🏛 Company Profile & Basic Information

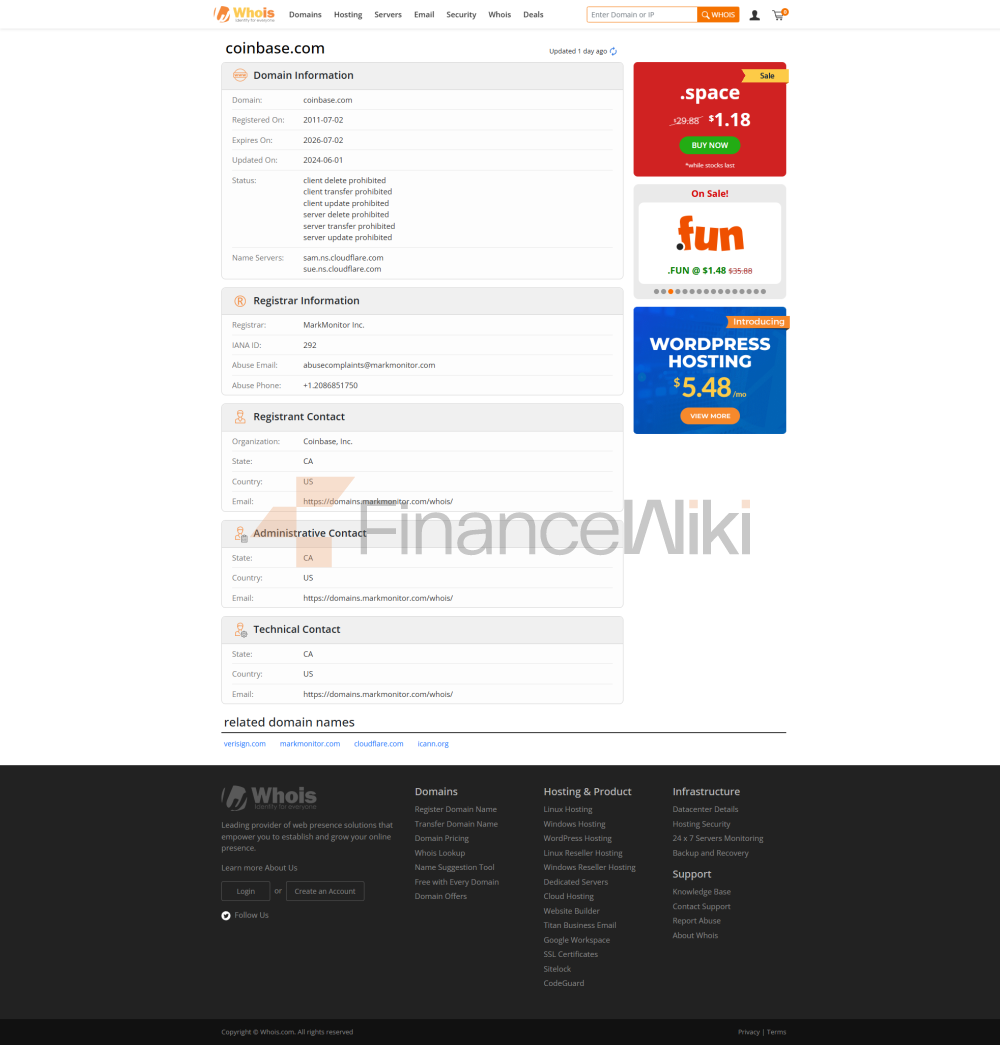

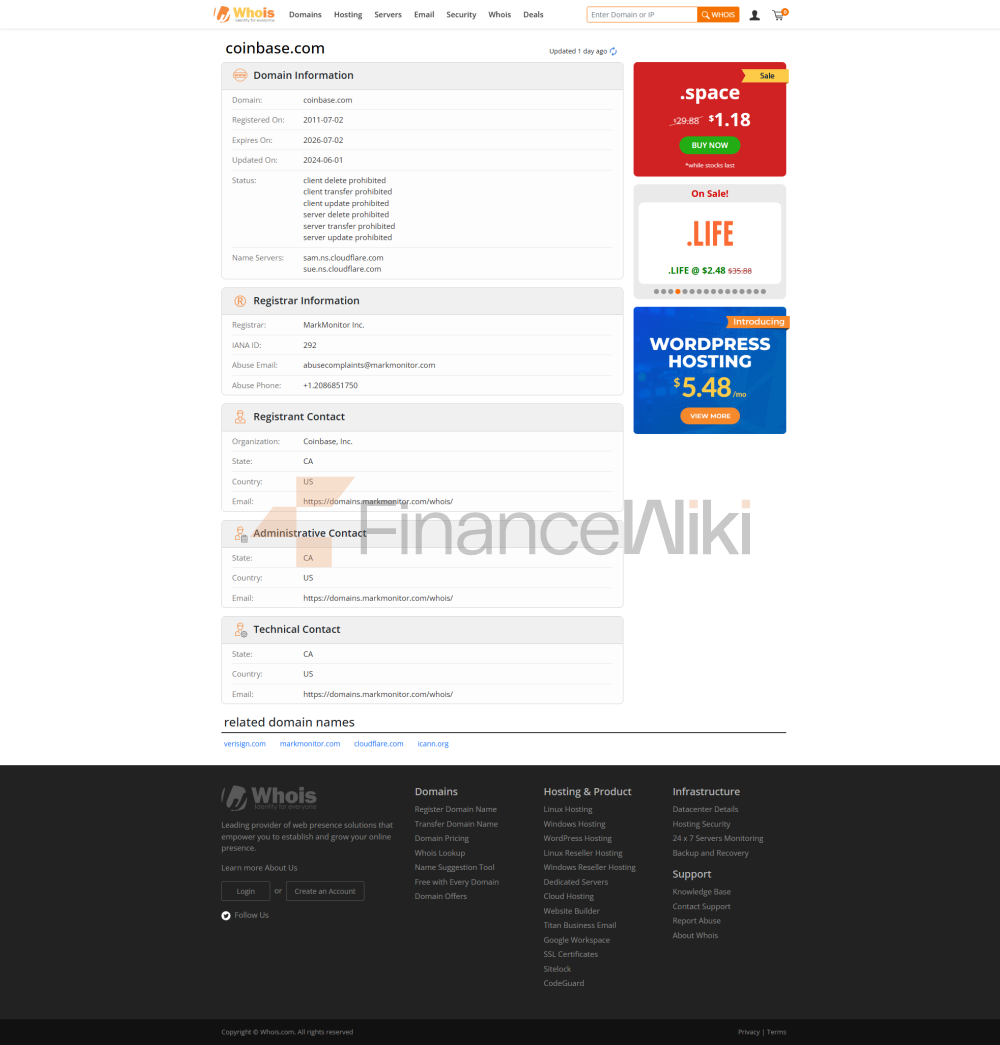

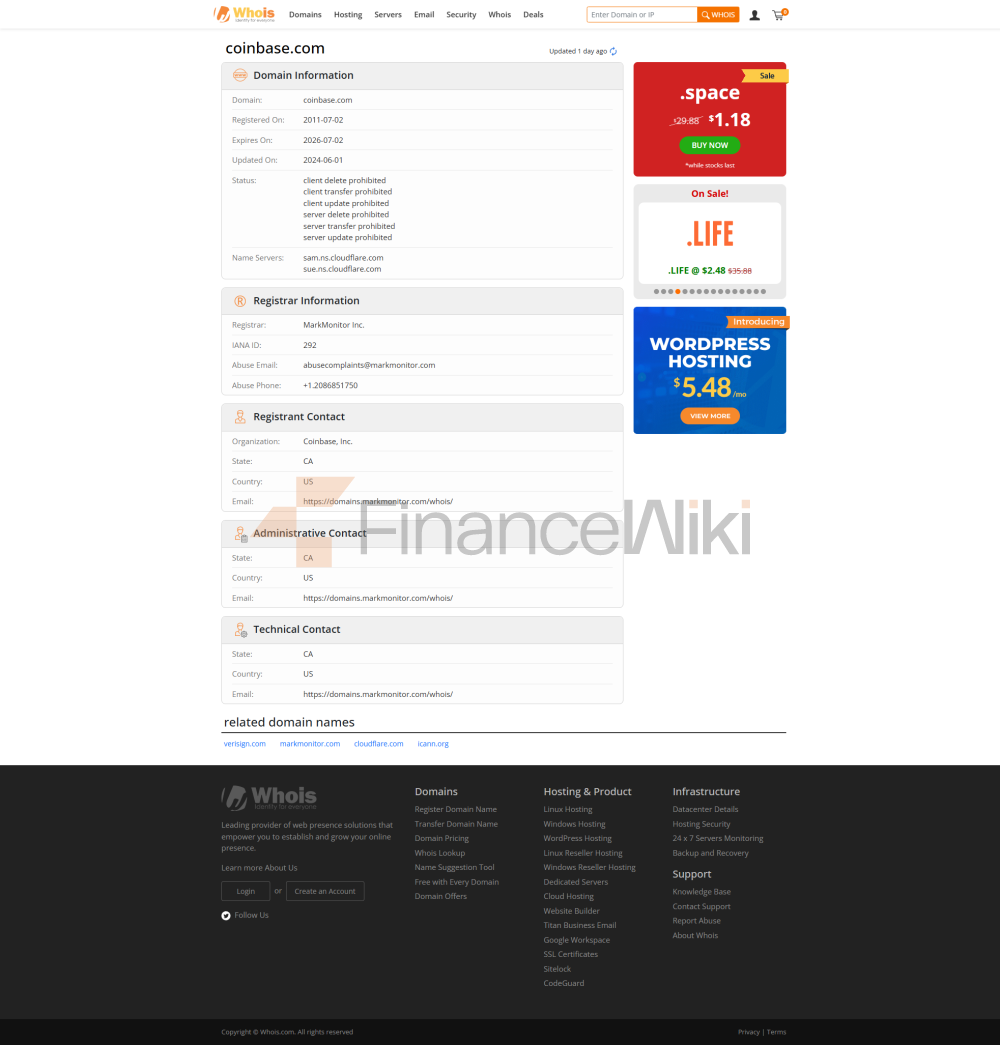

Coinbase Global, Inc. (Coinbase) was founded in June 2012 with a remote-first model and listed on Nasdaq as a direct listing on April 14, 2021 (ticker symbol COIN).

The company is registered in Delaware, with its legal headquarters at One Madison Avenue, New York City, and its registered capital consists of two classes of common stock, Class A ($0.00001 par value, 1 vote per share) and Class B (20 votes per share), the latter of which can be converted into Class A on a pro rata basis to maintain control of the company by the founding team.

As of 2021, Class B shares are held by founders and executives such as Brian Armstrong and hold more than a majority of voting power

👥 Senior Management & Advisory Team

Brian Armstrong: Founder and CEO since 2012 and Chairman of the Board of Directors Class B stock rights.

Emilie Choi: COO and President since 2018, leading operations and international expansion, and was a former LinkedIn executive.

Alesia Haas, CFO, has been responsible for financial strategy, compliance reporting and investor relations since the IPO.

Board members (new in 2024): Chris Lehane (OpenAI executive), Paul Clement (former U.S. Attorney General), Christa Davies (Aon CFO, Stripe/Workday Director) to strengthen policy and compliance context

Advisory Team: Established Global Advisory Council, membership undisclosed.

