland to become the designated bank of the park. Following the opening of Hong Kong Disneyland, Standard Chartered Bank (Hong Kong) has set up seven JETCO ATMs in the park to provide banking services to guests.

While banks in Hong Kong have implemented five-day settlement since 2006, Standard Chartered Bank (Hong Kong) has been providing full-time services (including counter services) from Saturday to Sunday in all branches since September 2006.

In July 2007, the Hong Kong Monetary Authority (HKMA) announced that foreign governments were not allowed to hold more than 20% of the shares of note-issuing banks in Hong Kong. Mr Sulliman Sullimin, Chief Executive Officer of Standard Chartered Bank (Hong Kong), said that banks in Hong Kong have accepted the relevant measures and believe that the measures will not hinder the operation of banks' business, and believe that the incident will have no impact on Standard Chartered's future introduction of overseas investors.

In December 2014, Standard Chartered Bank sold Essence Credit and Shenzhen Essence Microfinance Company to a consortium formed by CTS Financial Holdings, Australian financial institution Pepper Australia and US hedge fund York Capital.

In January 2015, Standard Chartered Bank closed its global equities business and laid off about 200 employees.

In September 2015, Standard Chartered Bank sold its MPF business to Manulife Financial.

On 26 October 2015, Standard Chartered Bank announced the termination of the Structured Products for listing on the Stock Exchange due to the need to adjust its operations.

In January 2022, Standard Chartered Bank acquired Royal Bank of Canada's Royal Bank of Canada Trust Hong Kong Limited. Royal Canada Trustee Hong Kong is the MPF trustee of Sun Hung Kai Properties' MPF employer-operated schemes.

It is also one of the four largest banks in Hong Kong. Hong Kong is the largest market for Standard Chartered Group, and Standard Chartered Bank (Hong Kong) offers a comprehensive range of products and services including credit cards, personal loans, mortgages, deposits and wealth management.

Standard Chartered Group (Standard Chartered's Hong Kong parent company) is listed on the London and Hong Kong stock exchanges and is one of the top 25 companies in the FTSE 100 by market capitalisation. The London Stock Exchange is listed under the symbol STAN; The listing code of the Hong Kong Stock Exchange is 2888.

As of December 31, 2020, Standard Chartered Bank (Hong Kong) had total assets of HK$2,456.789 billion, of which HK$1,286.964 billion was in Hong Kong, HK$536.671 billion in South Korea, HK$324.315 billion in China, HK$179.762 billion in Taiwan, HK$1,736.729 billion in customer deposits, and HK$1,091.656 billion in customer advances.