Şirket Profili

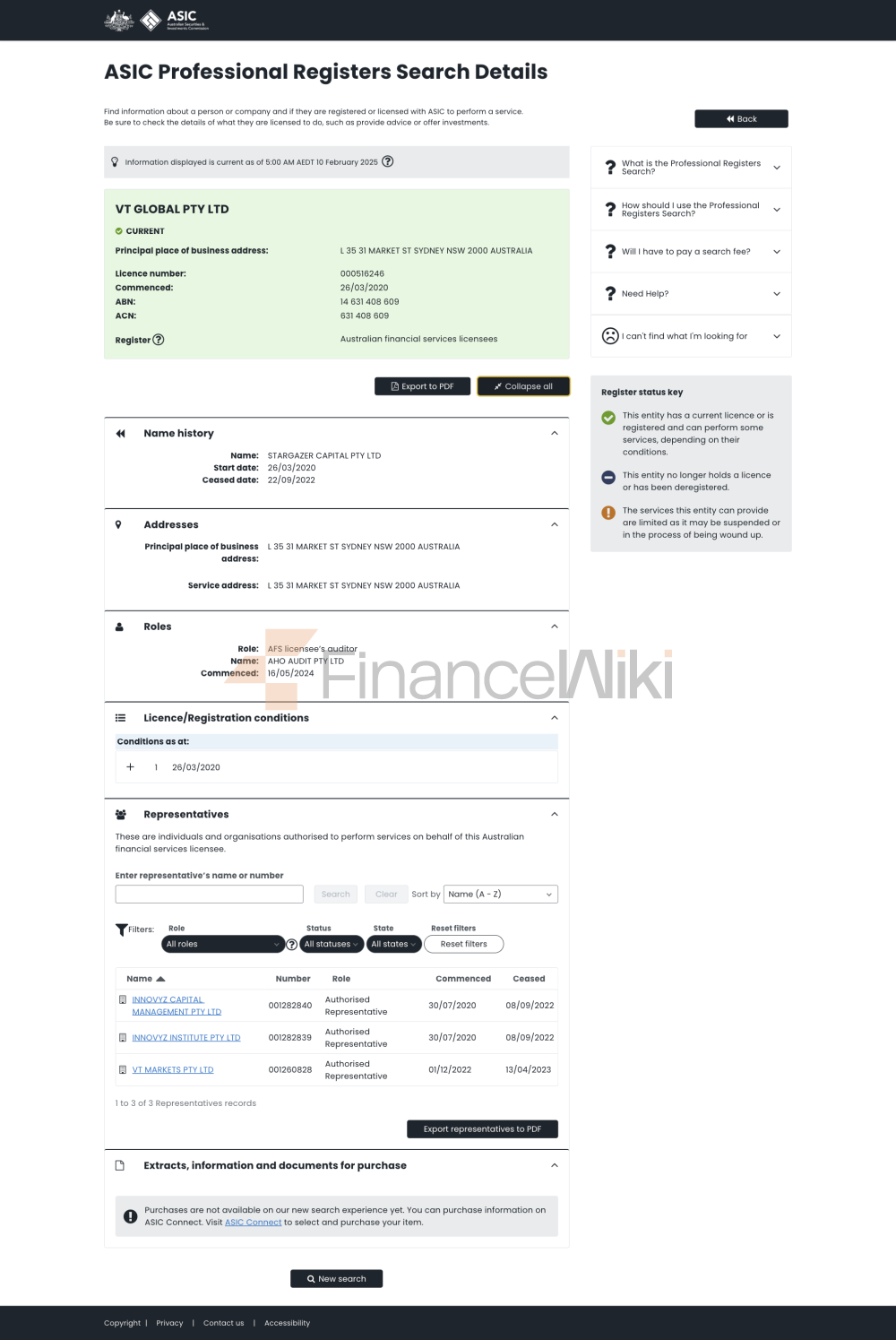

- Avustralya Menkul Kıymetler ve Yatırımlar Komisyonu (ASIC) tarafından yetkilendirilmiş, Lisans Numarası: 516246

- Güney Afrika Finans Endüstrisi Düzenleme Otoritesi (FSCA) tarafından denetleniyor

Sektör dernekleri üyeleri : Avustralya Finansal Bayiler Derneği (AFTA), Güney Afrika Yatırım Hizmetleri Derneği (SISA).

