Профиль компании

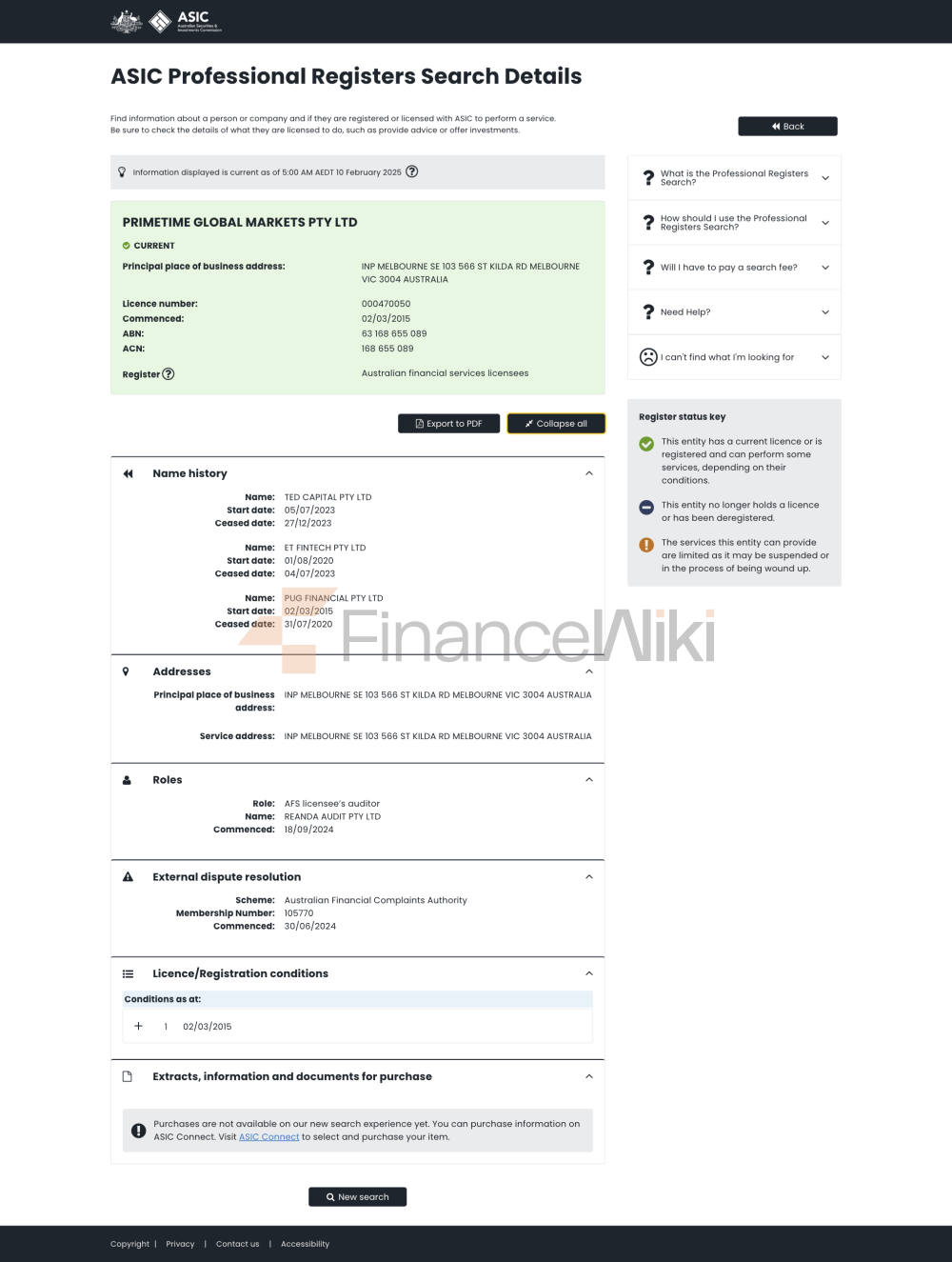

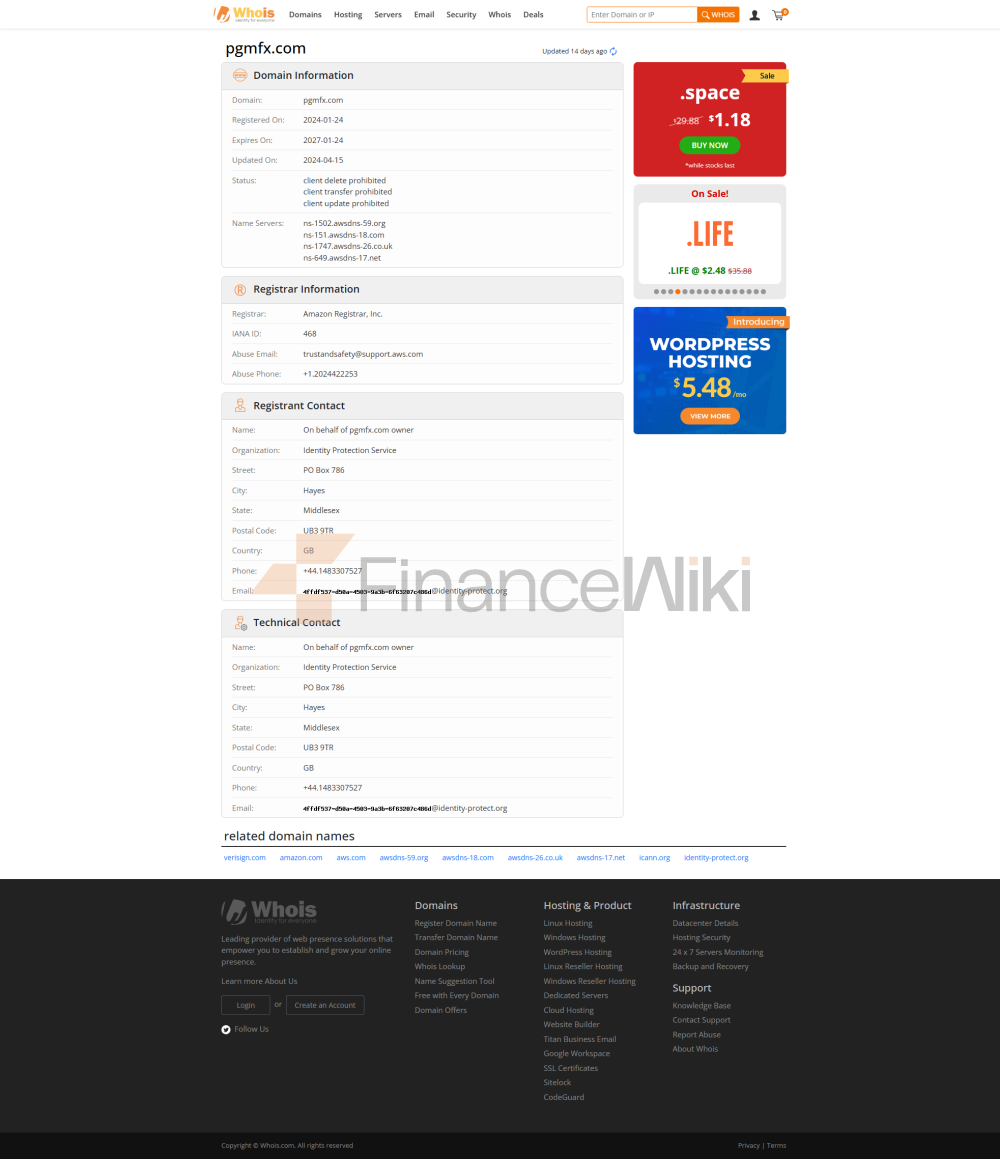

PGM (PrimetimeGlobalMarkets) была создана в 2015 году со штаб-квартирой в Мельбурне, Австралия. Это брокер иностранной валюты и контракта на разницу (CFD), регулируемый Австралийской комиссией по ценным бумагам и инвестициям ( ASIC ) (номер лицензии AFSL470050 ). Зарегистрированный капитал компании составляет 10 миллионов австралийских долларов, и она фокусируется на обеспечении прозрачной и безопасной торговой среды для глобальных трейдеров, охватывающей более 10 000 торговых инструментов, таких как иностранная валюта, драгоценные металлы, энергия, фондовые индексы и криптовалюты. Исполнительная команда PGM состоит из ветеранов финансовой индустрии и поддерживает тесное сотрудничество с Австралийской ассоциацией индустрии финансовых услуг (AFSA) и Глобальной ассоциацией CFD (GSCFA) для обеспечения соблюдения требований отрасли.

Основные сильные стороны и анализ рисков

Сильные стороны

- Строгое регулирование и соблюдение: ASIC регулируется, средства клиентов разделены на независимых трастовых счетах в соответствии с международными стандартами безопасности. Прошла сертификацию управления информационной безопасностью ISO27001 и сертификацию безопасности платежей PCIDSS.

- Разнообразные торговые продукты: Форекс: более 70 валютных пар, спред EUR / USD составляет всего 0,5 пункта. Драгоценные металлы: золото, серебро, платина, палладий и торговля CFD. Энергетические и фондовые индексы: сырая нефть, природный газ и глобальные индексы, такие как S & P 500 и FTSE 100. Криптовалюты: Bitcoin, Ethereum и другие основные валюты, поддержка стратегий высокой волатильности.

- Расширенная торговая платформа: MetaTrader4 / 5: поддержка Windows, Mac, iOS / Android, интегрированных сервисов Expert Advisor и VPS. Исполнение с низкой задержкой: развертывание нескольких дата-центров, скорость исполнения ордеров <50мс.

