Name &

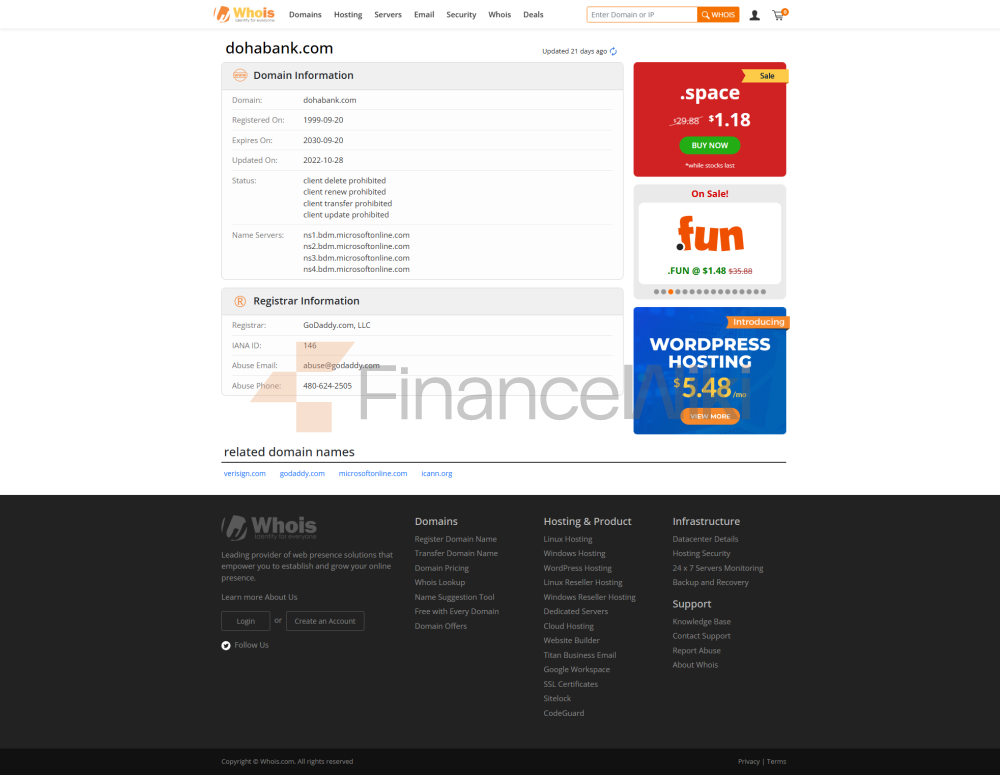

BackgroundDoha Bank is one of Qatar's leading commercial banks, founded in 1979 and headquartered in Doha, the capital of Qatar. As one of Qatar's largest local banks, Doha Bank is fully privately owned and unlisted. It is made up of a group of private shareholders and local investors and focuses on providing comprehensive financial services to Qatari and international customers. Bank Doha is committed to driving financial innovation and modernization to meet changing market needs and provide customers with high-quality financial products and services.

Scope of

ServicesDoha Bank's global service network, particularly in the Middle East, with a particularly strong presence in Qatar and the United Arab Emirates. In addition, the bank has branches in India, Kuwait, Oman, Indonesia, and other regions to provide cross-border banking services to customers. With its vast number of branches and self-service kiosks, Doha Bank has a large number of offline outlets and ATMs across Qatar, ensuring that customers can conduct daily transactions, deposits and withdrawals, and payment services at any time. Bank Doha is also continuing to drive digital transformation, enabling customers to conduct convenient banking operations through online and mobile banking on a global scale.

Regulation &

ComplianceDoha Bank is strictly regulated by Qatar Central Bank and strictly adheres to Qatar's financial regulations and compliance requirements. The bank is an important part of Qatar's banking system and is subject to the Qatari government's regulatory requirements for the banking sector. As a major commercial bank in Qatar, Doha Bank has joined the Qatar Deposit Insurance Program to protect customers' deposits. In addition, the Bank has maintained a good compliance record over the past few years, with no major violations, and has continuously strengthened its internal control system to ensure compliance and stability.

Financial HealthDoha

Bank's financial position is healthy, with its capital adequacy ratio consistently at a high level, demonstrating the bank's ability to respond effectively to market volatility and risks. At the same time, its non-performing loan ratio remained low, and banks adopted prudent loan origination policies and effective risk control measures to ensure the quality of their loan portfolios. In terms of liquidity coverage ratio, Doha Bank has strong liquidity management capabilities, which can maintain good solvency and liquidity during market turbulence.

