name and background<

span style="font-family: sans-serif; color: black" > full name: VTB Bank (Azerbaijan) Open Joint Stock Company

was established in 2008 as a subsidiary of VTB Group, formerly known as Azerbaijan Foreign Trade Bank, which was registered in 2001.

Headquarters location: 1st floor, Messenat Plaza, 38 Khatai Avenue, Baku, AzerbaijanShareholder

Background: VTB Bank (Azerbaijan) is wholly owned by Russia's VTB Bank (PJSC), which holds more than 90% of the shares of the Russian government through the Federal Property Management Agency, the Ministry of Finance and the Deposit Insurance Agency. VTB Bank (Azerbaijan) is not listed on the Azerbaijan Stock Exchange and operates in a group strategy that combines local market needs.

service scope

coverage area: VTB Bank (Azerbaijan) mainly serves the whole of Azerbaijan, covering major regions such as Baku, Narimanov, Nassimi, etc., and supports cross-border financial services in Russia, CIS countries, Europe, Asia, Africa and the United States through VTB Group's international network. The bank does not have an overseas branch in Azerbaijan, but provides international support through the group's branches in Shanghai, Iran and other places.

Number of offline branches: As of 2023, the bank has 10 branches in Azerbaijan, mainly located in Baku, serving both individual and corporate customers.

ATM distribution: The bank operates about 50 ATMs and hundreds of POS terminals located in Baku's business districts and transport hubs (such as Heydar Aliyev International Airport) to support cash withdrawals, payments and transfers.

services and products

VTB Bank (Azerbaijan) offers a wide range of financial services to individuals, SMEs and large enterprises, with product lines including:

personal banking: Savings accounts, fixed deposits, consumer loans (from 10.49% p.a., up to 50,000 AZN), credit and debit cards (Visa, MasterCard, MIR payment systems supported), foreign exchange services and installment plans. Featured products include fast loan approval (up to 50,000 AZN in 1 minute).

Corporate Banking: provides investment loans, working capital loans, trade finance, bank guarantees, cash management and foreign exchange trading services to enterprises. The FastPay.kg platform supports real-time payments and account management for businesses.

SME services: Customized loans, overdrafts and factoring services, with a focus on supporting non-oil sectors and regional economic development.