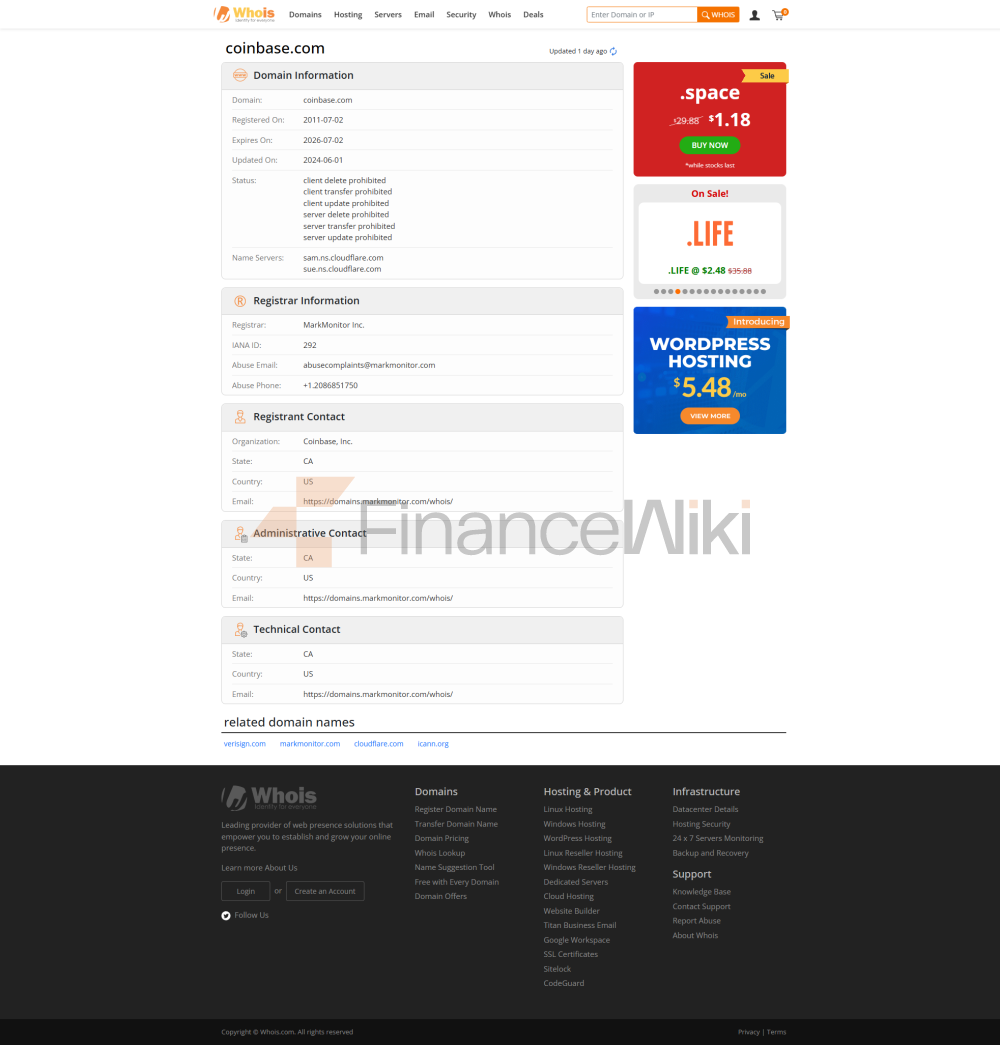

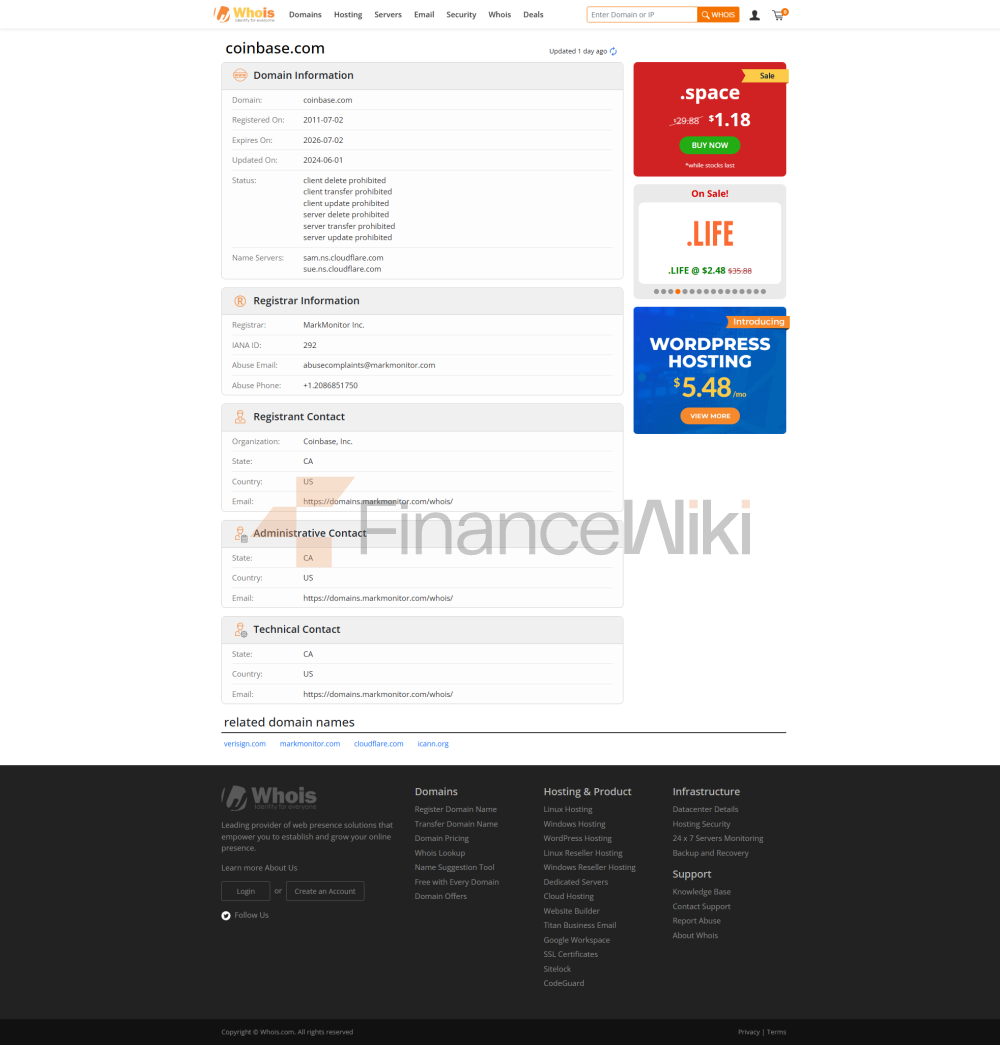

🏗 Corporate structure with subsidiary

parent company Coinbase Global, Inc. Key operating entities include Coinbase, Inc. (the main trading platform), Coinbase Custody Trust Company, LLC (custody services), and others.

Coinbase Securities, Inc., formerly a FINRA-registered securities dealer, was deregistered in early 2024, with subsequent regulatory and related OTC activities undertaken by the parent company.

🌐 Enterprise classification and market positioning

