Hồ sơ công ty

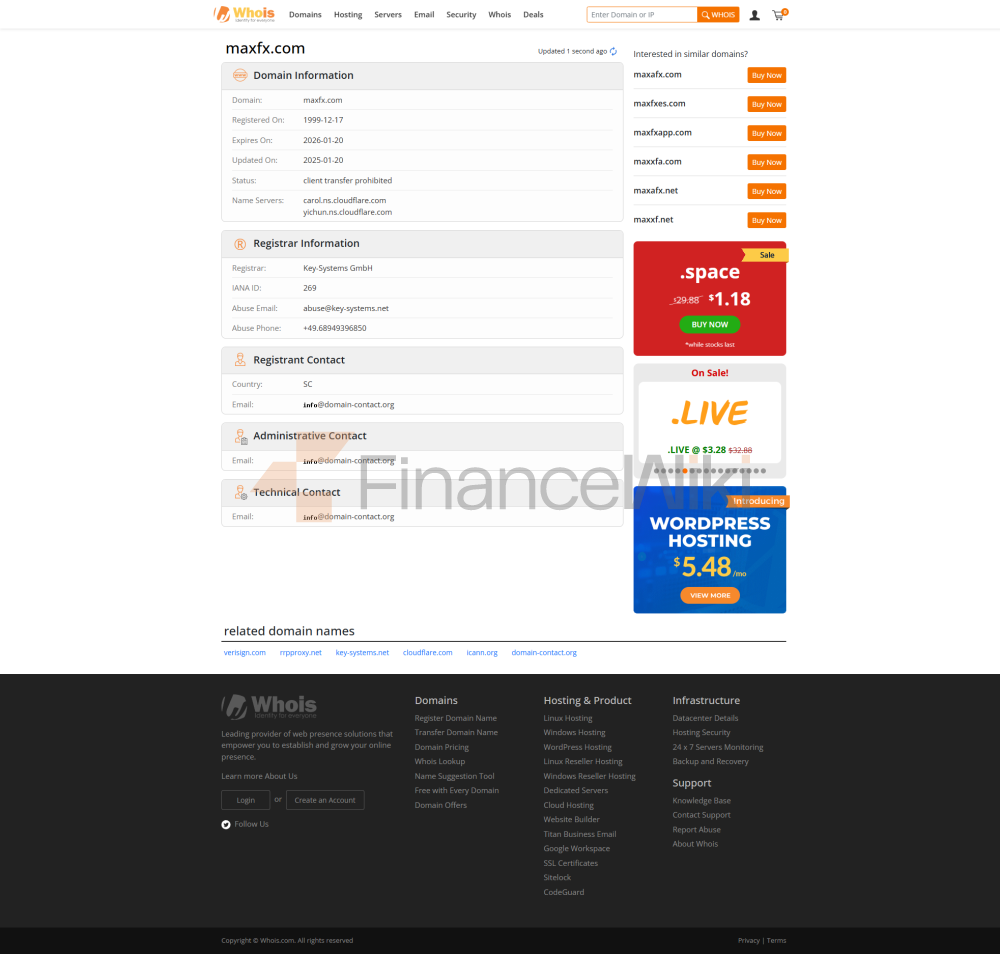

MaxFX (Fondex) là một nhà môi giới ngoại hối được đăng ký tại Síp và trang web chính thức của nó là https://maxfx.com . Công ty tuyên bố cung cấp cho khách hàng các sản phẩm và dịch vụ tài chính đa dạng thông qua nền tảng của mình, bao gồm ngoại hối, chỉ số, cổ phiếu, kim loại quý, năng lượng, ETF và tiền điện tử. Mặc dù công ty tuyên bố có nhiều công cụ giao dịch và chênh lệch thấp, nhưng rất khó để có được thông tin thời gian thực vì hiện tại không thể truy cập trang web của nó.

Địa chỉ công ty

Địa chỉ công ty , số 58 đường Trương Giang, quận mới Phố Đông, Thượng Hải, thành phố Thượng Hải. Địa chỉ công ty nằm ở quận mới Phố Đông, gần công viên công nghệ cao Trương Giang, vị trí địa lý thuận

Thông tin pháp lý

MaxFX tuyên bố có giấy phép do Ủy ban Chứng khoán và Giao dịch Cộng hòa Síp (CySEC) cấp (Số giấy phép: 138 / 11), nhưng giấy phép này đã được xác minh là nghi ngờ sao chép. Do đó, tình trạng pháp lý của MaxFX trên wikifx được liệt kê là "Nghi ngờ sao chép giả" và nhận được điểm số tương đối thấp (1.45/10). Điều này cho thấy các nhà đầu tư cần phải thận trọng về dịch vụ của mình.

Tuyên bố tuân thủ

MaxFX cam kết tuân thủ các quy định của các cơ quan quản lý tài chính có liên quan, đảm bảo an toàn cho tiền của khách hàng và cung cấp môi trường giao dịch minh bạch. Tuy nhiên, do tính xác thực của giấy phép quy định của mình, khách hàng nên đặc biệt chú ý đến rủi ro khi chọn dịch vụ.

