Kurumsal Profil

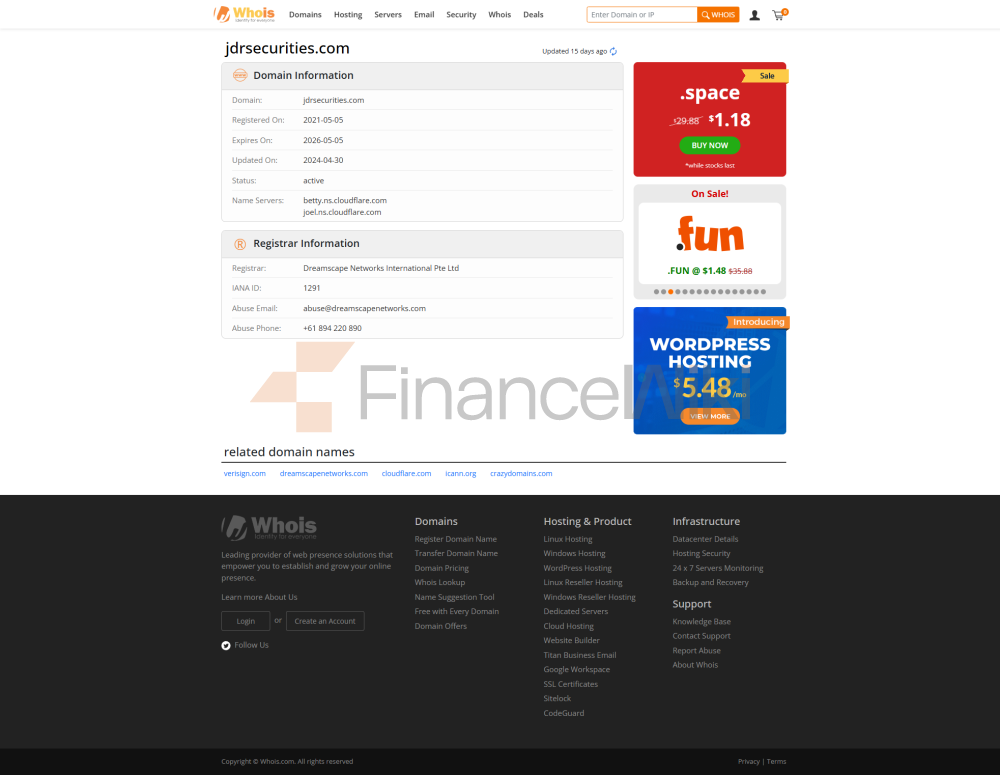

JDR Menkul Kıymetler 2021 'de kuruldu ve merkezi Sidney, Avustralya' da. Şirketin

- Düzenleyiciler : Avustralya Menkul Kıymetler ve Yatırımlar Komisyonu (ASIC), Yeni Zelanda Finansal Hizmetler Sağlayıcı Tescili (FSPR)

- Lisans Türü : Avustralya - Atanmış Temsilci (AR); Yeni Zelanda - Genel Kayıt Lisans Numarası :

- Avustralya: 001296086

- Yeni Zelanda: 1005237

- Uygunluk Beyanı : JDR Securities, şeffaf işlemleri sağlamak, adil işlemleri korumak ve müşteri fonlarının güvenliğini korumak için marekt 'in Avustralya ve Yeni Zelanda' daki yasa ve mali düzenlemelerine uyar.

- Forex : Büyük döviz çiftlerini (örn. Euro / USD, GBP / USD) ve gelişmekte olan piyasa döviz çiftlerini kapsar.

- Endeksler : Hisse senedi endekslerini içerir (örn. NASDAQ, DOW JONES) ve diğer endeksli ürünler.

- Emtialar : Değerli metalleri (örneğin altın, gümüş), enerji ürünlerini (örneğin ham petrol), tarım ürünlerini vb. içerir.

-

Özel Betik : Bireysel ihtiyaçları karşılamak için güçlü bir kod tabanı sağlar. -

Ticaret Sinyalleri : Tüccarlar için zengin bir sinyal tabanı - Para Yatırma Yöntemleri :

- Banka Transferi

- Ödeme Platformları: Alipay, Skrill, Neteller, Dragonpay, Sticpay

- Banka Transferi (1-2 iş günü)

- Ödeme Platformları: Skrill, Negonpay

Ticaret Ürünleri

JDR Securities, aşağıdaki kategorilerde ticaret ürünleri sunar:

Ticaret yazılımı

JDR Securities, tüccarlara aşağıdaki özellikleri sağlayan beyaz etiketi kullanır: Metatrader 4 (MT4) platformu:

MT4 platformu, farklı ticaret alışkanlıkları ve ihtiyaçları olan müşteriler için uygun olan Windows, Mac, iOS ve Android dahil olmak üzere çok uçlu nokta operasyonlarını destekler.

