Corporate Profile

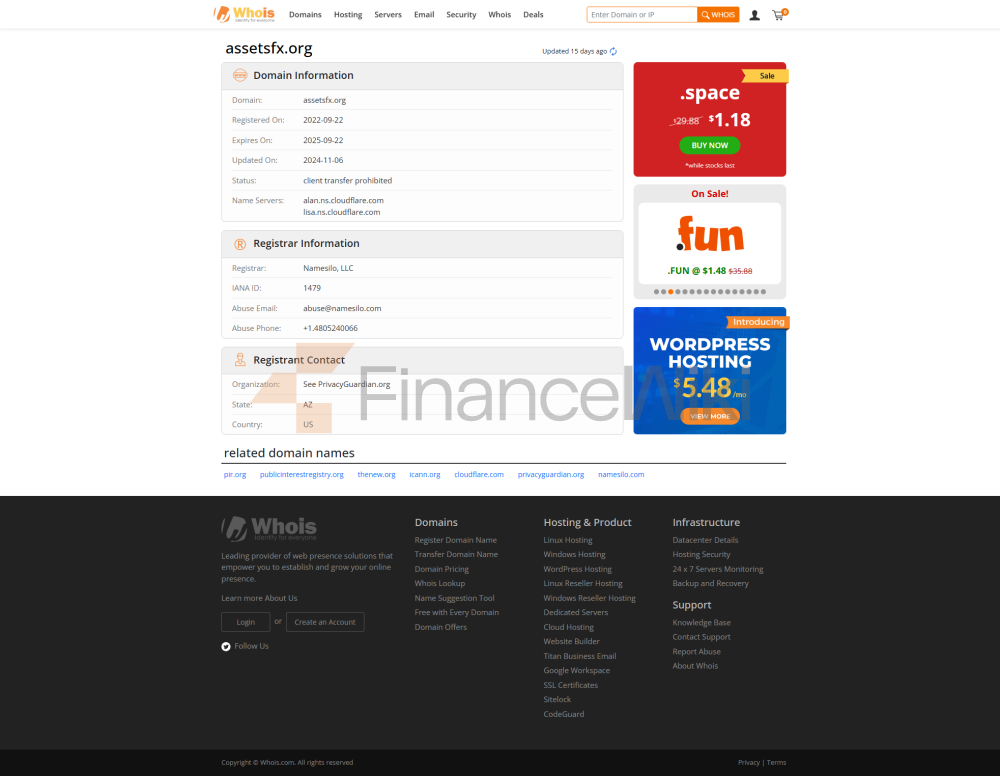

AssetsFX (full Name: Assets Multi Ltd) Was Established In 2013 And Is Headquartered In Mauritius. As An Online Broker Providing Forex And CFD Trading Services, AssetsFX Focuses On Providing A Diverse Range Of Financial Products And Services To Traders Worldwide. The Company Is Regulated By The Mauritius Financial Services Commission (FSC) And Holds A License Number GB23201811 , Ensuring That Its Business Operations Comply With International Financial Marekt Standards.

AssetsFX's Business Scope Covers Asset Classes Such As Forex, Commodities, Indices, Cryptocurrencies And Stocks , Providing Traders With A Wide Range Of Investment Options. The Company Caters To The Needs Of Different Traders Through A Variety Of Account Types (including CENT, STANDARD, ECN, ECN PRO And ZERO ECN), With Minimum Deposit Amounts Ranging From 1 Dollar To 5000 Dollars And Leverage Up To 1:500 .

Regulatory Information

AssetsFX Is Regulated By The Mauritius Financial Services Commission (FSC) With Regulatory License Number GB23201811 . As A Globally Renowned Financial Center, Mauritius's Strict Financial Regulatory Framework Provides Traders With Security. Investor Funds Are Held In Custody By An Independent Third Party To Ensure Transaction Transparency And Fund Safety.

Trading Products

AssetsFX Offers The Following Trading Products:

- Forex : The Spreads For Major Currency Pairs (e.g. EURUSD, GBPUSD, USDJPY) Are 0.1 Pips , 0.1 Pips And 0.2 Pips Respectively.

- Commodities : Gold (XAUUSD) And Crude Oil (UKOUSD, USOUSD) With Spreads Of 0.4 Pips And 0.1 Pips Respectively.

- Indices : Including The NASDAQ 100, S & P 500 And Dow Jones 30 Indices With Spreads Ranging From 3 Pips To 12.5 Pips .