Uygunluk beyanı : VT Piyasaları, müşteri fonlarının güvenliğini ve şeffaflığını sağlamak için ilgili ülkelerin mali yasalarına ve düzenlemelerine kesinlikle uyar.

Temel İş

Ana İş Alanları : Döviz, değerli metaller, enerji, hisse senedi endeksleri, hisse senetleri ve kripto para birimleri için CFD ticaret hizmetleri sağlayın.

- Perakende müşterileri ve kurumsal müşteriler li > Junior ve gelişmiş tüccarlar

Teknoloji Platformu : VT Markets, MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader ve mobil uygulamalar (iOS ve Android) sunar.

Risk Yönetim Sistemi :

- Pazar riskini gerçek zamanlı olarak izlemek için yapay zeka ve IOT teknolojisi ile birleştirilmiş AIoT risk kontrol sistemini benimsemek.

- Farklı ürünlere göre esnek bir şekilde ayarlanmış, 500: 1 'e kadar çeşitli kaldıraç seçenekleri sunar.

Geliştirme Kilometre Taşları

- 2015: Platform geliştirme ve ekip oluşturma / ekibi için ilk fonlama. li >

- 2018: Uluslararası pazarları genişletmek ve teknik yetenekleri geliştirmek için A Serisi finansmanı tamamlandı.

- 2020: Güney Afrika Yatırım Hizmetleri Derneği (SISA) ile kurulan stratejik ortaklık.

- 2022: Otomatik ticaret araçlarını başlatmak için fintech şirketi Traction ile işbirliği yaptı.

- 2020: "En İyi Ticaret Deneyimi" ödülünü kazandı (Global Finans Girişimi tarafından sunulur).

- 2022: "En Yenilikçi Forex Broker" olarak adlandırıldı (Finansal İnovasyon Ödülleri tarafından ödüllendirildi).

> > > Yönetimde güçlü Atılım

- 2023 yılına kadar Yönetim Büyüklüğünde 1 milyar $'a ulaşan atılım.

Kurumsal Yapı ve Sermaye Yapısı

- Merkezi Avustralya' da birden fazla şubesi bulunan (örn. Taipei).

- Esnekliği ve verimliliği birleştiren bir matris yönetim yapısını benimser.

Eşitlik yapısı : Ortaklara, kurumsal yatırımcılara ve stratejik ortaklara ortaklaşa aittir. Belirli oran açıklanmamıştır.

Ticaret ürünleri

-

Euro / USD yayılımı : 1,2 pip kadar düşük (standart STP hesapları için)

Ticaret yazılımı

- Gerçek zamanlı piyasa verileri, gelişmiş grafikler ve göstergeler sağlayan dünyanın en yaygın kullanılan ticaret platformu.

- Profesyonel tüccarların ihtiyaçlarını karşılamak için Otomatik Ticaret (EA) desteği.

WebTrader :

- İndirme gerektirmeyen ve cihazlar arası erişimi destekleyen web tabanlı ticaret platformu.

VT Piyasaları APP :

- mobil uç ticaret uygulaması, her zaman, her yerde ticaret işlevleri sağlayan iOS ve Android cihazlarını destekler.

