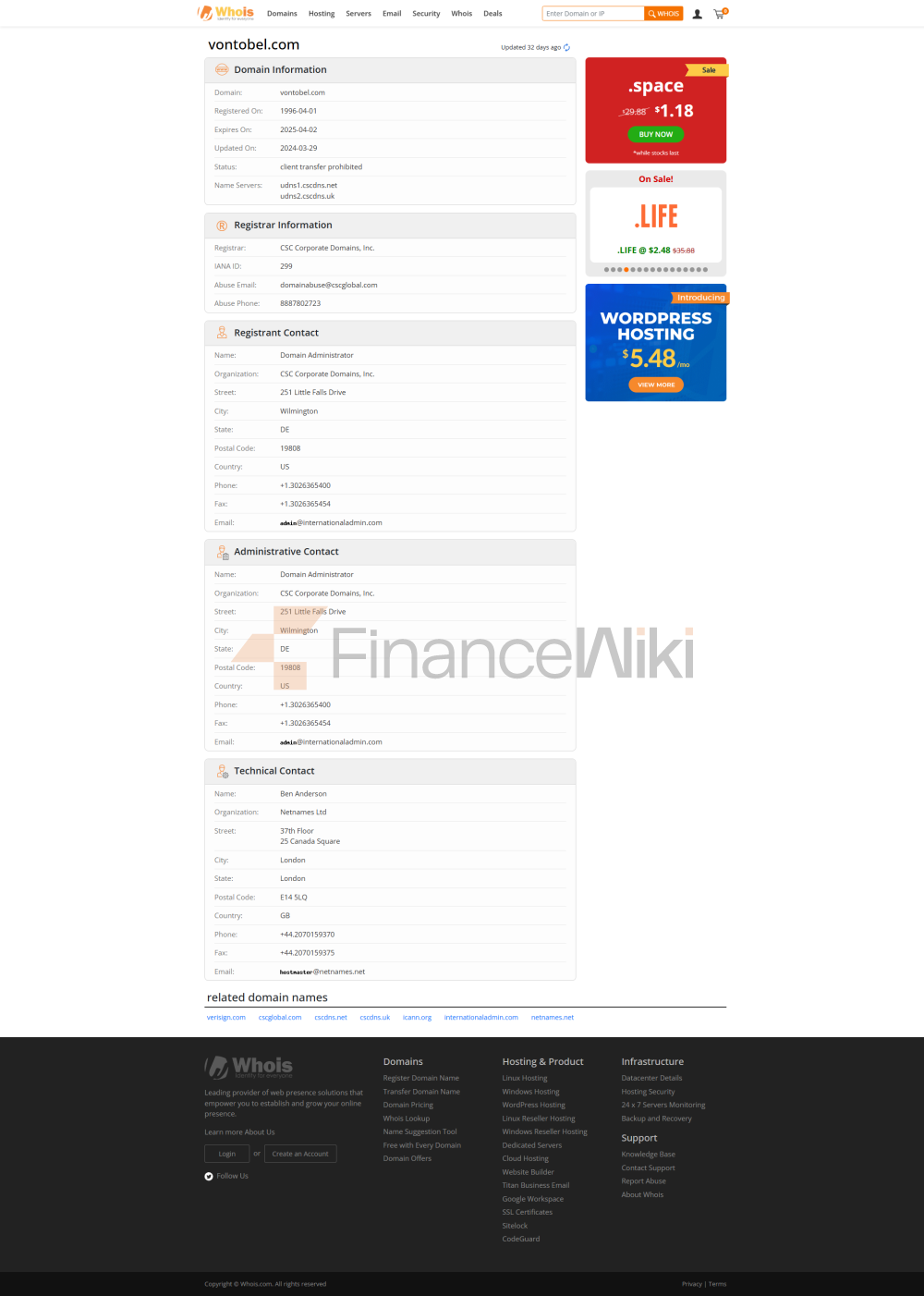

the name and background of the basic information of the bank

Bank Vontobel AG is a Swiss private bank founded in 1924 and headquartered in Zurich, Switzerland. The Vontobel Bank was founded by the Von Tobel family and is still managed by the family today. As a commercial bank, it is committed to providing diversified financial services such as wealth management, asset management, and investment banking. Vontobel Bank is not listed, remains family-owned, and is not a state-owned or joint venture bank.