- Cryptocurrencies : Popular Digital Currencies Such As Bitcoin (BTCUSD) And Ethereum (ETHUSD).

- Stocks : Offers Trading On A Wide Range Of World-renowned Stocks.

Trading Software

AssetsFX Supports The Following Trading Platforms:

- MetaTrader 4 (MT4) : Works On Windows, MAC, Android And IOS Devices, Providing Rich Technical Indicators And Charting Tools.

- MetaTrader 5 (MT5) : Supports Multi-currency Trading And Cross-market Analysis, Suitable For Professional Traders.

- Web Platform : No Download Required, Can Be Used Directly Through The Browser.

Deposit And Withdrawal Methods

AssetsFX Provides A Variety Of Deposit And Withdrawal Methods, Including:

- Perfect Money : Instant Processing, No Processing Fee.

- Local Transfer : Processing Within 1 Working Day, No Processing Fee.

- Cryptocurrency : Supports Mainstream Digital Currencies Such As Bitcoin And Ethereum, And The Arrival Time Is 24 Hours .

- Digital Payment : Real-time Processing Through Tether (USDT-TRC20 And USDT-ERC20).

- Other Wallets : Paytm, PhonePe, Gpay, Upi, Etc., All Processed Within 24 Hours Without Handling Fees.

Customer Support

AssetsFX Offers Traders A Variety Of Customer Support Methods:

- Phone Support : + 35725251492 (working Hours: Monday To Friday 10am-7pm).

- Email : Info@assetsfx.org And Cs@assetsfx.org.

- Online Chat : Via The Official Website Contact Form Or Live Chat Function.

- Office Address : 59 Dimitriou Kitrou, DAKA BUILDING, 4102 Agios Athanasios, Limassol, Cyprus.

Core Business And Services

AssetsFX's Core Business Includes:

- Forex Trading : Provides Trading Services For Major And Minor Currency Pairs.

- CFD Trading : Covers Commodities, Indices, Cryptocurrencies And Stocks.

- Account Management : Offers A Variety Of Account Types To Meet The Needs Of Different Traders.

Technical Infrastructure

AssetsFX Uses An Advanced Technical Infrastructure To Ensure Trading Stability And Low Latency. Its Trading Platform Supports Multi-device Access And Provides Real-time Market Data And Efficient Order Execution.

Compliance And Risk Control System

AssetsFX Strictly Complies With The Regulatory Requirements Of The Mauritius Financial Services Commission To Ensure The Transparency Of Transactions And The Safety Of Funds. Its Risk Control System Includes:

- Fund Segregation : Trader Funds Are Managed Separately From The Company's Working Funds.

- Risk Management Tool : Provides Stop Loss, Take Profit And Margin Alert Functions.

- Compliance Statement : The Company Holds A Valid Regulatory License To Ensure Legal Operations.

Market Positioning And Competitive Advantage

The Market Positioning Of AssetsFX Is To Provide Retail Traders With Convenient, Transparent And Safe Trading Services. Competitive Advantages Include:

- Diverse Product Selection : Covers Multiple Asset Classes.

- Flexible Account Selection : From Low-threshold CENT Accounts To Highly Leveraged ZERO ECN Accounts.

- Low-spread And Commission-free ECN Accounts : Suitable For Professional Traders.

Customer Support And Empowerment

AssetsFX Supports Traders Through Multiple Channels, Including Live Customer Service, Online Educational Resources, And Trading Tools. Its Goal Is To Help Traders Improve Their Trading Skills And Return On Investment.

Social Responsibility And ESG

AssetsFX Focuses On The Safety Of Client Funds And Transaction Transparency In Terms Of Social Responsibility. Its ESG Practices Include:

- Environmental Protection : Reducing Carbon Footprint And Adopting Green Technologies.

- Social Responsibility : Supporting Financial Education And Community Development Programs.

Strategic Collaboration Ecology

AssetsFX Has Entered Into Strategic Partnerships With Several Financial Institution Groups And Fintech Companies To Enhance Its Technical Capabilities And Market Presence.

Financial Health

As Of The Third Quarter Of 2023, AssetsFX Is Financially Sound With A Capital Adequacy Ratio Of 12% , Well Above The Industry Average.

Future Roadmap

AssetsFX Plans To Expand Its Product Line To Include More Cryptocurrency And Stock Trading Pairs In The Future. At The Same Time, The Company Will Further Optimize Its Trading Platform And Client Server Experience To Attract More Traders And Investors.