Para Yatırma ve Çekme Yöntemleri

Aşağıdaki ödeme yöntemleri desteklenir:

- Kredi Kartı: MasterCard, Visa

- Banka Transferi: Uluslararası ve Yurtiçi Banka Transferi

- Elektronik Cüzdan: Neteller, Skrill, Unionli Pay

Müşteri Desteği

24 / 7 Müşteri Sunucusu : Canlı canlı sohbet, telefon ve e-posta desteği içerir. Eğitici Kaynaklar : Ticaret rehberleri, MT4 / MT5 öğreticileri, günlük piyasa analizi ve ticaret sinyalleri sağlar. Sosyal Platformlar : LinkedIn, YouTube, Facebook ve Instagram 'da aktif, endüstri haberlerini ve ticaret stratejilerini paylaşıyor.

Çekirdek İş ve Hizmetler

Standart STP : Asgari 100 dolar depozito, 1,2 pip 'ten yayılır.

Takasları kopyalayın : Tüccarların ticaret sürecini basitleştirerek deneyimli tüccarların pozisyonlarını kopyalamasına izin verir.

Ticaret platformu Trader 4 (MT4), Trader 4, Meta4, Trader 5. (MT5), WebTrader ve VT Markets mobil uygulamaları. Çoklu Hesap Yöneticisi (MAM) ve Ticaret Sinyalleri araçları mevcuttur. Teknik Destek :

- Sorunsuz işlemleri sağlamak için 7x24 teknik destek.

- Performans ve güvenliği artırmak için düzenli sistem güncellemeleri.

uyum ve risk kontrol sistemi

düzenleyici :

- Avustralya Menkul Kıymetler ve Yatırımlar Komisyonu (ASIC) lisans numarası: 516246

- Güney Afrika Mali Sanayi Düzenleme Otoritesi (FSCA)

-

Ticaret riskini gerçek zamanlı olarak izlemek ve yönetmek için AIoT risk kontrol sistemini benimsiyor. Çeşitli kaldıraç seçenekleri sunar, ancak risk maruziyetini kesinlikle sınırlar. Pazar Konumlandırma ve Rekabet Avantajı

Pazar Konumlandırma

- Ağırlıklı olarak dünya çapında perakende tüccarlarına ve kurumsal müşterilere hizmet veriyor.

- Farklı ihtiyaçları karşılamak için çeşitli ve esnek ticaret araçları sağlamaya odaklanın.

Rekabet Avantajı : -

Geniş ürün seçimi : 1.000 'den fazla ticaret aracı. Esnek kaldıraç seçenekleri 500' e kadar: 1. - Düşük işlem maliyetleri : Spreadler ve komisyonlar son derece rekabetçidir.

Müşteri desteği ve yetkilendirme

Eğitim kaynakları :

- Ticaret rehberleri, kurslar, bloglar ve podcast 'ler sağlar.

- Günlük piyasa analizi ve haftalık piyasa genel görünümü sağlar.

Araçlar ve hizmetler :

- Ekonomik takvim, ticaret sinyalleri, Ticaret Merkezi MT4 araçları.

- Otomatik ticareti desteklemek için Uzman Danışmanlara (EAs) erişim.

sosyal sorumluluk ve ESG / hp > : - Topluluğa aktif katılım, eğitim ve çevre projelerine destek.

ESG taahhüdü :

- Teknolojik yollarla karbon ayak izini azaltmak.

- Finansal katılımı teşvik etmek ve daha fazla tüccara adil ticaret fırsatları sağlamak.

Stratejik İşbirliği Ekolojisi

Ortaklar :

- Fintech Company Traction: Otomatik ticaret araçları geliştirmek için işbirliği.

- Güney Afrika Yatırım Hizmetleri Derneği (SISA): Pazar şeffaflığını ve müşteri korumasını iyileştirmek.

