NCM Investment · Hồ sơ công ty

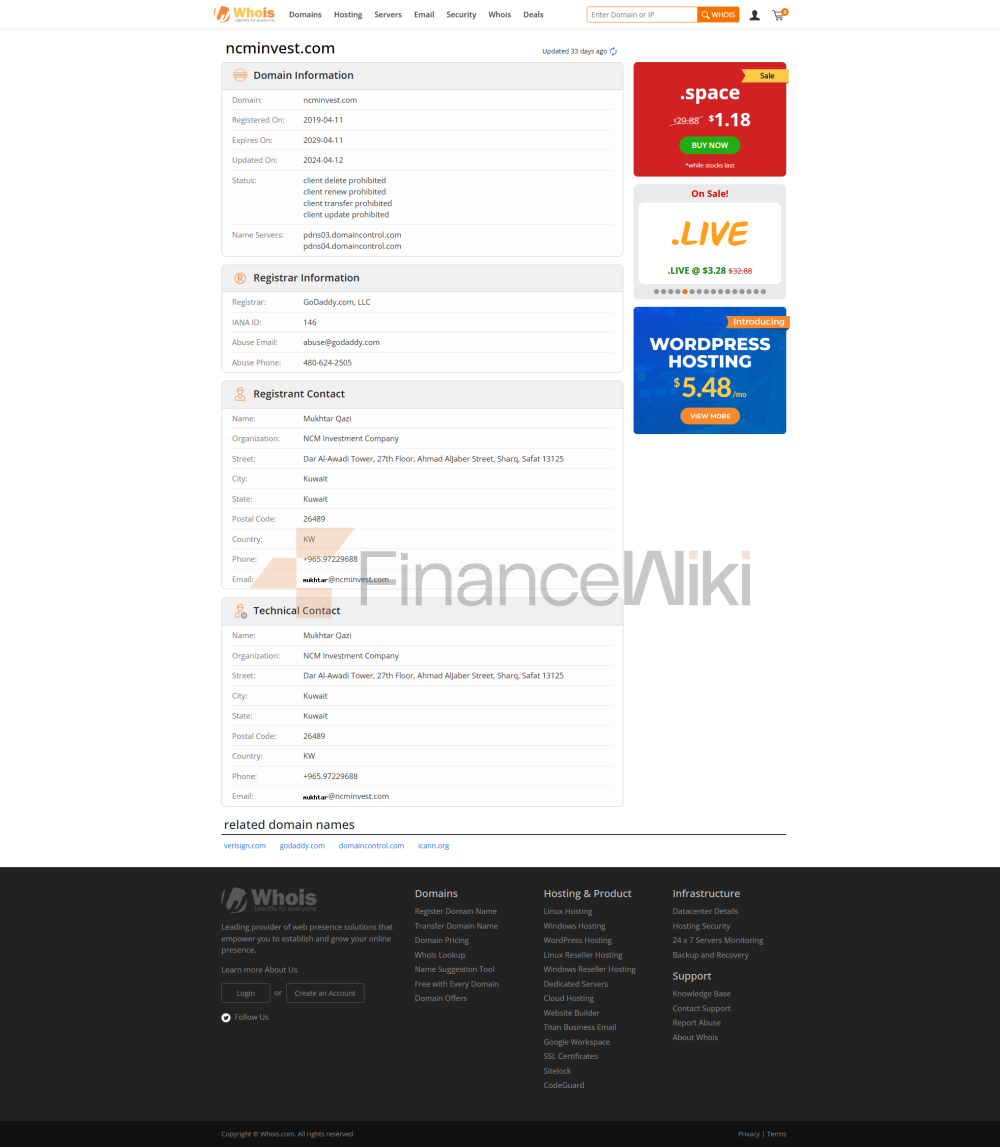

NCM Investment, có trụ sở tại Kuwait, đã hoạt động được 2-5 năm và cung cấp một loạt các công cụ thị trường bao gồm Forex, Vàng và Bạc, Dầu, Sản phẩm nông nghiệp, Chỉ số Hoa Kỳ và CFD cho cổ phiếu và chỉ số. Mặc dù không được kiểm soát, công ty cung cấp các loại tài khoản như Standard, Standard Market, Standard Floating và Plus với yêu cầu tiền gửi tối thiểu là $500 và đòn bẩy tối đa là 1: 100.

