Basic

InformationBanque de Tunisie, abbreviated as BT, is one of the oldest banks in Tunisia and can be called the "originator" of the country's banking industry. It is a commercial bank with deep local roots and an international outlook. BT's listing on the Bourse de Tunis demonstrates the transparency of its market-oriented operations. Its shareholding structure is a mix of local and foreign forces, with the dominance of local Tunisian shareholders and the participation of international capital such as France's Crédit Mutuel.

Full name and background

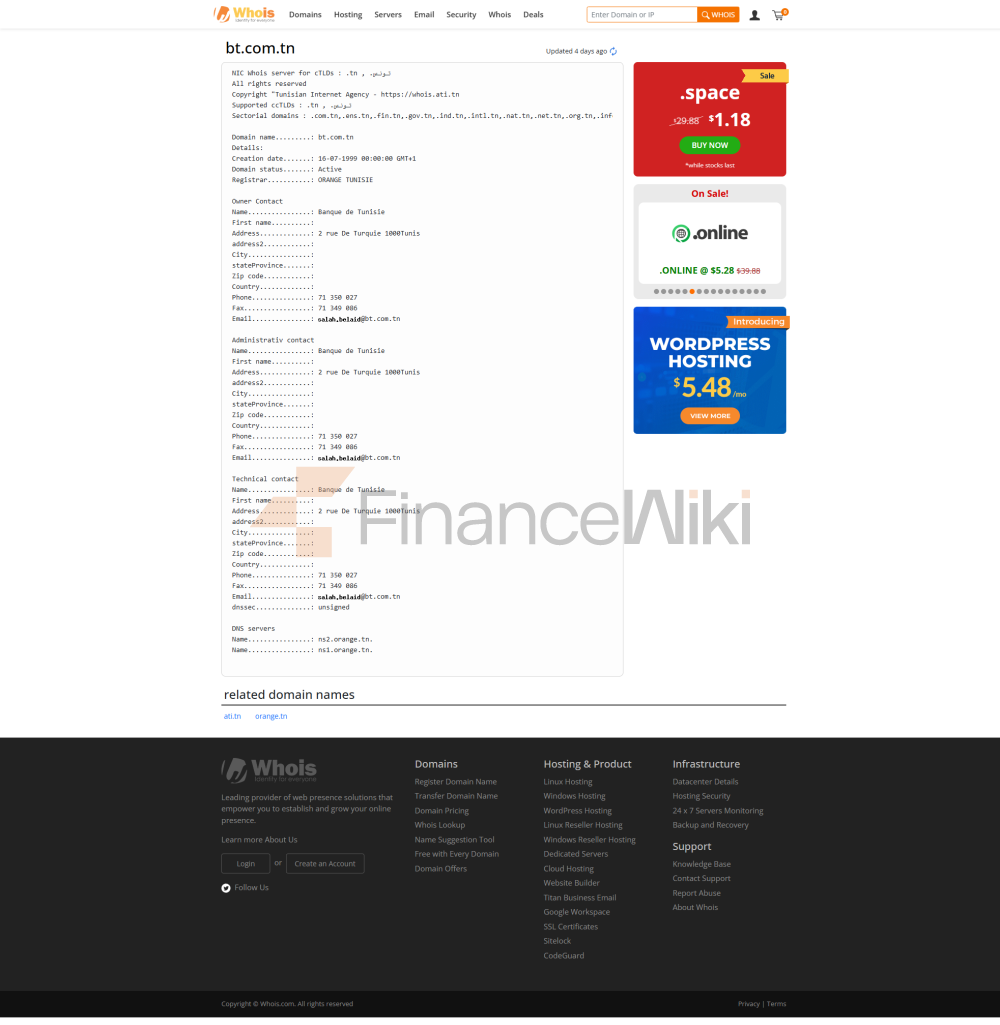

: Banque de Tunisie (Arabic: البنك التونسي, meaning "Bank of Tunisia").

Founded: On September 23, 1884, the Tunisian office was upgraded to an independent bank by the then Banque Transatlantique, which has a history of 140 years, which can be called "the financial cornerstone tempered by time".

Headquarters location: Tunis, the capital of Tunisia, in the modern headquarters building on Rue de Turquie, which is strategically located and symbolizes its status as the financial center of Tunisia.

Shareholder background: BT is a listed company, with local shareholders in Tunisia holding about 67% of the shares, and Crédit Mutuel of France holding 33%, forming a pattern of "local leadership and international support". Historically, BT has undergone several shareholding changes, such as when Tunisia became independent in 1956, when the French Crédit Industriel et Commercial (CIC) transferred a majority of its shareholding to the Tunisian government; In 2012, Crédit Mutuel increased his stake to 33% by acquiring the former president's family.

Coverage area

: BT mainly serves the whole territory of Tunisia, with outlets in major cities across the country, and supports cross-border financial services through cooperation with international banks (such as Western Union, Moneygram). It is not as international as global banks, but it is a "ubiquitous financial partner" for local Tunisian businesses and individuals.

Offline outlets: BT has about 150 branches, covering urban and rural areas in Tunisia, and the density of outlets is among the highest in the region.

ATM distribution: BT has an extensive ATM network, with hundreds of ATMs located in bank branches, shopping malls and transportation hubs, supporting 24-hour withdrawal and inquiry services. ATMs support multi-currency operation, which is convenient for tourists and local residents.

Regulatory and compliance

regulators: BT is under the direct supervision of the Banque Centrale de Tunisie (BCT) and is subject to Tunisian banking law and Basel International. BCT has strict requirements for BT's capital adequacy ratio, liquidity and other indicators to ensure its stable operation.

