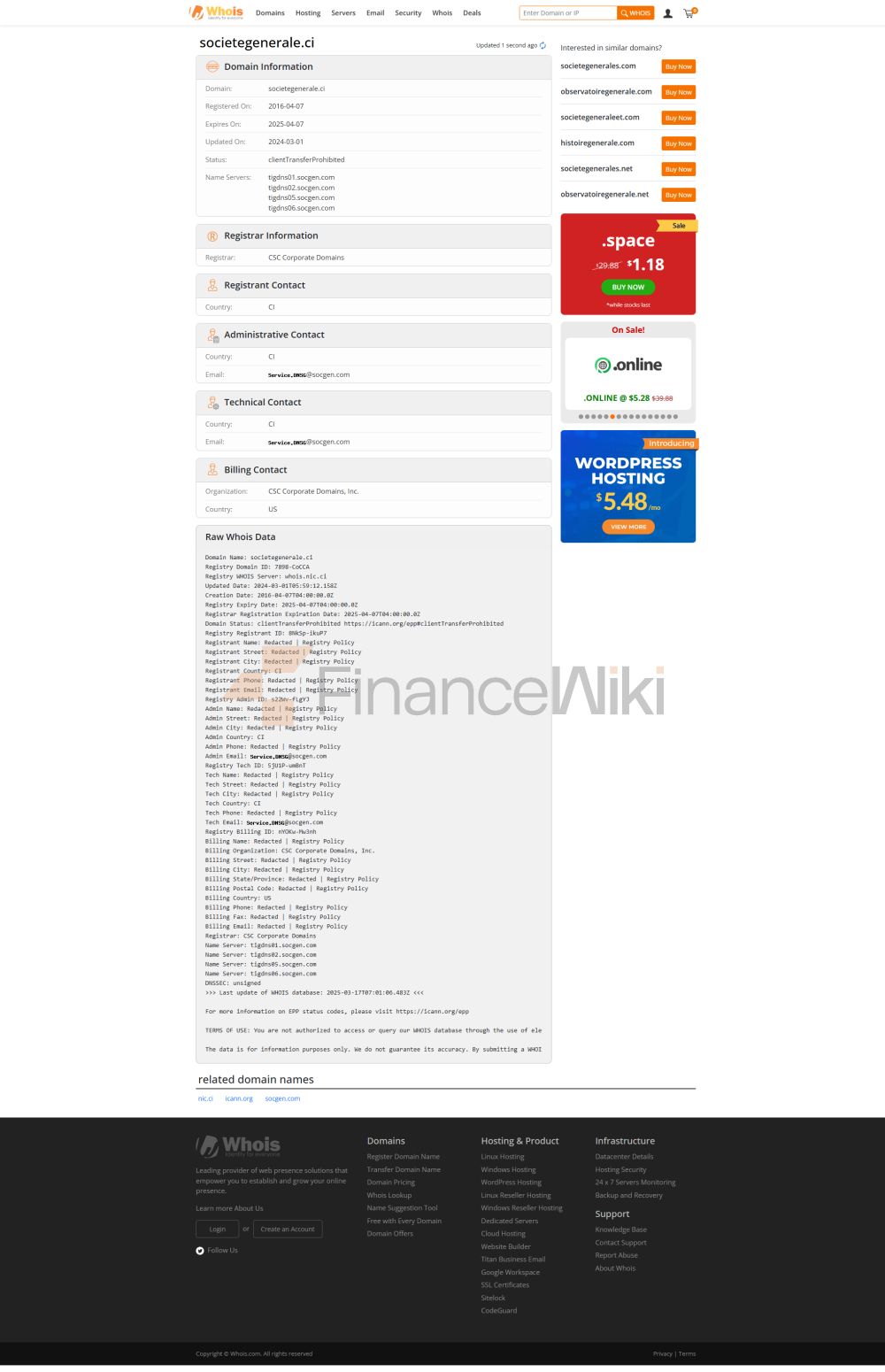

SGBCI, full name Société Générale Côte d'Ivoire is a commercial bank that belongs to the French Société Générale group and is positioned as a leading financial service provider in the region. SGBCI was established on 23 November 1962 and is headquartered in Abidjan, Côte d'Ivoire, at Plateau, 5-7 Avenue Joseph Anoma, 01 BP 1355 Abidjan 01. The shareholder structure is dominated by the Société Générale group, with a stake of approximately 71.84%, while the rest is held by retail investors (18.09%) of the BRVM (regional stock exchange) and Allianz Côte d'Ivoire Assurance (4.7%). Listed on the Regional Stock Exchange (BRVM) of the West African Economic and Monetary Union (UEMOA) since April 7, 1976, SGBCI is not a state-owned or joint venture, but a commercial bank dominated by an international financial group.

Scope of

ServicesSGBCI mainly serves the West African region, especially Côte d'Ivoire, covering individuals, enterprises and institutions. As of the latest data, SGBCI has 66 offline outlets in Côte d'Ivoire, located in Abidjan, Binjeville, Gagnoa, Dab, San Pedro and other places, ranking among the highest in the West African Economic and Monetary Union (WAEMU). The number of ATMs is not disclosed, but its digital services, such as YUP mobile payments, reduce reliance on traditional ATMs due to an extensive network of ATMs that support Visa cards and local payment needs. SGBCI further expands its regional capital markets services through its subsidiaries Sogebourse (brokerage) and Sogespar (asset management).