Deposit & Loan

ProductsDoha Bank offers a range of deposit products, including demand deposits, time deposits, and high-yield savings accounts. Time deposit products have competitive interest rates, especially long-term deposits, which can provide customers with higher returns. Banks also offer special products such as Large Certificates of Deposit (CDs) to meet the savings needs of different customers. Doha Bank's High Yield Savings Account is designed for customers who want to earn higher interest rates, with flexible access to funds that give them more financial freedom.

In terms of loan products, Doha Bank offers a variety of options, including home loans, car loans, and personal lines of credit. Mortgage interest rates are relatively low, and banks offer a variety of flexible repayment options to help customers create a repayment plan that is right for their financial situation. Car loan products are also characterized by preferential interest rates and easy approval, which are suitable for a wide range of customer groups. Personal lines of credit have moderate interest rates and more lenient approval conditions, allowing customers to access the funds they need in a short period of time.

List of common

feesDoha Bank's account management fees and service fees are relatively transparent, and there are usually no monthly or annual fees for the bank's basic account. In terms of transfer fees, banks usually do not charge fees for domestic transfers, while cross-border transfers require a fee depending on the destination and amount. There is also a fee for interbank withdrawals at ATMs, but there are no additional fees if you use Doha Bank's ATMs. In addition, the overdraft fee is also clearly listed, and customers need to bear a certain amount of interest fees when overdrafting, and the bank has certain restrictions on the overdraft amount.

Digital Service

ExperienceDoha Bank excels in digital services, with its mobile banking app and online banking platform highly rated among users. User ratings are above 4 stars on both Google Play and the App Store, showing customer recognition of its convenient features. The app supports a variety of core functions such as account inquiry, transfer, bill payment, etc., and uses advanced security measures, including fingerprint recognition and facial recognition login.

In terms of technological innovation for banks, Doha Bank has launched AI customer service and robo-advisory services to help customers better manage their personal finances. At the same time, the bank is also actively promoting open banking APIs, supporting cooperation with other fintech companies to expand their service scope and further improve technological innovation and service efficiency.

Quality of Customer

ServiceDoha Bank offers 24/7 phone support, live chat, and customer service via social media, so customers can contact the bank at any time for any matters. The bank's customer service system is efficient, the complaint rate is low, and the resolution time of user problems is relatively short, showing its excellent customer service level. According to customer feedback, Doha Bank has a high level of satisfaction in complaint handling and problem resolution, especially in terms of professionalism and responsiveness of the bank's service staff.

In addition, in order to serve a diverse customer base, Doha Bank also provides multi-language support, especially English and Arabic, to ensure that cross-border users can access convenient banking services.

Security

MeasuresDoha Bank has adopted advanced anti-fraud technology in terms of fund security, including a real-time transaction monitoring system, to ensure the security of customer transactions. At the same time, the bank strictly adheres to international standards for data protection and has passed ISO 27001 certification to ensure that its information management system meets global data security requirements. Banks have also joined Qatar's deposit insurance scheme in terms of deposit insurance, and depositors are guaranteed by the state up to a certain amount.

Featured Services & DifferentiationDoha

Bank has launched a number of unique services, including a fee-free account designed specifically for the student population to help young people manage their personal finances with ease. In addition, the bank also provides exclusive wealth management products for elderly customers, providing them with more secure investment solutions. For environmentally conscious customers, Doha Bank has also launched green financial products, especially in the areas of sustainable investment and ESG (Environmental, Social, Governance) investment, to further meet the market demand for environmental protection and socially responsible investment.

In terms of high-net-worth client services, Doha Bank provides customized private banking services to help affluent clients manage and grow their assets. The bank's private banking services include personalized financial planning, asset allocation, tax optimization and other services to ensure the long-term growth of customers' wealth.

Market Position & AccoladesDoha

Bank occupies an important position in Qatar's banking market, making it one of the most influential commercial banks in Qatar due to its extensive network of outlets, excellent service and solid financial performance. Globally, Doha Bank ranks high in terms of asset size, and although it is not in the top 50 in the world, it has a large market share and popularity in the Middle East.

In terms of industry honors, Doha Bank has repeatedly won the "Best Digital Bank" and "Most Innovative Bank" awards, especially in the field of fintech and digital transformation. These accolades are a testament to Doha Bank's leading position in the financial markets of the Middle East and the world.