United

Bank for Africa Plc (UBA) is a commercial bank positioned as a leading pan-African financial services group in Africa, known as the "Global Bank of Africa". Founded in 1948 as British and French Bank Limited (BFB), UBA was officially registered as UBA in 1961 and is headquartered in Lagos Island, Nigeria. As a public company, its shares are traded on the Nigerian Stock Exchange under the symbol UBA. The shareholder structure is diversified, including institutional investors, individual investors, UBA Employee Investment Trust (about 6.3%), Heirs Holdings Limited (about 4.8%), etc.

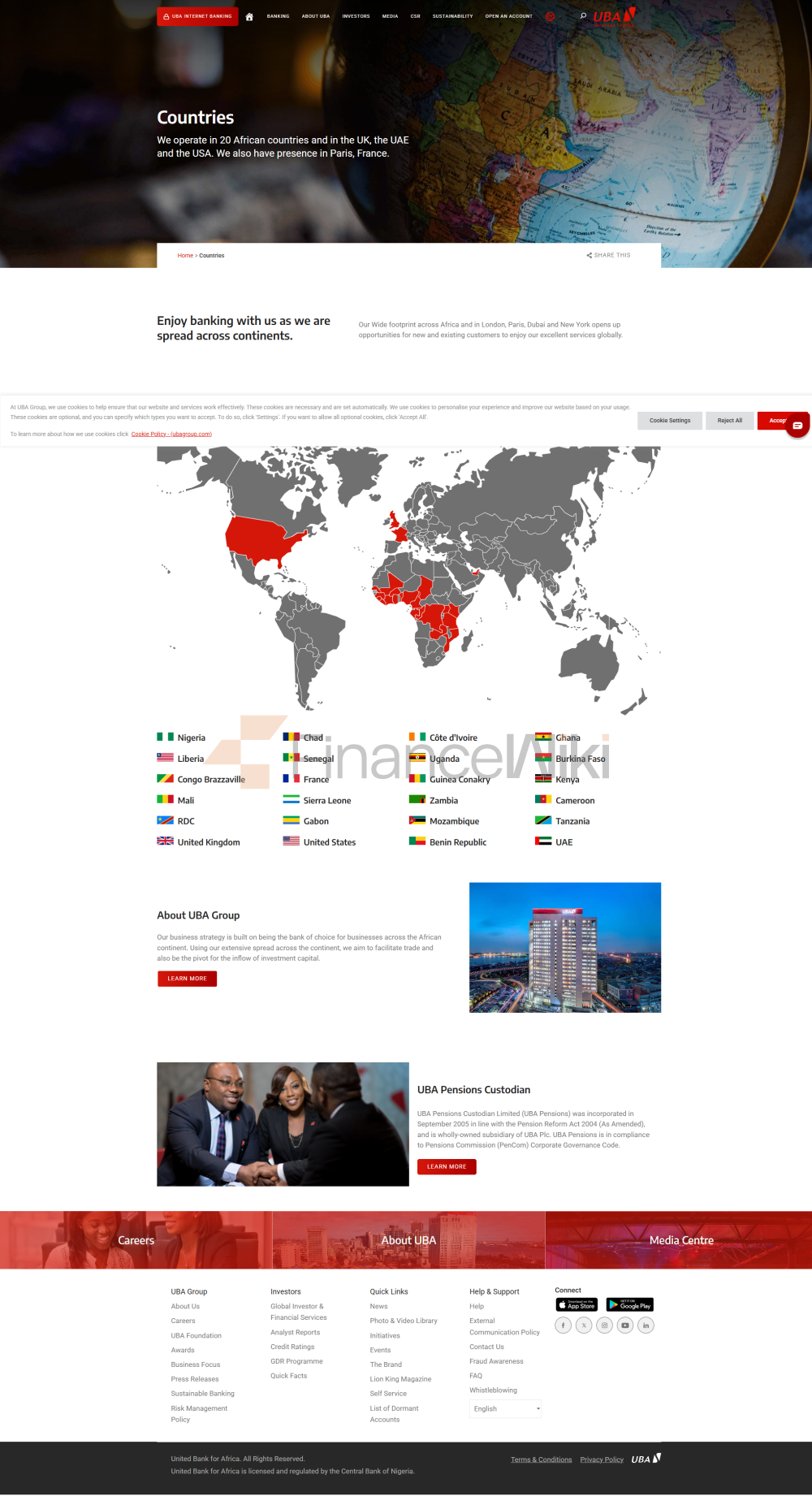

CoverageUBA covers a wide range of 20 African countries, including Nigeria, Ghana, Benin, Côte d'Ivoire, Burkina Faso, Guinea, Chad, Cameroon, Kenya, Gabon, Tanzania, Zambia, Uganda, Liberia, Sierra Leone, Mozambique, Senegal, Democratic Republic of the Congo, Congo Brazzaville and Mali. In addition, UBA has branches in the United Kingdom (London), the United States (New York), France (Paris) and the United Arab Emirates (Dubai), obtained a UAE banking license in December 2021 and launched a full-fledged banking business in France in November 2024. As of September 2024, UBA has more than 1,000 offline outlets and 1,740 ATMs, mainly concentrated in the African market, and about 13,500 POS terminals supporting retail payments, with a global customer base of more than 45 million.

