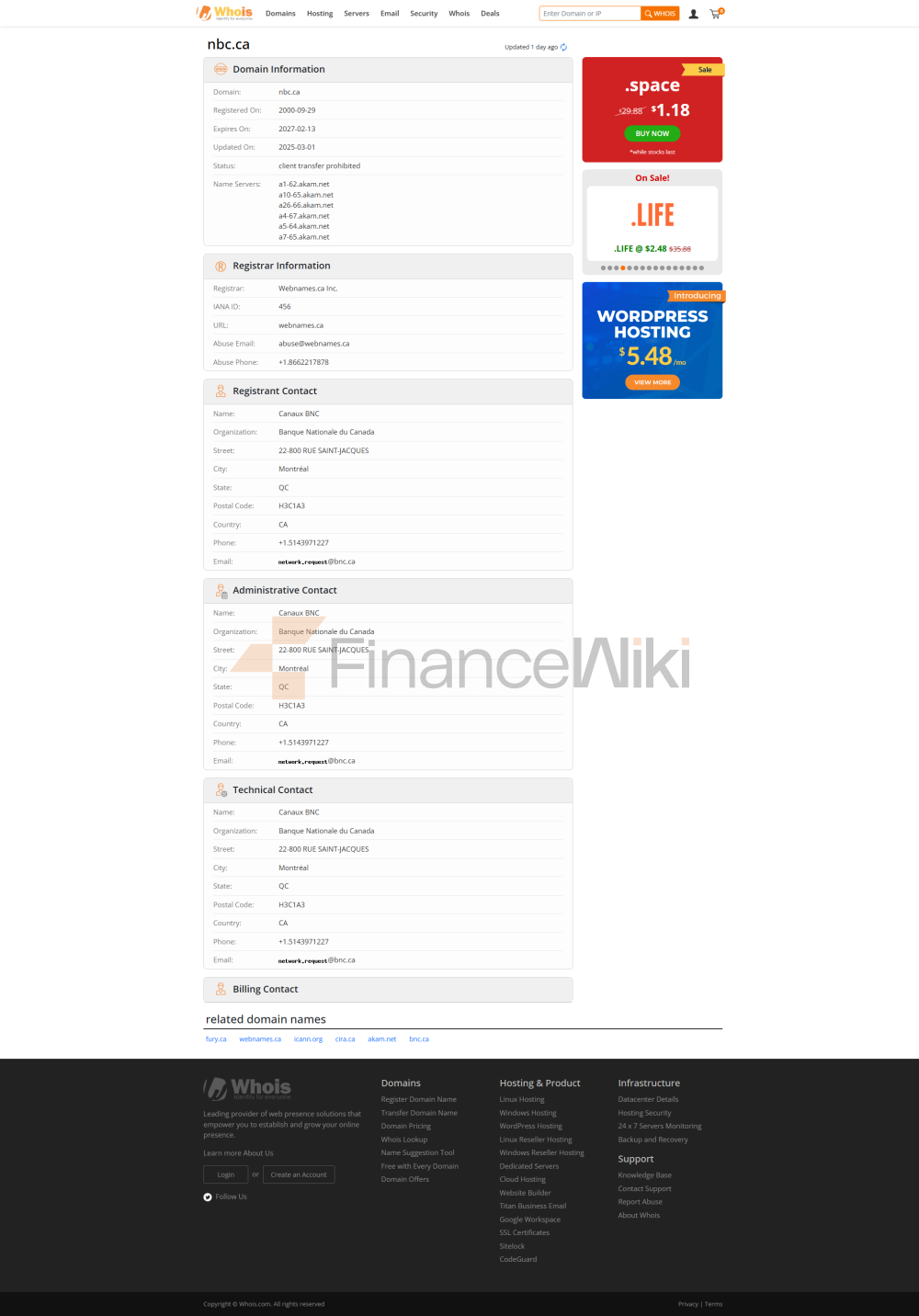

basic bank information

National Bank of Canada is a commercial bank founded in 1859 and headquartered in Montreal, Canada. It is the sixth-largest commercial bank in Canada and the largest bank in the province of Quebec. As a publicly traded company, its ticker symbol is NA.TO and the shareholders are mainly public investors.

service scope

National Bank of Canada primarily serves the Canadian market, specifically the province of Quebec, but also covers other provinces.