In the crypto asset space, Coinbase offers a comprehensive "digital asset financial infrastructure." Serving retail users, institutional investors, merchants, and developers, it serves more than 100 countries and has more than 108 million registered users, making it a one-stop crypto financial platform.

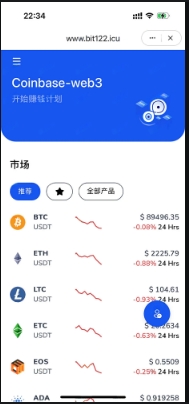

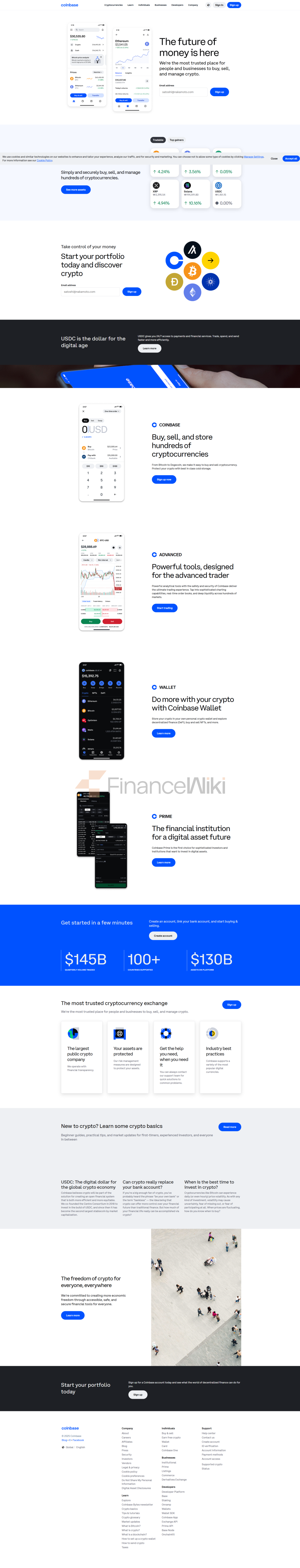

🛍 Product structure and service system

Retail: Coinbase App, Coinbase Advanced (formerly Pro), Coinbase Wallet, Coinbase Card, Earn (staking yield service for crypto assets), USD Coin (stablecoin), etc.

