4XC Info

4XC, Purportedly A FX And CFD Broker Registered In The Cook Islands With Registration Number 12767/2018 And License Number MC03/2018. The Broker Claims To Offer Clients A Wide Range Of Tradable Financial Instruments With Leverage Up To 1:500, MT4 And MT5 For Windows, IOS, Android And Webtrader, As Well As Three Different Real Account Types And 24/5 Customer Support Services.

Advantages And Disadvantages

Advantages

- Extensive Trading Platforms And Tools, Lack Of Strict Supervision

- Multiple Account Types To Meet Different Trading Needs

- Maximum Leverage Of 1:500

- Comprehensive Deposit And Withdrawal Methods

- Advanced Trading Tools And Educational Resources

- 24/5 Customer Support

Disadvantages

- Lack Of Strict Supervision, Financial Crime And Money Laundering Concerns

- Spreads And Commissions Vary Depending On Account Type

- High Volume Traders On Pro And VIP Accounts Pay Commission Fees

4XC Regulatory Information

4XC Group Complies With International Regulatory Standards And Is Authorised And Regulated By The FSC (Cook Islands). License Number: MC03/2018

Market Instruments

4XC Advertises That It Offers Access To A Wide Range Of Trading Instruments In Financial Marekt, Including Forex, Precious Metals, Index CFDs, Cryptocurrencies And Forwards.

Account Types

4XC Claims To Offer Three Types Of Trading Accounts, Namely Standard, Professional And VIP. The Minimum Initial Deposit Amount For Standard Accounts Is 50 Dollars (MT4 And MT5), While The Minimum Initial Funding Requirements For The Other Two Account Types Are 100 Dollars And $10,000 Respectively (MT4 And MT5).

Leverage

4XC Offers A Maximum Leverage Ratio Of 1:500. Keep In Mind That The Greater The Leverage, The Greater The Risk Of Losing Your Deposited Funds. The Use Of Leverage Has Both Advantages And Disadvantages.

Spreads And Commissions4XC Claims That Different Account Types Can Enjoy Different Spreads And Commissions. Specifically, The Standard Account Has A Floating Spread Of 0.8 Pips, The VIP Account Has A Floating Spread Of 0.6 Pips, While The Professional Account Members Can Enjoy A Floating Spread Of 0.2 Pips, But Need To Pay A Commission Of 2 Dollars Per Lot.

Standard Account: Offers A Floating Spread With A Starting Spread Of 1.0 Pips. There Is No Commission Handling Fee For This Account Type.

Professional Account: Offers A Lower Floating Spread With A Starting Spread Of 0.0 Pips And Charges A Commission Of 5 Dollars Per Round Of 1.0 Forex Lots.

VIP Account: Offers A Minimum Floating Spread With A Starting Spread Of 0.0 Pips. However, The Commission Is Slightly Lower, With A Commission Of 4 Dollars Per Round Of 1.0 Forex Lots.

Trading Platform

4XC Offers Two Popular Trading Platforms: MetaTrader 4 (MT4) And MetaTrader 5 (MT5), Both Available On Desktop, Android, Web And IOS.

Deposits And Withdrawals

4XC Accepts Deposits And Withdrawals Via Bank Transfer, CAPTEIRAX, VISA, MasterCard, American Express, Cryptocurrency, Neteller, Skrill, Volet, Pay Retailers, Helpay2, Fasapay, Sticpay, Globepay, Hoko, And Perfect Money. Most Deposits Do Not Have A Processing Fee, While Withdrawal Fees Depend On The Specific Method

Contact

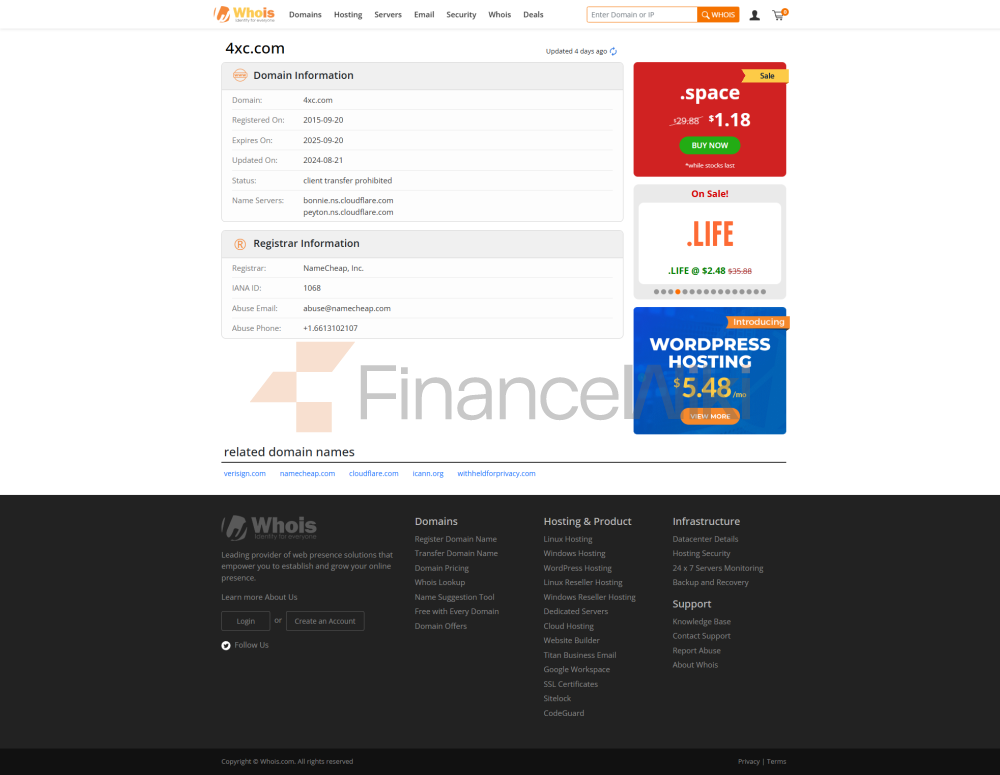

4xCube Ltd

Company Registration Number 12767/2018 | Operating License Number MC03/2018

Business Hours

Monday To Friday: 00:00 - 24:00 (GMT + 2)

Saturday: 00:00 - 07:00 (GMT + 2)

Sunday: Closed

Address: 1st Floor, BCI House, Avarua, Rarotonga, Cook Islands

/p >Telephone

+ 44 8000 488 033

+ 44 8000 488 033

Support@4xc.com

Info@4xc.com