Scope of

ServicesVontobel Bank has a wide range of services covering many regions around the world, with a particular presence in the wealth management markets in Europe, North America and Asia. Despite its relatively small number of offline outlets, Vontobel Bank is able to provide personalized wealth management solutions to high-net-worth clients by covering the global market through its online platform and private banking services. The distribution of bank ATMs is also relatively limited, mainly concentrated in Switzerland and a few international financial centers.

Regulation &

ComplianceBanco Vontobel is strictly regulated by the Swiss Financial Market Supervisory Authority (FINMA) to ensure the bank's compliance. As a bank providing wealth management services, Vontobel Bank also participates in the Swiss deposit insurance scheme in accordance with international banking regulatory norms. Recently, the bank has a robust compliance record, with no major compliance incidents, demonstrating good regulatory compliance.

a key indicator of financial health

, Vontobel Bank's capital adequacy ratio remains at a high level, ensuring that it is able to respond to market risks. Its non-performing loan ratio is at a very low level, reflecting the quality of its robust risk management and wealth management businesses. The bank's liquidity coverage ratio is also relatively sufficient, with strong capital dispatch capabilities and the ability to deal with emergencies, showing that the bank is financially sound and has effective risk control.

deposit and loan products

Vontobel Bank offers a wide range of customized deposit products, mainly for high net worth clients. Although the interest rate on demand deposits is relatively low, the interest rates on time deposits and large certificates of deposit (CD) products are more competitive. Banks also offer high-yield savings accounts to cater to customers with higher wealth management needs. For wealth management clients, Fontobel Bank's deposit products are often tailored to meet the financial goals of different clients.

LoansVontobel Bank's loan products include housing loans, car loans and personal lines of credit, mainly for its high-end customer base. The interest rate of the loan is determined based on the client's wealth management plan and credit assessment, providing a degree of flexibility. The bank also provides customizable repayment solutions, including deferred repayment, adjustable interest rate and other services, to ensure that customers can enjoy more flexibility in the financing process.

List of Common Fees

Von Tobel Bank's account management fees are mainly focused on high-end customer accounts and usually include a monthly or annual fee, which is higher but matches the personalized service provided by the bank. The fee structure for transfer fees is more transparent, but cross-border transfer fees can be higher. Overdraft fees and ATM interbank withdrawal fees are relatively routine. The bank's service fee standards are adjusted for high-net-worth customers, and some services may come with higher hidden fees.

digital service experience

APP and online banking

Vontobel Bank's APP and online banking platform have good reviews, especially among wealthy customers, with high user ratings. Its core features include real-time transfers, account management, investment tool integration, and more to meet the needs of high-net-worth clients. Vontobel Bank is also at the forefront of technological innovation, applying artificial intelligence customer service and robo-advisory services to enhance the investment experience of customers. The bank also supports open banking APIs, which allow customers to integrate with other financial services.

customer service

quality service

channelVontobel Bank offers 24/7 phone support, and customers can get help quickly through live chat and social media. Banks pay a lot of attention to the quality of service when it comes to customer support, with a low complaint rate and a relatively short average time to resolution. For international clients, Vontobel Bank provides multilingual support to ensure that cross-border clients can access wealth management services without barriers.

security

measuresFunds

securityVontobel Bank provides deposit insurance to customers to ensure the safety of customers' funds. Banks also employ advanced anti-fraud technologies, such as real-time transaction monitoring and intelligent risk control systems, to protect against potential financial risks. Vontobel Bank excels in the security of funds and always prioritizes the safety of its clients' property.

Data

SecurityVontobel Bank strictly follows the ISO 27001 information security management standard to ensure the security of customer data. Banks have a proven track record of data breaches, minimizing the risk of data breaches through regular audits and vulnerability fixes.

Featured Services and Differentiated

SegmentsVontobel Bank offers services in multiple market segments, including fee-free accounts for students, exclusive wealth management products for senior customers, and green financial products (such as ESG investments) that focus on environmental protection and sustainable investment. Through these customized services, banks are able to meet the financial needs of different customers and provide tailor-made wealth management solutions.

High Net Worth ServicesAs

a private bank, Vontobel Bank's High Net Worth clients provide highly customized financial planning, covering global asset allocation, tax optimization, retirement planning and other fields. Banks have high threshold requirements for high-net-worth customers, but the services they provide are also very sophisticated, including exclusive financial advisors, customized wealth management solutions, etc.