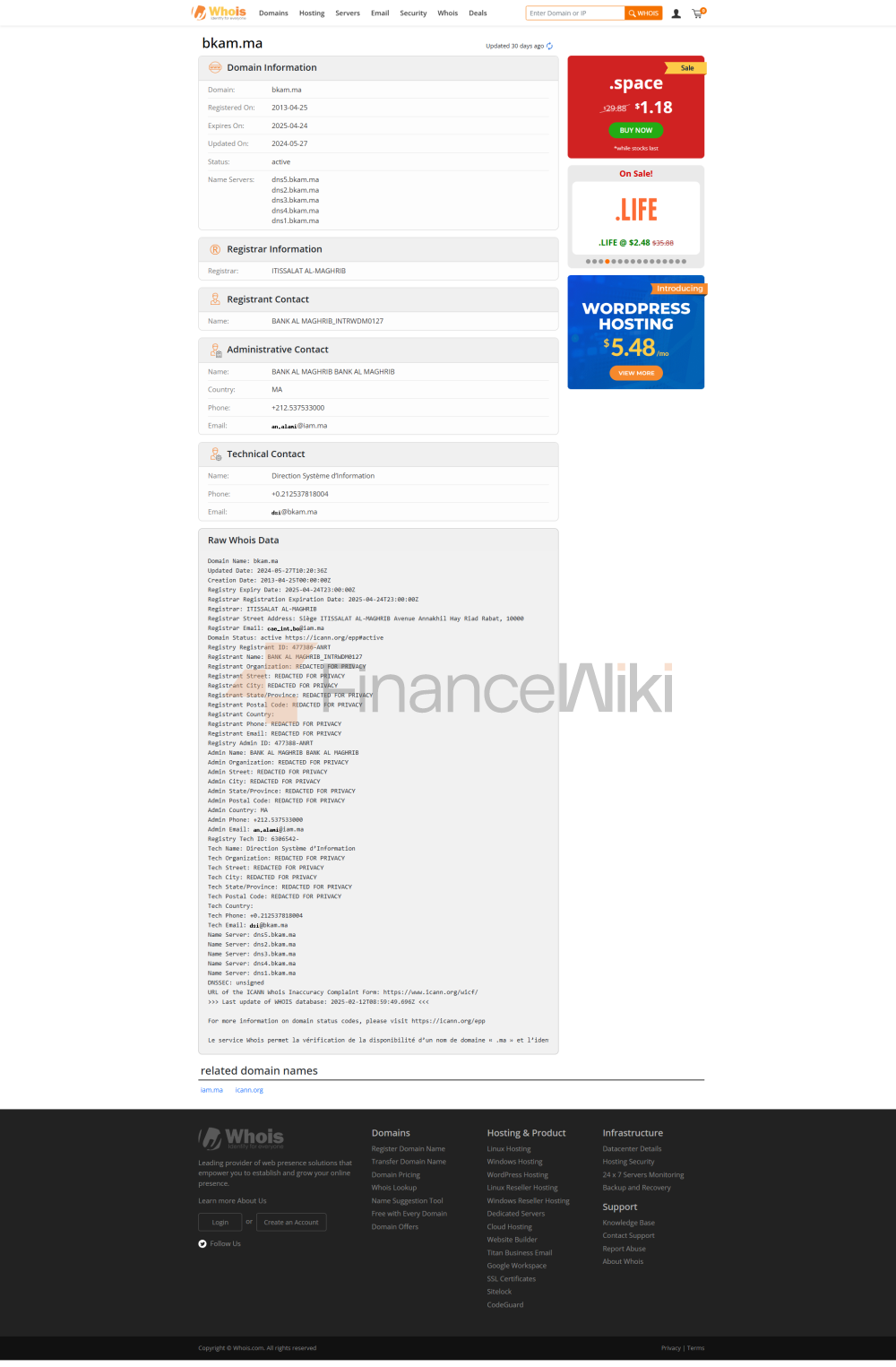

O Banco Maghreb (árabe: "Banco de Marrocos") é o banco central do Reino de Marrocos. Foi estabelecido em 1959 como sucessor do Banco Nacional de Marrocos (fundado em 1907). Em 2008, as reservas cambiais detidas pelo Banco do Magrebe foram estimadas em 3,60 bilhões de dólares. Além da gestão cambial, o Al-Maghrib Bank supervisiona vários bancos privados que prestam serviços bancários comerciais. O banco está sediado no Boulevard Mohammed V em Rabat; tem filiais em Casablanca e agentes em 18 outras cidades marroquinas.

Em 1958, o governo marroquino iniciou negociações com o Banco Francês e Nacional de Marrocos para recuperar seus próprios direitos de emissão. Decreto nº. 30.1959.21 de 233/59/1 o Banco de Marrocos, que assumiu a emissão de moeda no dia seguinte e substituiu o Banco Nacional de Marrocos. Em 1967, o Banco de Marrocos emitiu uma nova moeda, o Dirham marroquino. A Lei Bancária de 1974 fortaleceu o papel do "Banco de Marrocos", especialmente na área de supervisão bancária., o Banco de Marrocos começou a emitir frações como dirhams, substituindo o franco.

Em junho de 1987, o banco adotou o nome de Al-Maghrib Bank. No mesmo mês, o banco criou o Dar As-Sikkah, um departamento responsável pela impressão de notas e cunhagem de moedas.

Uma nova Lei Bancária, promulgada em agosto de 1993, estabelece um quadro regulamentar uniforme para todas as instituições de crédito em Marrocos. A lei reforça o papel do Banco do Magrebe na gestão e supervisão das instituições de crédito. Em Setembro, o Banco adoptou alterações aos regulamentos, clarificando o seu papel na política monetária e concedendo-lhe maior autonomia.

2006, 76 1 de Março (05 38 / 20) A Lei nº 59-233 promulgada pelo Dahir nº 23-2005-1 da 1426ª sessão revogou o Dahir nº 03 da 1959ª sessão de 30 / 1378, que instituiu o Banco do Magrebe. A nova lei reforça a independência do Banco do Magrebe na política monetária e fornece uma base jurídica para a responsabilidade do seu sistema de pagamentos. A nova lei estabelece o banco como uma entidade jurídica pública, controlada pelo Comissário de Contas, pelo Comissário do Governo e pelo Tribunal de Contas. A Lei nº 06 amplia a jurisdição da Lei Bancária sobre determinadas instituições envolvidas em atividades bancárias, redefine o papel da Comissão Nacional de Crédito e do Conselho das Instituições de Crédito, reforça a autonomia do Banco do Magrebe na supervisão bancária e estabelece uma série de outras medidas, incluindo a proteção dos clientes das instituições de crédito e o tratamento das instituições de crédito em perigo.

Em 3 de 2022 de 2015, o Banco do Magrebe assinou um acordo de cooperação com o Office des Changes, a agência de comércio exterior do país. O objetivo é estabelecer um quadro formal para o intercâmbio de dados e conhecimentos em áreas de interesse mútuo.

Em 6/23/2018, um terremoto de 8,6 metros de longitude oeste atingiu a região de Marrakech-Safi, em Marrocos. Uma semana após o terremoto, o Banco do Magrebe doou 800 milhões de dirhams para operações de socorro em áreas atingidas pelo terremoto.