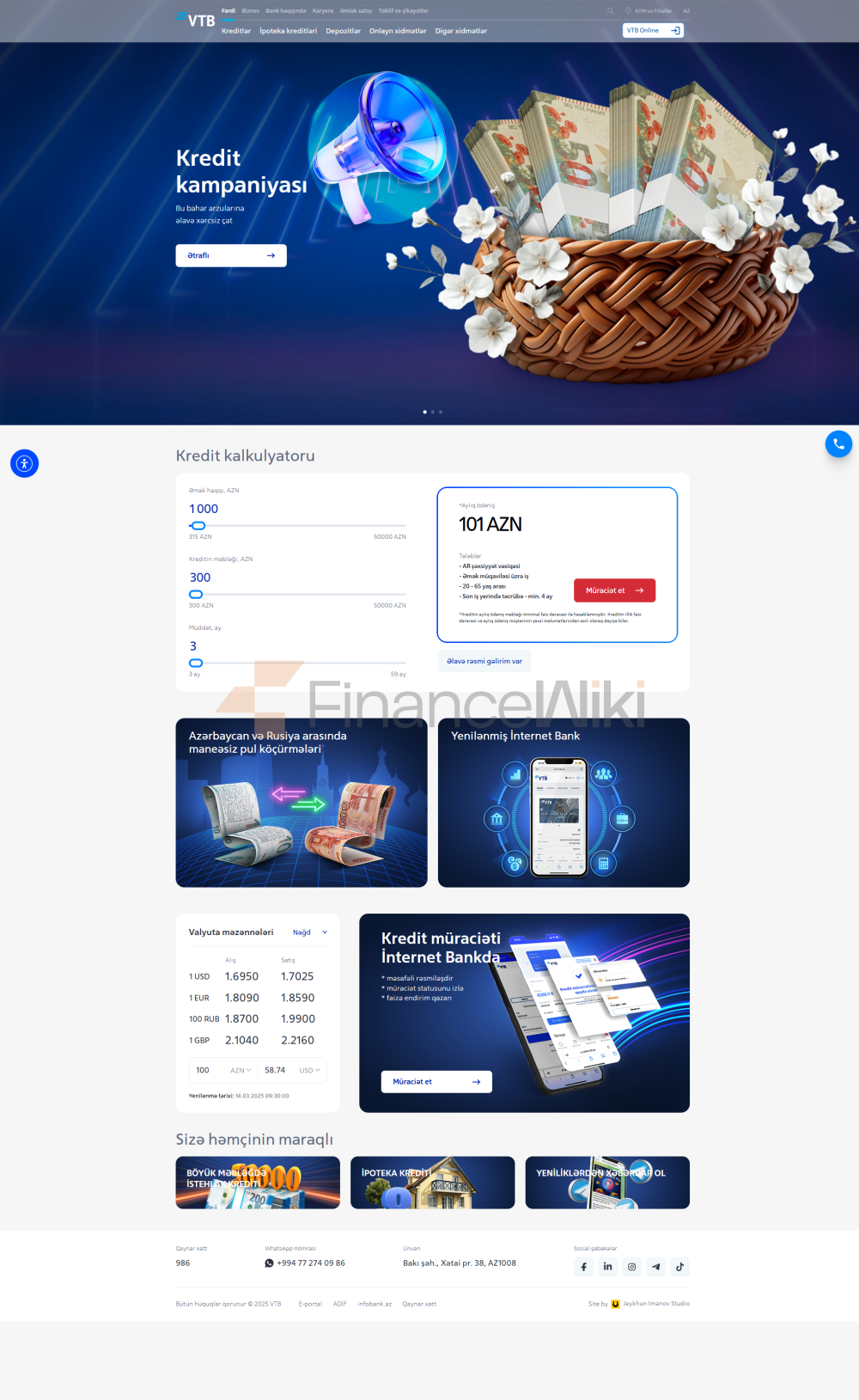

e-banking: 7/24 online services, including account management, transfers, bill payments and loan applications, are provided through the VTB Online mobile app and internet banking platform.

payment services: support POS terminal payments, contactless payments and cross-border money transfers (e.g. withdrawals at ATMs in Azerbaijan via Russian VTB cards).

VTB Bank Azerbaijan attracts customers who value efficiency and cross-border finance with its fast approval and international service capabilities.

regulatory and compliance<

span style="font-family: sans-serif; color: black" > regulated: VTB Bank (Azerbaijan) is regulated by the Central Bank of Azerbaijan (CBAR) and is subject to the Azerbaijan Banking Act and international financial standards such as the Basel Accord. Its parent company, VTB Bank, is regulated by the Central Bank of Russia.

Deposit Insurance Program: The bank participates in the Azerbaijan Deposit Insurance Fund (ADIF), which protects deposits of up to 30,000 AZN (about $17,600) per customer.

Recent Compliance Record: VTB Bank (Azerbaijan) has a good track record of local compliance with no major violations. However, its parent company, VTB Bank, has been sanctioned by the United States and the European Union since 2022 due to Russia's actions in Ukraine, including being excluded from the SWIFT system, which could affect cross-border transaction capabilities.

financial healthVTB

Bank (Azerbaijan)'s financial performance reflects its solid operations, with the following key indicators (as of Q1 2025):

Non-performing loan ratio (NPL): The specific data is not disclosed, but industry trends indicate that it is below the average level of the Azerbaijani banking sector (0.3% in 2022), reflecting effective risk management.

