Корпоративный профиль

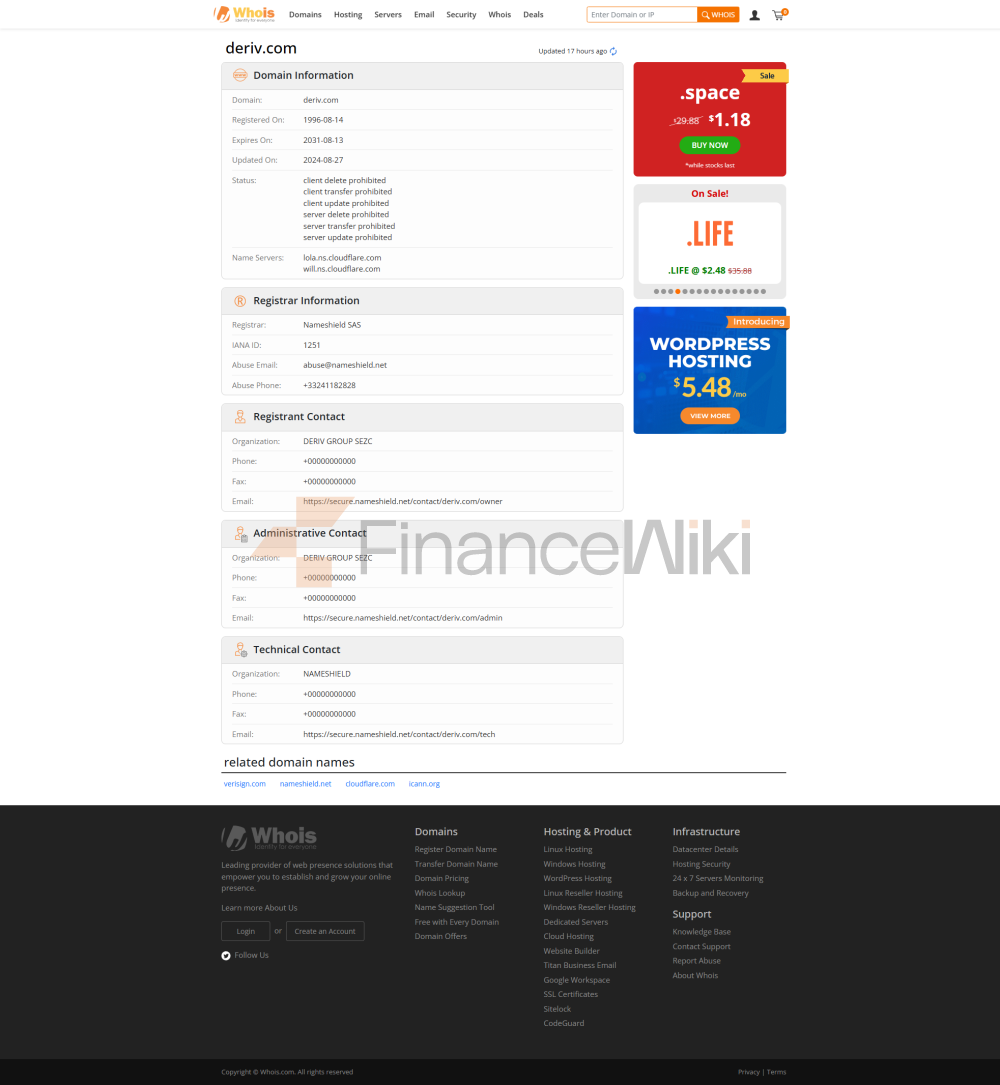

Deriv - брокер онлайн-торговли, основанный в 1999 году и разработанный Regent Markets. Название компании Deriv Group со штаб-квартирой на Мальте. В качестве давней торговой платформы предшественники Deriv включают такие бренды, как BetOnMarkets.com и Binary.com. Эволюция и интеграция этих брендов сделали Deriv важным игроком на текущем рынке.

Deriv предлагает широкий спектр торговых продуктов и услуг, включая Forex, криптовалюты, сырьевые товары, фондовые индексы и контракты на разницу (CFD), среди прочего. Его платформа предназначена для удовлетворения потребностей разных трейдеров. От новичков до профессиональных трейдеров, они могут найти подходящий инструмент для них на Deriv.

