TEMEL BİLGİ:

KYTE BROKING LIMITED, merkezi 55 Baker Street, Londra, Birleşik Krallık 'ta bulunan ve 41 çalışanı bulunan özel bir limited şirkettir. Market Securities Group, bankalar, varlık yöneticileri, hedge fonları ve satış tarafı şirketleri gibi kurumsal müşterilere çok çeşitli varlıklar arası yürütme ve tavsiye çözümleri sağlayan, küresel erişime sahip bağımsız bir brokerdir. 1994 yılında KYTE BROKING LIMITED, İngiltere ve Avrupa' da sabit gelirli vadeli işlemler ve seçenekler için niş yürütme hizmetleri sağlayan, bağımsız bir takas yapmayan (ncm) bir üye olarak kuruldu. 2000 yılında canlı açık ağlama ticaretinin sona ermesiyle Kyte Brokerage, bilgisayarlı ticarete uyum sağladı ve personelinin çoğunu yerden ekrana taşıdı. Kyte Brokerage, bankalar, Finansal Kurum Grupları, riskten korunma fonları ve piyasa oluşturma gruplarından oluşan müşteri tabanına geniş bir uygulama hizmetleri yelpazesi sunmak için birçok Avrupa ve ABD borsasında katılımcı oldu.

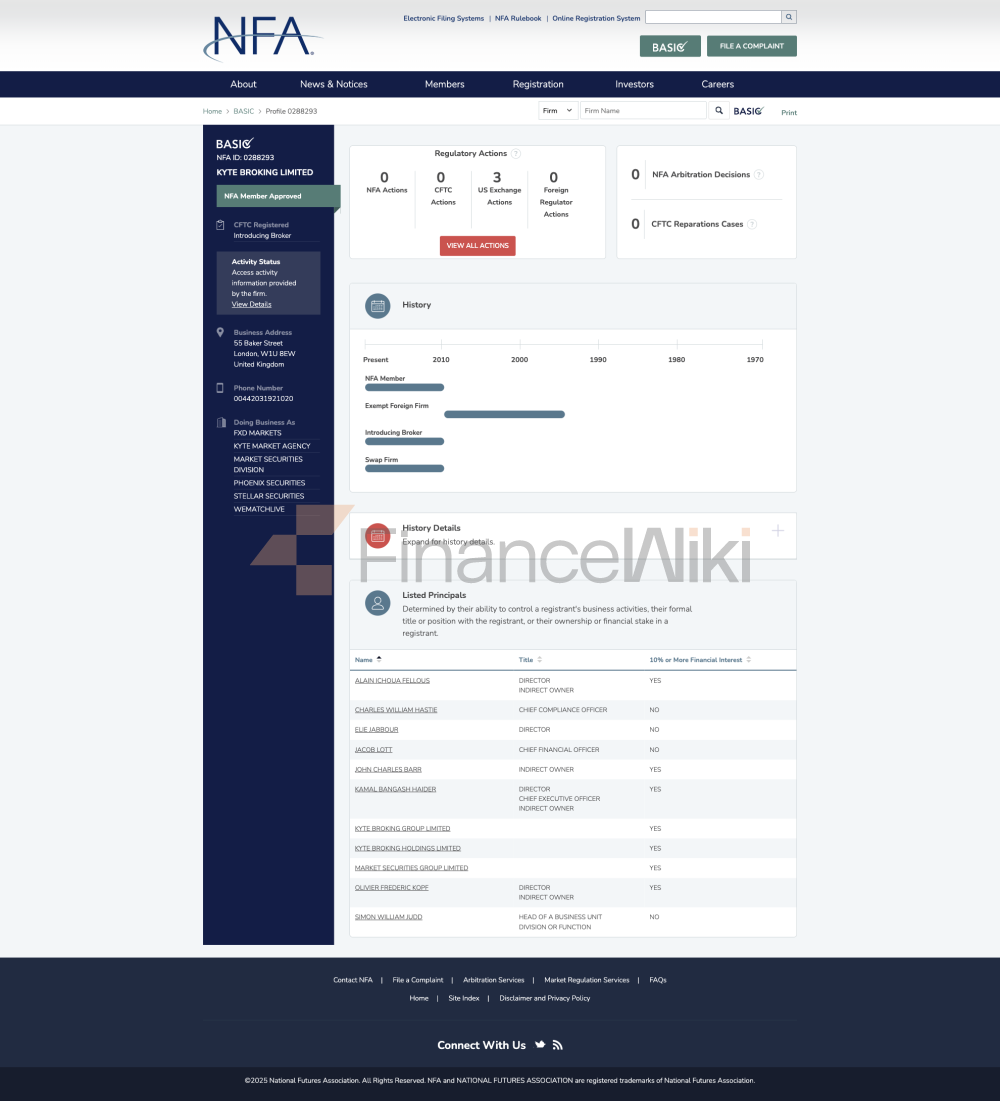

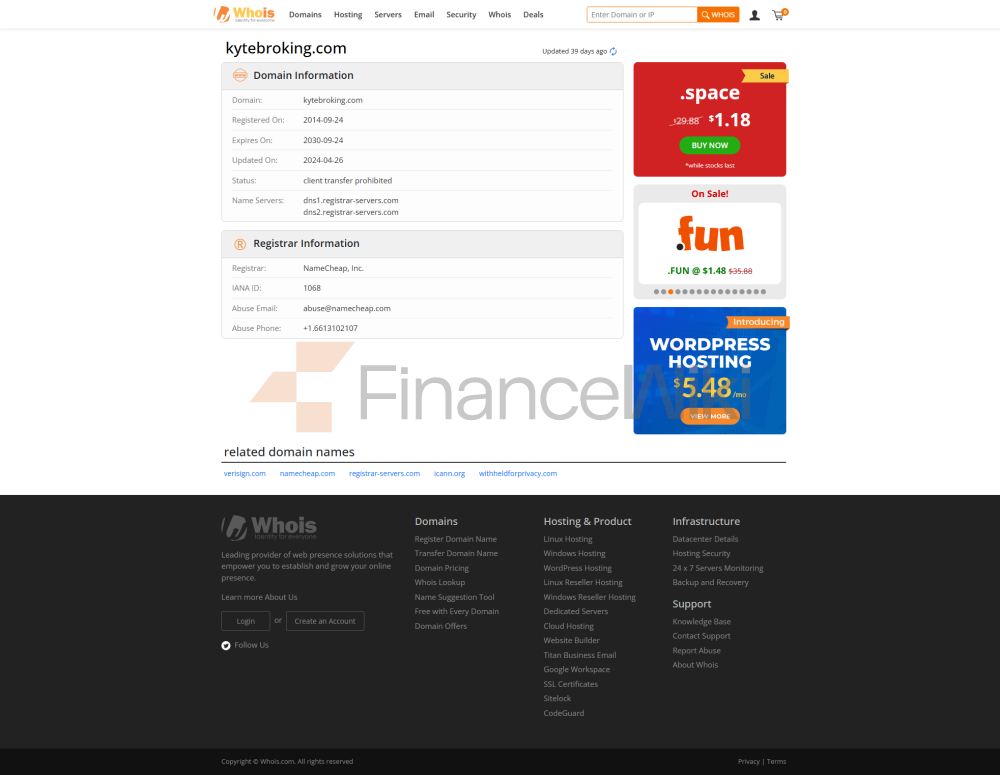

Düzenleyici Bilgi:

KYTE BROKING LIMITED, 174863 numaralı düzenleyici lisans numarasına sahip Birleşik Krallık Finansal İdare Otoritesi (FCA) tarafından düzenlenir

İşletme Büyüklüğü

Firma, bankalar, varlık yöneticileri, riskten korunma fonları ve satış tarafı şirketler gibi kurumsal müşterilere çok çeşitli varlıklar arası yürütme ve tavsiye çözümleri sunar.

