Hồ sơ công ty

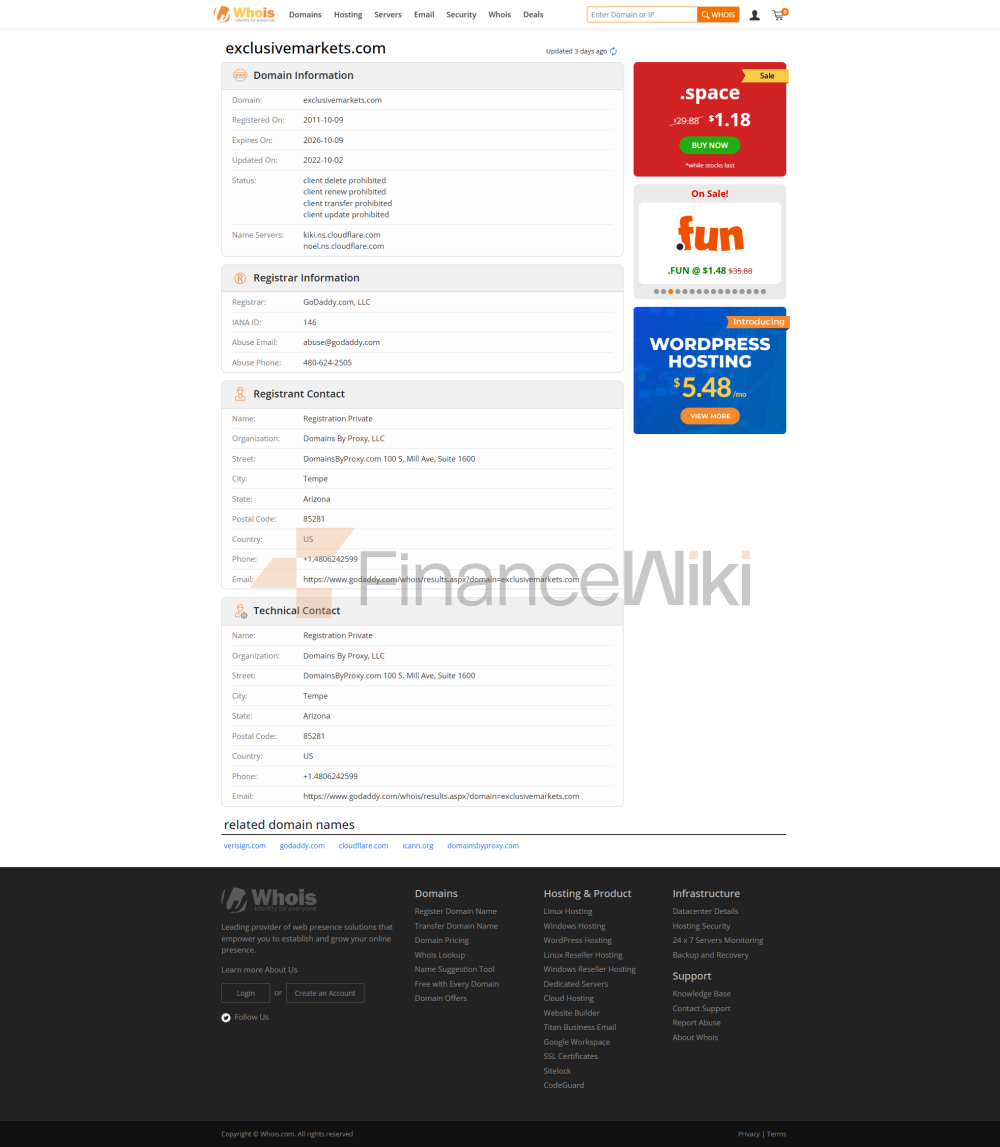

Exclusive Markets Ltd là nhà cung cấp dịch vụ tài chính được thành lập tại Seychelles vào ngày 22 tháng 10 năm 2020 , có trụ sở chính tại Tầng 3, Tòa nhà Vairam, Providence, Đảo Mahe, Seychelles (Phòng 15 (A)). Công ty cung cấp dịch vụ giao dịch trên các thị trường tài chính như ngoại hối, kim loại quý, hàng hóa, chỉ số, cổ phiếu, trái phiếu, ETF và tiền điện tử cho các nhà giao dịch trên toàn thế giới thông qua các nền tảng MetaTrader 4 (MT4) và MetaTrader 5 (MT5). Tính đến quý 3 năm 2023, công ty đã cung cấp cho khách hàng hơn 30.000 công cụ giao dịch , bao gồm nhiều loại tài sản và cung cấp cho các nhà đầu tư nhiều lựa chọn giao dịch đa dạng.