<3> <3> Kayıtlı sermaye : Açıklanmamış Yönetim boyutu : 2023 itibariyle 1 milyar doların üzerinde Finansal derecelendirme : Üçüncü taraf bir derecelendirme kuruluşu tarafından "istikrarlı" olarak değerlendirildi. Gelecek Yol Haritası

Kısa vadeli hedef : 2024, ticaret platformu işlevlerini optimize edin ve kullanıcı deneyimini iyileştirin. Orta vadeli hedef : 2025, daha fazla ülke ve bölgeye genişletin, uluslararası etkiyi artırın. Uzun vadeli hedef : 2027, dünyanın önde gelen çok varlıklı sınıf ticaret hizmeti platformu haline gelir.

Teknik Destek :

- Sorunsuz işlemleri sağlamak için 7x24 teknik destek.

- Performans ve güvenliği artırmak için düzenli sistem güncellemeleri.

uyum ve risk kontrol sistemi

düzenleyici :

- Avustralya Menkul Kıymetler ve Yatırımlar Komisyonu (ASIC) lisans numarası: 516246

- Güney Afrika Mali Sanayi Düzenleme Otoritesi (FSCA)

-

Pazar Konumlandırma ve Rekabet Avantajı

Pazar Konumlandırma

- Ağırlıklı olarak dünya çapında perakende tüccarlarına ve kurumsal müşterilere hizmet veriyor.

- Farklı ihtiyaçları karşılamak için çeşitli ve esnek ticaret araçları sağlamaya odaklanın.

-

Geniş ürün seçimi : 1.000 'den fazla ticaret aracı. - Düşük işlem maliyetleri : Spreadler ve komisyonlar son derece rekabetçidir.

Müşteri desteği ve yetkilendirme

Eğitim kaynakları :

- Ticaret rehberleri, kurslar, bloglar ve podcast 'ler sağlar.

- Günlük piyasa analizi ve haftalık piyasa genel görünümü sağlar.

Araçlar ve hizmetler :

- Ekonomik takvim, ticaret sinyalleri, Ticaret Merkezi MT4 araçları.

- Otomatik ticareti desteklemek için Uzman Danışmanlara (EAs) erişim.

sosyal sorumluluk ve ESG / hp > : - Topluluğa aktif katılım, eğitim ve çevre projelerine destek.

ESG taahhüdü :

- Teknolojik yollarla karbon ayak izini azaltmak.

- Finansal katılımı teşvik etmek ve daha fazla tüccara adil ticaret fırsatları sağlamak.

Stratejik İşbirliği Ekolojisi

Ortaklar :

- Fintech Company Traction: Otomatik ticaret araçları geliştirmek için işbirliği.

- Güney Afrika Yatırım Hizmetleri Derneği (SISA): Pazar şeffaflığını ve müşteri korumasını iyileştirmek.

<3> <3> Kayıtlı sermaye : Açıklanmamış Yönetim boyutu : 2023 itibariyle 1 milyar doların üzerinde Finansal derecelendirme : Üçüncü taraf bir derecelendirme kuruluşu tarafından "istikrarlı" olarak değerlendirildi. Gelecek Yol Haritası

Kısa vadeli hedef : 2024, ticaret platformu işlevlerini optimize edin ve kullanıcı deneyimini iyileştirin. Orta vadeli hedef : 2025, daha fazla ülke ve bölgeye genişletin, uluslararası etkiyi artırın. Uzun vadeli hedef : 2027, dünyanın önde gelen çok varlıklı sınıf ticaret hizmeti platformu haline gelir.

- Topluluğa aktif katılım, eğitim ve çevre projelerine destek.

- Teknolojik yollarla karbon ayak izini azaltmak.

- Finansal katılımı teşvik etmek ve daha fazla tüccara adil ticaret fırsatları sağlamak.

Stratejik İşbirliği Ekolojisi

Ortaklar :

- Fintech Company Traction: Otomatik ticaret araçları geliştirmek için işbirliği.

- Güney Afrika Yatırım Hizmetleri Derneği (SISA): Pazar şeffaflığını ve müşteri korumasını iyileştirmek.

Gelecek Yol Haritası

teşvik dolandırıcılığı

teşvik dolandırıcılığı