Hồ sơ công ty

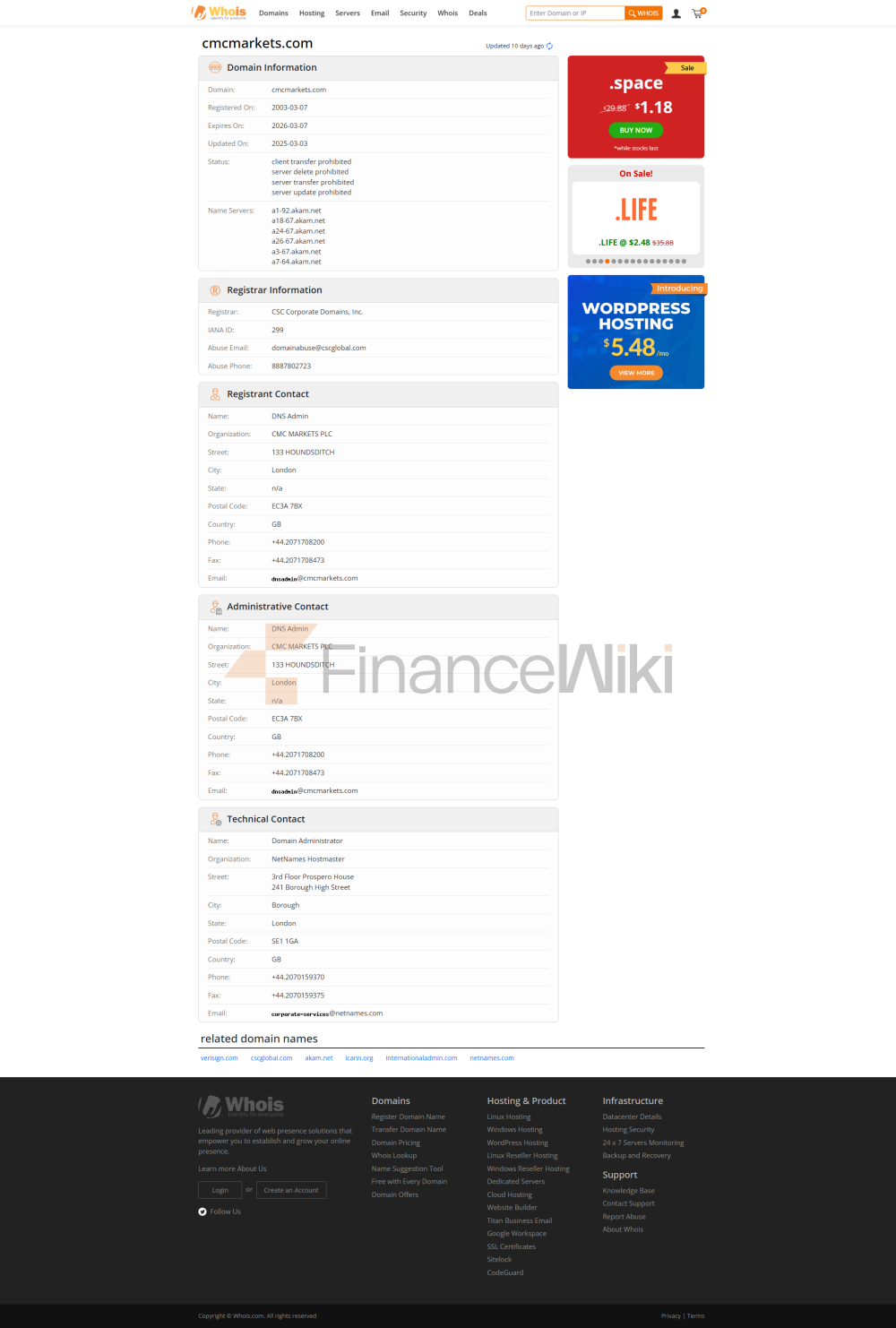

CMC Markets được thành lập vào năm 1989, có trụ sở chính tại London, Vương quốc Anh và có chi nhánh tại 15 quốc gia trên toàn thế giới, bao gồm Úc, Canada, Đức, Pháp, Singapore và New Zealand. Công ty được niêm yết trên Sở giao dịch chứng khoán London vào năm 2016 và có vốn hóa thị trường là 536 triệu bảng Anh tính đến tháng 8 năm 2018. Là nhà giao dịch hợp đồng chênh lệch (CFD) và ngoại hối hàng đầu thế giới, CMC Markets cung cấp một loạt các dịch vụ giao dịch tài chính chất lượng cao cho các nhà giao dịch trên toàn thế giới với sức mạnh vốn mạnh và hoạt động tuân thủ ổn định.