Thông tin pháp lý

Exclusive Markets Ltd được quy định bởi Cơ quan Dịch vụ Tài chính Seychelles (FSA) và có giấy phép số SD031. Mặc dù tuân thủ khung pháp lý nước ngoài của Seychelles, giấy phép này có quy định tương đối hạn chế, có nghĩa là sự an toàn của tiền của khách hàng có thể gặp rủi ro nhất định. Ngoài ra, công ty còn có một chi nhánh tại Síp, Exclusive Markets (Cyprus) Ltd, đăng ký số HE 421534, đặt tại Athalassas 62, Mezzanine, 2012, Strovolos, Nicosia.

Sản phẩm giao dịch

Thị trường độc quyền cung cấp một loạt các sản phẩm giao dịch đáp ứng nhu cầu của các nhà đầu tư khác nhau:

- Giao dịch ngoại hối : Bao gồm các cặp tiền tệ chính và nhỏ như EUR / USD, GBP / USD, v.v. Kim loại quý : Bao gồm vàng (XAU / USD) và bạc (XAG / USD). Hàng hóa : như dầu thô (dầu thô), khí tự nhiên (khí tự nhiên) và nông sản (như lúa mì). Chỉ số : Cung cấp các chỉ số chính trên thế giới như chỉ số trung bình công nghiệp Dow Jones (DJI), chỉ số Nasdaq (IXIC) và chỉ số FTSE 100 (FTSE 100). Cổ phiếu, trái phiếu và ETF : Cho phép các nhà giao dịch tham gia giao dịch hợp đồng chênh lệch (CFD) trên các cổ phiếu riêng lẻ (như Apple, Microsoft), trái phiếu và ETF. Tiền điện tử : Hỗ trợ giao dịch các tài sản kỹ thuật số chính thống như Bitcoin (BTC / USD), Ethereum (ETH / USD).

Phần mềm giao dịch

Thị trường độc quyền cung cấp cho các nhà giao dịch các nền tảng giao dịch sau:

- MetaTrader 4 (MT4) : Hoạt động trên máy tính để bàn, thiết bị web và di động, hỗ trợ nhiều công cụ phân tích kỹ thuật và cố vấn chuyên gia. MetaTrader 5 (MT5) : Phiên bản dành cho máy tính để bàn, web và di động, cung cấp các tính năng nâng cao hơn như ngôn ngữ kịch bản tích hợp và các chỉ số kỹ thuật khác. WebTrader : Không cần tải xuống, truy cập trực tiếp vào các chức năng giao dịch thông qua trình duyệt.

- Giao dịch sao chép xã hội : Cho phép các nhà giao dịch sao chép hoạt động của các nhà giao dịch thành công khác và tuân theo các chiến lược giao dịch chuyên nghiệp.

Phương thức gửi và rút tiền

Thị trường độc quyền cung cấp nhiều phương thức gửi và rút tiền, bao gồm B2B in pay, Nuvei, PayTrust, Fastpay, Perfect Money, Beeteller, Bitwallet, SticPay, X Pay, Dragonpay, Skrill, Neteller, Binance Pay và Local Deposit. Công ty cam kết gửi và rút tiền không có phí xử lý và hỗ trợ gửi tiền ngay lập tức. Việc rút tiền thường được xử lý trong vòng 24 giờ làm việc và có thể được xử lý trong cùng một ngày cho các yêu cầu rút tiền trước 3 giờ chiều GMT.

Hỗ trợ khách hàng

Nhóm hỗ trợ khách hàng của Exclusive Markets cung cấp các dịch vụ đa kênh, bao gồm:

- Trò chuyện trực tuyến

- Điện thoại (+ 44 20 8097 6094)

- Email (info@exclusivemarkets.com)

- Line

Hoạt động kinh doanh và dịch vụ cốt lõi của

Hoạt động kinh doanh cốt lõi của Exclusive Markets bao gồm:

- Giao dịch ngoại hối bán lẻ : Cung cấp quyền truy cập vào thị trường ngoại hối cho các nhà giao dịch bán lẻ trên toàn thế giới.

- Hợp đồng chênh lệch (CFD) Giao dịch : Các sản phẩm CFD bao gồm cổ phiếu, chỉ số và hàng hóa.

- Giao dịch tiền điện tử : Cung cấp dịch vụ giao dịch tiền điện tử chính như Bitcoin và Ethereum. Giao dịch sao chép xã hội : Cho phép các nhà giao dịch tuân theo chiến lược hoạt động của các nhà giao dịch chuyên nghiệp.

Cơ sở hạ tầng kỹ thuật của công ty

Cơ sở hạ tầng kỹ thuật của công ty dựa trên nền tảng MetaTrader, hỗ trợ nhiều công cụ giao dịch và các tính năng nâng cao như:- Trading Central : Cung cấp phân tích thị trường thời gian thực và báo cáo nghiên cứu.