Sản phẩm giao dịch

MaxFX cung cấp các sản phẩm giao dịch cho 7 loại tài sản chính, bao gồm hơn 600 công cụ:

- Forex : Cung cấp các cặp tiền tệ chính như EUR / USD, GBP / USD, v.v. Chỉ số (Indices) : Bao gồm các chỉ số chứng khoán chính trên thế giới như chỉ số Dow Jones, chỉ số Nasdaq.

- Cổ phiếu (Stocks) : Bao gồm cổ phiếu của các công ty nổi tiếng thế giới như Apple, Microsoft. Kim loại quý (Precious Metals) : Như vàng (XAU / USD), bạc (XAG / USD). Năng lượng (Energy) : Như dầu thô tương lai (WTI và Brent). ETF (Exchang- Traded Funds) : Cung cấp nhiều loại sản phẩm ETF chỉ số. Tiền điện tử (Cryptocurrencies) : Bao gồm Bitcoin (BTC / USD) và Ethereum (ETH / USD).

Tỷ lệ đòn bẩy

MaxFX cung cấp cho khách hàng bán lẻ tỷ lệ đòn bẩy lên đến 1: 500 . Mặc dù đòn bẩy cao có thể khuếch đại lợi nhuận, nhưng nó cũng làm tăng đáng kể rủi ro giao dịch và đặc biệt không phù hợp với các nhà giao dịch thiếu kinh nghiệm.

Chênh lệch và hoa hồng

MaxFX cung cấp chênh lệch từ 0,5 pip và hứa không tính phí hoa hồng , có thể hấp dẫn hơn đối với các nhà giao dịch nhỏ.

Phần mềm giao dịch

MaxFX cung cấp cho nhà giao dịch nền tảng Ctrl der, hỗ trợ web, máy tính để bàn và thiết bị di động (bao gồm cả máy tính bảng và điện thoại thông minh) .

Chức năng nền tảng

- Giao dịch thủ công : Hỗ trợ các loại đơn hàng cơ bản như lệnh thị trường và lệnh giới hạn.

- Sao chép giao dịch : Cho phép nhà giao dịch sao chép hành động của các nhà giao dịch thành công khác.

- Giao dịch tự động : Hỗ trợ thực hiện tự động các chiến lược và tín hiệu.

- Công cụ phân tích nâng cao : Cung cấp nhiều loại biểu đồ, chỉ số kỹ thuật và chức năng phân tích thị trường. Quản lý rủi ro : Bao gồm các công cụ dừng lỗ, chốt lời và mở rộng vị thế.

Khả năng tương thích nền tảng

Nền tảng der tương thích với nhiều hệ điều hành khác nhau, bao gồm Windows, MacOS, Linux, iOS và Android, đảm bảo rằng các nhà giao dịch có thể truy cập nó trên bất kỳ thiết bị nào.

Phương thức gửi và rút tiền

MaxFX cung cấp nhiều phương thức gửi và rút tiền, bao gồm:

- Thẻ tín dụng / thẻ ghi nợ : Hỗ trợ VISA, MasterCard và Maestro. Chuyển khoản : Hỗ trợ chuyển khoản ngân hàng SEPA.

- Ví kỹ thuật số : như Absa, B2B In Pay và PayTrust. Tiền điện tử : Chấp nhận tài sản kỹ thuật số như USDT.

Yêu cầu tiền gửi tối thiểu

- Thẻ tín dụng / thẻ ghi nợ : Không có yêu cầu tiền gửi tối thiểu. Chuyển khoản ngân hàng SEPA : Tiền gửi tối thiểu là 100 EUR . USDT : Tiền gửi tối thiểu là 250 USDT .

Thời gian xử lý tiền gửi và rút tiền

- Thẻ tín dụng / thẻ ghi nợ và PayTrust tiền gửi : xử lý ngay lập tức.

- Gửi tiền B2B In Pay : Khoảng 5 phút. Chuyển khoản và rút tiền : 1-3 ngày làm việc.

- Gửi tiền Absa : 3-5 ngày làm việc.

Phí xử lý

MaxFX cam kết không tính bất kỳ khoản phí gửi và rút tiền nào , giúp giảm chi phí giao dịch cho khách hàng.

Hỗ trợ khách hàng

MaxFX cung cấp dịch vụ hỗ trợ khách hàng đa kênh:

- Hỗ trợ qua điện thoại : + 2484671987.

- Email : support@fondex.com.sc.

- Trò chuyện trực tiếp : Bạn có thể liên hệ trực tiếp trên trang web chính thức hoặc ứng dụng di động.

- Phương tiện truyền thông xã hội : Có tài khoản chính thức trên Facebook, Telegram, LinkedIn, Instagram và YouTube.