Regulation &

ComplianceUBA is heavily regulated by regulators in many countries. In Nigeria, the Central Bank of Nigeria (CBN) is the main regulator; In countries such as Uganda, it is regulated by a local central bank such as the Bank of Uganda; In the United Kingdom, the United States, France and the United Arab Emirates, it is regulated by the Financial Conduct Authority (FCA), the Federal Reserve, the Banque de France and the Central Bank of the United Arab Emirates, respectively. UBA has joined the Nigerian Deposit Insurance System (NDIC) to protect customer deposits. The recent compliance record is good, and no major violations and penalties have been reported. In 2023, the African Development Bank approved $175 million in financing to support UBA.

Financial healthAs

of September 2024, UBA has total assets of 31.801 trillion naira (about US$18.9 billion) and shareholders' equity of about 3.585 trillion naira (about US$2 billion). According to publicly available data, UBA's Capital Adequacy Ratio (FADE) remains above regulatory requirements at around 12%-14%, indicating that it has a strong capital buffer capacity. The non-performing loan ratio is about 3%-5%, which is a manageable level in the industry. The Liquidity Coverage Ratio (LCR) is in line with international standards and is usually maintained above 100% to ensure short-term liquidity needs.

Deposits & Loans

: UBA offers current accounts, time deposits, savings accounts and foreign currency accounts. There is no fixed interest rate for current accounts, and savings accounts usually have an annual interest rate of between 2% and 4%, depending on the country; The interest rate for time deposits (e.g. 3 months to 5 years) is around 4%-7%, depending on the deposit amount and tenor. High-yield savings accounts and products like CDs are available in select markets with yields of up to 8%-10%, subject to a minimum deposit requirement (e.g. 10 million naira).

Loans: UBA provides home loans, car loans, and personal lines of credit. Mortgage interest rates are typically 12%-18%, depending on credit rating and loan tenure (up to 20 years); The interest rate of the car loan is about 15%-20%, and the term is usually 3-5 years; Personal lines of credit have interest rates ranging from 18% to 25%, with a low threshold and a proof of income or guarantee. Some loans offer flexible repayments, such as early repayment without penalty or adjustment of repayment cycle.

List of common fees

Account management fee: The monthly fee for a regular current account is about 100-500 naira (about 0.06-0.3 USD), and it may be waived for high-end accounts.

Transfer fee: Approximately 10-50 naira per domestic transfer, 0.5%-1% of the transaction amount (minimum $5, maximum $50) for cross-border transfers.

Overdraft fee: Depending on the account type, the overdraft interest rate is around 18%-22%/year.

ATM interbank withdrawal fee: about 50-100 naira per transaction, international ATM withdrawals may be subject to an additional fee of 1%-2%.

Hidden Fee Alert: Some accounts require a minimum balance (e.g. 5,000 naira) and a penalty of 50-200 naira/month may be charged for anything below this amount. Clients are advised to check the account terms regularly to avoid additional fees.

Digital Services

ExperienceUBA's digital banking platform (U-Direct) includes a mobile app and online banking that supports facial recognition, real-time transfers, bill payments and investment management. The app has a rating of around 4.0-4.5 stars on the App Store and Google Play, with users reporting a user-friendly interface but occasional connection issues. Core features include instant transfers (support for merchants worldwide), bill management (utility bills, mobile top-ups, etc.), and foreign exchange and fixed deposit calculators. UBA actively adopts open banking APIs to integrate with enterprise ERP systems to improve corporate customer experience. In addition, UBA has introduced AI customer service (named "Leo") to provide 24/7 intelligent Q&A, but complex questions still require human support. Robo-advisory services are being piloted in some markets, mainly for high-net-worth clients.

Customer Service Quality

UBA offers 24/7 phone support (e.g. +1-212-308-7222 for US customers), live chat, and social media responses (Twitter, Facebook, etc.). Social media response times are typically within 1-2 hours, complaints are handled within an average of 3-5 business days, and user satisfaction is around 80%-85%. Multi-language support covers English, French, Swahili, etc., suitable for cross-border customers. Customers in the African market can get face-to-face service through 1000+ outlets, and some countries (such as Kenya, Uganda) provide 24/7 customer service centers.

Security Measures

: UBA participates in the Nigerian Deposit Insurance Scheme, which protects deposits up to 500,000 naira (approximately US$300). Anti-fraud technologies include real-time transaction monitoring, two-factor authentication, and biometric authentication.

Data security: UBA is ISO 27001 certified, and the data protection measures are in line with international standards. No recent major data breaches have been reported, but customers are advised to update their passwords regularly and avoid sharing sensitive information (e.g., ATM card PINs).

Featured Services & Differentiated

Market Segments: UBA offers student accounts, waivers of monthly fees, and low-barrier loans (e.g. KES 300,000 overdraft in the Kenyan market). Dedicated accounts for seniors offer higher savings rates (around 5%-6%) in some markets. Green financial products include renewable energy loans to support ESG investment.

High-net-worth services: UBA private banking services provide customized wealth management, trust management and cross-border investment solutions for customers with assets of more than 10 million naira (about US$6,000).

Market Position & AccoladesUBA

is one of the leading banks in sub-Saharan Africa, ranking around 300-400 in terms of global assets and among the top 10 in Africa. In 2023, it was named "African Bank of the Year" by The Banker and in 2024 it was awarded "Best Regional Bank in West Africa" by The African Bank Awards.