- Lịch giao dịch : Hiển thị các sự kiện kinh tế quan trọng và thông cáo báo chí.

- Dịch vụ lưu trữ VPS : Đảm bảo hoạt động ổn định của nền tảng giao dịch. Web TV : Cung cấp phân tích thị trường thời gian thực và video giáo dục.

- Tín hiệu giao dịch : Cung cấp cho nhà giao dịch tư vấn chiến lược giao dịch chuyên nghiệp.

Hệ thống tuân thủ và kiểm soát rủi ro

Thị trường độc quyền tuân thủ các yêu cầu quy định của Cơ quan Dịch vụ Tài chính Seychelles (FSA) và thực hiện các biện pháp quản lý rủi ro sau:

- Kiểm soát đòn bẩy : Cung cấp đòn bẩy từ 1: 1 đến 1: 2000 theo các loại tài khoản khác nhau để đảm bảo nhà giao dịch duy trì quản lý rủi ro trong giao dịch có đòn bẩy cao.

- Spread và hoa hồng : Cung cấp chênh lệch ban đầu từ 0 điểm để đáp ứng nhu cầu chi phí giao dịch thấp.

- Phân lập quỹ khách hàng : Phân lập quỹ khách hàng khỏi quỹ riêng của công ty để giảm nguy cơ biển thủ quỹ.

- Chính sách chống rửa tiền (AML) : Thực hiện xác minh danh tính khách hàng và giám sát giao dịch để ngăn chặn rửa tiền và tài trợ khủng bố.

Định vị thị trường và lợi thế cạnh tranh

Định vị thị trường của Exclusive Markets chủ yếu là cung cấp dịch vụ giao dịch chi phí thấp và thanh khoản cao. Lợi thế cạnh tranh bao gồm:

- Yêu cầu tiền gửi thấp : Tiền gửi tối thiểu là 5 đô la Mỹ, phù hợp với các nhà giao dịch nhỏ.

- Loại đa tài khoản : Cung cấp năm loại tài khoản để đáp ứng nhu cầu của các nhà giao dịch khác nhau. Công cụ giao dịch rộng : Hơn 30.000 sản phẩm giao dịch bao gồm nhiều loại tài sản. Đòn bẩy linh hoạt và chênh lệch : Tùy chọn đòn bẩy cao và chênh lệch thấp cung cấp nhiều lựa chọn hơn cho các nhà giao dịch có kinh nghiệm và chuyên nghiệp.

Hỗ trợ và trao quyền cho khách hàng

Công ty trao quyền cho khách hàng theo nhiều cách:

- Tài nguyên giáo dục : Cung cấp phân tích thị trường, chiến lược giao dịch và video giáo dục.

- Công cụ giao dịch : Các công cụ như Trading Central và các tín hiệu giao dịch để giúp nhà giao dịch đưa ra quyết định giao dịch sáng suốt hơn.

- Hỗ trợ khách hàng : Hỗ trợ đa kênh, đa ngôn ngữ để đảm bảo các vấn đề của nhà giao dịch được giải quyết kịp thời.

Trách nhiệm xã hội và ESG

Mặc dù không đề cập rõ ràng đến chính sách ESG, Exclusive Markets gián tiếp thực hiện trách nhiệm xã hội của mình bằng cách cung cấp một môi trường giao dịch minh bạch và hoạt động tuân thủ.

Hệ sinh thái hợp tác chiến lược

Exclusive Markets đã thiết lập quan hệ đối tác với các bộ xử lý thanh toán, nền tảng giao dịch và nhà cung cấp công nghệ để đảm bảo sự tuân thủ và hiệu quả của công nghệ và dịch vụ của họ. Hiện tại không có thông tin hợp tác chiến lược quan trọng nào được công bố.

Sức khỏe tài chính của công ty

Sức khỏe tài chính của công ty không được cung cấp với dữ liệu tài chính cụ thể, nhưng từ việc mở rộng kinh doanh liên tục và đa

Lộ trình tương lai

Thị trường độc quyền có kế hoạch tiếp tục mở rộng các sản phẩm giao dịch và phạm vi thị trường, giới thiệu các tính năng và công nghệ sáng tạo hơn, chẳng hạn như phân tích giao dịch dựa trên AI và các công cụ đầu tư thông minh.

Tóm tắt

Thị trường độc quyền là nhà cung cấp dịch vụ tài chính được quy định bởi FSA của Seychelles, cung cấp các sản phẩm giao dịch đa dạng, điều kiện giao dịch linh hoạt và hỗ trợ kỹ thuật mạnh mẽ. Tuy nhiên, vị thế pháp lý ở nước ngoài của nó có thể gây ra rủi ro nhất định cho sự an toàn của quỹ và các nhà giao dịch nên thận trọng trong việc đánh giá và chọn nhà môi giới phù hợp với nhu cầu của họ.