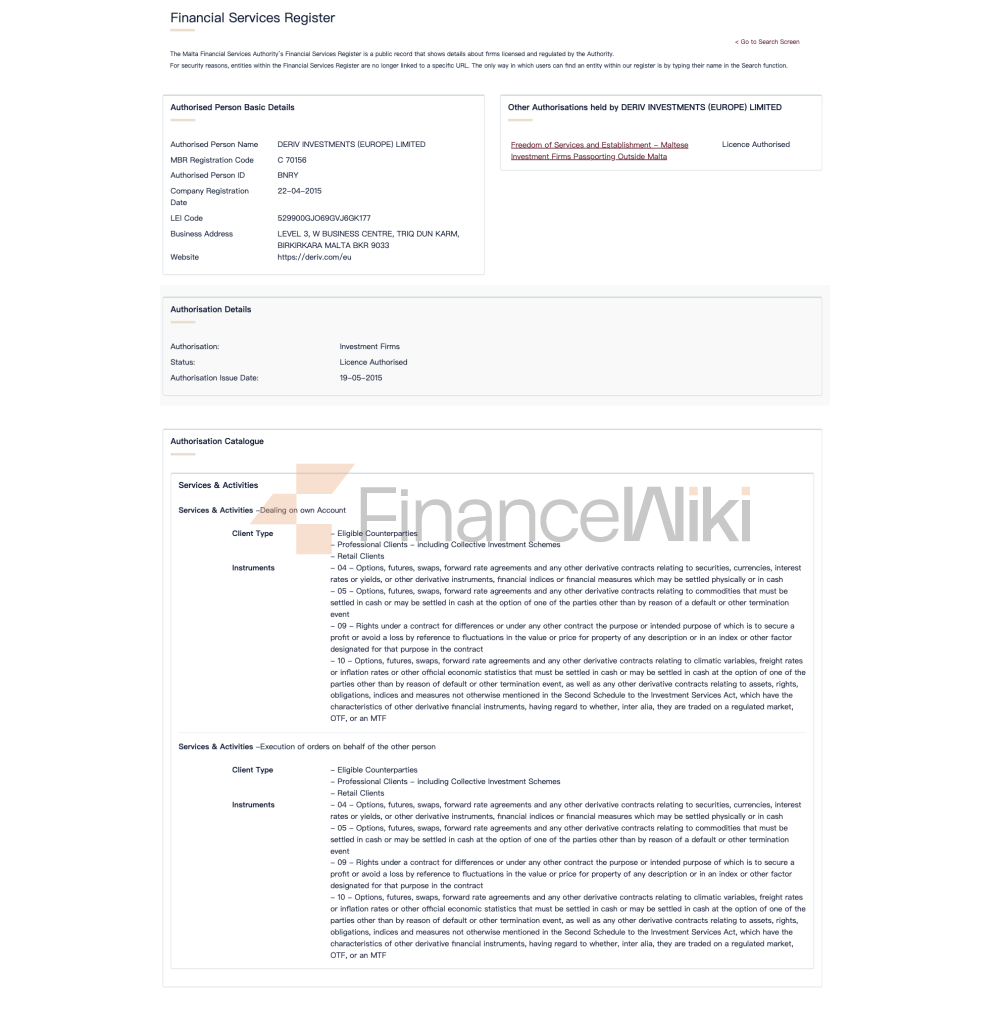

Нормативная информация Deriv в настоящее время не контролируется финансовыми регуляторами ни в одной стране или регионе. Хотя его материнская компания Binary.com лицензирована Управлением финансовых услуг Мальты (MFSA) на Мальте, сам Deriv официально не уполномочен ни одним регулирующим органом. Это важно при выборе Deriv для торговли, так как без нормативного надзора средства инвесторов и безопасность торговли не могут быть адекватно гарантированы.

Торговые продукты Deriv предлагает широкий спектр торговых продуктов, охватывающих несколько классов финансовых активов:

- Валютные пары Forex : Включая основные валютные пары (например, EUR / USD) и незначительные валютные пары.

- Криптовалюта : Обеспечивает торговлю цифровыми валютами, такими как Bitcoin и Ethereum.

- Сырьевые товары : Включает золото, серебро, сырую нефть и т. д.

- Фондовый индекс : Охватывает основные мировые фондовые индексы, такие как индекс Доу-Джонса, индекс Nasdaq и т. д.

- Производные индексы : Это уникальный для Deriv виртуальный индекс, который имитирует колебания реального рынка и предоставляет трейдерам дополнительные торговые возможности.