- Гибкая система счетов: счет CENT: от $100, подходит для новичков. Счет STP: порог $300, более низкие спреды, кредитное плечо 1: 400. ECN счет: от $5000, исполнение на институциональном уровне с нулевой комиссией.

Предупреждение о рисках

- Высокий риск кредитного плеча: кредитное плечо 1: 400 может увеличить потери, необходим строгий контроль рисков.

- Волатильность криптовалют: цены на цифровые валюты сильно колеблются, а риск удержания позиции ночью высок.

Торговые условия и структура комиссий

- Спреды и комиссии: Форекс: EUR / USD спреды от 0,5 пипса, без комиссии (кроме ECN счетов). Драгоценные металлы: Золото спреды от 1,2 пипса, серебро от 0,05 пипса. Валюта спреда: Биткойн от 12 пипсов, Эфириум от 8 пипсов. Коэффициент кредитного плеча: Форекс / Криптовалюты: до 1: 400. Криптовалюта: до 1: 20.

- Снятие средств и техническая поддержка

- Способ депозита: мгновенное поступление: кредитная карта (Visa / Mastercard), электронный кошелек (PayPal / Skrill). 1-3 рабочих дня: банковский телеграфный перевод (минимум $100).

- Правила снятия средств: время обработки: в течение 24 часов электронного кошелька, банковский перевод 2-5 рабочих дней. Никаких комиссий за снятие средств (кроме комиссий за банковский перевод).

- Технические средства: шифрование SSL + брандмауэр: для обеспечения безопасности данных транзакций. Сервис VPS: уменьшите задержку до менее 20 мс, подходит для высокочастотной торговли.

Служба поддержки клиентов и образовательные ресурсы

- Каналы поддержки: круглосуточная онлайн-служба поддержки клиентов: электронная почта (cn.support@pgmfx.com), чат в реальном времени. Управляющие специальными счетами: состоятельные клиенты получают индивидуальную услугу.

- Возможности для обучения: бесплатные ресурсы: Руководства по торговле, отчеты по анализу рынка, вебинары. Инструменты торговли: встроенные технические индикаторы MT4 / MT5, экономический календарь, калькулятор рисков.

контроль за комплаенс-риском и социальная ответственность

- Безопасность фонда: средства клиентов независимо размещаются в ведущих учреждениях, таких как ANZ и Westpac. Ежедневные выверки и регулярные аудиты ASIC для обеспечения прозрачности фондов.

- Инструменты контроля рисков: приказы стоп-лосс / тейк-профит, защита от отрицательного баланса, система раннего предупреждения о волатильности. Мониторинг аномальных сделок в режиме реального времени для предотвращения манипулирования рынком.

- Обязательства ESG: Окружающая среда: внедрение безбумажного офиса, зеленая энергия в центре обработки данных. Общество: Финансирование проектов финансового образования в Мельбурне для улучшения финансовой разведки молодежи. Управление: Совет директоров учредил независимый комитет по соблюдению требований и регулярно раскрывал отчеты ESG.

Позиционирование рынка и стратегическое сотрудничество

- Конкурентное преимущество: широта продукта: более 10 000 торговых разновидностей, охватывающих основные и новые активы. Технологическая экология: Сотрудничайте с cFasa и MarketDL для предоставления данных о ликвидности в режиме реального времени. Институциональные услуги: Предоставление доступа к API и решений white label для хедж-фондов и компаний по управлению активами.

- Партнеры: Платежные учреждения: Интеграция с PayPal и Neteller для оптимизации эффективности депозитов и снятия средств. Отраслевые ассоциации: члены AFSA и GSCFA, способствующие разработке отраслевых стандартов.

Финансовое здоровье и планирование на будущее

- Финансовые данные (2023 квартал): Шкала управления активами (AUM): 1,20 миллиарда долларов. Количество глобальных клиентов: 220 000 + со среднегодовым темпом роста 18%. Доход: 25% CAGR за последние три года и рентабельность по чистой прибыли 15%.

- Маршрут разработки: расширение продукта: добавлены зеленые финансовые продукты, такие как фондовые индексы Юго-Восточной Азии и контракты на углеродный кредит. Региональная экспансия: выход на рынки Латинской Америки и Ближнего Востока в 2024 году. Технологические инновации: разработка торговых помощников с искусственным интеллектом и оптимизация механизмов выполнения алгоритмов.

Резюме

PGM прочно входит в число ведущих брокеров в Австралии с регуляторным одобрением ASIC, охватом нескольких активов и передовыми торговыми технологиями. Его низкие спреды, высокое кредитное плечо и экосистема MT4 / MT5 привлекают мировых трейдеров, но они должны быть бдительны в отношении рисков высокого кредитного плеча и волатильности криптовалют. Ожидается, что в будущем за счет зеленых финансов и расширения возможностей ИИ PGM укрепит свои позиции на мировом рынке и станет отраслевым эталоном как для соблюдения требований, так и для инноваций.