Deposit insurance: BT participates in Tunisia's deposit insurance program (Fonds de Garantie des Dépôts Bancaires), which provides depositors with deposit protection of up to about 20,000 Tunisian dinars (about US$6,500), which boosts depositors' confidence.

Compliance Record: BT has not had any major compliance scandals in recent years, demonstrating its robust internal governance capabilities. Historically, in 2012, concerns were raised by the shareholders of the former president's family, but trust in the market has been restored through equity liquidation.

Financial Health

Capital Adequacy Ratio: Based on 2021 data, BT's capital adequacy ratio is approximately 13.4%, higher than the 10% required by Tunisian regulators and the 10.5% required by Basel III, indicating that it has sufficient capital buffers to address risks.

Non-Performing Loan Ratio: BT's non-performing loan ratio (NPL) is around 10%, which is lower than the Tunisian banking industry average of 13.1%, reflecting its excellent credit risk management.

Liquidity Coverage Ratio (LCR): BT's LCR is expected to meet Basel III requirements of more than 100%, ensuring that it has sufficient liquid assets in a 30-day stress scenario, and can be called a "guardian of financial stability".

Deposit & Loan ProductsDeposit

Class:

demand deposit: about 1%-2% per annum, suitable for daily fund management, high flexibility.

Time Deposit: 1-year, 3-year and 5-year products are available, with interest rates ranging from 3% to 5%, depending on the amount and tenor.

Featured products: BT launches "Compte Épargne Plus" with a minimum deposit of 1,000 dinars and an interest rate of up to 5.5%; There is also a large certificate of deposit (Certificat de Dépôt), which is suitable for locking in large amounts of income.

Loans:Mortgage: The annual interest rate is about 6%-8%, the term is up to 20 years, the down payment is required to be 20%-30%, and the fixed or variable interest rate is supported.

Car loan: The interest rate is about 7%-9%, the term is 3-5 years, and the approval threshold is low, which is suitable for middle-class families.

Personal Line of Credit: Unsecured loans with an interest rate of approximately 10%-12% and a maximum amount of approximately 50,000 dinars, with proof of income.

Flexible repayment: BT offers a no-penalty option for early repayment, and some loans support grace periods to reduce repayment pressure.

List of common fees

Account management fee: Monthly fee of about 2-5 dinars for a regular current account, no monthly fee for premium accounts (e.g. Visa Platinum package).

Transfer fee: Free of charge for domestic transfers or as low as 1 dinar per transaction; Cross-border transfers are subject to a fee of 0.5%-1% depending on the amount, with a minimum of 5 dinars.

Overdraft fee: The overdraft interest rate is about 15%/year, and the daily penalty interest is 0.1% for the part exceeding the credit limit.

ATM inter-bank withdrawal fee: BT's own ATM is free, and each inter-bank ATM withdrawal is about 1-2 dinars.

Hidden Fee Alert: Some accounts require a minimum balance (about 100 dinars), otherwise a penalty of 5 dinars/month will be charged; Cross-border services may involve exchange rate conversion fees and should be carefully checked.

Digital Service Experience

App & Online Banking: BT's mobile banking app (BT Mobile) has a rating of around 4.2/5 on Google Play and the App Store, with users reporting a user-friendly interface with occasional delays. The online banking platform supports PC operation and has comprehensive functions.

Core functions: support face recognition login, real-time transfer (domestic second), bill management, loan application tracking. The investment tools are highly integrated, and you can directly purchase wealth management products.

Technological innovation: BT introduced AI customer service (chatbot) to deal with common problems; Support robo-advisors and recommend personalized financial solutions; The Open Banking API is still in the pilot stage and is expected to work with third-party fintech companies in the future.

Customer Service Quality

Service Channels: BT offers 24/7 phone support (hotline +216 71 145 145), live chat response time of about 5 minutes, and social media (Facebook, Twitter) replies are usually within 1 hour.

Complaint handling: The complaint rate is low, the average resolution time is about 3-5 working days, and the user satisfaction rate is about 85% (based on local media surveys).

Multi-language support: French, Arabic, and English services are available, which is suitable for cross-border customers, and some high-end account managers support Italian.

Security measures

: Deposits are protected by the Tunisian deposit insurance scheme up to a maximum of 20,000 dinars. BT adopts a real-time transaction monitoring system, and abnormal transactions will trigger SMS/email reminders to effectively prevent fraud.

Data security: BT is ISO 27001 certified, and the data encryption standard reaches the international level. In recent years, there have been no major data breaches, demonstrating its information security management capabilities.

Featured Services & Differentiated

Market Segments:

Student Account (Pack BT Étudiants): No account management fees, with a low-limit credit card, suitable for students aged 18-25.

Exclusive wealth management for the elderly: provide high-yield time deposits (interest rate increase of 0.5%), and have a dedicated relationship manager service.

Green Finance: BT launched an ESG investment fund to support renewable energy projects and attract environmentally conscious customers.

High-net-worth services: BT's private bank (BT Prestige) threshold is 500,000 dinars, and services include customized investment portfolios, overseas asset allocation, and tax planning.

Market Position & Accolades

Industry Rankings: BT is one of the leaders in terms of asset size and market share in the Tunisian banking sector, having the highest market capitalization of Tunisian listed companies at the end of the 2000s. Globally, it ranks among the small and medium-sized banks in terms of assets, but it has a significant presence in the region.

Awards: BT has won the Global Finance magazine's "Best Bank in Tunisia" award several times, and was nominated for "Best Innovative Bank" for digital transformation in 2020.