- Контракты на разницу цен (CFD) : Позволяет трейдерам торговать на основе колебаний цены базового актива.

- <Цифровыеопционыиопционымультипликатора: предлагает множество типов торговли опционами, включая варианты с высоким кредитным плечом и ограниченным риском.

Торговые продукты Deriv охватывают как традиционные финансовые рынки, так и новые цифровые активы, предоставляя трейдерам широкий спектр вариантов.

Торговое программное обеспечение Deriv предлагает множество торговых платформ в соответствии с предпочтениями разных трейдеров:

- DerivTrader : веб-платформа, предоставляющая интуитивно понятные инструменты для построения графиков и данные в реальном времени.

- DerivGo : предназначена для мобильной торговли и поддерживает устройства iOS и Android.

- DerivBot : Автоматизированная торговая платформа, позволяющая трейдерам настраивать и выполнять автоматизированные торговые стратегии.

- DerivMT5 : платформа, интегрированная с MetaTrader 5 (MT5), которая поддерживает продвинутый аналитический и алгоритмический трейдинг.

- DerivX : многофункциональная торговая платформа, предоставляющая разнообразные типы ордеров и инструменты для построения графиков.

- SmartTrader : платформа, ориентированная на технический анализ, подходит для трейдеров со сложными стратегиями.

Торговая платформа Deriv спроектирована с упором на пользовательский опыт, предоставляя разнообразные инструменты и возможности для более эффективного выполнения торговых стратегий.

Методы ввода и вывода средств Deriv поддерживает различные способы оплаты, обеспечивая легкий доступ к средствам трейдеров:

- Кредитные / дебетовые карты : Включая Visa, MasterCard, Maestro и т. Д.

- Электронные кошельки : Advcash, Neteller, Skrill и т. Д.

- Криптовалюты : Биткойн, Эфириум, USDT и т. Д. Банковские переводы : Поддержка местных и международных банковских переводов.

- Мобильные платежи : Включая M-Pesa, MTN, Vodafone и т. Д.

Для минимальных и максимальных сумм для пополнения и снятия, Deriv варьируется в зависимости от способа оплаты и типа валюты. Например, депозиты Visa и MasterCard обычно от 10 до 5000 долларов США , в то время как электронные кошельки и криптовалюты более гибки для пополнения и снятия средств.

Служба поддержки клиентов Deriv предлагает несколько каналов поддержки клиентов для удовлетворения потребностей трейдеров по всему миру:

- Live Chat : для срочных вопросов и консультаций в режиме реального времени.

- Справочный центр : содержит часто задаваемые вопросы (часто задаваемые вопросы), обучающие видео и практические руководства.

- Форум сообщества : позволяет трейдерам обмениваться опытом, делиться стратегиями и искать поддержку сообщества. Физические офисы : Deriv имеет офисы во многих странах и регионах мира , включая Мальту, Сингапур, Дубай, Руанду и т. д.

Команда поддержки клиентов Deriv известна своими многоязычными услугами, которые могут оказать четкую и своевременную помощь трейдерам в разных странах и регионах.

Основной бизнес и услуги Основной деятельностью Deriv является предоставление услуг онлайн-торговли производными финансовыми инструментами для розничных и институциональных инвесторов. Его услуги охватывают несколько финансовых рынков, включая иностранную валюту, криптовалюты, товары и фондовые индексы. Deriv помогает трейдерам участвовать в рынке по-разному с помощью своей разнообразной платформы и инструментов:

- Маржинальная торговля : позволяет трейдерам контролировать более крупные позиции с небольшой суммой денег.

- Опционная торговля : предлагает цифровые опционы и варианты множителя, чтобы помочь трейдерам достичь высокой прибыли с ограниченным риском.

- Торговля CFD : Сделки основаны на колебаниях цен базового актива без удержания фактического актива.

Бизнес-модель Deriv подчеркивает гибкость и разнообразие, подходящую для трейдеров с различными стилями торговли и инвестиционными целями.

Техническая инфраструктура Техническая инфраструктура Deriv основана на высокопроизводительных серверах и передовых торговых механизмах, обеспечивая быструю и стабильную торговлю Казнь. Его платформа поддерживает торговлю несколькими устройствами, включая ПК, мобильные устройства и веб-точки. Кроме того, Deriv также предоставляет API-интерфейсы, которые позволяют трейдерам интегрироваться со сторонними инструментами и торговыми платформами.