Global Brokerage

Küresel aracılık ekibi, Avrupa, Amerika Birleşik Devletleri, Asya ve Pasifik 'te doğal akış, piyasa analizi, ticaret fikirleri ve yürütme çözümleri sağlar.

Nakit >

Londra ve Paris 'teki nakit sermaye sayaçları, bankacılık, aracılık, satış ve analist geçmişinden deneyimli profesyoneller tarafından yönetilmektedir. Hisse senedi çözümleri sunarlar ve hisse senedi, opsiyonlar ve yetkilendirmelere odaklanarak özel durumlara müşteri erişimini optimize ederler.

Amerika, Avrupa ve Asya 'yı kapsayan küresel piyasalara geniş bir erişim sunarlar. Müşterilerimiz arasında riskten korunma fonları (özel durumlar; uzun / kısa), varlık yöneticileri (uzun; emeklilik fonları), delta1 sayaçları, dalgalanma sayaçları, tescilli ticaret ve usul ticaret sayaçları bulunmaktadır. Müşterilerine iki ana araştırma ürünü türü sunarlar: piyasa izleme ve özel durumlar.

Emtialar

Londra Emtia Sayaçları hem kağıt hem de fiziksel enerji yürütme hizmetleri sunar. İnovasyon ekibi, önde gelen banka ve kurumlardan satış ekiplerinden ve bayilerden birçok üyeyi kendine çekmiştir. Akış ticaretine ek olarak, müşterilerimizin risklerinin profesyonelce yönetilmesini ve karlarını en üst düzeye çıkarmasını sağlamak için riskten korunma planları geliştirdik.

Ekibimiz, sistematik ve ad hoc piyasa çözümleri üreten, türev alım satım işlemlerinin yürütülmesi ve takas edilmesi konusunda uzmandır. Güçlü emtia endeksi uzmanlıklarıyla gurur duyuyorlar, elektronik ticaret ve sipariş yönlendirmede lider teknolojiyle birlikte çok çeşitli küresel sözleşmeleri kapsayan deneyim sunuyorlar ve hızla değişen bir pazarda sağlam bir rekabet avantajı sağlıyorlar.

Hisse Türevleri

Market Securities 'Equity Türevleri bölümünün bir dizi uzman türev uzmanı var. Tek hisse senedi opsiyonlarında, endeksli türevlerinde, delta one ürünlerinde ve egzotik ürünlerde piyasa lideri ekiplere sahipler ve geniş bir küresel özkaynak türevleri kapsamı sunuyorlar.

Vadeli İşlemler ve Seçenekler

Londra merkezli sabit gelirli listelenmiş türevler sayaçları, özellikle ICE-LIFFE, EUREX ve CME / CBOT için kısa vadeli faiz oranlarına odaklanarak vadeli işlemler ve seçenek ürünleri için yürütme kapasitesi ve likidite sağlar. Yardım masası, kuruluşundan bu yana mükemmel piyasa yapıcı ve son kullanıcı ilişkileri kurmuş ve sürdürmüştür.

Forex

FX Spot ve FX Opsiyon sayaçları, dünyanın önde gelen şirketleriyle uzun yıllara dayanan forex aracılığı deneyimine sahip deneyimli profesyoneller tarafından yönetilmektedir. Aşağıdakiler dahil olmak üzere bir dizi müşteriyle ilgilenirler: riskten korunma fonları, kurumsal müşteriler, yatırım bankaları ve banka dışı likidite sağlayıcılar.

GUI ve API aracılığıyla özel Forex likidite havuzlarına düşük gecikmeli erişim sağlayan profesyonel bir elektronik Forex piyasası yürütme mekanı sağlarlar.

Çoğu döviz çifti için jenerik ürünlerden egzotik ürünlere kadar geniş bir ürün yelpazesinde forex seçenekleri çözümleri sunarlar. Katma değerli uygulama, piyasa yapıcılar ve bayiler aracılığıyla artan likidite, tam anonimlik, ticaret fikirleri ve araştırma hizmetleri sağlar.