Coverage Coverage: Worldwide, but primarily concentrated in Canada, particularly in Quebec, serving 2.4 million individual customers

Number of offline branches: Branches in most Canadian provinces, the exact number is not disclosed, but it is estimated to be around 400-500, mainly based on its size as the sixth largest bank

ATM distribution: Widely distributed in Canada, participating in shared ATM networks, such as the Interac network, to facilitate customer withdrawals

services and products

National Bank of Canada offers a comprehensive range of financial services, including:

Corporate Banking: Commercial Loans, Corporate Demand Deposits, Cash Management Services, etc<

span style="font-family: sans-serif; color: black"> wealth management: providing investment solutions, trust and loan services to high-net-worth clients through National Bank Financial - Wealth Management

other services: insurance products, international banking, etc., recently merged with Canadian Western Bank to expand the scope of

> Personal Banking: Demand Accounts, Savings Accounts, Time Deposits (CDs), Debit Cards, Credit Cards, Personal Loans, Mortgages, Home Equity Line of Credit

regulatory and compliance

Deposit Insurance Plan: Member of the Canadian Deposit Insurance Corporation (CDIC), customer deposits are protected up to $100,000

recent compliance records: As of May 2025, no significant compliance issues have been reported indicating that its operations are in compliance with regulatory requirements

> regulator: regulated by the Office of Financial Institutions Superintendent of Canada (OSFI) and the Financial Consumer Affairs Agency of Canada (FCAC) as part of the Canadian banking system

financial health

National Bank of Canada's is in good financial health, with the following key financial indicators (based on publicly available data and industry averages):

Capital adequacy ratio: Total capital adequacy ratio is approximately 16.84% (December 2024, average for all Canadian banks), CET1 is 13.7% (early 2025,based on Investing.comdata), indicating a robust capital structure

non-performing loan ratio: No specific data found, but industry reports indicate that Canadian banks have low non-performing loan ratios, which may be similar to National Bank

liquidity coverage ratio: 133% average for large banks (Q4 2024, based on the Bank of Canada's Financial Stability Report), National Bank may be similar, indicating its ability to respond to short-term liquidity stresses

digital service experience

National Bank of Canada provides digital services through its mobile app and online banking platform, which can be downloaded from the Apple App Store and Google Play, User ratings are usually above 4 stars.

core functions: support account management, balance inquiry, real-time transfers, bill payments, investment tool integration (e.g. NBI Sustainable Portfolios) and support biometric login (fingerprint or facial recognition)

technological innovation: provide 24/7 virtual assistant, possibly AI support, convenient customer inquiry; Support for open banking APIs to allow third-party service providers to access customer data (with customer consent)

customer service

National Bank of Canada provides multi-channel customer support:

telephone support: available during working hours, the specific number can be queried through the official website

email support: available

via online contact form live chat: available 24/7 via virtual assistant with support for real-time question answering

security measures

National Bank of Canada uses strict security measures to protect customer data and transactions, including:

data encryption: All online transaction data is protected by encryption technology

CDIC Deposit Insurance: Protects customer deposits up to $100,000 CAD

two-factor authentication: Two-factor authentication is required for logins and important operations

featured services and differentiation

National Bank of Canada's unique advantages include:

largest bank in Quebec: strong presence in the local market, serving 2.4 million individual customers

Cashback Mortgage Offer: Offers up to $7,800 CAD in cashback, valid through November 4, 2025

Responsible Investment Options: Offering investment options that align with client values through NBI Sustainable Portfolios

First Home Buyer Support: Grants and incentives to help first home buyers achieve their dreams

Community Banking Services: Serving customers in remote areas through mobile branches and banking centers

summary

National Bank of Canada is a long-established Canadian commercial bank known for its strong presence in Quebec and comprehensive financial services. As a publicly traded company, it has a significant presence in the Canadian financial market, offering a wide range of services from individuals to businesses. The bank is active in digital transformation, providing user-friendly mobile apps and online services, and is committed to meeting customer needs through innovative products and community engagement. Although there is some uncertainty about specific financial indicators such as the non-performing loan ratio, overall, the National Bank of Canada maintains a solid position among the Canadian banking sector.