Система соблюдения требований и контроля рисков Хотя Deriv в настоящее время не регулируется, он принял ряд мер с точки зрения управления рисками:

- Контроль высокого кредитного плеча : Для различных торговых продуктов Deriv устанавливает различные ограничения кредитного плеча, до 1: 1000.

- Изоляция риска : Обеспечение разделения клиентских средств от операционных средств компании через независимую структуру счета.

- Мониторинг рынка : Мониторинг колебаний рынка с помощью технических средств для предотвращения ненормального торгового поведения.

Меры по управлению рисками Deriv предназначены для минимизации торговых рисков, но его Отсутствие регулирования может ограничить эффективность этих мер.

Позиционирование рынка и конкурентное преимущество Deriv заключается в предоставлении разнообразного спектра торговых инструментов и гибких торговых платформ для удовлетворения потребностей разных трейдеров. Его конкурентные преимущества включают в себя:

- Разнообразие продуктов : покрытие нескольких классов активов для удовлетворения предпочтений разных трейдеров.

- Пользовательский опыт : предложение различных торговых платформ для адаптации к различным стилям торговли и потребностям.

- Низкое требование к начальному депозиту : Минимальный депозит всего 5 долларов США для некоторых счетов, подходит для начинающих трейдеров с ограниченными средствами.

- Многоязыковая поддержка : покрытие трейдеров по всему миру, предоставление поддержки клиентов и образовательных ресурсов на нескольких языках.

Несмотря на нерегулируемость, Deriv привлек многочисленных трейдеров по всему миру благодаря гибкости своих технологий и платформы.

Поддержка клиентов и Расширение прав и возможностей Deriv помогает трейдерам улучшать свои навыки с помощью своих образовательных ресурсов, в том числе:

- Справочный центр : Предоставляет часто задаваемые вопросы и практические руководства.

- Форум сообщества : Здесь трейдеры могут делиться опытом и обсуждать стратегии.

- Блог : Предоставляет анализ рынка, советы по трейдингу и отраслевую динамику.

Образовательные ресурсы Deriv являются практическими и помогают трейдерам быстро овладевать торговыми навыками и повышать прибыльность.

Социальная ответственность и ESGDEriv имеют ограниченное раскрытие информации о социальной ответственности, но как глобальная финтех-компания, она может иметь определенные социальные обязанности в следующих областях:

- Финансовое образование : Помощь все больше людей понимают финансовый marekt и торговые инструменты с помощью образовательных ресурсов.

- Расширение возможностей технологий : поддержка инноваций в области финансовых технологий и содействие развитию финансового marekt.

Дерив еще прямо не опубликовал свой отчет ESG (Environmental, Social, Governance), но по мере усиления глобального внимания к устойчивому развитию это может иметь значение в этой области в будущем.

Стратегическая экосистема сотрудничества Дерив сотрудничает с партнерами в нескольких секторах финансовых технологий, включая платежные платформы, поставщиков технологических решений и компании, занимающиеся анализом данных. Эти партнерские отношения предназначены для повышения производительности платформы Deriv, опыта торговли и возможностей Client Server.

Информация о финансовом состоянии Financial Health Deriv не раскрывается публично, но как брокер онлайн-торговли, работающий более 20 лет, его финансовое положение, вероятно, будет относительно стабильным.

Будущая дорожная карта Будущая дорожная карта Deriv может включать следующие аспекты:

- Инновации в продуктах : Добавляйте больше торговых продуктов и услуг для удовлетворения меняющихся потребностей рынка.

- Соответствие нормативным требованиям : Изучайте возможность получения лицензий в большем количестве стран и регионов, чтобы повысить соответствие платформы требованиям и доверие инвесторов.

- Технические обновления : Постоянно оптимизируйте торговую платформу и системы бэк-офиса для повышения скорости торговли и пользовательский опыт.

- Расширение глобализации : продолжайте открывать офисы в большем количестве стран и регионов для расширения своего глобального влияния.

Как давно зарекомендовавший себя и технологический брокер онлайн-торговли, Deriv может продолжать добиваться прогресса в инновациях в области финансовых технологий и расширении рынка в будущем.

Приведенный выше формальный контент для внедрения предприятия составлен в строгом соответствии со структурой и требованиями к данным пользователя и стремится объективно и точно представить основную информацию, преимущества и скрытые риски Deriv.