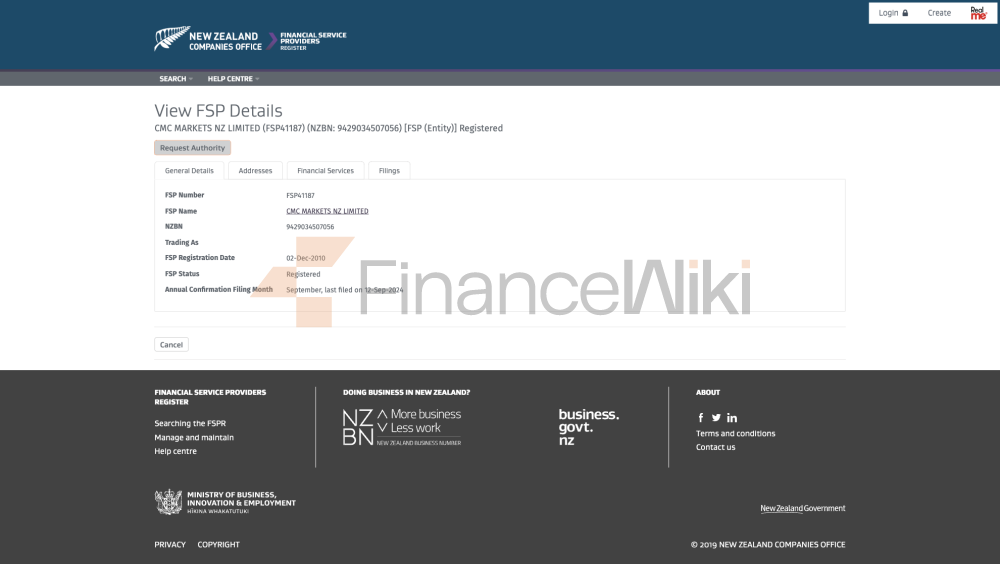

Thông tin pháp lý CMC Markets được giám sát chặt chẽ bởi nhiều cơ quan quản lý tài chính hàng đầu trên toàn thế giới, đảm bảo tính hợp pháp và minh bạch của các hoạt động giao dịch. Các cơ quan quản lý chính bao gồm:

- Cơ quan Quản lý Tài chính (FCA) , số giấy phép 173730

- Ủy ban Chứng khoán và Đầu tư Úc (ASIC) Cơ quan Giám sát Tài chính Liên bang Đức (BaFin) Cơ quan Quản lý Công nghiệp Đầu tư Canada (IIROC) Cơ quan Quản lý Tài chính Singapore (MAS) Cơ quan Quản lý Tài chính New Zealand (FMA)

Các yêu cầu nghiêm ngặt của các cơ quan quản lý này đảm bảo sự tuân thủ của CMC Markets, bảo mật tài sản của khách hàng và môi trường giao dịch minh bạch.

Sản phẩm giao dịch CMC Markets cung cấp gần 10.000 sản phẩm tài chính, bao gồm các loại sau:

- Sản phẩm ngoại hối : Cung cấp 348 hợp đồng chênh lệch ngoại hối, bao gồm các cặp tiền tệ chính, thứ cấp và mới nổi, với mức chênh lệch thấp nhất là 0,7

- Sản phẩm chỉ số : Bao gồm 100 hợp đồng chênh lệch chỉ số chứng khoán giao ngay và tương lai trên toàn thế giới, với mức chênh lệch thấp nhất là 1