Regulation &

ComplianceSGBCI is regulated by the Central Bank of the West African Economic and Monetary Union (BCEAO) and the Banking Supervisory Authority of Côte d'Ivoire (Commission Bancaire de l'UEMOA) and is subject to WAEMU's financial regulations and SWIFT international standards. SGBCI participates in Côte d'Ivoire's deposit insurance scheme (Fonds de Garantie des Dépôts), which provides some protection for customer deposits, the exact amount of which varies from region to region, and customers are advised to check with their banks directly. In terms of compliance records, SGBCI's overall performance was solid and there were no major penalties for non-compliance, but it was resilient to operational challenges caused by labor disputes in 2013 and subsequently restructured through management adjustments.

Financial

HealthSGBCI is a leading bank in Côte d'Ivoire with a solid financial performance. As of 2015, total assets amounted to 1.138 trillion CFA francs (approximately 1.7 billion euros), with customer loans and deposits accounting for 16 percent and 15 percent, respectively. The key indicators are as follows: the capital adequacy ratio (CAR) meets the requirements of BCEAO, usually above 10%, showing strong risk resistance; The non-performing loan ratio (NPL) is not publicly available, but it is expected to be lower than the industry average (about 5%) thanks to strict risk control and economic recovery. The Liquidity Coverage Ratio (LCR) performed well due to its diversified funding sources and strong balance sheet. Net income increased by 166% in 2014, demonstrating strong profitability, although there was a brief period of pressure in 2013 due to rising costs.

Deposits & Loans

: SGBCI offers current accounts, time deposits and high-yield savings accounts, with fixed deposit interest rates ranging from 2% to 5% depending on the tenor (3 months to 5 years). Large certificates of deposit (similar to CDs) are mainly for corporate customers and have a higher yield than personal savings.

Loans: Personal loans include housing loans (interest rate of about 6%-8%, stable income and collateral required), car loans (interest rate of about 7%-9%, flexible term) and unsecured credit loans (higher interest rates, about 10%-12%). Corporate loans support agriculture (e.g., cocoa, coffee) and small and medium-sized enterprises, with some offering flexible repayment options such as grace periods or phased repayments.

SGBCI focuses on localized product design, such as YUP accounts for farmers, combined with electronic payment functions, to lower the barrier to entry.

List of common fees

Account management fees: Regular current accounts cost around 1,000-3,000 West African francs (CFA) per month, and high-end accounts may be higher.

Transfer fees: Free or as low as 500 CFA for domestic transfers, and about 1%-2% for cross-border transfers (SWIFT) (minimum 5,000 CFA).

ATM fees: SGBCI's own ATM withdrawals are free of charge, and inter-bank withdrawals are about 1000 CFA each time.

Overdraft fee: Depending on the account type, the overdraft interest rate is around 12%-15%.

Hidden fee reminder: Some accounts require a minimum balance (about 50,000 CFA), and a penalty (about 2,000 CFA/month) may be deducted if you fail to meet the standard. Customers are advised to read the terms of the contract carefully to avoid triggering additional fees for small transactions.

Digital Service

ExperienceSGBCI's digital services are leading in the West African region. The official app (SG Connect) and online banking platform (Sogeline) support real-time transfers, bill management, loan application and other functions, and the user rating is about 4.0/5 on Google Play and App Store, reflecting a good experience. Core features include facial recognition login, mobile payment (YUP platform), and forex trading tools. In terms of technological innovation, SGBCI launched its SMS banking service (Messalia) in 2006 and the Customer Relationship Center (YERI) in 2008, and supported open banking APIs to facilitate third-party fintech integration. The AI customer service function is being piloted, and the robo-advisory service is mainly for high-net-worth customers.

Customer Service

QualitySGBCI offers 24/7 telephone support (hotline: +225 27 20 20 10 10), live chat function via APP and official website, and response time is usually within 5 minutes. Social media (Twitter, Facebook) are very responsive, with an average response time of about 1 hour. The complaint handling efficiency is high, the average resolution time is 3-5 working days, and the user satisfaction ranks high in the region. Multi-language support includes French, English, and local languages (e.g. Baoulé, Dioula) at some outlets, making it suitable for cross-border customers and expatriates.

Security MeasuresFunds

Security: SGBCI participates in the Deposit Insurance Scheme to protect customer deposits (BCEAO is required for specific amounts). Anti-fraud technologies include real-time transaction monitoring, SMS transaction verification, and two-factor authentication (2FA).

Data security: SGBCI is ISO 27001 certified for information security and has not reported major data breaches. The bank uses encryption technology (TLS 1.3) to protect the data transmission of online banking and APP to ensure customer privacy.

Additional measures: SGBCI conducts regular cybersecurity drills and works with international anti-money laundering authorities to ensure compliance.

Featured Services and Differentiated

Market Segments: SGBCI Launches Student Accounts, Waives Monthly Fees and Offers Low-Threshold Savings Plans; For elderly customers, we provide high-yield time deposits and health insurance linkage products. In terms of green finance, SGBCI supports sustainable development loans for the cocoa and coffee industries, in line with ESG standards.

High-net-worth services: Private banking services (threshold of about 50 million CFA) provide customized investment portfolios, offshore account management and family trust services.

Agricultural Finance: Banking 1,300 farmers through YUP accounts, combined with electronic payments, to promote rural financial inclusion.

Market Position & AccoladesSGBCI

is the largest bank in the West African Economic and Monetary Union (WAEMU) and the largest market share in Côte d'Ivoire, with nearly 20% of customer loans and deposits. In the global bank rankings, SGBCI did not make it into the top 50 due to its regional positioning, but it firmly topped the list in the West Africa region. Recent awards include "Best Bank of WAEMU" (won several times, year not disclosed) and "Best Retail Bank in Côte d'Ivoire".