The

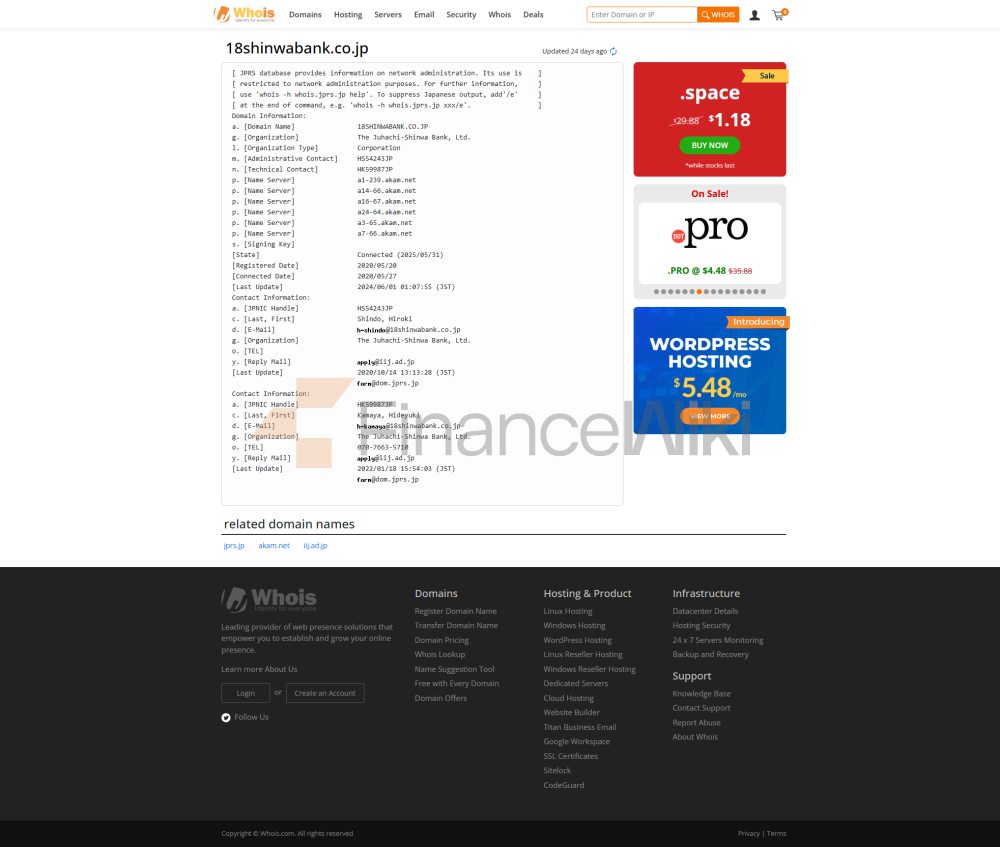

Shinwa Bank, Ltd. is a local bank headquartered in Nagasaki Prefecture, Japan, founded in 1877 as the "18th National Bank" and later renamed as "Affinity Bank" in 1943. The bank is currently privately owned and not listed on the stock exchange.

Scope of ServicesAffinity Bank's

main service areas are the Kyushu region of Japan, especially Nagasaki and Fukuoka prefectures. As of now, the bank has multiple branches and ATM networks in the Kyushu region to meet the financial needs of local residents and businesses.

Regulated & Compliant

Ami Bank is regulated by the Financial Services Agency (FSA) and participates in the deposit insurance program of the Japan Deposit Insurance Corporation of Japan (DICJ) to protect the interests of depositors. Recently, there have been no public reports of significant compliance issues with the bank.

Financial HealthAccording

to the latest financial report, Affinity Bank's capital adequacy ratio is in line with the regulatory requirements of the Financial Services Agency of Japan, the non-performing loan ratio remains low, and the liquidity coverage ratio is good, showing a solid financial position.

Deposit & Loan

ProductsAffinity Bank offers a variety of deposit products, including ordinary deposits, time deposits, and large certificates of deposit (CDs). In addition, banks offer high-yield savings accounts to attract customers. When it comes to loans, Affinity Bank offers home loans, car loans, and personal lines of credit with competitive interest rates and flexible repayment options to meet the needs of different customers.

List of common expensesThe

account management fee of Kinwa Bank may vary depending on the account type, but it is generally a few hundred yen per month. Domestic transfer fees and ATM interbank withdrawal fees also vary depending on the transaction amount and method. Banks advise customers to maintain a minimum balance to avoid possible additional fees.

Digital Service

ExperienceAffinity Bank provides mobile banking applications and online banking services, supporting functions such as facial recognition login, real-time transfers, bill management, and investment tool integration. The bank continues to promote technological innovation and plans to introduce AI customer service, robo-advisors and open banking APIs to improve the customer experience.

Customer Service Quality

Affinity Bank offers a variety of customer service channels, including phone support, online chat, and social media. The bank is committed to improving the efficiency of complaint handling, reducing the mean time to resolution, and improving customer satisfaction. In addition, the bank offers multilingual support to serve cross-border customers.

Security

MeasuresAmiwa Bank's deposit insurance limit is 10 million yen per customer, and advanced anti-fraud technology, such as real-time transaction monitoring, is used to ensure the safety of funds. In terms of data security, the bank has been ISO 27001 certified and has not had any major data breaches.

Featured Services & Differentiated

Affinity Bank provides special services for different customer groups, such as fee-free student accounts, exclusive wealth management products for the elderly, and green financial products (ESG investment). For high-net-worth clients, the bank offers private banking services and customized financial solutions.