Liquidity Coverage Ratio (LCR): The liquidity ratio is 146%, well above the regulatory requirement of 30%, indicating sufficient liquidity support.

> Capital adequacy ratio (CAR): about 22%, much higher than the 12% required by CBAR, indicating a strong capital buffer.

As of the first quarter of 2025, the bank has assets of 348.5 million AZN, loan portfolio of 235.8 million AZN, capital of 95.7 million AZN, and net interest income increased by 42.5% year-on-year to 7.5 million AZN, indicating its financial health and growth potential.

digital service experience

APP and online banking: VTB Bank (Azerbaijan) provides VTB Online mobile application and internet banking platform. With a rating of about 4.0 out of 5 stars on Google Play and the App Store, VTB Online is praised for its stability and convenience, but its features are relatively basic.

core functionality:

real-time transfers: support domestic and international transfers via BI-FAST and SWIFT systems.

Bill management: Utility bills, mobile top-ups, and insurance payments are supported.

investment tool integration: Doesn't offer stock or fund investment features, but supports deposit management and loan applications.

technology innovation:AI customer service: Mobile apps may integrate AI-powered chatbots to handle frequently asked questions and account inquiries.

Open Banking API: Enables third-party developers to integrate payments and financial services and promote the open banking ecosystem.

contactless payment: Contactless payment with Visa and MasterCard, compatible with the MIR payment system, suitable for Russian customers.

>Face recognition: Support account login and transaction verification.

VTB Bank (Azerbaijan) focuses on efficiency and cross-border functionality in digital services, but there is still room for improvement in the retail customer experience.

customer service<

span style="font-family: sans-serif; color: black">VTB Bank (Azerbaijan) provides multi-channel customer service to meet the needs of individual and business customers:

Phone: Customer hotline +994 12 492 00 80 for 24/7 support.

e-mail: e-mail support via the official website (www.vtb.az) to handle account and product inquiries.

Live chat: The VTB Online platform provides a live chat function to quickly respond to customer questions.

Branch service: 10 branches provide face-to-face consultations, working hours Monday to Friday 9:00-18:00, cash transactions until 17:30.

security measures

VTB Bank (Azerbaijan) uses multi-layered security measures to protect customer assets and data:

Anti-Money Laundering & Anti-Fraud: Strict compliance with CBAR'S AML/CFT requirements, monitoring of suspicious transactions, and regular risk assessments.

transaction security: Enterprise customers reduce the risk of unauthorized transactions through VTB Online's multi-level authorization mechanism.

Physical security: Branches and ATMs are equipped with surveillance systems and security personnel to prevent theft and fraud.

> cybersecurity: Online transactions are protected using SSL encryption and multi-factor authentication, including facial recognition and SMS verification, and customer data is encrypted and anonymized to ensure privacy.

featured services and differentiation

VTB Bank (Azerbaijan) is unique in the Azerbaijani banking sector thanks to its international background and group support:

Fast loan approval: Provide loan approval service of up to 50,000 AZN within 1 minute to meet customers' urgent financial needs.

MIR payment system: supports the Russian MIR payment system, making it convenient for Russian customers to use bank cards and POS terminals in Azerbaijan.

Corporate Services Expertise: Efficient cash management and cross-border payment solutions for businesses through FastPay.kg platforms and trade finance products.

Social responsibility: Actively participate in the development of financial education and non-oil industries in Azerbaijan and support the diversification of the regional economy.

> international network: a financial network connecting Russia, the CIS, Europe, Asia and Africa, supported by the VTB Group, supporting cross-border trade and investment.

summary

VTB Bank (Azerbaijan), as a subsidiary of VTB Group in Azerbaijan, has a strong presence in the local financial market thanks to its joint venture background, international network and digital innovation. Banks meet the needs of individuals to large corporations through diversified products, solid financial performance, and efficient services. Despite the impact of the international sanctions imposed by the parent company, its localized operations in Azerbaijan performed well.