Các nhà giao dịch có thể chọn chênh lệch cố định hoặc nổi khi sử dụng các nền tảng giao dịch phổ biến như MT4 / 5 và hỗ trợ thực hành thông qua tài khoản demo. Hỗ trợ khách hàng có thể được liên hệ qua điện thoại từ các trụ sở khu vực bao gồm Kuwait, UAE, Thổ Nhĩ Kỳ và Jordan, cũng như thông qua hệ thống lệnh công việc.

Các tùy chọn gửi và rút tiền bao gồm Knet, thẻ tín dụng, thẻ ghi nợ UAE, NAPS và Benefit. NCM Investment cũng cung cấp các tài nguyên giáo dục như Học viện, Tin tức thị trường và Lịch kinh tế để giúp các nhà giao dịch đưa ra quyết định sáng suốt.

Tình trạng pháp lý

NCM Investment hoạt động như một nền tảng giao dịch không được kiểm soát.

Các tổ chức tài chính không được kiểm soát không bị giám sát và các quy định do các cơ quan quản lý áp đặt. Sự thiếu quy định này có nghĩa là các nhà đầu tư có thể không nhận được sự bảo vệ như bảo hiểm tiền gửi, chương trình bồi thường hoặc cơ chế giải quyết tranh chấp trong trường hợp tổn thất hoặc tranh chấp tài chính.

Ưu điểm và nhược điểm

Ưu điểm:

- Phạm vi công cụ thị trường: NCM Investment cung cấp một loạt các công cụ thị trường bao gồm ngoại hối, vàng và bạc, dầu, sản phẩm nông nghiệp, chỉ số Hoa Kỳ và CFD trên cổ phiếu và chỉ số. Sự đa dạng này mang đến cho các nhà giao dịch nhiều cơ hội để đa dạng hóa danh mục đầu tư và khám phá các thị trường khác nhau.

- Nhiều loại tài khoản để lựa chọn: Nhiều loại tài khoản được cung cấp, chẳng hạn như tài khoản chuẩn, tài khoản thị trường tiêu chuẩn, tài khoản nổi tiêu chuẩn và tài khoản cao cấp, để các nhà giao dịch có thể chọn tài khoản phù hợp nhất với sở thích và mục tiêu giao dịch của họ.

- Tùy chọn tài khoản demo: NCM Investment cung cấp tùy chọn tài khoản demo cho phép các nhà giao dịch thực hành chiến lược giao dịch và làm quen với các tính năng của nền tảng mà không phải mạo hiểm tiền thật. Điều này rất có lợi cho các nhà giao dịch mới làm quen muốn tích lũy kinh nghiệm trong môi trường không có rủi ro.

- Hỗ trợ khách hàng có thể truy cập: NCM Investment cung cấp hỗ trợ khách hàng có thể truy cập thông qua đường dây điện thoại của các trụ sở chính trong khu vực và thông qua hệ thống bán vé, bao gồm Kuwait, UAE Điều này đảm bảo rằng các nhà giao dịch có thể dễ dàng tìm kiếm sự giúp đỡ và giải quyết bất kỳ vấn đề nào họ có thể gặp phải.

- Tài nguyên giáo dục có sẵn: NCM Investment cung cấp các tài nguyên giáo dục như học viện, tin tức thị trường và lịch kinh tế. Những tài nguyên này có thể giúp các nhà giao dịch nâng cao kiến thức và kỹ năng của họ để họ có thể đưa ra quyết định giao dịch sáng suốt hơn.

Nhược điểm:

- Thiếu quy định: Một trong những nhược điểm chính của NCM Investment là thiếu quy định. Hoạt động như một tổ chức tài chính không được kiểm soát khiến các nhà giao dịch gặp phải nhiều rủi ro khác nhau, bao gồm bảo vệ nhà đầu tư hạn chế, nguy cơ gian lận cao hơn và sự không chắc chắn về

- Rủi ro gian lận gia tăng: Trong trường hợp không có sự giám sát theo quy định, các tổ chức tài chính không được kiểm soát có nguy cơ hoạt động gian lận gia tăng. Thương nhân có thể dễ bị gian lận, quản lý quỹ không đúng cách hoặc các kế hoạch gian lận khác.