Địa chỉ công ty

Số 58 đường Trương Giang, quận mới Phố Đông, Thượng Hải Địa chỉ công ty nằm ở quận mới Phố Đông, Thượng Hải, gần công viên công nghệ cao Trương Giang, vị trí địa lý thuận lợi để thu hút nhân tài công nghệ cao.

Kinh doanh và dịch vụ cốt lõi

Hoạt động kinh doanh cốt lõi của MaxFX tập trung vào giao dịch ngoại hối bán lẻ, đối tượng dịch vụ chính là:

- Nhà giao dịch cá nhân : Cung cấp các công cụ giao dịch đa dạng và chênh lệch thấp, phù hợp với các nhà giao dịch có kinh nghiệm.

- Nhà đầu tư tổ chức : Cung cấp các giải pháp tùy chỉnh và dịch vụ chuyên nghiệp hơn.

Cơ sở hạ tầng kỹ thuật

MaxFX sử dụng nền tảng ctrader làm công cụ giao dịch chính của mình, được biết đến với tính linh hoạt và sức mạnh của nó. Với sự hỗ trợ giao dịch thủ công, giao dịch sao chép và giao dịch tự động, ctrader cung cấp cho các nhà giao dịch các phương thức hoạt động đa dạng.

Hệ thống tuân thủ và kiểm soát rủi ro

MaxFX cam kết tuân thủ các quy định của các cơ quan quản lý tài chính có liên quan, đảm bảo an toàn cho tiền của khách hàng và cung cấp một môi trường giao dịch minh bạch. Công ty sử dụng các biện pháp kiểm soát rủi ro nghiêm ngặt, bao gồm:

- Chốt lỗ và chốt lời : giúp các nhà giao dịch quản lý rủi ro một

- Kiểm soát đòn bẩy : Đặt giới hạn đòn bẩy khác nhau dựa trên trải nghiệm của khách hàng.

- Cách ly quỹ : Quỹ của khách hàng được tách ra khỏi quỹ hoạt động của công ty để đảm bảo an toàn cho quỹ.

Định vị thị trường và lợi thế cạnh tranh

Định vị của MaxFX trên thị trường là cung cấp cho các nhà giao dịch một môi trường giao dịch chênh lệch thấp, không có hoa hồng, lợi thế cạnh tranh của nó bao gồm:

- Một loạt các công cụ giao dịch : Bao gồm nhiều loại tài sản và đáp ứng nhu cầu của các khách hàng khác nhau.

- Lựa chọn đòn bẩy linh hoạt : Thích ứng với khả năng chấp nhận rủi ro của các nhà giao dịch khác nhau. Hỗ trợ đa thiết bị : Đảm bảo nhà giao dịch giao dịch mọi lúc, mọi nơi.

Lợi thế kỹ thuật

Khả năng tương thích đa thiết bị và các công cụ phân tích phong phú của nền tảng ctrader là những lợi thế kỹ thuật chính của MaxFX.Hỗ trợ khách hàng và trao quyền cho

MaxFX cung cấp các dịch vụ hỗ trợ khách hàng toàn diện, bao gồm trò chuyện trực tiếp, hỗ trợ qua điện thoại và email, cũng như tương tác truyền thông xã hội. Khách hàng có thể liên hệ theo nhiều cách để được hỗ trợ kịp thời.

Tài nguyên giáo dục

MaxFX cung cấp các tài nguyên giáo dục giao dịch cơ bản, bao gồm phân tích thị trường, chỉ số kỹ thuật và quản lý rủi ro, để giúp người mới bắt đầu nhanh chóng.

Trách nhiệm xã hội và ESG

MaxFX chưa công bố chính sách chi tiết về trách nhiệm xã hội của doanh nghiệp và ESG. Là một nhà môi giới ngoại hối, trách nhiệm xã hội chính của nó có thể được thể hiện trong các khía cạnh như hoạt động tuân thủ và bảo vệ sự an toàn của tiền của khách hàng.

Sinh thái hợp tác chiến lược

MaxFX chưa công khai quan hệ đối tác chiến lược của mình, nhưng các công cụ giao dịch mở rộng của nền tảng

Sức khỏe tài chính

Sức khỏe tài chính của MaxFX chưa được công khai và do tính xác thực của giấy phép quy định của nó bị nghi ngờ, sức khỏe tài chính cần được xác minh thêm.

Lộ trình tương lai

Kế hoạch tương lai của MaxFX bao gồm tiếp tục mở rộng các công cụ giao dịch và ảnh hưởng thị trường, nhưng chi tiết cụ thể chưa được công bố.

Cảnh báo rủi ro

Giấy phép quy định CySEC của Síp (số giấy phép: 138 / 11) mà MaxFX tuyên bố, các nhà đầu tư nên cảnh giác về điều này và chú ý đến sự an toàn của quỹ.

Nhìn chung, MaxFX cung cấp một môi trường giao dịch đa dạng, nhưng tình trạng quy định và tính minh bạch tài chính của nó cần được quan tâm hơn nữa.