Institutional: Coinbase Commerce (merchant collection), Prime (institutional trading platform), Custody (custody service), open API platform support for developers/DeFi applications.

💻 technical infrastructure and security capabilities

Support web, iOS, Android and other multi-platforms; The custody uses a multi-level cold storage architecture to ensure asset segregation; In 2023, the L2 network Base will be launched to strengthen the Ethereum DeFi link. The company has a cyber security team to successfully respond to ransomware attacks without loss of customer assets.

💵 Deposit and withdrawal methods

Supports ACH, Wire transfers, credit/debit cards, Apple Pay (coming in 2024).

🎧 Customer support and service enablement

The acquisition of AI customer service Agara improved response efficiency and restored the BBB A+ rating, indicating that the quality of customer service continues to improve.

>

⚖ compliance and regulatory system

U.S. regulation: Holds NYDFS BitLicense, multi-state currency transmission license, securities dealer registered as broker-dealer, and is included in the FINRA regulatory system.

International License: Obtained digital asset licenses in Canada, France, Spain, Italy, Ireland, the Netherlands, Singapore, and obtained the first international Restricted Dealer approval in Canada.

Compliance penalties: In 2023, we reached a fines and rectification agreement with NYDFS for AML/KYC deficiencies of approximately US$100 million, and we will continue to improve the system in the future.

🏅 Core Business & Strategic Advantages

As the world's largest bitcoin custodian, it accounts for about 12% of the world's assets under custody and about 11% of ether pledged assets, with a total of $404 billion in assets under custody. Institutional market services (Prime, Custody) have leading liquidity and trust; The Base Network helps it deepen its DeFi and Web3 ecosystems.

📉 Executive structure, voting system and risk warning

The company adopts a dual-share structure, with Class B shares with 20 times the voting rights and Class A shares with 1 times; Brian Armstrong maintains control of the Board and strategy by holding a large number of Class B shares. This arrangement excludes the company from the criteria of the major indexes, and some large institutions may not include their shares, potentially suppressing liquidity.

>

💳 Financial and operational conditions

According to the 2019–2023 financial report and the fourth quarter 2024 announcement, the company's revenue and profit fluctuate with the volatility of the crypto market, but the overall assets, shareholders' equity, technology and team continue to expand, and it is resilient in the long term.

🚀 Market strategy and future direction

In the future, we will focus on the expansion of global licenses, the deepening of institutional and derivatives lines (including legalization litigation of staking, but SEC disputes), the expansion of the Base L2 network ecosystem, the strengthening of customer automation services, the cooperation between data security and regulators, and the continuous optimization of the asset custody system.

🌱 ESG, social impact and governance

Coinbase is cautious in its handling of social issues, and has caused controversy over its strategy; We will continue to improve our ESG reporting on diversity hiring, remote working, cyber security transparency, and governance.

🤝 Strategic cooperation and ecosystem construction

working with BlackRock (via Aladdin) and Google Cloud; Acquisition of Secure Tagomi to Enhance Institutional Services; Coinbase Ventures supports early-stage Web3 founding teams to build a virtuous ecological closed loop.

💡 Summary

As a compliance-driven digital asset financial platform, Coinbase has a leading edge in asset custody, institutional services, and technology infrastructure. The dual-share structure consolidates the control of the founders, strengthens the accumulation of regulatory resources and promotes global expansion. However, liquidity and high-pressure U.S. regulatory policies remain core challenges. The company is moving towards global license coverage, institutional extension and Web3 network layout, which has important reference value for future development.

Unable To Withdraw

Unable To Withdraw