- Tiền gửi tối thiểu tương đối cao: NCM Investment yêu cầu tiền gửi tối thiểu là $500 và có thể được coi là tương đối cao so với một số nhà môi giới khác trong ngành.

- Rủi ro hoạt động và danh tiếng: Các tổ chức tài chính không được kiểm soát có thể phải đối mặt với những thách thức hoạt động và rủi ro danh tiếng do thiếu cơ cấu quản trị, giao thức quản lý rủi ro và kiểm soát nội bộ. Điều này có thể dẫn đến bất ổn tài chính hoặc làm tổn hại danh tiếng của công ty

- Sự không chắc chắn về mặt pháp lý: Hoạt động mà không có quy định có thể gây ra sự không chắc chắn về mặt pháp lý cho NCM Investment và khách hàng của nó. Nếu không có hướng dẫn và giám sát quy định rõ ràng, có thể xảy ra tranh chấp pháp lý hoặc hành động thực thi quy định dẫn đến kiện tụng, phạt tiền hoặc các hình phạt khác.

Công cụ thị trường

NCM Investment cung cấp cho các nhà giao dịch một loạt các công cụ thị trường bao gồm:

- Forex: Còn được gọi là giao dịch ngoại hối hoặc tiền tệ, Forex cho phép các nhà giao dịch đầu cơ tỷ giá hối đoái giữa các cặp tiền tệ khác nhau, chẳng hạn như EUR / USD hoặc GBP / JPY. Đây là một trong những thị trường tài chính lớn nhất và thanh khoản nhất trên thế giới

- Vàng và bạc: Các kim loại quý như vàng và bạc là những mặt hàng phổ biến vì giá trị nội tại và ý nghĩa lịch sử của chúng. Các nhà giao dịch có thể suy đoán về biến động giá của vàng và bạc, tận dụng vị thế trú ẩn an toàn của họ trong thời điểm bất ổn kinh tế hoặc lạm phát.

- Dầu khí & Gas: Giao dịch hàng hóa dầu khí liên quan đến đầu cơ về biến động giá của dầu thô, khí đốt tự nhiên và các sản phẩm liên quan khác. Những hàng hóa này đóng vai trò quan trọng trong nền kinh tế toàn cầu và bị ảnh hưởng bởi các yếu tố như động lực cung và cầu, các sự kiện địa chính trị và xu hướng kinh tế vĩ mô.

- Nông nghiệp: Các sản phẩm nông nghiệp bao gồm các loại cây trồng như lúa mì, ngô, đậu nành Trong giao dịch nông sản, các nhà đầu tư có thể định vị giá của các mặt hàng cơ bản này dựa trên các yếu tố như điều kiện thời tiết, báo cáo cây trồng và xu hướng nhu cầu toàn cầu.

- Chỉ số Hoa Kỳ: Các chỉ số như S & P 500, Chỉ số Trung bình Công nghiệp Dow Jones và Chỉ số tổng hợp Nasdaq đại diện cho một rổ cổ phiếu trên tất cả các lĩnh vực của nền kinh tế Hoa Kỳ. Trong giao dịch chỉ số Hoa Kỳ, các nhà đầu tư có thể tiếp xúc với hiệu suất tổng thể của thị trường chứng khoán Hoa Kỳ và kiếm lợi nhuận từ các xu hướng thị trường rộng lớn.

- Hợp đồng chênh lệch trên cổ phiếu và chỉ số: Giao dịch hợp đồng chênh lệch (CFD) cho phép các nhà đầu tư suy đoán về biến động giá của các cổ phiếu riêng lẻ hoặc toàn bộ chỉ số mà không CFD cung cấp tính linh hoạt và đòn bẩy, giúp các nhà giao dịch có thể kiếm lợi nhuận từ cả thị trường tăng và giảm.