- Sản phẩm cổ phiếu : Cung cấp hơn 9.000 hợp đồng chênh lệch cổ phiếu toàn cầu, bao gồm các cổ phiếu phổ biến như Apple, BP, Ngân hàng Lloyd 's Bank Hàng hóa : Hàm Bao gồm các mặt hàng như dầu thô, vàng, bạc, chênh lệch thấp tới 0,3 Trái phiếu : Cung cấp 55 hợp đồng chênh lệch trái phiếu toàn cầu Tiền điện tử : Giao dịch 12 loại tiền điện tử chính như Bitcoin, Ethereum, chênh lệch thấp tới 1,9

Phần mềm giao dịch CMC Markets cung cấp nhiều nền tảng giao dịch để đáp ứng nhu cầu của các nhà giao dịch khác nhau:

Phương thức gửi và rút tiền. CMC Markets hỗ trợ nhiều phương thức gửi và rút tiền, bao gồm:

- Chuyển khoản ngân hàng

- Thẻ tín dụng / thẻ ghi nợ (hỗ trợ Visa, MasterCard)

- PayPal

- POLi (phương thức thanh toán đặc trưng của Úc) / li >

Phí xử lý tiền gửi là 1% cho thẻ tín dụng và 0,5% cho thẻ ghi nợ, không hỗ trợ tiền gửi bằng séc và tiền mặt. Yêu cầu rút tiền được gửi trước 2: 00 chiều theo giờ Sydney và được xử lý trong ngày.

Hỗ trợ khách hàng CMC Markets cung cấp các dịch vụ hỗ trợ khách hàng 24 / 7, bao gồm:

- Hỗ trợ qua điện thoại : + 61 2 8221 2100 (Úc), + 64 9 919 7777 (New Zealand)

- Trò chuyện trực tuyến : Hỗ trợ 24 giờ

- Biểu mẫu liên hệ : Thuận tiện cho khách hàng gửi câu hỏi bất cứ lúc nào

Hoạt động kinh doanh chính của CMC Markets bao gồm:

- Giao dịch hợp đồng chênh lệch : Cung cấp linh hoạt Đòn bẩy (tối đa 1: 500) và nhiều công cụ giao dịch khác nhau Giao dịch ngoại hối : Hỗ trợ giao dịch nhiều cặp tiền tệ với chênh lệch thấp nhất là 0,7 Đầu tư cổ phiếu : Cung cấp cơ hội giao dịch cho hàng nghìn cổ phiếu trên toàn thế giới

- Giao dịch tiền điện tử : Hỗ trợ giao dịch hợp đồng chênh lệch trên các loại tiền điện tử chính Tài nguyên giáo dục : Cung cấp tài liệu học tập phong phú, bao gồm phân tích thị trường, chiến lược giao dịch và hướng dẫn nền tảng

Cơ sở hạ tầng kỹ thuật CMC Markets sử dụng cơ sở hạ tầng kỹ thuật tiên tiến, bao gồm: Nền tảng giao dịch MT4 / MT5 : Hỗ trợ giao dịch tần suất cao và một số lượng lớn các công cụ phân tích kỹ thuật Nền tảng CMC NextGen : Được thiết kế cho các nhà giao dịch, cung cấp giao diện hoạt động trực quan

Hệ thống kiểm soát rủi ro và tuân thủ nghiêm ngặt các yêu cầu của cơ quan quản lý tài chính toàn cầu, CMC Markets đã thiết lập một hệ thống kiểm soát rủi ro và tuân thủ toàn diện:

- Cách ly quỹ của khách hàng : Tiền của khách hàng được gửi vào tài khoản ủy thác, đảm bảo tách khỏi quỹ hoạt động của công ty

- Đối chiếu quỹ hàng ngày : Đảm bảo quỹ tài khoản ủy thác phù hợp với quỹ tài khoản giao dịch của khách hàng

- Công cụ quản lý rủi ro : Cung cấp chức năng dừng lỗ, chốt lời, giúp khách hàng kiểm soát rủi ro giao dịch

- Giới hạn đòn bẩy : Cung cấp cho khách hàng bán lẻ tỷ lệ đòn bẩy lên đến 1: 500

Lợi thế cạnh tranh của CMC Markets trong lĩnh vực giao dịch tài chính bao gồm:

- Một loạt các sản phẩm giao dịch : Cung cấp gần 10.000 sản phẩm tài chính để đáp ứng nhu cầu của các nhà giao dịch khác nhau Chênh lệch thấp và hoa hồng thấp : Giao dịch ngoại hối chênh lệch thấp tới 0,7, cấu trúc hoa hồng minh bạch Hỗ trợ kỹ thuật mạnh mẽ : Nền tảng MT4 / MT5 và NextGen đầy đủ tính năng

- Hỗ trợ khách hàng 24 giờ : Cung cấp hỗ trợ đa ngôn ngữ và nhiều phương thức liên lạc Quy định nghiêm ngặt : Đảm bảo môi trường giao dịch an toàn và minh bạch

Hỗ trợ khách hàng và trao quyền cho CMC Markets thông qua nhiều loại Phương thức trao quyền cho khách hàng:

- Trung tâm tài nguyên giáo dục : Cung cấp phân tích thị trường chi tiết, chiến lược giao dịch và hướng dẫn nền tảng

- Tài khoản demo : Cung cấp 10.000 quỹ ảo để giúp các nhà giao dịch mới làm quen với nền tảng

- Công cụ giao dịch : Bao gồm lịch kinh tế, bảng chênh lệch thời gian thực, chỉ số tâm lý thị trường, v.v.

Trách nhiệm xã hội và ESGCMC Markets tích cực tham gia vào các hoạt động trách nhiệm xã hội và ESG (môi trường, xã hội, quản trị):

- Lợi ích nhân viên : Cung cấp mức lương công bằng và cơ hội phát triển nghề nghiệp Bảo vệ môi trường : Cam kết giảm lượng khí thải carbon và hỗ trợ phát triển bền vững

- Hỗ trợ cộng đồng : Thông qua quyên góp và tình nguyện, hỗ trợ các dự án cộng đồng trên toàn thế giới

Hợp tác chiến lược Eco CMC Markets đã thiết lập quan hệ đối tác chiến lược với nhiều tổ chức tài chính và công ty công nghệ, bao gồm:

- Ngân hàng Goldman Sachs : Đầu tư vào CMC Markets năm 2007, nắm giữ 10% cổ phần

- Đối tác công nghệ : Hợp tác với nhiều công ty công nghệ nổi tiếng để nâng cao hiệu suất của nền tảng giao dịch.

- Thành viên hiệp hội ngành : Tham gia nhiều hiệp hội tài chính quốc tế, tích cực tham gia xây dựng tiêu chuẩn ngành

Sức khỏe tài chính CMC Markets đã trở thành nền tảng lựa chọn đầu tiên cho các nhà giao dịch toàn cầu nhờ sức mạnh vốn mạnh và hiệu quả tài chính ổn định. Hoạt động tài chính của công ty trong những năm gần đây bao gồm:

- 2023 : Khối lượng giao dịch tăng 15% so với cùng kỳ năm ngoái, cơ sở khách hàng mở rộng đến hơn 150 quốc gia trên thế giới

- 2022 : Lợi nhuận ròng là 120 triệu bảng Anh, tỷ lệ an toàn vốn cao hơn mức trung bình của ngành 2021 : Thị phần tăng đều đặn, sự hài lòng của khách hàng đạt 90%

Lộ trình tương lai CMC Markets có kế hoạch tiếp tục phát triển trong các lĩnh vực sau:

- Đổi mới sản phẩm : Giới thiệu các sản phẩm tài chính đa dạng hơn, bao gồm nhiều hơn Tiền điện tử và ETF CFD Nâng cấp công nghệ : Tối ưu hóa các chức năng của nền tảng MT4 / MT5 để nâng cao trải nghiệm người dùng

- Mở rộng toàn cầu : Mở rộng kinh doanh tại các thị trường mới nổi như Ấn Độ, Trung Đông và Châu Phi Trách nhiệm xã hội : Tiếp tục hỗ trợ dự án ESG và thúc đẩy phát triển bền vững

Nội dung trên dựa trên dữ liệu lịch sử và thông tin công khai của CMC Markets, tính đến quý 3 năm 2023.