Para Yatırma ve Çekme Yöntemleri

JDR Menkul Kıymetler aşağıdaki gibi çeşitli para yatırma ve çekme yöntemleri sunar:

Güçlü >% 2 taşıma ücreti .

Müşteri Desteği

JDR Securities, aşağıdakiler dahil olmak üzere çok kanallı müşteri destek hizmetleri sağlar:

-

İletişim :- Tel: + 64 9 888 8547 (Yeni Zelanda), + 61 2 8252 7653 (Avustralya)

- E-posta: service@jdrsecurities.com

- Çevrimiçi Sohbet

- İletişim Formu

- Facebook: li > Instagram: https://www.instagram.com/jdrsecurities

- LinkedIn: https://www.linkedin.com/company/jdrsecurities

Temel İş ve Hizmetler

JDR Securities 'in temel işi, bireysel ve kurumsal tüccarlar için çeşitlendirilmiş finansal hizmetler sağlamayı içerir. Aşağıdakiler ana hizmetleridir:

-

Aracılık Hizmetleri : Müşterilerin yatırım ihtiyaçlarını karşılamak için döviz, endeksler ve emtialar için ticaret hizmetleri sağlayın. -

Risk Yönetimi : Müşterilerin kaldıraç ve yayılma kontrolü yoluyla risk maruziyetini optimize etmesine yardımcı olun. -

Eğit ve güçlendir : Tüccarlara piyasa analizi, ticaret araçları ve eğitim kaynakları sağlayın.

Teknik alt yapı

JDR Securities 'in teknik altyapısı Metatrader 4' e (MT4) dayalıdır ve aşağıdaki sistem ve araçlarla eşleştirilmiştir:

uyum ve risk kontrol sistemi

JDR Menkul Kıymetler, ASIC ve FSPR 'nin düzenleyici gerekliliklerine kesinlikle uygundur. Uygunluk ve risk kontrol sistemi aşağıdaki önlemleri içerir:

-

Sermaye güvenliği : Fonların güvenliğini sağlamak için müşteri fonlarının şirket işletme fonlarından ayrılması. -

Risk Yönetimi : Kaldıraç sınırları ve kayıp mekanizmalarını durdurma yoluyla ticaret risklerini kontrol edin. -

Kara Para Aklamayı Önleme (AML) : Kara para aklamayı önlemek için sıkı kimlik doğrulaması ve işlem izlemesi uygulayın.

Pazar Konumlandırma ve Rekabet Avantajı

JDR Securities, Avustralya ve Yeni Zelanda pazarlarında aşağıdaki rekabet avantajlarına sahiptir:

Müşteri Desteği ve Güçlendirme

JDR Securities 'in müşteri desteği ve güçlendirme üzerindeki vurgusu aşağıdaki yönlere yansır:

- Eğitim Kaynakları : Tüccarların becerilerini geliştirmelerine yardımcı olmak için pazar analizi, ticaret rehberleri ve eğitim makaleleri sağlayın.

sosyal sorumluluk ve ESG

JDR Securities, sosyal sorumluluğu yerine getirmeye odaklanır ve aşağıdakiler dahil olmak üzere çevre koruma, sosyal refah ve kurumsal yönetişim (ESG) projelerine aktif olarak katılır:

- Çevre koruma : Yeşil enerji projelerini destekleyin ve karbon salınımlarını azaltın.

Stratejik İşbirliği Ekosistemi

JDR Securities, birkaç fintech şirketi ve ödeme platformuyla işbirliği yaparak kapsamlı bir ortak ekosistemi oluşturmuştur. İşbirliği şunları içerir:

- Ödeme Platformu Entegrasyonu : Müşteri mevduatı ve para çekme deneyimini optimize etmek için Alipay ve Skrill gibi ödeme platformlarıyla işbirliği yapın.

- Teknoloji Çözümleri : Platform performansını ve hizmet kalitesini iyileştirmek için AI ve büyük veri teknolojisi şirketleri ile işbirliği yapın.

JDR Securities 'in mali konumu sağlamdır. 2023Q3 itibariyle, şirketin yıllık işlem hacmi 10 milyar AUD ve aktif müşteri sayısı 50.000 + . Şirket, müşteri fonlarının güvenliğini ve sorunsuz işlemleri sağlamak için sermaye yeterliliği ve finansal şeffaflığa odaklanmaktadır.

Gelecek yol haritası

JDR Securities 'in gelecekteki planlaması aşağıdaki yönleri içerir:

- Ürün genişlemesi : Daha fazla ticaret aracı ve finansal ürün eklemeyi planlıyor.

- Teknoloji yükseltmesi : Ticaret platformunu sürekli olarak optimize edin ve teknik altyapısını yükseltin.

-

Pazar genişlemesi : Yeni pazar fırsatlarını keşfedin ve küresel iş düzenini genişletin.

Yukarıdaki plan sayesinde JDR Securities, küresel tüccarlara kaliteli finansal hizmetler sunmaya ve sektördeki konumunu pekiştirmeye devam edecek.